US electronic security systems market was valued at US$ 10.33 Mn in 2018, and is calculated to reach US$ 20.50 Mn by 2027, growing at a CAGR of 8.4% from 2019 – 2027.

The US electronic security systems market is anticipated to grow at a higher pace during the forecast period, mainly due to a large number of vendors coming forward and offering electronic security systems to the federal, state and local government agencies throughout the US. The leading players are involved in designing, developing, installation, and maintenance of technically complex integrated electronic security systems for federal government customers. There are number of agencies and associations in the United States working for the development of security systems, such as, Department of Homeland Security (DHS), Department of Defense, Department of Transportation, Department of Health and Human Services, US States Security Licensing Guide, Department of Energy, National Security Agency (NSA), General Services Administration (GSA), and Electronic Security Association (ESA), among others.

The electronic security systems market players are experiencing significant demand for their products and solutions in recent years as the buyer’s base is at a constant rise. The buyers of electronic security systems include the Federal Government verticals. The demand for electronic security systems differs among end-users; for instance, the Department of Homeland Security (DHS) demands for access control systems such as biometrics systems, network management support service; intrusion detection system among other. Alike to DHS, the Department of Defense (DoD) also demands biometrics and intrusion detection, the DoD also procures card readers, video surveillance systems, electronic locks. On the other hand, the Department of Transportation (DoT) majorly adopts smart card readers and video surveillance cameras. The mixed demand for different system types is throttling the growth of the electronic security systems market. Pertaining to the factors as mentioned above, the bargaining power of buyers is expected to remain high throughout the forecast period.

Market Insights

Rise in Adoption of AI in Video Surveillance Cameras

There is a massive demand for the incorporation of artificial intelligence (AI) in video surveillance systems. The incorporation of Artificial Intelligence (AI) in video surveillance systems to assist in video, Big Data, and the Internet of Things (IoT) analytics is attributed to reduce the analysis timing and improve decision-making capabilities. The video analytics software also enhances the capabilities of IP cameras and enables them to function intelligently and efficiently. AI assists in effective monitoring, followed by feeding captured imageries and alerting the guards in case of suspicious activities in and around the workstations. This factor helps the surveillance teams to enhance security, and save human efforts and time. Moreover, AI in video surveillance systems facilitate a wide range features such as facial recognition, motion detection, and license plate reading. The processing power of modern video surveillance cameras has increased to a greater extent with the incorporation of AI, which in turn has increased the hosting power of cameras for various analytics tools, thereby enhancing the reliability of IP camera. Thus, the incorporation of AI in video surveillance systems is fueling the electronic security systems market and is anticipated to bolster the market in the future.

Electronic security systems Market - Product Type Insights

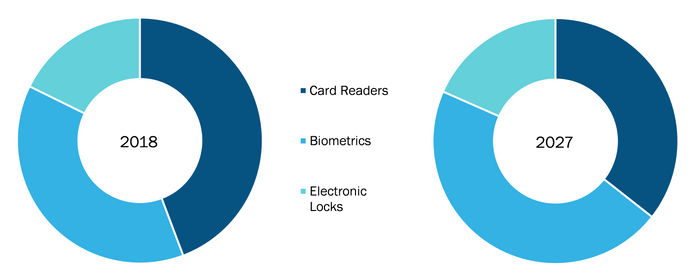

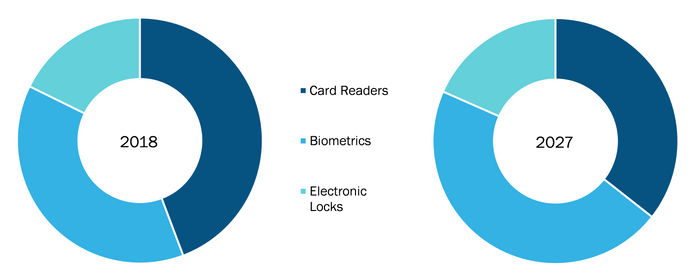

The US electronic security systems market by product type is segmented into surveillance systems, alarming systems, and access control. The surveillance systems segment dominated the electronic security systems market heavily and is projected to continue its dominance throughout the forecast period from 2019 – 2027. The access control system segment is the anticipated to surge at a prime rate during the forecast period.

