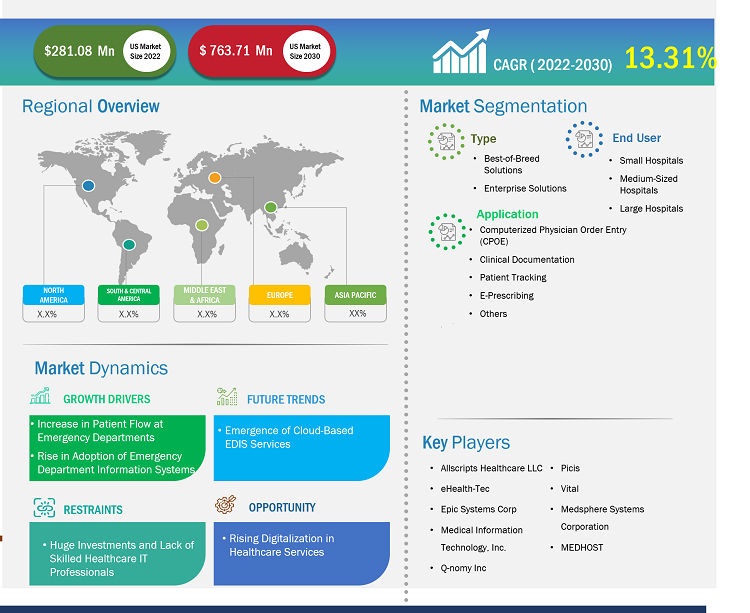

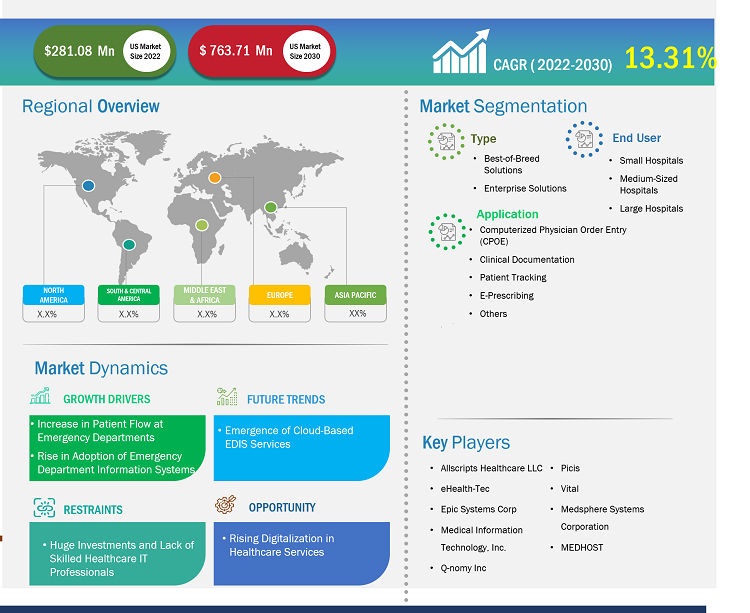

The US emergency department information system market size was valued at US$ 281.09 million in 2022 and is projected to reach US$ 763.71 million by 2030; it is estimated to register a CAGR of 13.31% from 2022 to 2030.

Market Insights and Analyst View:

An emergency department information system is an expanded electronic health record (EHR) system created specially to handle data and streamline procedures in support of emergency department patient care and operations. The ambulatory and inpatient environments are very dissimilar from the emergency department environment. Emergency care settings are episodic and typically more complex than ambulatory and inpatient settings, which prioritize longitudinal treatment. Patients frequently need quick medical attention and urgent care when they visit the emergency department. From check-in and triage to documentation and order processing, communication with other hospital employees, and discharge, speed, and accuracy are essential throughout the whole ED visit. Factors such as an increase in patient flow at emergency departments, and a rise in adoption of emergency department information systems drive the market growth. However, the huge investments and lack of skilled healthcare hinder the emergency department information system market growth.

