The US pharmaceutical market size is expected to grow from US$ 846.72 billion in 2022 to US$ 1,285.79 billion by 2030; the US pharmaceutical market forecast is estimated to record a CAGR 5.36% during 2022–2030.

Analyst’s Viewpoint

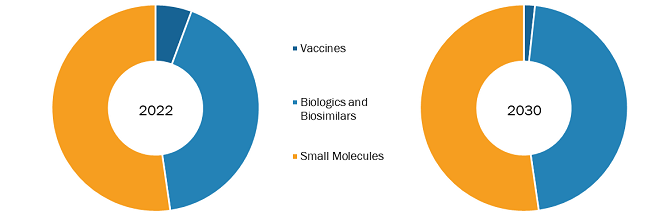

Rising workplace-associated disorders, rise in pharmaceutical production capacity, increased approvals of generic drugs, and escalating R&D investments in the pharmaceutical sector drive the US pharmaceutical market growth. However, the high cost of drug development and marketing approval hinders the market growth. The US pharmaceutical market forecast, by product, is segmented into vaccines, biologicals & biosimilars, and small molecules. The small molecules segment is further bifurcated into generic and branded. The small molecules segment held the largest market share in 2022. The biologicals & biosimilars segment is expected to register the highest CAGR during the forecast period.

Pharmaceutical is a broad segment that consolidates a group of chemicals classified based on their pharmacological effect and therapeutic use. For instance, alkaloids were the first pure pharmaceuticals derived from plants; they include quinine, nicotine, cocaine, atropine, and morphine. Similarly, some drugs are made of animal origin, which includes glandular extracts containing hormones. These pharmaceutical products diagnose, treat, and prevent chronic diseases such as cancer, diabetes, and genetic disorders.

Market Insights

Increased Approval of Generic Drugs

The demand for generic drugs, which serve as an alternative to branded drugs, has increased tremendously owing to their low costs. Many branded drug patents are nearing expiry, which is a major reason for the surged production of generics. In February 2023, Zydus Lifesciences received tentative approval from the US Food & Drug Administration (USFDA) for two generic drugs: bosentan tablets (32 mg) and canagliflozin tablets (100 mg and 300 mg). Bosentan tablet is indicated for the treatment of pulmonary arterial hypertension (PAH) in pediatric patients with age 3 years or above. The canagliflozin tablet is indicated to improve glycemic control in patients with type 2 diabetes mellitus. In July 2022, Glenmark PHARMACEUTICALs Inc. received approval from the USFDA for norethindrone acetate and ethinyl estradiol capsules, and ferrous fumarate capsules (1 mg/20 mcg). The approved drug is the generic version of Taytulla capsules offered by Allergan PHARMACEUTICALs International, which is a prescription birth control pill. In November 2022, the USFDA granted tentative approval for Lupin’s Abbreviated New Drug Application (ANDA) for drospirenone tablets, 4 mg, which is a generic version of Slynd Tablets, 4 mg, of Exeltis USA Inc.

Thus, the growing number of approvals of generic drugs drives the US pharmaceutical market share and demand for generic segment.

Escalating R&D Investments in Pharmaceutical Industry

Majority of investments in the US pharmaceutical market, companies primarily target drug discovery and development. According to the Pharmaceutical Research and Manufacturers Association (PhRMA), pharmaceutical companies in the US perform more than half of the world's R&D, with investments totaling ~US$ 75 billion, and they hold intellectual property rights on most of the new pharmaceuticals. In 2021, Pfizer Inc. invested US$ 13,829 million in research and development, recording an increase of US$ 4.4 billion from 2020 (US$ 9,393 million). Similarly, Johnson & Johnson invested US$ 14.7 billion in research and development in 2021, with an annual rise of 21% in its all-time-high investment recorded in 2020. These investments reflect the commitment of companies to creating life-enhancing innovations.

The research-based pharmaceutical industry is an important asset of the European economy; it is one of the top-performing high-technology segments in the region. As per the European Federation of Pharmaceutical Industries and Associations (EFPIA), the research-based pharmaceutical industry in Europe invested ~US$ 44,266.18 million (€ 41,500 million) in R&D in 2021. Similarly, governments of countries in Asia Pacific are focusing on pharmaceutical R&D activities. For instance, the Government of Thailand launched the “Thailand 4.0” initiative to facilitate the country’s shift from a “manufacturing hub” to an “innovation hub.” Additionally, as per the India Brand Equity Foundation, the foreign direct investment (FDI) inflows in the Indian drugs and pharmaceuticals sector reached US$ 1,414 million between 2021 and 2022.