Surveillance Systems Insights

Surveillance security systems are available in both wired and wireless configurations and can be further segmented into: camera, video management, and IP video recording. These systems continuously monitor buildings such as governmental buildings, federal office buildings, or governmental infrastructures. The output of surveillance systems can be used remotely viewed on smartphones, tablets, and computers for recording any illegal activities. It helps the building owners in monitoring the tasks when remotely. The US Federal Governmental buildings and infrastructures are challenged with severe levels of threat from various illicit groups. Thus, with an objective to secure the building or infrastructure premises from any unlawful entrance, the Federal Government is undertaking significant strides to adopt technologically advanced surveillance systems, which is boosting the surveillance systems market, which in turn is catalyzing the growth of the US electronic security systems market.

Access Control Systems Insights

The US governmental buildings, transportation systems, border areas, airports, seaports, and various other infrastructures have experienced illegal entrance which has led to significant loss in terms of monetary funds and data. This factor has escalated the demand for access control systems across the country, thereby, driving the electronic security systems market in the US. The card readers are by far the most attractive access control systems across verticals of Federal Government, however, higher demand for biometrics is being experienced in the current scenario. In the current technologically advanced market scenario, the card readers are easily breach-able, which is again a potential threat to various security-prone infrastructures. On the other hand, biometrics systems are highly secured as the same records and access an individual’s biological characteristics. These factors are attracting the customers which is propelling the electronic security systems market in the US.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

US Electronic Security Systems Market: Strategic Insights

Market Size Value in US$ 10.33 Million in 2018 Market Size Value by US$ 20.50 Million by 2027 Growth rate CAGR of 8.4% from 2019 to 2027 Forecast Period 2019-2027 Base Year 2018

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

US Electronic Security Systems Market: Strategic Insights

| Market Size Value in | US$ 10.33 Million in 2018 |

| Market Size Value by | US$ 20.50 Million by 2027 |

| Growth rate | CAGR of 8.4% from 2019 to 2027 |

| Forecast Period | 2019-2027 |

| Base Year | 2018 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Mergers and acquisition and acquiring contracts are the two most prominent strategies adopted by companies to enhance the product portfolio and meet the growing demand. The players present in the electronic security systems market also adopt the strategy of expansion and investment in research and development to enlarge customer base in the US and worldwide, which also permits the players to maintain their brand name globally.

US Electronic security systems Market, by Product Type

- Video Surveillance Systems

- Camera

- Video Management

- IP Video Recording

- Alarming Systems

- Monitoring System

- Intrusion Detection System

- Perimeter Alarm System

- Access Control System

- Card Reader

- Biometrics

- Electronic Systems

US Electronic security systems Market, by Component

- Camera

- Monitor

- Storage Devices

- Software

- PSIM

- Identity Management

Electronic security systems Market - Company Profiles

- ADT

- BAE Systems

- Evergreen Fire and Security

- Honeywell International Inc.

- Surveillance Secure Inc.

- Integrated Security Technologies

- Johnson Controls

- KBR Inc.

- Leidos

- Lockheed Martin Corporation

- LVW Electronics

- MC Dean Inc.

- Mantech International Corporation

- Northrop Grumman Corporation

- Orion Security Systems

- Parsons Corporation

- Securitas Electronic Security, Incorporated.

- Science Application International Corporation

- Security Hunter

- Serco Inc.

- Siemens

- Split Pine Technologies, Inc.

- Stanley Convergent Security Solutions

- Xator Corporation

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Component

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 US Electronic Security Systems Market, by Product Type

1.3.2 US Electronic Security Systems Market, by Component

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. US Electronic Security Systems– Market Landscape

