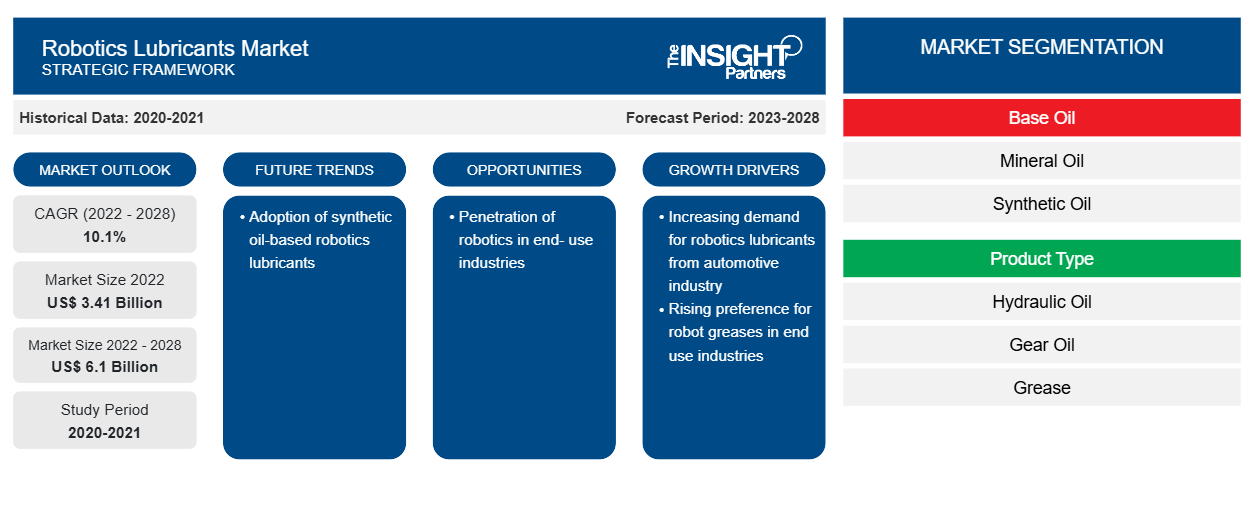

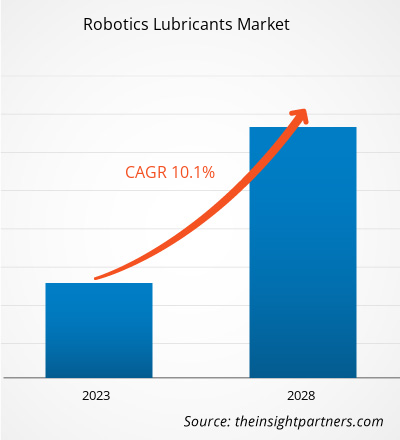

[Research Report] The robotics lubricants market size is expected to grow from US$ 3,413.72 million in 2022 to US$ 6,095.41 million by 2028; it is estimated to register a CAGR of 10.1% from 2022 to 2028.

MARKET ANALYSIS

Lubricants are used to reduce friction between surfaces and the heat generated, increasing the life of the surfaces involved. Industrial robots are involved in material handling, assembly, and dispensing, due to which they become exposed to the effects of wear and corrosion. Lubricants for robotics are developed to help decrease the downtime of industrial robots and positively impact quality, costs, and efficiency of the manufacturing process. Lubricants consist of a variety of fluids to withstand extreme conditions. Grease is a widely used lubricant for robotics operations.