Such high investments in R&D activities are driving the growth of the US pharmaceutical market share at present and also in future years.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

US Pharmaceutical Market: Strategic Insights

Market Size Value in US$ 846.72 billion in 2022 Market Size Value by US$ 1,285.79 billion by 2030 Growth rate CAGR 5.36% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

US Pharmaceutical Market: Strategic Insights

| Market Size Value in | US$ 846.72 billion in 2022 |

| Market Size Value by | US$ 1,285.79 billion by 2030 |

| Growth rate | CAGR 5.36% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Future Trend

Increasing Adoption of AI-Based Tools for Drug Discovery

Artificial intelligence (AI) is emerging as an important tool in the healthcare sector, as it helps understand the action mechanism of drugs. The use of AI tools has already been proven to accelerate the process of discovering new candidate therapeutics; the process that earlier used to take years to complete can now be accomplished within months using AI. In addition to reducing the timelines of drug discovery, AI helps enhance the agility of the research process, increase the accuracy of predictions on drug safety and efficacy, and boost the speed and precision of discovery and preclinical testing, thereby providing a competitive edge to R&D strategies.

Many pharmaceutical companies are collaborating with AI companies to harness the benefits of AI in drug discovery. For instance, in 2019, Pfizer partnered with Concreto HealthAI to advance its work in precision oncology using AI and real-world data. The company believes that AI tools have tremendous potential in developing and using drugs to improve patient outcomes. Further, in 2022, Pfizer extended its partnership with CytoReason to leverage its AI technology for improving drug candidate discovery and drug development processes. Similarly, in 2019, Janssen collaborated with a French startup Iktos Pharmaceuticals to develop an AI-powered drug design system. Janssen's new drug design system will enhance the process of discovering new medications by accelerating the identification of molecules. Additionally, in January 2020, Bayer partnered with a UK-based AI-driven drug discovery company, where Bayer will use the AI drug discovery platform to identify and optimize novel structures as potential drug candidates to treat cardiovascular and oncological diseases. Similarly, GlaxoSmithKline (GSK) collaborated with Insilico Medicine, a Baltimore-based AI-driven company, to explore the AI capability of Insilico for easing the process of identification of novel biological targets.

Thus, the growing adoption of AI-based tools for drug discovery is likely to trigger the demand of the US pharmaceutical market analysis during the forecast period.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Market Opportunity

Rising Incidences of Chronic Diseases and Infectious Diseases

The Centers for Disease Control and Prevention (CDC) states that 6 in 10 adults in the US suffer from at least one chronic disease, such as cancer, heart disease, lung disease, stroke, neurological disease, diabetes, and kidney disease. Moreover, 4 in 10 adults in the country suffer from 2 or more chronic diseases. According to the CDC, ~1,752,735 new cancer cases were reported in the US in 2019. The most prevalent cancer types are breast cancer, lung and bronchus cancer, prostate cancer, colon and rectum cancer, melanoma cancer, and liver cancer. Further, according to data published by the American Diabetes Association, ~37.3 million people, representing 11.4% of Americans, were possibly diabetic in 2019. Among these, ~28.7 million people were diagnosed with diabetes, while ~8.5 million did not undergo a proper diagnostic procedure. Further, per the National Ambulatory Medical Care Survey: 2019, there were 10.2 million visits to physicians for the treatment of infectious and parasitic diseases.

According to the World Health Organization, chronic diseases represent 77% of the total disease burden and 86% of all deaths in Europe. Thus, 70–80% of the total healthcare costs are spent on the management of chronic diseases. The surging prevalence of infectious diseases, especially in Southeast Asia, is also likely to propel the demand for pharmaceuticals in the coming years, eventually driving the growth of the pharmaceutical market. For instance, as per the Revised National Tuberculosis Control Programme Report, ~4.4 lakh patients died due to tuberculosis in India in 2018, i.e., 29% of the total 1.5 million deaths caused by the disease across the world. Thus, the rising incidence of chronic diseases and infectious diseases bolsters the demand for drugs, which would continue to drive the US pharmaceutical market growth in the future.

