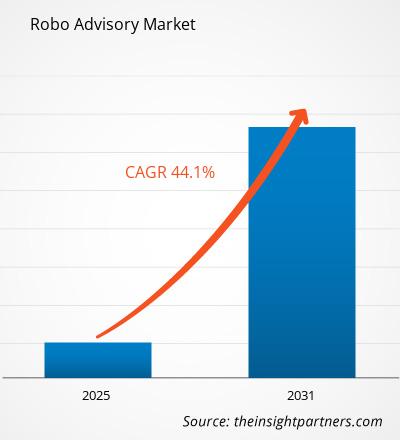

The robo advisory market is projected to grow from US$ 5.89 billion in 2023 to US$ 51.84 billion by 2031; it is expected to expand at a CAGR of 31.2% from 2025 to 2031.

Several emerging economies are encouraging regional players to expand their testing and research into Robo-advisory services. These activities are also expected to serve as a stimulus for market expansion. Robo-advising services primarily provide investment advisory services for individual finances. Robo-advisors are rapidly replacing the gaps left by human investment advisors, such as capability, capacity, and cost, owing mostly to the increased adoption of digitalization across the investment industry, combined with the development of AI in robotics.

Robo Advisory Market Analysis

The growing digitization of the BFSI business has hastened the expansion of digital investments, with robo-advisors playing a significant role. Robo-advisory services are particularly useful for passive investors who do not desire personal monitoring of their portfolio's progress. The need for robo-advisers is expected to rise as the financial sector increasingly uses technology-enabled analytics for investment consultations. Another driver of industry growth is the rapid shift from traditional investment services to robo-advising investment services. Furthermore, robo-advisors are now available on investing platforms rather than traditional financial services, enabling their widespread use.

Robo Advisory Market Overview

- Rapid automation of processes and enterprises in end-user sectors is driving the development of robo-advisory services. These services minimize the need for human labor because internet platforms provide the same services at a much lower cost. Furthermore, as long as the user has access to the Internet, the services are available at all times.

- The growing usage of robo-advisory in industrial verticals such as retail banking, asset management, and others to perform algorithmic calculations on data and communicate complete information is propelling the industry ahead.

- Furthermore, robo-advisers provide unique benefits such as low-cost portfolios, tax loss harvesting, safe and secure investments, better decision-making, and credit risk reduction. Such elements are expected to fuel industry expansion during the predicted period.

Robo Advisory Market Driver and Opportunities

Focus on New Launches to Drive the Robo Advisory Market

- Many robo-advisor solution providers are working on releasing innovative solutions to provide customers with improved financial advice. For instance, In July 2022, The Vanguard Group, Inc. announced the debut of Vanguard Personal Advisor, which is specifically designed for members in employer-sponsored retirement plans.

- Similarly, in June 2023, Revolut, a worldwide neobank and financial technology business, launched a robo adviser in the United States to automate consumer investment portfolios and streamline the investment process.

Increasing Integration of Digital Technology in Financial Services to Create Lucrative Market Opportunities

- Robo advising platforms offer automated financial management services that can be accessed online or via mobile platforms. They provide sophisticated financial information and advice in a simplified manner that everyone can understand, regardless of financial background.

- The global financial sector has grown rapidly as digital technologies have become more widely used. The incorporation of Artificial Intelligence (AI) into investment processes has enabled automated investing

- The market's rise can also be linked to the service's perks, such as accessibility, cost-effectiveness, and convenience.

Robo Advisory Market Report Segmentation Analysis

The key segment that contributed to the derivation of the Robo Advisory market analysis is type.

- In 2023, the high net worth individuals (HNWIs) sector had the highest market revenue share. The increased demand for HNWIs by private equity managers to protect their investments is expected to promote the segment's growth.

- In 2023, the fintech robo advisors segment had the highest market revenue share. Fintechs around the world rely on both automated and personalized consulting services. Furthermore, fintech firms may quickly deploy robo advisers by leveraging modern technologies like advanced analytics and quantitative finance.

Robo Advisory Market Share Analysis By Geography

- The scope of the Robo Advisory market is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America.

- North America is expected to dominate the market due to the presence of various key participants, including Betterment LLC, Wealthfront Inc., Charles Schwab & Co. Inc., and Vanguard Group, among others. Furthermore, the region has outperformed other regions in terms of technological advancement and the robotics sector.

Robo Advisory Market Report Scope

Robo Advisory Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the Robo Advisory market. Some of the recent key market developments are listed below:

- In November 2023, WealthKernel, a wealthtech business that provides digital investing services, announced a partnership with Bambu, a provider of digital wealth technology. This collaboration introduces Bambu GO, a ready-to-use robo-adviser platform developed exclusively for financial institutions. [Source: WealthKernel, Company Website]

Robo Advisory Market Report Coverage & Deliverables

The Robo Advisory market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Robo Advisory Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

Robo Advisory Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 14.28 Billion |

| Market Size by 2031 | US$ 184.32 Billion |

| Global CAGR (2025 - 2031) | 44.10% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Online Recruitment Market

- Industrial Valves Market

- Smart Parking Market

- Hot Melt Adhesives Market

- Emergency Department Information System (EDIS) Market

- Aircraft MRO Market

- Terahertz Technology Market

- Formwork System Market

- Single-Use Negative Pressure Wound Therapy Devices Market

- Fixed-Base Operator Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Application, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Rising utilization of digital technology and focus on new launches are the major factors that propel the global robo-advisory market.

The global Robo Advisory market was estimated to grow at a CAGR of 31.2% during 2023 - 2031.

Increasing integration of digital technology in financial services to play a significant role in the global robo advisory market in the coming years.

Asia Pacific is anticipated to grow with a high growth rate during the forecast period.

The major players holding majority shares are Betterment LLC, Fincite Gmbh, Wealthfront Corporation, The Vanguard Group, Inc., and The Charles Schwab Corporation.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

The List of Companies

1. AXOS INVEST, INC.

2. BETTERMENT LLC

3. CHARLES SCHWAB AND CO., INC.

4. FUTUREADVISOR

5. HEDGEABLE, INC.

6. NUTMEG SAVING AND INVESTMENT LIMITED

7. PERSONAL CAPITAL CORPORATION

8. SIGFIG WEALTH MANAGEMENT, LLC

9. THE VANGUARD GROUP, INC.

10. WEALTHFRONT CORPORATION

Get Free Sample For

Get Free Sample For