Growth Drivers and Challenges:

Emergency department information systems help enhance hospitals' decision-making by providing comprehensive real-time data for hospital administrations. Furthermore, the use of emergency department information systems during COVID-19 has grown dramatically, and crowding in emergency departments (EDs) affects both adult and pediatric hospitals. However, there has been an increase in pediatric patients visiting EDs in recent years. Data from the 2018 National Hospital Ambulatory Medical Care Survey showed 130 million annual ED visits, with 25.6 million, or one-third, made by patients under 15. In addition, a record number of pediatric behavioral health concerns, RSV, influenza, COVID-19, and ED visits from children occurred in late 2022 and early 2023. The demand for emergency department information systems is high in North America due to the wide acceptance of technology in countries such as the US and Canada. Also, the rising adoption of telematics healthcare digital transformation in healthcare settings, the growing expenditure in healthcare infrastructure, and the availability of technologically advanced devices are driving the US emergency department information systems market. In addition, the rapidly increasing adoption of hospital IT for greater efficiency in administrative processes propels the emergency department information system market growth.

High capital requirements for implementing emergency department information systems and low perceived return on investments are the major forces obstructing the adoption of these emergency department information systems. The installation of EDIS requires massive organizational changes and leads to alterations in the pattern of providing healthcare services in emergency departments. The financial and clinical outcomes of healthcare facilities are correlated, and this correlation dictates, to a reasonable extent, the investments suitable for achieving a particular health outcome. The cost of implementation, operation, and maintenance of EDIS is also a significant barrier to adopting such systems. Thus, despite the benefits of e-prescription systems, end users are reluctant to adopt e-prescribing solutions. The expenses are not limited to the one-time purchase price of a system. They involve recurrent costs incurred by implementation services, maintenance and support services, e-prescribing and EHR/EMR integration services, and, sometimes, training and education. As a result, smaller hospitals and office-based physicians refrain from investing in emergency department information systems.

The lack of expertise and skills required for handling modern healthcare IT and informatics solutions is another challenge healthcare providers face. Demand for research and healthcare is anticipated to rise with the aging of the baby boomer population. Simultaneously, a large percentage of skilled and experienced IT workforce is reaching the age of retirement. On the other hand, the number of younger workers available is not sufficient to fill this gap. The lack of expertise and administrative capacity required for data collection, health information analysis, and reporting is a common overarching challenge that limits EDIS implementation, thereby restraining market expansion.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

US Emergency Department Information System Market: Strategic Insights

Market Size Value in US$ 281.09 million in 2022 Market Size Value by US$ 763.71 million by 2030 Growth rate CAGR of 13.31% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

US Emergency Department Information System Market: Strategic Insights

| Market Size Value in | US$ 281.09 million in 2022 |

| Market Size Value by | US$ 763.71 million by 2030 |

| Growth rate | CAGR of 13.31% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The “US Emergency Department Information System Market” is segmented on the basis of type, application, infection severity, end user, and country.

Segmental Analysis:

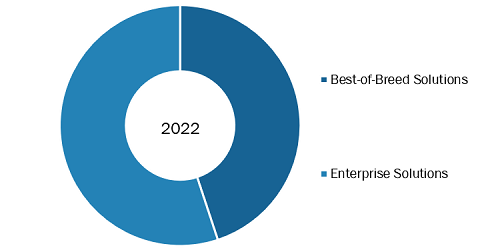

Based on type, the US emergency department information system market is segmented into enterprise solutions and best-of-breed solutions. The best-of-breed solutions segment is likely to hold the largest share of the market in 2022. and the same segment projected to register the highest CAGR in the market during the forecast period.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Enterprise solutions integrate a provider's branches and multiple legal entities through a centralized and distributed architecture in which data is synchronized to create a single database. The solution complies with the WHO, healthcare legal requirements, and insurance requirements. It is a cloud-based system that aids users in accessing real-time data from anywhere at any time. A centralized system manages all legal and financial entities in the enterprise solution, which makes business productive. The increasing acceptance of EHR/EMR, rising usage of big data in healthcare, financing for the preservation of electronic patient health records, and regulatory mandates are propelling the enterprise solutions segment growth.

