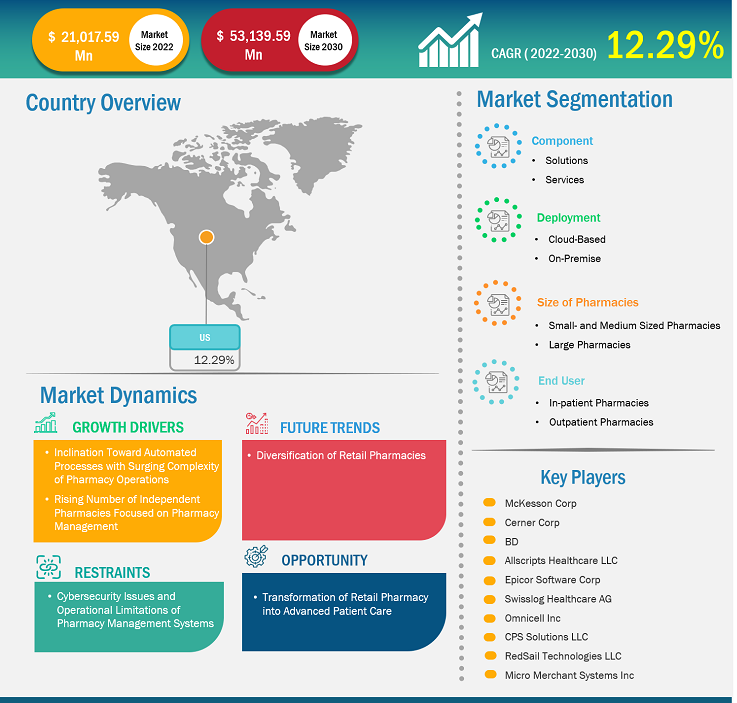

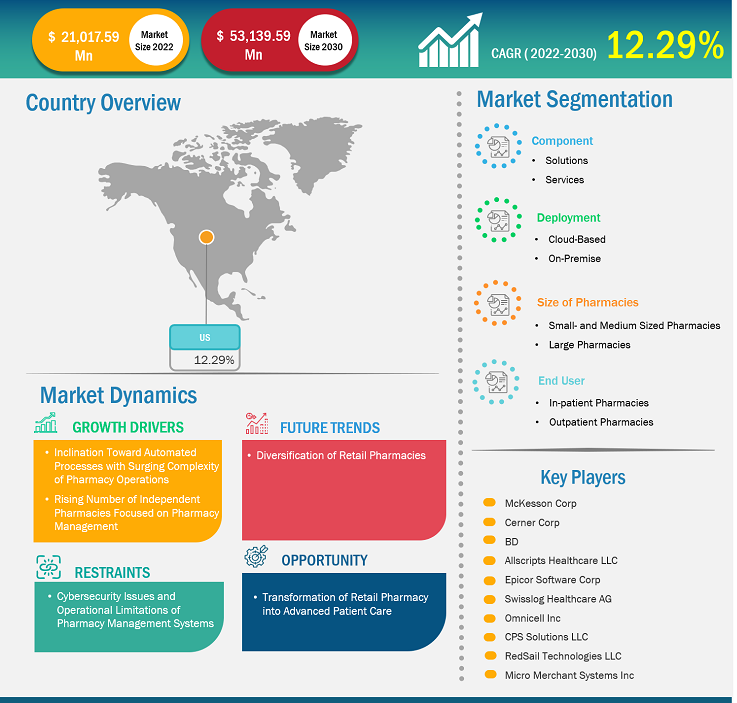

The US pharmacy management system market size is projected to grow from US$ 21,017.59 million in 2022 to US$ 53,139.59 million by 2030; the market is estimated to record a CAGR of 12.29% during 2022–2030.

Market Insights and Analyst View:

Pharmacy management systems, also called pharmacy software, is a system that stores all information about operations in pharmacies. It helps in data storage, manages the entire system, regulates the use of pharmaceutical products, and helps improve consumer satisfaction. Pharmacy management software enhances inventory management and medicine dispensing, and controls adverse drug events (ADE). The rising demand for reducing medication errors and the increasing number of prescriptions propel the pharmacy management system market in the US. The rising number of hospitals investing in new technologies to enhance healthcare process management and prevent medication errors is also expected to drive market expansion.