Product-Based Insights

The US pharmaceutical market analysis, by product, is segmented into vaccines, biologicals & biosimilars, and small molecules. The small molecules segment is further bifurcated into generic and branded. The small molecules segment held the largest market share in 2022. The biologicals & biosimilars segment is expected to register the highest CAGR during the forecast period. In the US pharmaceutical market growth, biosimilars treat patients with cancers, kidney diseases, diabetes, and other autoimmune diseases such as rheumatoid arthritis and Crohn's disease. Biologics are the most expensive medicines in the US pharmaceutical market outlook, costing tens of thousands of dollars yearly per patient. Biosimilars are expected to be priced 15–30% lower than their reference product. In 2020 alone, biosimilars saved US$ 7.9 billion, with savings expected to grow significantly in the next few years as more biosimilars enter the market. According to Cardinal Health, it is expected that biosimilars are expected to reduce the US drug expenditure by US$ 133 billion by 2025. The recognition of biosimilars as efficacious and safe agents by patients, specialists, primary care clinicians, and other healthcare professionals is propelling the demand for biosimilars. In addition, biosimilars help improve the quality of life among millions of patients while saving billions of dollars for healthcare systems per year. They have come up as potent and cost-effective options for treating many diseases—including chronic skin conditions such as psoriasis; bowel diseases such as Crohn’s disease, irritable bowel syndrome, and colitis; diabetes; autoimmune disease; cancer; kidney conditions; and arthritis. During 2017–2018, the National Health Service (NHS) saved US$ 401.10 million by switching from 10 expensive medicines to better-value and equally effective alternatives such as biologics, with an expectation of even more savings in the future. The potential savings from using biosimilars can also be used to fund other new treatments. With the high prevalence of chronic diseases, the demand for biosimilars in treating life-threatening illnesses has surged rapidly over the last five years. Such a factor has assisted the growth of the US pharmaceutical market trends in the recent past and is expected to follow a similar trend during the forecast period.

US Pharmaceutical Market Trends, by Product – 2022 and 2030

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Country Analysis

In recent years, pharmaceutical sales revenues in the US pharmaceutical market outlook have accounted for nearly half of the global total. Five of the 10 top US pharmaceutical market companies worldwide were from the US in 2021. Pfizer is one of the companies that provides prescription drug revenues worldwide, heavily boosted by its COVID-19 vaccine Comirnaty. AbbVie is another US pharmaceutical market participant that has made a great impression worldwide, with the pharmaceutical segment generating a record US$ 55 billion in 2021, driven especially by its longstanding top-seller brand Humira. Despite the influence of several emerging countries, the US has captured a dominant share of the pharmaceutical market globally. The US pharmaceutical market is home to a few major pharma companies worldwide. Most advanced US pharmaceutical market products are easily accessible to American consumers, albeit at a cost.

The US pharmaceutical market accounts for about 45% of the global pharmaceutical market and 22% of global production. The US pharmaceuticals output and sales remained robust in 2022, driven by the global vaccination rollout and suppressed demand for essential and non-essential medical treatments. The US pharmaceutical market has made great strides over the past few decades due to a greater focus on research and development (R&D). Pharma companies spend over 21% of their revenues on R&D, and this sizeable investment is wasted if a medication does not receive regulatory approval. The R&D expenditure of the US pharmaceutical market totaled some US$ 102 billion in 2021. This figure will likely increase significantly in the coming years due to the costs of developing effective and safe COVID-19 treatments and vaccines.

Johnson & Johnson, Merck & Co Inc, Abbott Laboratories, Amgen Inc, Eli Lilly and Company, Bristol-Myers Squibb Company, Bayer AG, Takeda Pharmaceuticals, Zoetis Inc, Moderna Inc, AbbVie Inc, Pfizer Inc, Gilead Sciences Inc, and Regeneron Pharmaceuticals Inc are a few of the key companies operating in the US pharmaceutical market report. Leading players in the US pharmaceutical market report focus on expanding and diversifying their market presence and clientele, tapping prevailing business opportunities. In August 2023, Bristol Myers Squibb acquired Mirati Therapeutics Inc. The goal of Mirati, a commercial-stage targeted oncology firm, is to find, create, and provide ground-breaking treatments that will improve the quality of life for cancer patients and their families. The assets of Mirati provide a compelling opportunity to expand Bristol Myers Squibb's oncology trademark, as they complement the company's portfolio and creative pipeline. By virtue of this acquisition, Bristol Myers Squibb will expand its commercial portfolio by incorporating KRAZATI, a significant lung cancer medication. The business obtains access to a number of intriguing clinical assets that enhance its pipeline for oncology treatments and make excellent prospects for both combination and single-agent development.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The market growth in the US pharmaceutical market is driven by rising workplace-associated disorders, rise in pharmaceutical production capacity, increased approvals of generic drugs, and escalating R&D investments in the pharmaceutical sector. However, the high cost of drug development and marketing approval hinders the market growth.