The US emergency department information system market, by application, is segmented into computerized physician order entry (CPOE), clinical documentation, patient tracking, e-prescribing, and others. The computerized physician order entry (CPOE) segment held the largest share of the US emergency department information system market in 2022 and is anticipated to register the highest CAGR during 2022–2030. Computerized physician order entry (CPOE) is a software tool that assists doctors in entering medical orders into computer systems in inpatient and ambulatory settings. Many old ways of enlisting medicine orders, including spoken (in person or over the phone), written (paper prescriptions), and fax, are being replaced by CPOE. Users can define prescription orders, as well as laboratory, referral, admission, imaging, and treatment orders, electronically using these platforms. Government attempts to upgrade the IT infrastructure and information technology that aids in the lowering of healthcare expenses are driving the market for the CPOE segment.

The US emergency department information system market by end user is segmented into small hospitals, medium-sized hospitals, and large hospitals. The medium-sized hospitals segment is likely to lead the market for the US emergency department information systems in 2022 and is expected to retain its dominance during the forecast period 2022–2030. To lower the expenses and improve care quality, hospitals invest in information technology such as EDIS and EHR. Hospitals classified as medium-sized have between 94 and 277 general and surgical beds. The removal of decision support or patient level from the model resulted in insignificant correlations between all postulated paths, according to further study of the EHR construct.

Research further reveals that the presence of these two variables alone resulted in a statistically meaningful association with general safety, whereas all other routes were found to be insignificant. As a result, medium-sized hospitals should think about investing in emergency department information systems or electronic health record technologies that focus on decision support and patient-level data. According to the research, these applications can improve overall safety in medium-sized hospitals.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Competitive Landscape and Key Companies:

Developments in the US emergency department information system market have been characterized as organic and inorganic growth strategies. Various companies are focusing on organic growth strategies such as launches, expansion, enhancement, and relocation. Inorganic growth strategies witnessed in the US emergency department information system market were mergers & acquisitions, partnerships, and collaborations. These activities have cemented the way for the expansion of the business and customer base of US emergency department information system market players.

- In March 2023, Vital, a leading AI-driven digital health company that improves the patient experience, raised US$ 24.7 million in Series B funding to drive expansion and support the rapid growth of its modern software. Vital’s solutions make it easier for healthcare providers and health systems to communicate with and engage patients during emergency department (ED) and inpatient visits. The funding round was headed by Transformation Capital, with support from strategic health system investors, Threshold Ventures, and Vital CEO / Mint.com creator Aaron Patzer, bringing Vital’s total funding to over US$ 40 million.

- In June 2022, Oracle acquired health IT company Cerner Corporation through an all-cash tender offer for US$ 95.00 per share, or ~US$ 28.3 billion in equity value. Cerner Corporation is a leading provider of digital information systems used to empower medical professionals to provide better healthcare to individual patients and communities within hospitals and health systems. The transaction is Oracle's largest acquisition and one of the largest takeovers in the year.

- In January 2022, the Gippsland Health Alliance (GHA) planned to expand its Allscripts Sunrise electronic health record (EHR) across the Victoria, Australia, region of Gippsland. GHA’s EHR Community Health project Phase 3 witnessed the deployment of the Sunrise Emergency Care module at the emergency department facilities of the Central Gippsland Health Service, West Gippsland Healthcare Group, Bairnsdale Regional Health Service, and Bass Coast Health, which covers the Southern part of the region.

