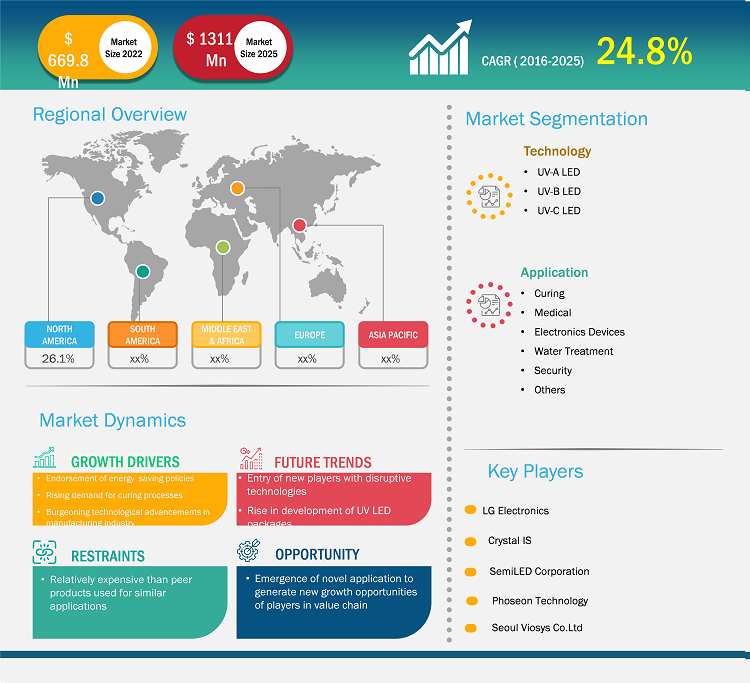

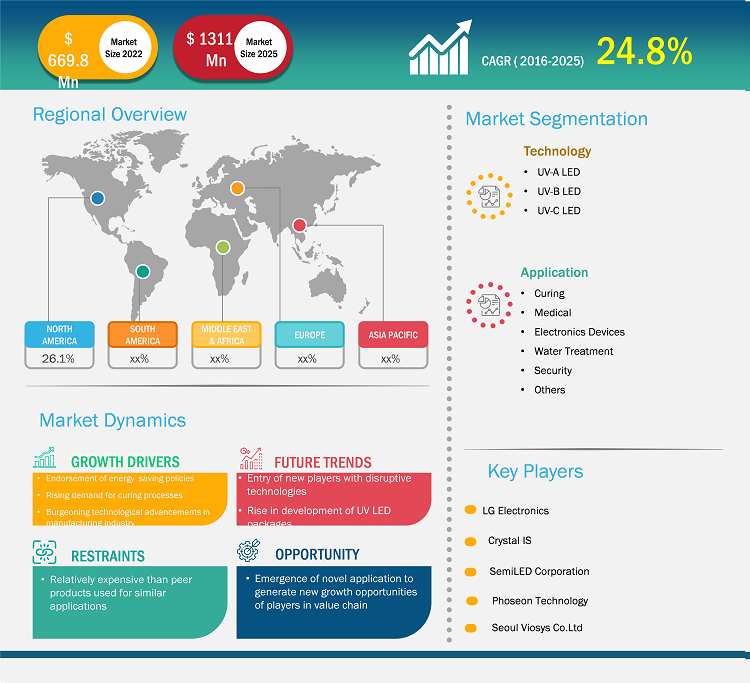

[Research Report] The UV LED market was valued at US$ 178.4 Mn in 2016 and is projected to reach US$ 1,311.7 Mn in 2025; it is expected to grow at a CAGR of 24.8% from 2017 to 2025.

Analyst Perspective:

The UV LED market report states that the UV LED market has been experiencing substantial growth in recent years, driven by the increasing demand for UV LEDs across various industries. UV LEDs, or ultraviolet light-emitting diodes, are solid-state lighting technology that emits ultraviolet light at different wavelengths. They offer numerous advantages over traditional UV lamps, including energy efficiency, longer lifespan, compact size, and environmental friendliness. UV LED suppliers are crucial in meeting the rising demand for UV LEDs. These suppliers manufacture and provide high-quality UV LEDs to various industries, such as electronics, printing, and manufacturing. They offer diverse UV LED products, including UV-A, UV-B, and UV-C LEDs, catering to different application requirements.