Johnson & Johnson, Merck & Co Inc, Abbott Laboratories, Amgen Inc, Eli Lilly and Company, Bristol-Myers Squibb Company, Bayer AG, Takeda Pharmaceuticals, Zoetis Inc, Moderna Inc, AbbVie Inc, Pfizer Inc, Gilead Sciences Inc, and Regeneron Pharmaceuticals Inc are a few of the key companies operating in the US pharmaceutical market. Leading players focus on expanding and diversifying their market presence and clientele, tapping prevailing business opportunities.

The US pharmaceutical market, by product, is segmented into vaccines, biologicals & biosimilars, and small molecules. The small molecules segment is further bifurcated into generic and branded. The small molecules segment held the largest market share in 2022. The biologicals & biosimilars segment is expected to register the highest CAGR during the forecast period.

The CAGR value of the US Pharmaceutical Market during the forecasted period of 2022-2030 is 5.36%.

Pharmaceutical is a broad segment that consolidates a group of chemicals classified based on their pharmacological effect and therapeutic use. For instance, alkaloids were the first pure pharmaceuticals derived from plants; they include quinine, nicotine, cocaine, atropine, and morphine. Similarly, some drugs are made of animal origin, which includes glandular extracts containing hormones. Drugs or medicines from animal origins are biological, biosimilar, and vaccines. These pharmaceutical products diagnose, treat, and prevent chronic diseases such as cancer, diabetes, and genetic disorders.