- In February 2020, Medsphere Systems Corporation announced that KLAS Research recognizes the company’s Wellsoft Emergency Department Information System as the best solution of its kind. In the 2020 Best in KLAS Awards: Software and Services report, KLAS named Wellsoft the number one EDIS software system for the ninth consecutive year and fifteenth time overall.

- In January 2020, FastMed, an urgent care clinic operator, was the first of its kind to implement Epic Systems EHR. FastMed patients gain access to Epic’s patient portal, MyChart, giving patients 24-hour access to their health information, online appointment scheduling, secure direct messaging and communication with their care team, and online bill pay. On top of adding an urgent care clinic provider, several hospitals have recently implemented Epic Systems EHR. In late 2019, Tanner Health System in Georgia adopted Epic EHR.

- In November 2020, Vital, AI-powered software for hospital emergency departments and patients, collaborated with Collective Medical to improve the patient experience in the emergency department by keeping patients & their families informed throughout every step of a visit. Collective’s thousands of client partners rely on these systems for rich, real-time clinical insights to improve care decisions and the patient experience. These providers can also access Vital’s platform without additional IT integration to provide real-time patient updates.

Company Profiles

- Veradigm LLC

- eHealth-Tec

- Epic Systems Corp

- Medical Information Technology, Inc

- Q-nomy Inc

- Picis

- Vital

- MEDHOST

- Oracle Corp

- Medsphere Systems Corporation

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Application, End User, and Country

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The US emergency department information system market is expected to be valued at US$ 763.71 million in 2030.

The US emergency department information system market, based on application, is segmented into computerized physician order entry (CPOE), clinical documentation, patient tracking, e-prescribing, and others. The CPOE segment held the largest market share in 2022 and is anticipated to register the highest CAGR during the forecast period.

The US emergency department information system market was valued at US$ 281.09 million in 2022.

The US emergency department information system market majorly consists of the players, including Veradigm LLC, eHealth-Tec, Epic Systems Corp, Medical Information Technology, Inc, Q-nomy Inc, Picis, Vital, MEDHOST, Oracle Corp, and Medsphere Systems Corporation.

The factors driving the growth of the US emergency department information system market include the increase in patient flow at emergency departments and the rise in the adoption of emergency department information systems. However, huge investments and lack of skilled healthcare IT professionals hamper the growth of the US emergency department information system market.

The emergency department information system (EDIS) is a database system used by emergency response services to track patients in emergency rooms and aid with other aspects of the ED workflow. To ensure the secure availability of sensitive healthcare information, these solutions are often utilized to streamline patient care delivery, conform to applicable data interoperability requirements, and adhere to applicable privacy and protection policies. It's a comprehensive electronic health record that's utilized to keep track of patient information.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. US Emergency Department Information System Market – Market Landscape

4.1 Overview

4.2 PEST Analysis

4.2.1 US PEST Analysis

5. US Emergency Department Information System Market – Key Market Dynamics

5.1 Key Market Drivers

5.1.1 Increase in Patient Flow at Emergency Departments

5.1.2 Rise in Adoption of Emergency Department Information Systems

5.2 Market Restraints

5.2.1 Huge Investments and Lack of Skilled Healthcare IT Professionals

5.3 Market Opportunities

5.3.1 Rising Digitalization in Healthcare Services

5.4 Future Trends

5.4.1 Emergence of Cloud-Based EDIS Services

5.5 Impact Analysis

6. US Emergency Department Information System Market – Country Analysis

6.1 US Emergency Department Information System Market Revenue (US$ Mn), 2020 – 2030

7. US Emergency Department Information System Market – Revenue and Forecast to 2030 – by Type

7.1 Overview

7.2 US Emergency Department Information System Market Revenue Share, by Type, 2022 & 2030 (%)

7.2.1.1 US Emergency Department Information System Market, By Type, 2020–2030 (US$ Million)

7.3 Best-of-Breed Solutions

7.3.1 Overview

7.3.2 Best-of-Breed Solutions: Emergency Department Information System Market – Revenue and Forecast to 2030 (US$ Million)