The applications of UV LEDs are extensive. In healthcare, UV LEDs are used for water and air purification, disinfection, and sterilization processes. They are also widely employed in industrial manufacturing processes, such as curing and drying inks, adhesives, and coatings. Additionally, UV LEDs find applications in counterfeit detection, forensic analysis, and horticulture. The UV LED market is anticipated to grow further in the coming years, driven by advancements in UV LED technology, increasing awareness about energy-efficient lighting solutions, and the growing need for effective disinfection and purification methods. UV light manufacturers will continue to play a pivotal role in meeting the market demand, ensuring the availability of high-quality UV LEDs to support various industries and applications. UV LED lighting has gained significant attention due to its numerous applications and advantages. UV light LEDs emit ultraviolet light, which is useful in various industries such as disinfection, curing, and fluorescence analysis. One specific type is the 250 nm UV LED, which operates at a wavelength ideal for sterilization and germicidal purposes. Additionally, UV-C LEDs have become increasingly popular for their ability to produce UV-C radiation, known for its germicidal properties. The compact size, energy efficiency, and long lifespan of UV LED technology make it a preferred choice for many applications where ultraviolet light is required.

Market Overview:

Ultraviolet (UV) LED technology can produce ultraviolet light from electrical energy. Numerous technologies, including UV-A, UV-B, and UV-C, create UV LED products. The use of UV LED was formerly restricted to particular niche applications, including curing, counterfeit detection, forensics, and others. The UV LED business is anticipated to benefit from the growing tendency towards the creation of sophisticated UV LEDs for novel applications and the development of UV LEDs that are very efficient. The UV LED printer market has experienced significant growth in recent years. UV LED printers offer numerous advantages over traditional printers, such as faster printing speeds, higher resolution, and the ability to print on a wide range of materials. In parallel, the UV LED sterilizer box wholesale market has also witnessed remarkable growth. UV LED sterilizer boxes are efficient and convenient for sanitizing various items, including mobile phones, accessories, baby bottles, and personal protective equipment. Moreover, the UV LED technology market has seen significant advancements and widespread adoption. This technology is utilized in various applications, such as water and air purification, counterfeit detection, medical devices, and industrial processes. The increasing focus on sustainability and the need for efficient and eco-friendly solutions drives the market for UV LED technology.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

UV LED Market: Strategic Insights

Market Size Value in US$ 178.4 Million in 2016 Market Size Value by US$ 1,311.7 Million by 2025 Growth rate CAGR of 24.8% from 2017-2025 Forecast Period 2017-2025 Base Year 2017

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

UV LED Market: Strategic Insights

| Market Size Value in | US$ 178.4 Million in 2016 |

| Market Size Value by | US$ 1,311.7 Million by 2025 |

| Growth rate | CAGR of 24.8% from 2017-2025 |

| Forecast Period | 2017-2025 |

| Base Year | 2017 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Market Driver:

Rise in Utilization of UV Curing System to Drive Growth of UV LED Market

The rise in the utilization of UV curing systems has played a crucial role in driving market growth and is a major UV led driver. UV curing refers to using ultraviolet light to instantly cure or dry coatings, inks, adhesives, and other materials. This technology offers several advantages over traditional curing methods, making it increasingly popular in various industries. One of the fundamental drivers of market growth is the superior performance and efficiency offered by UV curing systems. UV curing provides faster and more precise curing than conventional methods such as heat or solvent evaporation. Furthermore, UV curing systems offer significant environmental benefits, further contributing to their market growth. Unlike heat curing, UV curing does not involve the release of harmful volatile organic compounds (VOCs) or the emission of hazardous by-products. UV curing is a solvent-free process, reducing the environmental footprint and minimizing health and safety risks for workers. The shift towards greener and more sustainable manufacturing practices has prompted many industries to adopt UV curing systems as a viable alternative. The versatility of UV curing technology is another factor driving its market growth. UV curable materials can be used on various substrates, including plastics, metals, glass, and textiles.