Krey players in the US pharmacy management system market are significantly opting for growth strategies such as mergers and acquisitions. Large players are acquiring smaller businesses and new entrants to gain rights to their technologies to improve and expand their product offerings.

Growth Drivers:

Inclination Toward Automated Processes with Surging Complexity of Pharmacy Operations

A steady rise in healthcare spending has been driving innovations in healthcare IT, and the adoption of state-of-the-art products and services in the US. Pharmacy management systems allow end users to control the pharmacy reliably. These systems have revolutionized the pharmaceutical sector by automating the billing process, speeding up the claim process, and ensuring the dispensation of accurate billing information to patients. Features such as inventory management, prescription processing, patient management, billing and insurance management, and reporting and analytics aid the safe and effective administration of pharmaceutical drugs. These systems continue to store and organize information. Further, IT solutions enable the simplification of drug dispensing and automation of drug handling in a supply chain. In the US, Avant Pharmacy and Wellness Center, Spence’s Pharmacy, and Copper Bend Pharmacy are among the pharmacies using these management systems.

Advancements in healthcare technology drive modernization in ambulatory and retail pharmacies. The increasing awareness about new health information technology (HIT) and the use of robotic dispensing systems have made pharmacy operations quicker and more efficient while ensuring optimum patient safety.

Technology innovations have led to more streamlined and coordinated workflows in pharmacies, helping them optimize operations throughout the drug delivery cycle. Pharmacy management software reduces the risk of medication errors and provides personalized medication plans. This software has become an essential solution in the US due to the high complexity of the healthcare sector in the country.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

US Pharmacy Management System Market: Strategic Insights

Market Size Value in US$ 21,017.59 million in 2022 Market Size Value by US$ 53,139.59 million by 2030 Growth rate CAGR of 12.29% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

US Pharmacy Management System Market: Strategic Insights

| Market Size Value in | US$ 21,017.59 million in 2022 |

| Market Size Value by | US$ 53,139.59 million by 2030 |

| Growth rate | CAGR of 12.29% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The “US Pharmacy Management System Market” is segmented on the basis of component, deployment, size of pharmacies, and end users. Based on component, the market is bifurcated into solutions and services. The solutions segment is subsegmented into EMR/HER, inventory management, purchase order management, supply chain management, regulatory and compliance information, clinical pharmacy management, and others. In terms of deployment, the US pharmacy management system market is segmented into cloud-based and on-premise. The US pharmacy management system market, by size of pharmacies, is bifurcated into small- and medium-sized pharmacies, and large pharmacies. Based on end user, the market is segmented into in-patient pharmacies and outpatient pharmacies.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Segmental Analysis:

The US pharmacy management system market, by component, is segmented into solutions and services. The solutions segment held a larger share of the market in 2022 and is expected to record a CAGR of 11.81% during 2022-2030. The services segment is expected to witness a higher CAGR of 13.97% during 2022–2030. The pharmacy retail industry in the US is booming with hundreds of emerging retailers entering the ecosystem. However, challenges such as shrinking profit margins, lack of skilled personnel, and reduced government support are compelling pharmacy owners to implement pharmacy management software solutions. Companies in the US pharmacy management system market offer services such as new facility entry, refill order entry, refill request management, and emergency kit order entry. Registering a new facility takes ample time and huge operational costs. Pharmacy management service providers help eliminate these issues by setting up a workflow process that provides convenience to pharmacists, thereby reducing the total number of man-hours required to perform the task and performing tasks cost-effectively.