7.4 Enterprise Solutions

7.4.1 Overview

7.4.2 Enterprise Solutions: Emergency Department Information System Market – Revenue and Forecast to 2030 (US$ Million)

8. US Emergency Department Information System Market – Revenue and Forecast to 2030 – by Application

8.1 Overview

8.2 US Emergency Department Information System Market Revenue Share, by Application, 2022 & 2030 (%)

8.2.1.1 US Emergency Department Information System Market, By Application, 2020–2030 (US$ Million)

8.3 Computerized Physician Order Entry (CPOE)

8.3.1 Overview

8.3.2 Computerized Physician Order Entry: Emergency Department Information System Market – Revenue and Forecast to 2030 (US$ Million)

8.4 Clinical Documentation

8.4.1 Overview

8.4.2 Clinical Documentation: Emergency Department Information System Market – Revenue and Forecast to 2030 (US$ Million)

8.5 Patient Tracking

8.5.1 Overview

8.5.2 Patient Tracking: Emergency Department Information System Market – Revenue and Forecast to 2030 (US$ Million)

8.6 E-Prescribing

8.6.1 Overview

8.6.2 E-Prescribing: Emergency Department Information System Market – Revenue and Forecast to 2030 (US$ Million)

8.7 Others

8.7.1 Overview

8.7.2 Others: Emergency Department Information System Market – Revenue and Forecast to 2030 (US$ Million)

9. US Emergency Department Information System Market – Revenue and Forecast to 2030 – by End User

9.1 Overview

9.2 US Emergency Department Information System Market Revenue Share, by End User, 2022 & 2030 (%)

9.2.1.1 US Emergency Department Information System Market, By End User, 2020–2030 (US$ Million)

9.3 Small Hospitals

9.3.1 Overview

9.3.2 Small Hospitals: Emergency Department Information System Market – Revenue and Forecast to 2030 (US$ Million)

9.4 Medium-Sized Hospitals

9.4.1 Overview

9.4.2 Medium-Sized Hospitals: Emergency Department Information System Market – Revenue and Forecast to 2030 (US$ Million)