This makes UV curing systems applicable in various industries, such as printing and packaging, automotive, electronics, and wood coatings. The ability to cure coatings and inks on diverse surfaces expands the potential market and drives the adoption of UV curing systems across different sectors. The rising demand for such high-performance coatings drives the need for efficient and reliable UV curing systems. The UV versus LED curing systems market presents a dynamic landscape. UV curing systems use UV light to cure inks, coatings, and adhesives, providing fast and efficient drying. On the other hand, LED curing systems employ LED technology for the same purpose. UV and LED curing systems have advantages and are preferred in different industries and applications. The market for these systems is influenced by factors such as cost-effectiveness, performance requirements, and compatibility with specific materials. Manufacturers and end-users consider various factors to determine which curing system suits their needs best.

Segmental Analysis:

On the basis of application, the UV LED market is categorized into:

- Curing

- Medical

- Electronics Device

- Water Treatment

- Security

- Others

The curing segment held the largest share of the UV LED market in 2016, whereas the water treatment segment is anticipated to register the highest CAGR in the market during the forecast period. The curing segment is the largest shareholder in the UV LED market due to its widespread adoption across the printing, automotive, electronics, and packaging industries. UV curing systems offer advantages such as faster times, energy efficiency, and environmental sustainability. The printing industry has played a significant role in driving the growth of the curing segment. Advancements in UV LED technology have further expanded the range of applications for UV curing systems, solidifying their dominant position in the market.

Regional Analysis:

The North America UV LED market was valued at US$ 0.036 billion in 2016 and is projected to reach US$ 0.29 billion by 2025; it is expected to grow at a CAGR of 26.1% during the forecast period. North America has emerged as the dominant region in the UV LED market. The region's dominance can be attributed to several key factors contributing to its market leadership. Firstly, North America has a strong presence of major UV LED manufacturers and suppliers. The region has many prominent players in the UV LED industry, including manufacturers of UV LED chips, modules, and systems. These companies have invested in research and development, enabling them to offer innovative products and drive market growth. The established infrastructure and expertise in UV LED technology give North America a competitive advantage, allowing it to dominate the market. Secondly, North America has diverse industries that extensively utilize UV LED technology. These industries include automotive, healthcare, electronics, printing, and aerospace. The demand for UV LED applications such as curing, sterilization, and disinfection is high in these sectors.

The region's advanced manufacturing capabilities and stringent regulations regarding energy efficiency and environmental sustainability have further boosted the adoption of UV LED technology. Thirdly, North America has a strong focus on technological advancements and innovation. The region is known for its robust research and development activities in various industries. This emphasis on innovation has facilitated the development of new and improved UV LED products and solutions. North American companies continuously strive to enhance UV LED systems' performance, efficiency, and reliability, contributing to the region's market dominance. North America's favorable market conditions, such as a well-developed infrastructure, supportive government initiatives, and a strong economy, have played a substantial role in the region's dominance. These factors have fostered a conducive business environment for UV LED manufacturers and end-users, driving market growth and propelling North America to the forefront of the UV LED market.

The Europe UV LED market is witnessing substantial growth, driven by several factors specific to the region. Europe has been at the forefront of adopting energy-efficient technologies and sustainable practices, which has created a favorable environment for the expansion of UV LED applications. One significant driver for the Europe UV LED market is the increasing emphasis on environmental sustainability. UV LEDs offer energy efficiency and longer lifespans than traditional UV lamps, aligning with Europe's focus on reducing carbon emissions and promoting green technologies. This has led to the widespread adoption of UV LEDs in various industries across the region. Furthermore, Europe has a strong presence in the automotive, electronics, and printing industries, which are significant consumers of UV LED technology. UV LEDs are used for curing and drying in these industries, offering faster and more efficient production processes. The region's robust manufacturing base and focus on innovation contribute to the growth of UV LED applications in these sectors. Regarding UV LED suppliers, Europe boasts a competitive landscape with several established players and emerging companies. These suppliers cater to the diverse demands of the regional market, offering a wide range of UV LED products and solutions. Collaboration between UV LED suppliers, research institutions, and industry players fosters innovation and drives market growth in Europe.

The Asia Pacific UV LED market is experiencing rapid growth driven by strong economic development, especially in countries like China, Japan, and South Korea. The region's electronics, printing, and agriculture industries are increasingly adopting UV LED technology for various applications such as sterilization, curing, and pest control. The market benefits from a robust network of manufacturers, suppliers, and distributors, offering a wide range of UV LED products. Government support and favorable regulations for energy efficiency further contribute to market expansion. UV-curable resin usage is relatively low in South Korea, but it is nevertheless significant throughout production. South Korean-based LED manufacturers are about to introduce a new line of UV-C LED goods. Technology-intensive UV-C LEDs are anticipated to contribute to the Asia-Pacific region's market expansion substantially. Korean LED manufacturers have contributed substantially to the region's UV LED industry with their advanced technologies, high-quality products, and strong market presence.