US Pharmacy Management System Market, by Component – 2022 and 2030

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Based on deployment, the US pharmacy management system market is segmented into cloud-based and on-premise. The cloud-based segment held a larger market share in 2022, and the same segment is anticipated to register a higher CAGR of 13.06% during 2022–2030. Cloud-based deployment offers a safer and more standardized information system to manage patient data. Cloud-based pharmacy management systems can be connected to computers via the internet and web browser, which enables access to the data anytime and anywhere, on different devices. These systems offer a standardized way to help commercial and academic institutions manage laboratory data generated from sample testing, instrument usage, automation, and report generation. Moreover, they are easy to manage, and they help users access real-time information regarding drug inventory, administrative staff, doctor’s prescriptions, medical stock refills, etc.

Based on size of pharmacies, the US pharmacy management system market is segmented into small- and medium-sized pharmacies, and large pharmacies. The large pharmacies segment held a larger market share in 2022, and the small- and medium-sized pharmacies segment is anticipated to register a higher CAGR of 13.22% during 2022–2030. Rapid changes in healthcare systems and consumer behavior propel pharmacies to evolve from small medical dispensaries to well-being centers. Digitalization has played a major role in eliminating manual tasks, allowing pharmacies to invest resources into improving their businesses by incorporating innovative strategies that benefit customers and drug suppliers. A customer management system has proven to be a vital solution in small and medium-sized pharmacy businesses. It has an attractive, user-friendly interface. The system also leads to easy navigation and automatically refreshes the patient’s list. Additionally, it allows pharmacists to access information and manage numerous patient profiles at their fingertips.

Based on end user, the US pharmacy management system market is segmented into in-patient pharmacies and outpatient pharmacies. The in-patient pharmacies segment held a larger market share in 2022. It is anticipated to register a higher CAGR of 12.74% during 2022–2030. Inpatient pharmacies operate within hospitals and dispense medications to admitted patients receiving treatment. These pharmacists contribute to the management of patient health besides doctors and nurses. Pharmacy management systems designed for in-patient pharmacies must integrate with the various systems operating throughout a hospital to maintain accurate electronic medical records and electronic health records (EMR and EHR).

Country Analysis:

The US has a well-developed information technology sector. Advancements in medical technologies have enabled stakeholders in the healthcare sector to efficiently manage their workflows. Integrating information technology in pharmacy and medical management has led to improvements in care quality and operational efficiencies, which has resulted in maximized revenues. The adoption of pharmacy management systems allows pharmacies to meet regulatory and compliance requirements. The US pharmacy management system market growth is attributed to factors such as the rising adoption of these systems with a focus on process automation and an increase in the number of companies providing these software solutions.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the US pharmacy management system market are listed below:

- In June 2023, Micro Merchant Systems, Inc., a developer of the PrimeRx pharmacy technology management system, was awarded a Bronze Stevie Award in the 2023 American Business Awards competition for "Achievement in Product Innovation."

- In January 2023, RedSail Technologies released Axys, a cloud-based pharmacy management system. The Axys system offers pharmacies a fresh and modern solution based on the latest technology available.

- In July 2023, RedSail Technologies, LLC collaborated with DosePlanner, a cloud-based medication management solution provider. This strategic collaboration aims to empower pharmacies and healthcare providers with enhanced workflow efficiency, improved patient care, and optimized operational performance.

- In September 2022, McKesson Corporation acquired Rx Savings Solutions (RxSS), a company focused on developing solutions to maintain prescription price transparency and benefit insights. RxSS contracts directly with health plan providers to maximize the effectiveness of benefit design to drive prescription cost savings for members. Following the closing of this transaction, RxSS would become a part of the company’s Prescription Technology Solutions business.

Competitive Landscape and Key Companies:

McKesson Corp., Becton Dickinson and Co., Allscripts Healthcare LLC., Epicor Software Corp, Swisslog Healthcare AG, Omnicell Inc, CPS Solutions LLC, RedSail Technologies LLC, Micro Merchant Systems Inc, and Oracle Corp are the prominent US pharmacy management system market companies. These companies focus on new technologies, existing products’ advancements, and geographic expansions to meet the growing consumer demand worldwide.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Deployment, Size of Pharmacies, End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The US pharmacy management system market majorly consists of the players such as McKesson Corp., Becton Dickinson and Co., Allscripts Healthcare LLC., Epicor Software Corp, Swisslog Healthcare AG, Omnicell Inc., CPS Solutions LLC, RedSail Technologies LLC, Micro Merchant Systems Inc, and Oracle Corp.