GROWTH DRIVERS AND CHALLENGES

The growing demand for robotics lubricants in the end use industries has aided the robotics lubricants market growth. In the manufacturing sector, a robotics lubricant is one of the key components that help an equipment operate with maximum reliability and at peak efficiency. Greases, hydraulic oils, and gear oils are used across several end-use industries, including automotive, electrical & electronics, food & beverages, logistics, and metal & machinery fabrication. Robotic grease contains base oil such as mineral oil or synthetic oil, thickener, and additives, which impart distinct product qualities. Greases possess several properties such as sealing ability, low leakage tendency, protection against corrosion, and heavy load handling. Several commercially available robot greases are food grade and comply with certain international standards for specific industries such as food & beverages and medical & healthcare. Grease degrades due to friction and exposure to extreme temperatures till its viscosity levels are insufficient to effectively lubricate the internal mechanical components. Robot greasing is an integral part of maintaining the overall efficiency of robots and robotic components. The recommended frequency for robot greasing varies by brand and model. Thus, the advantages of greases over other lubricants and the preference for robot greases from end-use industries are driving the robotics lubricants market. However, fluctuations in global economic conditions led to an increase in the costs of additives, base stocks, transportation, and manufacturing. Several manufacturers witnessed inflationary pressure as well as lubricant additives supply across the lubricant supply chain. In 2022, base oil prices in the US increased from US$ 2 per gallon to US$ 5 per gallon. Moreover, in 2022, FUCHS Lubricants Co announced a price hike of 8–12% for its lubricant additive portfolio, which was implemented from October 2022. Further, in 2022, Ergon Inc increased the prices of naphthenic base oil. However, in 2023, Chevron Corporation announced a US$ 0.20 to US$ 0.50 decrease in base oil price. Thus, fluctuation in prices of raw materials is restraining the robotics lubricants market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Robotics Lubricants Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Robotics Lubricants Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

REPORT SEGMENTATION AND SCOPE

The "Global Robotics Lubricants Market Analysis to 2028" is a specialized and in-depth study with a major focus on the global robotics lubricants market trends and growth opportunities. The report aims to provide an overview of the global robotics lubricants market with detailed market segmentation by base oil, product type, end use industry, and geography. The global robotics lubricants market has been witnessing high growth over the recent past and is expected to continue this trend during the forecast period. The report provides key statistics on the consumption of robotics lubricants worldwide along with their demand in major regions and countries. In addition, the report provides the qualitative assessment of various factors affecting the robotics lubricants market performance in major regions and countries. The report also includes a comprehensive analysis of the leading players in the robotics lubricants market and their key strategic developments. Several analyses on the market dynamics are also included to help identify the key driving factors, market trends, and lucrative robotics lubricants market opportunities that would, in turn, aid in identifying the major revenue pockets.

Further, ecosystem analysis and Porter’s five forces analysis provide a 360-degree view of the global robotics lubricants market, which helps understand the entire supply chain and various factors affecting the market growth.

SEGMENTAL ANALYSIS

The global robotics lubricants market is segmented on the basis of base oil, product type, and end use industry. Based on base oil, the robotics lubricants market is segmented as mineral oil, synthetic, and others. Based on product type, the market is classified as hydraulic oil, gear oil, and grease. Based on end use industry, the market is classified as automotive, food and beverage, medical and healthcare, electrical and electronics, metals, and other manufacturing industries.

Based on mineral oil, the mineral oil accounted for a significant robotics lubricants market share. Many lubricant manufacturers provide multi-purpose lubricants for applications in robotic gear components, chains, bearings, and threaded connections. Castrol Ltd offers mineral-based gear oils, including Optigear ALR 320, Optigear BM 100, and Alpha SP 320, for all or selective robotic axial applications. On the basis of product type grease segment led the robotics lubricants market with a largest market share. Based on end use industry automotive accounted for a major robotics lubricants market share. The electrical and electronics segment is expected to register the fastest CAGR during the forecast period.