4.1 Market Overview

4.2 PEST Analysis

4.2.1 PEST Analysis: US Market

4.3 Porter’s Five Forces Analysis

4.3.1 Bargaining Power of Buyers

4.3.2 Bargaining Power of Suppliers

4.3.3 Threat to New Entrants

4.3.4 Threat to Substitutes

4.3.5 Degree of Competition

4.4 Ecosystem Analysis

5. Key Market Dynamics

5.1 Drivers

5.1.1 Increasing Incidences of Terrorist Attacks and Other Crimes

5.1.2 Rise in Adoption of AI in Video Surveillance Cameras

5.2 Restraints

5.2.1 High Maintenance and Installation Costs, and Privacy Issues

5.3 Opportunities

5.3.1 Proliferation of “Smart City” Initiatives

5.4 Trends

5.4.1 Integration of Bluetooth Low Energy is Expected to Draw Attention of End Users

5.5 Impact Analysis of Drivers and Restraints

6. Electronic Security Systems – US Market Analysis

6.1 US Electronic Security Systems Market Overview

6.1.1 US Electronic Security Systems Market Forecast and Analysis

6.1.2 Competitive Analysis

7. US Electronic Security Systems Market Analysis – By Product Type

7.1 Overview

7.2 US Electronic Security System Market Breakdown, by Product Type, 2018 and 2027

7.3 Surveillance Security System

7.3.1 Overview

7.3.2 Surveillance Security System Market, Revenue and Forecast to 2027 (US$ Bn)

7.3.2.1 Camera

7.3.2.1.1 Camera Market, Revenue and Forecast to 2027 (US$ Bn)

7.3.2.2 Video Management

7.3.2.2.1 Video Management Market, Revenue and Forecast to 2027 (US$ Bn)

7.3.2.3 IP Video Recording

7.3.2.3.1 IP Video Recording Market, Revenue and Forecast to 2027 (US$ Bn)

7.4 Alarming System

7.4.1 Overview

7.4.2 Alarming System Market, Revenue and Forecast to 2027 (US$ Bn)

7.4.2.1 Monitoring Systems

7.4.2.1.1 Monitoring Systems Market, Revenue and Forecast to 2027 (US$ Bn)

7.4.2.2 Intrusion Detection

7.4.2.2.1 Intrusion Detection Market, Revenue and Forecast to 2027 (US$ Bn)

7.4.2.3 Perimeter Alarm

7.4.2.3.1 Perimeter Alarm Market, Revenue and Forecast to 2027 (US$ Bn)

7.5 Access Control System

7.5.1 Overview

7.5.2 Access Control System Market, Revenue and Forecast to 2027 (US$ Bn)

7.5.2.1 Card Reader

7.5.2.1.1 Card Reader Market, Revenue and Forecast to 2027 (US$ Bn)

7.5.2.2 Biometrics

7.5.2.2.1 Biometrics Market, Revenue and Forecast to 2027 (US$ Bn)

7.5.2.3 Electronic Locks

7.5.2.3.1 Electronic Locks Market, Revenue and Forecast to 2027 (US$ Bn)

8. US Electronic Security Systems Market Analysis – By Component

8.1 Overview

8.2 US Electronic Security System Market Breakdown, by Component, 2018 and 2027

8.3 Camera

8.3.1 Overview

8.3.2 Camera Market, Revenue and Forecast to 2027 (US$ Bn)

8.4 Monitor

8.4.1 Overview

8.4.2 Monitor Market, Revenue and Forecast to 2027 (US$ Bn)

8.5 Storage Device

8.5.1 Overview

8.5.2 Storage Device Market, Revenue and Forecast to 2027 (US$ Bn)

8.6 Software

8.6.1 Overview

8.6.2 Software Market, Revenue and Forecast to 2027 (US$ Bn)

8.6.2.1 PSIM Locks

8.6.2.1.1 PSIM Market, Revenue and Forecast to 2027 (US$ Bn)

8.6.2.2 Identity Management

8.6.2.2.1 Identity Management Market, Revenue and Forecast to 2027 (US$ Bn)

9. Industry Landscape

9.1 Overview

9.2 Partnerships & Acquisitions

9.3 Synergetic Market

10. Company Profiles

10.1 ADT Inc.

10.1.1 Key Facts

10.1.2 Business Description

10.1.3 Products and Services

10.1.4 Financial Overview

10.1.5 SWOT Analysis

10.1.6 Key Developments

10.2 BAE SYSTEMS PLC

10.2.1 Key Facts

10.2.2 Business Description

10.2.3 Products and Services

10.2.4 Financial Overview

10.2.5 SWOT Analysis

10.2.6 Key Developments

10.3 Evergreen Fire and Security

10.3.1 Key Facts

10.3.2 Business Description