The US pharmacy management system market is analyzed on the component, deployment, size of pharmacies, and end users. Based on component, the market is segmented into solutions and services. The solutions segment held a larger share of the market in 2022 and is expected to record a CAGR of 11.81% during 2022-2030.

The inclination toward automated processes with the surging complexity of pharmacy operations and the rising number of independent pharmacies focused on pharmacy management are among the key factors driving the US pharmacy management system market growth. However, cybersecurity issues and operational limitations of pharmacy management systems are hindering the growth of the market..

Pharmacy management systems, also called pharmacy software, is a system that stores all information about operations in pharmacies. It helps in data storage, manages the entire system, regulates the use of pharmaceutical products, and helps improve consumer satisfaction. Pharmacy management software enhances inventory management and medicine dispensing, and controls adverse drug events (ADE). The rising demand for reducing medication errors and the increasing number of prescriptions propel the pharmacy management system market in the US. The rising number of hospitals investing in new technologies to enhance healthcare process management and prevent medication errors is also expected to drive market expansion. The report covers detailed insights with respect to the services offered by the market players operating in the sector.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Research Methodology

2.1 Coverage

2.2 Secondary Research

2.3 Primary Research

3. US Pharmacy Management System Market – Market Landscape

3.1 Overview

3.1.1 US PEST Analysis

4. US Pharmacy Management System Market – Key Market Dynamics

4.1 Market Drivers

4.1.1 Inclination Toward Automated Processes with Surging Complexity of Pharmacy Operations

4.1.2 Rising Number of Independent Pharmacies Focused on Pharmacy Management

4.2 Market Restraints

4.2.1 Cybersecurity Issues and Operational Limitations of Pharmacy Management Systems

4.3 Market Opportunities

4.3.1 Transformation of Retail Pharmacy into Advanced Patient Care

4.4 Future Trends

4.4.1 Diversification of Retail Pharmacies

4.5 Impact Analysis

5. US Pharmacy Management System Market – Country Analysis

5.1 US Pharmacy Management System Market

5.1.1 Overview

6. Pharmacy Management System Market – Revenue and Forecast to 2030 – by Component

6.1 Overview

6.2 US Pharmacy Management System Market Revenue Share, by Component 2022 & 2030 (%)

6.3 Solutions

6.3.1 Overview

6.3.2 Solution: US Pharmacy Management System Market – Revenue and Forecast to 2030 (US$ Million)

6.3.2.1 EMR/EHR

6.3.2.1.1 Overview

6.3.2.1.2 EMR/EHR: US Pharmacy Management System Market – Revenue and Forecast to 2030 (US$ Million)

6.3.2.2 Inventory Management

6.3.2.2.1 Overview

6.3.2.2.2 Inventory Management: US Pharmacy Management System Market – Revenue and Forecast to 2030 (US$ Million)

6.3.2.3 Purchase Order Management

6.3.2.3.1 Overview

6.3.2.3.2 Purchase Order Management: US Pharmacy Management System Market – Revenue and Forecast to 2030 (US$ Million)

6.3.2.4 Supply Chain Management

6.3.2.4.1 Overview

6.3.2.4.2 Supply Chain Management: US Pharmacy Management System Market – Revenue and Forecast to 2030 (US$ Million)

6.3.2.5 Regulatory and Compliance Information

6.3.2.5.1 Overview

6.3.2.5.2 Regulatory and Compliance Information: US Pharmacy Management System Market – Revenue and Forecast to 2030 (US$ Million)

6.3.2.6 Clinical Pharmacy Management

6.3.2.6.1 Overview

6.3.2.6.2 Clinical Pharmacy Management: US Pharmacy Management System Market – Revenue and Forecast to 2030 (US$ Million)