1. Introduction 16

1.1 Scope of the Study. 16

2. Pharmaceutical Market – Key Takeaways 17

3. Research Methodology 21

3.1 Coverage. 22

3.2 Secondary Research. 23

3.3 Primary Research. 24

4. Pharmaceutical Market – Market Landscape 25

4.1 Overview. 25

4.2 PESTLE Analysis. 25

4.2.1 Political Factors. 25

4.2.2 Economic Factors. 25

4.2.3 Social Factors. 26

4.2.4 Technological Factors. 26

4.2.5 Legal Factors. 27

4.2.6 Environmental Factors. 27

4.3 Expert’s Opinion. 28

4.4 Macro-Economic Framework of the U.S. 28

4.5 Import and Export Activities in the U.S. and Italy. 31

4.5.1 Import – Export Analysis. 31

4.5.2 US. 37

4.5.3 Italy. 50

4.6 Magazines, Publications, Universities, and Online Portals. 60

4.7 Events List 65

4.8 Trade Shows List 67

4.9 Useful Contacts -Events and Trade Shows, Associations, and Magazines. 68

4.9.1 Associations - MAIN PHARMACEUTICAL, VACCINE AND CONSUMER PRODUCT TRADE ASSOCIATIONS. 74

4.9.2 Magazines – Trade Magazines, Blogs, Journals, and Publications. 81

4.10 Information Regarding CDMOs. 84

4.10.1 Surplus/Deficit information. 84

4.10.2 Trade Balance. 84

4.10.3 Production and investment Done in the recent Past 85

4.10.4 Initiatives Taken by Pharmaceutical Countries. 86

4.11 Supply Chain Distribution Channel 87

4.12 Suggestions and Opportunities For Italian Companies. 98

4.13 Industry Performance. 99

4.14 Industry Outlook. 100

4.14.1 Market Size and Growth. 100

4.14.2 Research and Development (R&D) 100

4.14.3 Market Dynamics. 100

4.14.4 Regulatory Landscape. 101

4.14.5 Market Access and Pricing. 101

4.14.6 COVID-19 Impact 101

4.14.7 Generics and Biosimilars. 101

4.14.8 Digital Health Integration. 101

4.14.9 Supply Chain Resilience. 102

4.14.10 Workforce and Employment 102

4.14.11 Downward Pressure on Pricing. 102

4.14.12 From Treatment to Prevention and Beyond. 103

4.15 Key External Drivers. 103

4.15.1 Increasing Geriatric Population. 103

4.15.2 Advantages Offered by Continuous Manufacturing Process. 104

4.16 Demand Determinants in Future. 104

4.16.1 Growing Interest of Pharmaceutical Companies to Promote Product Sales through Contract Sales Organizations. 104

4.16.2 Rising Number of Healthcare Start-ups. 105

4.17 Industry Trends in the US Market 106

4.17.1 Increasing Adoption of Continuous Manufacturing in Pharmaceuticals. 106

4.17.2 Growing Adoption of AI-based Tools for Drug Discovery. 106

4.17.3 Growing Adoption of Self-Injecting Parenteral Devices. 106

5. Pharmaceutical Market – Key Market Dynamics 110

5.1 Market Drivers. 110

5.1.1 Rising Workplace-Associated Disorders. 110

5.1.2 Rise in Pharmaceutical Production Capacity. 111

5.1.3 Increased Approvals of Generic Drugs. 112

5.1.4 Escalating R&D Investments in Pharmaceutical Industry. 112

5.2 Market Restraints. 113

5.2.1 High Cost of Drug Development and Marketing Approval 113

5.3 Market Opportunities. 113

5.3.1 Rising Incidences of Chronic Diseases and Infectious Diseases. 113

5.3.2 Emerging Markets for Outsourcing Production Activities. 114

5.4 Future Trends. 115

5.4.1 Increasing Adoption of AI-based Tools for Drug Discovery. 115

5.5 Impact Analysis. 116

6. Pharmaceutical Market – US Analysis 117

6.1 US Pharmaceutical Market Revenue Forecast and Analysis. 117

6.1.1 US: Pharmaceutical Market, by Product, 2019–2030 (US$ Billion) 118

6.1.1.1 US: Pharmaceuticals Market For Product, by Type, 2019–2030 (US$ Billion) 118

6.2 Production mapping. 119

6.2.1 Pharma companies in the US- 119

6.2.2 The impact of COVID-19 on R&D- 119

6.3 Pricing Analysis of Key Products. 119

6.4 Production and Sales Statistics of Pharmaceutical Market in US. 122

6.5 Value Chain Analysis and Vendor’s Ecosystem.. 124

6.6 Go-to-Market Strategies for Companies. 125

6.6.1 Johnson & Johnson. 125

6.6.2 Pfizer Inc. 126

6.6.3 Merck Co & Inc. 126

6.7 Regulatory Scenario in the United States Associated With Pharmaceutical Industry. 127

6.7.1 Agencies, Organizations, Institutes, Centers, and Offices Associated with Pharmaceutical Product Regulation. 128

6.7.2 Regulations to enter and operate within the USA Market 128

6.8 HTS Codes for Drugs in United States. 129

6.8.1 Custom Duties. 131

6.8.2 Link Between HTS Codes and Custom Duties. 131

7. US Branded Small Molecules Market 132

7.1 US: Branded Small Molecules Market Revenue and Forecast to 2030. 132