10.3.3 Products and Services

10.3.4 Financial Overview

10.3.5 SWOT Analysis

10.3.6 Key Developments

10.4 Honeywell International Inc.

10.4.1 Key Facts

10.4.2 Business Description

10.4.3 Products and Services

10.4.4 Financial Overview

10.4.5 SWOT Analysis

10.4.6 Key Developments

10.5 Integrated Security Technologies, Inc.

10.5.1 Key Facts

10.5.2 Business Description

10.5.3 Products and Services

10.5.4 Financial Overview

10.5.5 SWOT Analysis

10.5.6 Key Developments

10.6 Johnson Controls International Plc.

10.6.1 Key Facts

10.6.2 Business Description

10.6.3 Products and Services

10.6.4 Financial Overview

10.6.5 SWOT Analysis

10.6.6 Key Developments

10.7 KBR Inc.

10.7.1 Key Facts

10.7.2 Business Description

10.7.3 Products and Services

10.7.4 Financial Overview

10.7.5 SWOT Analysis

10.7.6 Key Developments

10.8 LVW Electronics

10.8.1 Key Facts

10.8.2 Business Description

10.8.3 Products and Services

10.8.4 Financial Overview

10.8.5 SWOT Analysis

10.8.6 Key Developments

10.9 LOCKHEED MARTIN CORPORATION

10.9.1 Key Facts

10.9.2 Business Description

10.9.3 Products and Services

10.9.4 Financial Overview

10.9.5 SWOT Analysis

10.9.6 Key Developments

10.10 Leidos Holdings, Inc.

10.10.1 Key Facts

10.10.2 Business Description

10.10.3 Products and Services

10.10.4 Financial Overview

10.10.5 SWOT Analysis

10.10.6 Key Developments

10.11 M.C. Dean, Inc.

10.11.1 Key Facts

10.11.2 Business Description

10.11.3 Products and Services

10.11.4 Financial Overview

10.11.5 SWOT Analysis

10.11.6 Key Developments

10.12 ManTech International Corporation

10.12.1 Key Facts

10.12.2 Business Description

10.12.3 Products and Services

10.12.4 Financial Overview

10.12.5 SWOT Analysis

10.12.6 Key Developments

10.13 Orion Security Systems

10.13.1 Key Facts

10.13.2 Business Description

10.13.3 Products and Services

10.13.4 Financial Overview

10.13.5 SWOT Analysis

10.13.6 Key Developments

10.14 Northrop Grumman Corporation

10.14.1 Key Facts

10.14.2 Business Description

10.14.3 Products and Services

10.14.4 Financial Overview

10.14.5 SWOT Analysis

10.14.6 Key Developments

10.15 Parsons Corporation

10.15.1 Key Facts

10.15.2 Business Description

10.15.3 Products and Services

10.15.4 Financial Overview

10.15.5 SWOT Analysis

10.15.6 Key Developments

10.16 Surveillance Secure

10.16.1 Key Facts

10.16.2 Business Description

10.16.3 Products and Services

10.16.4 Financial Overview

10.16.5 SWOT Analysis

10.16.6 Key Developments

10.17 Science Application International Corporation

10.17.1 Key Facts

10.17.2 Business Description

10.17.3 Products and Services

10.17.4 Financial Overview

10.17.5 SWOT Analysis

10.17.6 Key Developments

10.18 Securitas Electronic Security, Incorporated

10.18.1 Key Facts

10.18.2 Business Description

10.18.3 Products and Services

10.18.4 Financial Overview

10.18.5 SWOT Analysis

10.18.6 Key Developments

10.19 Security Hunter

10.19.1 Key Facts

10.19.2 Business Description

10.19.3 Products and Services

10.19.4 Financial Overview

10.19.5 SWOT Analysis

10.19.6 Key Developments

10.20 Serco Inc.

10.20.1 Key Facts

10.20.2 Business Description

10.20.3 Products and Services

10.20.4 Financial Overview

10.20.5 SWOT Analysis

10.20.6 Key Developments

10.21 Split Pine Technologies, Inc

10.21.1 Key Facts

10.21.2 Business Description

10.21.3 Products and Services

10.21.4 Financial Overview

10.21.5 SWOT Analysis

10.21.6 Key Developments

10.22 Stanley Convergent Security Solutions, Inc

10.22.1 Key Facts

10.22.2 Business Description

10.22.3 Products and Services