6.3.2.7 Others

6.3.2.7.1 Overview

6.3.2.7.2 Others: US Pharmacy Management System Market – Revenue and Forecast to 2030 (US$ Million)

6.4 Services

6.4.1 Overview

6.4.2 Services: US Pharmacy Management System Market – Revenue and Forecast to 2030 (US$ Million)

7. Global US Pharmacy Management System Market – Revenue and Forecast to 2030 – by Deployment

7.1 Overview

7.2 US Pharmacy Management System Market Revenue Share, by Deployment 2022 & 2030 (%)

7.3 Cloud-based

7.3.1 Overview

7.3.2 Cloud-based: US Pharmacy Management System Market – Revenue and Forecast to 2030 (US$ Million)

7.4 On-premise

7.4.1 Overview

7.4.2 On-premise: US Pharmacy Management System Market – Revenue and Forecast to 2030 (US$ Million)

8. Global US Pharmacy Management System Market – Revenue and Forecast to 2030 – by Size of Pharmacies

8.1 Overview

8.2 US Pharmacy Management System Market Revenue Share, by Size of Pharmacies 2022 & 2030 (%)

8.3 Small and Medium-sized Pharmacies

8.3.1 Overview

8.3.2 Small and Medium-sized Pharmacies: US Pharmacy Management System Market – Revenue and Forecast to 2030 (US$ Million)