These manufacturers leverage their expertise in LED technology and production capabilities to offer a wide range of UV LEDs catering to various applications. They specialize in developing and manufacturing UV-A, UV-B, and UV-C LEDs, ensuring a comprehensive product portfolio to meet the diverse needs of industries. Korean LED manufacturers are known for their focus on research and development, constantly striving to innovate and improve UV LED performance. This commitment to technological advancement enables them to deliver UV LEDs with enhanced efficiency, higher output power, and improved reliability.

UV LED Market Report Scope

Key Player Analysis:

The UV LED market analysis consists of the players such as Koninklijke Philips, L.G Electronic, Crystal IS, Nichia Corporation, Phoseon Technology, SemiLEDs Corporation, Seoul Viosys Co. Ltd, Halma PLC, DOWA Electronics Materials Co., Ltd., and Heraeus Holding GmbH. Among the players in the UV LED Heraeus Holding GmbH and Phoseon Technology are the top two players owing to the diversified product portfolio offered.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the UV LED market. A few recent key market developments are listed below:

- In March 2022, Signify collaborated with Perfect Plants on grow lights. Two new climate cells are equipped with dimmable Philips GreenPower LED toplighting compact to grow lights and the Philips GrowWise Control System, providing a light system that can be used effectively and efficiently in every growth phase.

- In January 2021, OSRAM unveiled their new portable UV-C air cleaner to fight against viruses in this Covid-19 pandemic. The invisible ultraviolet light kills viruses with a reliability of 99.9%.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Technology , Applications