10.22.4 Financial Overview

10.22.5 SWOT Analysis

10.22.6 Key Developments

10.23 Siemens AG

10.23.1 Key Facts

10.23.2 Business Description

10.23.3 Products and Services

10.23.4 Financial Overview

10.23.5 SWOT Analysis

10.23.6 Key Developments

10.24 Xator Corporation

10.24.1 Key Facts

10.24.2 Business Description

10.24.3 Products and Services

10.24.4 Financial Overview

10.24.5 SWOT Analysis

10.24.6 Key Developments

11. Appendix

11.1 About The Insight Partners

11.2 Glossary of Terms

LIST OF TABLES

Table 1. US Electronic Security Systems Market Revenue and Forecasts to 2027 (US$ Bn)

Table 2. Glossary Of Terms, US Electronic Security Systems Market

LIST OF FIGURES

Figure 1. US Electronic Security Systems Market Segmentation

Figure 2. US Electronic Security Systems Market Overview

Figure 3. US Electronic Security Systems Market, By Product Type

Figure 4. US Electronic Security Systems Market, By Components

Figure 5. US Market – PEST Analysis

Figure 6. US Market – Porter’s Five Forces Analysis

Figure 7. Ecosystem Analysis –US Electronic Security Systems Market

Figure 8. Impact Analysis: Drivers and Restraints Pertaining to US Electronic Security System Market

Figure 9. US Electronic Security Systems Market Forecast and Analysis Revenue (US$ Bn)

Figure 10. US Electronic Security Systems Market Competitive Analysis

Figure 11. US Electronic Security System Market Breakdown, by Product Type, 2018 and 2027 (%)

Figure 12. Surveillance Security System Market, Revenue and Forecast to 2027 (US$ Bn)

Figure 13. Camera Market, Revenue and Forecast to 2027 (US$ Bn)

Figure 14. Video Management Market, Revenue and Forecast to 2027 (US$ Bn)

Figure 15. IP Video Recording Market, Revenue and Forecast to 2027 (US$ Bn)

Figure 16. Alarming System Market, Revenue and Forecast to 2027 (US$ Bn)

Figure 17. Monitoring Systems Market, Revenue and Forecast to 2027 (US$ Bn)

Figure 18. Intrusion Detection Market, Revenue and Forecast to 2027 (US$ Bn)

Figure 19. Perimeter Alarm Market, Revenue and Forecast to 2027 (US$ Bn)

Figure 20. Access Control Systems Market, Revenue and Forecast to 2027 (US$ Bn)

Figure 21. Card Reader Market, Revenue and Forecast to 2027 (US$ Bn)

Figure 22. Biometrics Market, Revenue and Forecast to 2027 (US$ Bn)

Figure 23. Electronic Locks Market, Revenue and Forecast to 2027 (US$ Bn)

Figure 24. US Electronic Security System Market Breakdown, by Component, 2018 and 2027 (%)

Figure 25. Camera Market, Revenue and Forecast to 2027 (US$ Bn)

Figure 26. Monitor Market, Revenue and Forecast to 2027 (US$ Bn)

Figure 27. Storage Device Market, Revenue and Forecast to 2027 (US$ Bn)

Figure 28. Software Market, Revenue and Forecast to 2027 (US$ Bn)

Figure 29. PSIM Market, Revenue and Forecast to 2027 (US$ Bn)

Figure 30. Identity Management Market, Revenue and Forecast to 2027 (US$ Bn)

The List of Companies - US Electronic Security Systems Market

- ADT

- BAE Systems

- Evergreen Fire and Security

- Honeywell International Inc.

- Surveillance Secure Inc.

- Integrated Security Technologies

- Johnson Controls

- KBR Inc.

- Leidos

- Lockheed Martin Corporation

- LVW Electronics

- MC Dean Inc.

- Mantech International Corporation

- Northrop Grumman Corporation

- Orion Security Systems

- Parsons Corporation

- Securitas Electronic Security, Incorporated.

- Science Application International Corporation

- Security Hunter

- Serco Inc.

- Siemens

- Split Pine Technologies, Inc.

- Stanley Convergent Security Solutions

- Xator Corporation

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For