8.4 Large Pharmacies

8.4.1 Overview

8.4.2 Large Pharmacies: US Pharmacy Management System Market – Revenue and Forecast to 2030 (US$ Million)

9. Global US Pharmacy Management System Market – Revenue and Forecast to 2030 – by End User

9.1 Overview

9.2 US Pharmacy Management System Market Revenue Share, by End User 2022 & 2030 (%)

9.3 Inpatient Pharmacies

9.3.1 Overview

9.3.2 Inpatient Pharmacies: US Pharmacy Management System Market – Revenue and Forecast to 2030 (US$ Million)

9.4 Outpatient Pharmacies

9.4.1 Overview

9.4.2 Outpatient Pharmacies: US Pharmacy Management System Market – Revenue and Forecast to 2030 (US$ Million)

10. Industry Landscape

10.1 Overview

10.2 Organic Growth Strategies

10.2.1 Overview

10.3 Inorganic Growth Strategies

10.3.1 Overview

11. Company Profiles

11.1 McKesson Corp

11.1.1 Key Facts

11.1.2 Business Description

11.1.3 Products and Services

11.1.4 Financial Overview

11.1.5 SWOT Analysis

11.1.6 Key Developments

11.2 Becton Dickinson and Co

11.2.1 Key Facts

11.2.2 Business Description

11.2.3 Products and Services

11.2.4 Financial Overview

11.2.5 SWOT Analysis

11.2.6 Key Developments

11.3 Veradigm Inc.

11.3.1 Key Facts

11.3.2 Business Description

11.3.3 Products and Services

11.3.4 Financial Overview

11.3.5 SWOT Analysis

11.3.6 Key Developments

11.4 Epicor Software Corp

11.4.1 Key Facts

11.4.2 Business Description

11.4.3 Products and Services

11.4.4 Financial Overview

11.4.5 SWOT Analysis

11.4.6 Key Developments

11.5 Swisslog Healthcare AG

11.5.1 Key Facts

11.5.2 Business Description

11.5.3 Products and Services

11.5.4 Financial Overview

11.5.5 SWOT Analysis

11.5.6 Key Developments

11.6 Omnicell Inc

11.6.1 Key Facts

11.6.2 Business Description

11.6.3 Products and Services

11.6.4 Financial Overview

11.6.5 SWOT Analysis

11.6.6 Key Developments

11.7 CPS Solutions LLC

11.7.1 Key Facts

11.7.2 Business Description

11.7.3 Products and Services

11.7.4 Financial Overview

11.7.5 SWOT Analysis

11.7.6 Key Developments

11.8 RedSail Technologies LLC

11.8.1 Key Facts

11.8.2 Business Description

11.8.3 Products and Services

11.8.4 Financial Overview

11.8.5 SWOT Analysis

11.8.6 Key Developments

11.9 Micro Merchant Systems Inc

11.9.1 Key Facts

11.9.2 Business Description

11.9.3 Products and Services

11.9.4 Financial Overview

11.9.5 SWOT Analysis

11.9.6 Key Developments

11.10 Oracle Corp

11.10.1 Key Facts

11.10.2 Business Description

11.10.3 Products and Services

11.10.4 Financial Overview

11.10.5 SWOT Analysis

11.10.6 Key Developments

12. Appendix

12.1 About The Insight Partners

12.2 Glossary of Terms

List of Tables

Table 1. Recent Organic Growth Strategies in USA Pharmacy Management System Market

Table 2. Recent Inorganic Growth Strategies in the USA Pharmacy Management System Market

Table 3. Glossary of Terms

List of Figures

Figure 1. US Pharmacy Management System Market Segmentation

Figure 2. US Pharmacy Management System Market – Key Takeaways

Figure 3. US: PEST Analysis

Figure 4. Pharmacy Management System Market: Key Industry Dynamics

Figure 5. US Pharmacy Management System Market Impact Analysis of Drivers and Restraints

Figure 6. US Pharmacy Management System Market – Revenue Forecast and Analysis – 2020–2030

Figure 7. US Pharmacy Management System Market Revenue Share, by Component 2022 & 2030 (%)

Figure 8. Solution: US Pharmacy Management System Market – Revenue and Forecast to 2030 (US$ Million)

Figure 9. EMR/EHR: US Pharmacy Management System Market – Revenue and Forecast to 2030 (US$ Million)

Figure 10. Inventory Management: US Pharmacy Management System Market – Revenue and Forecast to 2030 (US$ Million)

Figure 11. Purchase Order Management: US Pharmacy Management System Market – Revenue and Forecast to 2030 (US$ Million)

Figure 12. Supply Chain Management: US Pharmacy Management System Market – Revenue and Forecast to 2030 (US$ Million)

Figure 13. Regulatory and Compliance Information: US Pharmacy Management System Market – Revenue and Forecast to 2030 (US$ Million)

Figure 14. Clinical Pharmacy Management: US Pharmacy Management System Market – Revenue and Forecast to 2030 (US$ Million)

Figure 15. Others: US Pharmacy Management System Market – Revenue and Forecast to 2030 (US$ Million)

Figure 16. Services: US Pharmacy Management System Market – Revenue and Forecast to 2030 (US$ Million)

Figure 17. US Pharmacy Management System Market Revenue Share, by Deployment 2022 & 2030 (%)

Figure 18. Cloud-based: US Pharmacy Management System Market – Revenue and Forecast to 2030 (US$ Million)

Figure 19. On-premise: US Pharmacy Management System Market – Revenue and Forecast to 2030 (US$ Million)

Figure 20. US Pharmacy Management System Market Revenue Share, by Size of Pharmacies 2022 & 2030 (%)

Figure 21. Small and Medium-sized Pharmacies: US Pharmacy Management System Market – Revenue and Forecast to 2030 (US$ Million)

Figure 22. Large Pharmacies: US Pharmacy Management System Market – Revenue and Forecast to 2030 (US$ Million)

Figure 23. US Pharmacy Management System Market Revenue Share, by End User 2022 & 2030 (%)

Figure 24. Inpatient Pharmacies: US Pharmacy Management System Market – Revenue and Forecast to 2030 (US$ Million)

Figure 25. Outpatient Pharmacies: US Pharmacy Management System Market – Revenue and Forecast to 2030 (US$ Million)

Figure 26. Pre and Post COVID-19 Impact on Pharmacy Management System Market

The List of Companies - US Pharmacy Management System Market

- McKesson Corp.

- Becton Dickinson and Co.

- Allscripts Healthcare LLC.

- Epicor Software Corp

- Swisslog Healthcare AG

- Omnicell Inc

- CPS Solutions LLC

- RedSail Technologies LLC

- Micro Merchant Systems Inc

- Oracle Corp

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For