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Table of Contents

1 Table of Contents 2

1.1 List of Tables 9

1.2 List of Figures 10

1.2.1 Introduction 13

1.3 Scope of the Study 13

1.4 The Insight Partners Research Report Guidance 13

2 Key Takeaways 15

3 UV LED Market Landscape 17

3.1 Market Overview 17

3.2 Pricing Analysis 18

3.2.1 Pricing Analysis for UV LED Package by Technology Type (2016) 18

3.2.1.1 UV-A LED Package Pricing Analysis 18

3.2.1.2 UV-B LED Package Pricing Analysis 19

3.2.1.3 UV-C LED Package Pricing Analysis 19

3.3 Market Segmentation 20

3.3.1 Global UV LED Market - By Technology 21

3.3.2 Global UV LED Market - By Application 22

3.3.3 Global UV LED Market - By Geography 22

3.4 PEST Analysis 24

3.4.1 North America PEST Analysis 24

3.4.2 Europe PEST Analysis 26

3.4.3 Asia Pacific PEST Analysis 28

3.4.4 Middle East & Africa PEST Analysis 30

3.4.5 South America PEST Analysis 33

4 Global Market - Key Industry Dynamics 35

4.1 Key Market Drivers 35

4.1.1 Global endorsement of energy saving policies 35

4.1.2 Rising Demand for Curing Processes 35

4.1.3 Burgeoning Technological Advancements in Manufacturing Industry 36

4.1.4 Widespread application of UV LED across multiple industries 36

4.2 Key Market Restraints 37

4.2.1 Relatively expensive than peer products used for similar applications 37

4.3 Key Market Opporunities 37

4.3.1 Emergence of novel application to generate new growth opportunities for players in the value chain 37

4.4 Future Trends 38

4.4.1 Entry of new players with disruptive technologies would result into decline in cost 38

4.4.1 Rise in development of enhanced UV LED packages to cater next generation industries 38

4.5 Impact Analysis of Drivers and Restraints 39

5 UV LED Market - Global 40

5.1 Global UV LED Market Overview 40

5.2 Global UV LED Market Forecast and Analysis 40

6 Global UV LED Market Analysis - By Technology 42

6.1 Overview 42

6.2 UV-A LED 44

6.2.1 Overview 44

6.2.2 Global UV-A LED Market Revenue and Forecasts to 2025 (US$ Mn) 44

6.3 UV-B LED 45

6.3.1 Overview 45

6.3.2 Global UV-B LED Market Revenue and Forecasts to 2025 (US$ Mn) 45

6.4 UV-C LED 46

6.4.1 Overview 46

6.4.2 Global UV-C LED Market Revenue and Forecasts to 2025 (US$ Mn) 46

7 Global UV LED Market Analysis -By Application 48

7.1 Overview 48

7.2 Curing 49

7.2.1 Overview 49

7.2.2 Global Curing Market Revenue and Forecasts to 2025 (US$ Mn) 49

7.3 Medical 51

7.3.1 Overview 51

7.3.2 Global Medical Market Revenue and Forecasts to 2025 (US$ Mn) 51

7.4 Electronic Devices 53

7.4.1 Overview 53

7.4.2 Global Electronic Devices Market Revenue and Forecasts to 2025 (US$ Mn) 53

7.5 Water Treatment 54

7.5.1 Overview 54

7.5.2 Global Water Treatment Market Revenue and Forecasts to 2025 (US$ Mn) 54

7.6 Security 56

7.6.1 Overview 56

7.6.2 Global Security Market Revenue and Forecasts to 2025 (US$ Mn) 56

7.7 Others 57

7.7.1 Overview 57

7.7.2 Global Others Market Revenue and Forecasts to 2025 (US$ Mn) 57

8 Global UV LED Market - Geographical Analysis 58

8.1 Overview 58

8.2 North America UV LED Market Revenue and Forecasts to 2025 59

8.2.1 Overview 59

8.2.2 North America UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 59

8.2.3 North America UV LED Market Breakdown by Key Countries 61

8.2.3.1 U.S. UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 62

8.2.3.2 Canada UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 63

8.2.3.3 Mexico UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 63

8.2.4 North America UV LED Market Breakdown by Technology 65

8.2.5 North America UV LED Market Breakdown by Application 66

8.3 Europe UV LED Market Revenue and Forecasts to 2025 67

8.3.1 Overview 67

8.3.2 Europe UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 67

8.3.3 Europe UV LED Market Breakdown by Key Countries 69

8.3.3.1 France UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 70

8.3.3.2 Germany UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 71

8.3.3.3 Italy UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 72

8.3.3.4 Spain UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 73

8.3.3.5 UK UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 74

8.3.4 Europe UV LED Market Breakdown by Type 75

8.3.5 Europe UV LED Market Breakdown by Application 75

8.4 Asia Pacific (APAC) UV LED Market Revenue and Forecasts to 2025 77

8.4.1 Overview 77

8.4.2 Asia Pacific UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 77

8.4.3 Asia Pacific UV LED Market Breakdown by Key Countries 78

8.4.3.1 China UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 80