7.1.1 Overview. 132

7.1.2 US: Branded Small Molecules Market Positioning Analysis. 134

7.1.3 US Branded Small Molecules Market – Revenue and Forecast to 2030 (USD Billion) 135

8. US Generic Small Molecules Market 136

8.1 US: Generic Small Molecules Market Revenue and Forecast to 2030. 136

8.1.1 Overview. 136

8.1.2 US: Generic Small Molecules Market Positioning Analysis: 138

8.1.3 US Generic Small Molecules Market – Revenue and Forecast to 2030 (USD Billion) 139

9. US Biological and Biosimilar Products Market 140

9.1 US: Biological and Biosimilar Products Market Revenue and Forecast to 2030. 140

9.1.1 Overview. 140

9.1.2 US: Biological and Biosimilar Products Market Positioning Analysis: 142

9.1.3 US Biological and Biosimilar Products Market – Revenue and Forecast to 2030 (USD Billion) 143

10. US Vaccines Market 144

10.1 US: Vaccines Market Revenue and Forecast to 2030. 144

10.1.1 Overview. 144

10.1.2 US: Vaccines Market Positioning Analysis: 146

10.1.3 US Vaccines Market – Revenue and Forecast to 2030 (USD Billion) 147

11. Pharmaceutical Market – Industry Landscape 148

11.1 Overview. 148

11.2 Growth Strategies in the Pharmaceutical Market 148

11.3 Inorganic Growth Strategies. 149

11.3.1 Overview. 149

11.4 Organic Growth Strategies. 150

11.4.1 Overview. 150

12. Company Profiles 152

12.1 Moderna Inc. 152

12.1.1 Key Facts. 152

12.1.2 Business Description. 152

12.1.3 Products and Services. 153

12.1.4 Financial Overview. 154

12.1.5 SWOT Analysis. 156

12.1.6 Key Developments. 158

12.2 AbbVie Inc. 159

12.2.1 Key Facts. 159

12.2.2 Business Description. 159

12.2.3 Products and Services. 160

12.2.4 Financial Overview. 161

12.2.5 SWOT Analysis. 164

12.2.6 Key Developments. 168

12.3 Gilead Sciences Inc. 169

12.3.1 Key Facts. 169

12.3.2 Business Description. 169

12.3.3 Products and Services. 170

12.3.4 Financial Overview. 171

12.3.5 SWOT Analysis. 173

12.3.6 Key Developments. 177

12.4 Regeneron Pharmaceuticals Inc. 178

12.4.1 Key Facts. 178

12.4.2 Business Description. 178

12.4.3 Products and Services. 179

12.4.4 Financial Overview. 180

12.4.5 SWOT Analysis. 181

12.4.6 Key Developments. 185

12.5 Merck & Co Inc. 186

12.5.1 Key Facts. 186

12.5.2 Business Description. 186

12.5.3 Products and Services. 187

12.5.4 Financial Overview. 188

12.5.5 SWOT Analysis. 191

12.5.6 Key Developments. 195

12.6 Abbott Laboratories. 196

12.6.1 Key Facts. 196

12.6.2 Business Description. 196

12.6.3 Products and Services. 197

12.6.4 Financial Overview. 199

12.6.5 SWOT Analysis. 202

12.6.6 Key Developments. 206

12.7 Bristol-Myers Squibb Co. 207

12.7.1 Key Facts. 207

12.7.2 Business Description. 207

12.7.3 Products and Services. 208

12.7.4 Financial Overview. 209

12.7.5 SWOT Analysis. 211

12.7.6 Key Developments. 215

12.8 Vertex Pharmaceuticals Inc. 216

12.8.1 Key Facts. 216

12.8.2 Business Description. 216

12.8.3 Products and Services. 217

12.8.4 Financial Overview. 218

12.8.5 SWOT Analysis. 220

12.8.6 Key Developments. 222

12.9 Pfizer Inc. 223

12.9.1 Key Facts. 223

12.9.2 Business Description. 223

12.9.3 Products and Services. 224

12.9.4 Financial Overview. 225

12.9.5 SWOT Analysis. 227

12.9.6 Key Developments. 231

12.10 Eli Lilly and Co. 233

12.10.1 Key Facts. 233

12.10.2 Business Description. 233

12.10.3 Products and Services. 234

12.10.4 Financial Overview. 235

12.10.5 SWOT Analysis. 237

12.10.6 Key Developments. 241

12.11 Bayer AG. 242

12.11.1 Key Facts. 242

12.11.2 Business Description. 242

12.11.3 Products and Services. 243

12.11.4 Financial Overview. 245

12.11.5 SWOT Analysis. 248

12.11.6 Key Developments. 251

12.12 Johnson & Johnson. 252

12.12.1 Key Facts. 252

12.12.2 Business Description. 252

12.12.3 Products and Services. 253

12.12.4 Financial Overview. 256

12.12.5 SWOT Analysis. 258

12.12.6 Key Developments. 262

12.13 Amgen Inc. 264

12.13.1 Key Facts. 264

12.13.2 Business Description. 264

12.13.3 Products and Services. 265

12.13.4 Financial Overview. 266

12.13.5 SWOT Analysis. 268

12.13.6 Key Developments. 272

12.14 Takeda Pharmaceutical Co Ltd. 273

12.14.1 Key Facts. 273

12.14.2 Business Description. 273

12.14.3 Products and Services. 274

12.14.4 Financial Overview. 275

12.14.5 SWOT Analysis. 278