9.5 Large Hospitals

9.5.1 Overview

9.5.2 Large Hospitals: Emergency Department Information System Market – Revenue and Forecast to 2030 (US$ Million)

10. US Emergency Department Information System Market – Industry Landscape

10.1 Overview

10.2 Growth Strategies in US Emergency Department Information System Market

10.3 Organic Growth Strategies

10.3.1 Overview

10.4 Inorganic Growth Strategies

10.4.1 Overview

11. COMPANY PROFILES

11.1 Veradigm LLC

11.1.1 Key Facts

11.1.2 Business Description

11.1.3 Products and Services

11.1.4 Financial Overview

11.1.5 SWOT Analysis

11.1.6 Key Developments

11.2 eHealth-Tec

11.2.1 Key Facts

11.2.2 Business Description

11.2.3 Products and Services

11.2.4 Financial Overview

11.2.5 SWOT Analysis

11.2.6 Key Developments

11.3 Epic Systems Corp

11.3.1 Key Facts

11.3.2 Business Description

11.3.3 Products and Services

11.3.4 Financial Overview

11.3.5 SWOT Analysis

11.3.6 Key Developments

11.4 Medical Information Technology, Inc.

11.4.1 Key Facts

11.4.2 Business Description

11.4.3 Products and Services

11.4.4 Financial Overview

11.4.5 SWOT Analysis

11.4.6 Key Developments

11.5 Q-nomy Inc

11.5.1 Key Facts

11.5.2 Business Description

11.5.3 Products and Services

11.5.4 Financial Overview

11.5.5 SWOT Analysis

11.5.6 Key Developments

11.6 Picis

11.6.1 Key Facts

11.6.2 Business Description

11.6.3 Products and Services

11.6.4 Financial Overview

11.6.5 SWOT Analysis

11.6.6 Key Developments

11.7 Vital

11.7.1 Key Facts

11.7.2 Business Description

11.7.3 Products and Services

11.7.4 Financial Overview

11.7.5 SWOT Analysis

11.7.6 Key Developments

11.8 Medsphere Systems Corporation

11.8.1 Key Facts

11.8.2 Business Description

11.8.3 Products and Services

11.8.4 Financial Overview

11.8.5 SWOT Analysis

11.8.6 Key Developments

11.9 MEDHOST

11.9.1 Key Facts

11.9.2 Business Description

11.9.3 Products and Services

11.9.4 Financial Overview

11.9.5 SWOT Analysis

11.9.6 Key Developments

11.10 Oracle Corp

11.10.1 Key Facts

11.10.2 Business Description

11.10.3 Products and Services

11.10.4 Financial Overview

11.10.5 SWOT Analysis

11.10.6 Key Developments

12. Appendix

12.1 About The Insight Partners

12.2 Glossary of Terms

List of Tables

Table 1. US Emergency Department Information System Market, By Type – Revenue and Forecast to 2030 (US$ Million)

Table 2. US Emergency Department Information System Market, By Application – Revenue and Forecast to 2030 (US$ Million)

Table 3. US Emergency Department Information System Market, By End User – Revenue and Forecast to 2030 (US$ Million)

Table 4. Recent Organic Growth Strategies in US Emergency Department Information System Market

Table 5. Recent Inorganic Growth Strategies in the US Emergency Department Information System Market

Table 6. Glossary of Terms

List of Figures

Figure 1. US Emergency Department Information System Market Segmentation

Figure 2. US: PEST Analysis

Figure 3. US Emergency Department Information System Market: Key Industry Dynamics

Figure 4. Impact Analysis of Drivers and Restraints

Figure 5. US Emergency Department Information System Market – Revenue Forecast and Analysis – 2020–2030

Figure 6. US Emergency Department Information System Market Revenue Share, by Type, 2022 & 2030 (%)

Figure 7. Best-Of-Breed Solutions: Emergency Department Information System Market – Revenue and Forecast to 2030 (US$ Million)

Figure 8. Enterprise Solutions: Emergency Department Information System Market – Revenue and Forecast to 2030 (US$ Million)

Figure 9. US Emergency Department Information System Market Revenue Share, by Application, 2022 & 2030 (%)

Figure 10. Computerized Physician Order Entry: Emergency Department Information System Market – Revenue and Forecast to 2030 (US$ Million)

Figure 11. Clinical Documentation: Emergency Department Information System Market – Revenue and Forecast to 2030 (US$ Million)

Figure 12. Patient Tracking: Emergency Department Information System Market – Revenue and Forecast to 2030 (US$ Million)

Figure 13. E-Prescribing: Emergency Department Information System Market – Revenue and Forecast to 2030 (US$ Million)

Figure 14. Others: Emergency Department Information System Market – Revenue and Forecast to 2030 (US$ Million)

Figure 15. US Emergency Department Information System Market Revenue Share, by End User, 2022 & 2030 (%)

Figure 16. Small Hospitals: Emergency Department Information System Market – Revenue and Forecast to 2030 (US$ Million)

Figure 17. Medium-Sized Hospitals: Emergency Department Information System Market – Revenue and Forecast to 2030 (US$ Million)

Figure 18. Large Hospitals: Emergency Department Information System Market – Revenue and Forecast to 2030 (US$ Million)

Figure 19. Growth Strategies in US Emergency Department Information System Market

The List of Companies - US Emergency Department Information System Market

- Veradigm LLC

- eHealth-Tec

- Epic Systems Corp

- Medical Information Technology, Inc

- Q-nomy Inc

- Picis

- Vital

- MEDHOST

- Oracle Corp

- Medsphere Systems Corporation.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For