8.4.3.2 India UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 81

8.4.3.3 Taiwan UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 82

8.4.3.4 Japan UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 83

8.4.4 Asia Pacific UV LED Market Breakdown by Technology 84

8.4.5 Asia Pacific UV LED Market Breakdown by Application 85

8.5 Middle East & Africa (MEA) UV LED Market Revenue and Forecasts to 2025 87

8.5.1 Overview 87

8.5.2 Middle East & Africa UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 87

8.5.3 Middle East & Africa UV LED Market Breakdown by Key Countries 89

8.5.3.1 Saudi Arabia UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 90

8.5.3.2 UAE UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 91

8.5.3.3 South Africa UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 92

8.5.4 Middle East & Africa UV LED Market Breakdown by Technology 93

8.5.5 Middle East & Africa UV LED Market Breakdown by Material 94

8.6 South America UV LED Market Revenue and Forecasts to 2025 96

8.6.1 Overview 96

8.6.2 South America UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 96

8.6.3 South America UV LED Market Breakdown by Key Countries 98

8.6.3.1 Brazil UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 99

8.6.4 South America UV LED Market Breakdown by Technology 100

8.6.5 South America UV LED Market Breakdown by Application 100

9 Industry Landscape 103

9.1 Market Initative 103

9.2 Merger and Acquisition 103

9.3 New Development 103

10 Competitive Landscape 105

10.1 Competitive Product Mapping 105

10.2 Market Positioning 107

11 Global UV LED Market - Key Company Profiles 108

11.1 LG Electronics, Inc. 108

11.1.1 Key Facts 108

11.1.2 Business Description 108

11.1.3 Financial Overview 109

11.1.4 SWOT Analysis 110

11.1.5 Key Developments 111

11.2 Crystal IS 112

11.2.1 Key Facts 112

11.2.2 Business Description 112

11.2.3 Financial Overview 113

11.2.4 SWOT Analysis 113

11.2.5 Key Developments 115

11.3 Nichia Corporation 116

11.3.1 Key Facts 116

11.3.2 Business Description 116

11.3.3 Financial Overview 117

11.3.4 SWOT Analysis 117

11.3.5 Key Developments 118

11.4 Phoseon Technology 119

11.4.1 Key Facts 119

11.4.2 Business Description 119

11.4.3 Financial Overview 120

11.4.4 SWOT Analysis 120

11.4.5 Key Developments 122

11.5 SemiLEDs Corporation 123

11.5.1 Key Facts 123

11.5.2 Business Description 123

11.5.3 Financial Overview 124

11.5.4 SWOT Analysis 124

11.5.5 Key Developments 126

11.6 Seoul Viosys Co. Ltd. 128

11.6.1 Key Facts 128

11.6.2 Business Description 128

11.6.3 Financial Overview 129

11.6.4 SWOT Analysis 129

11.6.5 Key Developments 130

11.7 Halma PLC. 132

11.7.1 Key Facts 132

11.7.2 Business Description 132

11.7.3 Financial Overview 133

11.7.4 SWOT Analysis 133

11.7.5 Key Developments 135

11.8 DOWA Electronics Materials Co., Ltd Corporation 136

11.8.1 Key Facts 136

11.8.2 Business Description 136

11.8.3 Financial Overview 137

11.8.4 SWOT Analysis 137

11.8.5 Key Developments 139

11.9 Heraeus Holding GmbH 140

11.9.1 Key Facts 140

11.9.2 Business Description 140

11.9.3 Financial Overview 141

11.9.4 SWOT Analysis 142

11.9.5 Key Developments 143

11.10 Koninklije Philips N.V. 145

11.10.1 Key Facts 145

11.10.2 Business Description 145

11.10.3 Financial Overview 146

11.10.4 SWOT Analysis 147

11.10.5 Key Developments 148

12 Appendix 150

12.1 About The Insight Partners 150

12.2 Glossary of Terms 151

12.3 Methodology 152

12.3.1 Coverage 152

12.3.2 Secondary Research 153

12.3.3 Primary Research 153

12.4 Contact Us 154

12.5 Disclaimer 154

1.1 List of Tables

Table 1: Global UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 41

Table 2: North America UV LED Market Revenue and Forecasts to 2025 - By Technology (US$ Mn) 65

Table 3: North America UV LED Market Revenue and Forecasts to 2025 - By Application (US$ Mn) 66

Table 4: Europe UV LED Market Revenue and Forecasts to 2025 - By Technology (US$ Mn) 75

Table 5: Europe UV LED Market Revenue and Forecasts to 2025 - By Application (US$ Mn) 76

Table 6: Asia Pacific UV LED Market Revenue and Forecasts to 2025 - By Technology (US$ Mn) 84

Table 7: Asia Pacific UV LED Market Revenue and Forecasts to 2025 - By Material (US$ Bn) 85

Table 8: Middle East & Africa UV LED Market Revenue and Forecasts to 2025 - By Technology (US$ Mn) 93

Table 9: Middle East & Africa UV LED Market Revenue and Forecasts to 2025 - By Application (US$ Bn) 95

Table 10: South America UV LED Market Revenue and Forecasts to 2025 - By Technology (US$ Mn) 100

Table 11: South America UV LED Market Revenue and Forecasts to 2025 - By Application (US$ Bn) 102