12.14.6 Key Developments. 282

12.15 Zoetis Inc. 283

12.15.1 Key Facts. 283

12.15.2 Business Description. 283

12.15.3 Products and Services. 284

12.15.4 Financial Overview. 285

12.15.5 SWOT Analysis. 287

12.15.6 Key Developments. 290

List of Tables

Table 1. US Export Trade to Italy- Product: HSC 30 Pharmaceutical products. 43

Table 2. US Export Trade to Italy- Product: HSC 30 Pharmaceutical products. 44

Table 3. US Import Trade from Italy- Product: HSC 30 Pharmaceutical products. 47

Table 4. US Import Trade from Italy- Product: HSC 30 Pharmaceutical products. 48

Table 5. Italy Import Trade from US- Product: HSC 30 Pharmaceutical products. 54

Table 6. Italy Import Trade from US- Product: HSC 30 Pharmaceutical products. 55

Table 7. Italy Export Trade from US- Product: HSC 30 Pharmaceutical products. 58

Table 8. Italy Export Trade to US- Product: HSC 30 Pharmaceutical products. 59

Table 9. List of Magazines, Publications, Universities, and Online Portals. 61

Table 10. List of Events. 65

Table 11. List of Trade Shows. 67

Table 12. Events and Trade Shows. 68

Table 13. Counts of total nonfatal occupational injuries, illnesses, and respiratory illnesses (private industry, 2018–2022) (Thousand) 110

Table 14. US Pharmaceutical Market, by Product – Revenue and Forecast to 2030 (US$ Billion) 118

Table 15. US Pharmaceuticals Market For Product, by Type – Revenue and Forecast to 2030 (US$ Billion) 118

Table 16. Top Drugs by Price Increase, January and July 2022. 120

Table 17. Top Drugs by Percentage Price Increase, January and July 2022. 121

Table 18. Global Demand of Pharmaceutical (US$ Billion) 123

Table 19. Global Production of Pharmaceutical (US$ Billion) 123

Table 20. Production Size in US (US$ Billion) 123

Table 21. Novel Drug Approvals for 2023. 133

Table 22. Recent Generic Small Molecules Approvals by US FDA. 137

Table 23. Recent Biological and Biosimilar Products Approvals by US FDA. 141

Table 24. Recent Vaccines Approvals by US FDA. 145

Table 25. Recent Inorganic Growth Strategies in the Pharmaceutical Market 149

Table 26. Recent Organic Growth Strategies in the Pharmaceutical Market 151

List of Figures

Figure 1. Pharmaceutical Market Overview.. 17

Figure 2. Small Molecules Segment Held Largest Share of Product Segment in Pharmaceutical Market 17

Figure 3. Pharmaceutical Market – Industry Landscape. 19

Figure 4. Experts’ Opinion. 28

Figure 5. List of supplying markets for pharmaceutical product imported by United States. 37

Figure 6. List of supplying markets for pharmaceutical product imported by United States in US$ Thousand. 38

Figure 7. List of importing markets for a product exported by United States. 40

Figure 8. List of importing markets for a product exported by United States. 41

Figure 9. List of importing markets for a product exported by United States. 42

Figure 10. List of supplying markets for a product imported by Italy. 50

Figure 11. List of supplying markets for a product imported by Italy. 50

Figure 12. List of importing markets for a product exported by Italy. 51

Figure 13. List of importing markets for a product exported by Italy. 52

Figure 14. List of importing markets for a product exported by Italy. 53

Figure 15. Key Trends Impact 108

Figure 16. Key Trends Impact 109

Figure 17. Pharmaceutical Market Impact Analysis of Driver and Restraints. 116

Figure 18. US Pharmaceutical Market – Revenue Forecast and Analysis – 2020–2030. 117

Figure 19. US Branded Small Molecules Market Revenue and Forecast to 2030 (USD Billion) 135

Figure 20. US Generic Small Molecules Market Revenue and Forecast to 2030 (USD Billion) 139

Figure 21. US Biological and Biosimilar Products Market Revenue and Forecast to 2030 (USD Billion) 143

Figure 22. US Biological and Biosimilar Products Market Revenue and Forecast to 2030 (USD Billion) 147

Figure 23. Growth Strategies in the Pharmaceutical Market 148

The List of Companies - US Pharmaceutical Market

- Moderna Inc

- AbbVie Inc

- Gilead Sciences Inc

- Regeneron Pharmaceuticals Inc

- Merck & Co Inc

- Abbott Laboratories

- Bristol-Myers Squibb Co

- Vertex Pharmaceuticals Inc

- Pfizer Inc

- Eli Lilly and Co

- Bayer AG

- Johnson & Johnson

- Amgen Inc

- Takeda Pharmaceutical Co Ltd

- Zoetis Inc

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For