Table 12: Glossary of Terms, UV LED Market 151

1.2 List of Figures

Figure 1: Curing UV LED Market, Global Revenue (US$ Mn), 2016 & 2025 15

Figure 2: UV-A LED ASP (Package Level) US$ / Unit 18

Figure 3: UV-B LED ASP (Package Level) US$ / Unit 19

Figure 4: UV-C LED ASP (Package Level) US$ / Unit 19

Figure 5: UV LED Market Segmentation 20

Figure 6: UV LED Market Segmentation 21

Figure 7: North America PEST Analysis 24

Figure 8: Europe PEST Analysis 26

Figure 9: APAC PEST Analysis 28

Figure 10:MEA PEST Analysis 30

Figure 11: SAM PEST Analysis 33

Figure 12: UV LED Market Impact Analysis of Driver and Restraints 39

Figure 13: Global UV LED Market Breakdown By Technology, 2016 & 2025 (%) 42

Figure 14: Global UV-A LED Market Revenue and Forecasts to 2025 (US$ Mn) 44

Figure 15: Global UV-B LED Market Revenue and Forecasts to 2025 (US$ Mn) 46

Figure 16: Global UV-C LED Market Revenue and Forecasts to 2025 (US$ Bn) 47

Figure 17: Global UV LED Market Breakdown by Application, 2016 & 2025 (%) 48

Figure 18: Global Curing Market Revenue and Forecasts to 2025 (US$ Mn) 50

Figure 19: Global Medical Market Revenue and Forecasts to 2025 (US$ Mn) 52

Figure 20: Global Electronic Devices Market Revenue and Forecasts to 2025 (US$ Mn) 54

Figure 21: Global Water Treatment Market Revenue and Forecasts to 2025 (US$ Mn) 55

Figure 22: Global Security Market Revenue and Forecasts to 2025 (US$ Mn) 56

Figure 23: Global Others Market Revenue and Forecasts to 2025 (US$ Mn) 57

Figure 24: UV LED Market, Global Breakdown by Regions, 2016 & 2025 (%) 58

Figure 25: North America UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 60

Figure 26: North America UV LED Market Breakdown by Key Countries, 2016 & 2025(%) 61

Figure 27: U.S. UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 62

Figure 28: Canada UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 63

Figure 29: Mexico UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 64

Figure 30: North America UV LED Market Breakdown by Technology, 2016 & 2025 (%) 65

Figure 31: North America UV LED Market Breakdown by Application, 2016 & 2025 (%) 66

Figure 32: Europe UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 68

Figure 33: Europe UV LED Market Breakdown by Key Countries, 2016 & 2025 (%) 69

Figure 34: France UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 70

Figure 35: Germany UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 71

Figure 36: Italy UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 72

Figure 37: Spain UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 73

Figure 38: UK UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 74

Figure 39: Europe UV LED Market Breakdown by Technology, 2016 & 2025 (%) 75

Figure 40: Europe UV LED Market Breakdown by Application, 2016 & 2025 (%) 76

Figure 41: Asia Pacific UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 78

Figure 42: Asia Pacific UV LED Market Breakdown by Key Countries, 2016 & 2025 (%) 79

Figure 43: China UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 80

Figure 44: India UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 81

Figure 45: Taiwan UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 82

Figure 46: Japan UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 83

Figure 47: Asia Pacific UV LED Market Breakdown by Technology, 2016 & 2025 (%) 84

Figure 48: Asia Pacific UV LED Market Breakdown by Application, 2016 & 2025 (%) 85

Figure 49: Middle East & Africa UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 88

Figure 50: Middle East & Africa UV LED Market Breakdown by Key Countries, 2016 & 2025 (%) 89

Figure 51: Saudi Arabia UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 90

Figure 52: UAE UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 91

Figure 53: South Africa UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 92

Figure 54: Middle East & Africa UV LED Market Breakdown by Technology, 2016 & 2025 (%) 93

Figure 55: Middle East & Africa UV LED Market Breakdown by Application, 2016 & 2025 (%) 94

Figure 56: South America UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 97

Figure 57: South America UV LED Market Breakdown by Key Countries, 2016 & 2025 (%) 98

Figure 58: Brazil UV LED Market Revenue and Forecasts to 2025 (US$ Mn) 99

Figure 59: South America UV LED Market Breakdown by Technology, 2016 & 2025 (%) 100

Figure 60: South America UV LED Market Breakdown by Application, 2016 & 2025 (%) 101

Figure 61: UV LED Market Competitive Product Mapping 105

Figure 62: UV LED Market Competitive Product Mapping 106

The List of Companies

1. Koninklijke Philips N.V.

2. LG Electronics, Inc.

3. Crystal IS Inc.

4. Nichia Corporation

5. Phoseon Technology

6. SemiLEDs Corporation

7. Seoul Viosys Co. Ltd.

8. Sensor Electronic Technolgy Inc.

9. Halma PLC

10. Heraeus Holding GmBH

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For