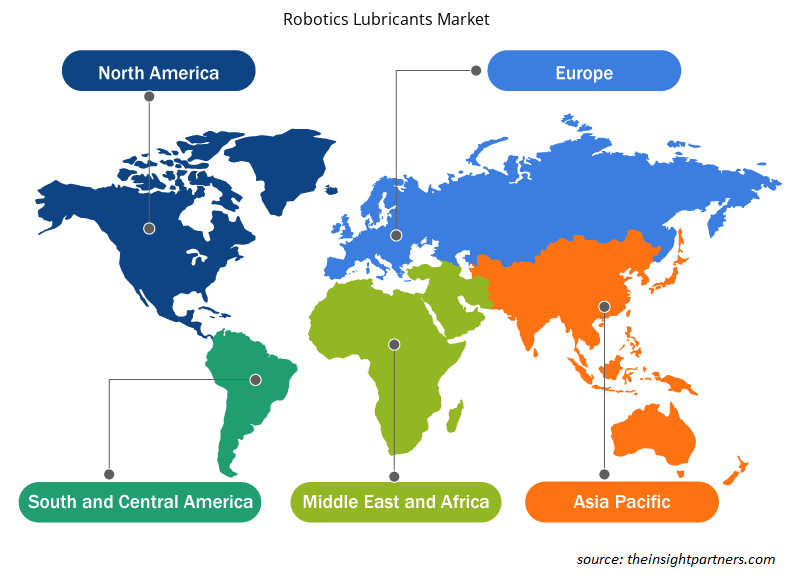

REGIONAL ANALYSIS

The report provides a detailed overview of the global robotics lubricants market with respect to five major regions, namely, North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA) and South & Central America. Asia Pacific accounted for a significant share of the market and valued at more than US$ 1.9 billion in 2022. Asia Pacific region is a prominent market for robotics lubricants owing to growth in the automotive and electronics sectors and a rise in industrialization, leading to increased demand from manufacturing sector. Europe is also expected to witness considerable growth reaching over US$ 1.2 billion in 2028, attributed to the increasing utilization of robotics lubricants in electrical and electronics industry. The North America is expected to grow at CAGR of around 9% from 2022 to 2028.

INDUSTRY DEVELOPMENTS AND FUTURE OPPORTUNITIES

Partnership, acquisitions, and new product launches were found to be the major strategies adopted by the players operating in the global robotics lubricants market.

In April 2023, FUCHS company launched ‘RENOLIT ROBO-G 0’ – a grease for robot lubrication. It is a semi-liquid extreme pressure (EP) grease based on lithium complex soap and mineral oil. The product is intended for application in precision gears such as industrial robots, machine tools and round tables.

Robotics Lubricants Market Regional Insights

Robotics Lubricants Market Regional Insights

The regional trends and factors influencing the Robotics Lubricants Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Robotics Lubricants Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Robotics Lubricants Market

Robotics Lubricants Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 3.41 Billion |

| Market Size by 2028 | US$ 6.1 Billion |

| Global CAGR (2022 - 2028) | 10.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Base Oil

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Robotics Lubricants Market Players Density: Understanding Its Impact on Business Dynamics

The Robotics Lubricants Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Robotics Lubricants Market are:

- Miller-Stephenson Inc

- Shell International BV

- Fuchs Petrolub SE

- BP Plc

- Idemitsu Kosan Co Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Robotics Lubricants Market top key players overview

IMPACT OF COVID/IMPACT OF GEOPOLITICAL SCENARIO/IMPACT OF RECESSION

Lockdowns, travel restrictions, and business shutdowns due to the COVID-19 pandemic adversely affected economies and industries in various countries in North America, Europe, Asia Pacific (APAC), South & Central America, and the Middle East & Africa (MEA). The crisis disturbed global supply chains, manufacturing activities, delivery schedules, and essential and nonessential product sales. Various companies announced possible delays in product deliveries and a slump in future sales of their products in 2020. Further, the international travel bans imposed by various governments in Europe, Asia Pacific, and North America forced several companies to discontinue their collaboration and partnership plans. All these factors hampered the chemicals & materials industry in 2020 and early 2021, thereby restraining the growth of various markets related to this industry, including the robotics lubricants market.

Before the COVID-19 outbreak, the robotics lubricants market was mainly driven by the rising demand from automotive and electronics industries. However, in 2020, various industries had to slow down their operations due to disruptions in value chains caused by the shutdown of national and international boundaries. The COVID-19 pandemic disrupted the supply chain of key raw materials and disturbed manufacturing processes due to restrictions imposed by government authorities in various countries. Such factors reduced the production of robotics lubricants.

COMPETITIVE LANDSCAPE AND KEY COMPANIES

Some of the key players operating in the robotics lubricants market include, Miller-Stephenson Inc, Shell International BV, Fuchs, Petrolub SE, BP Plc, Idemitsu Kosan Co Ltd, Chemie-Technik GmbH, Anand Engineer Pvt Ltd, Kluber Lubrication GmbH & Co KG, and Schaeffler Austria GmbHamong others.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Small Satellite Market

- Digital Pathology Market

- Social Employee Recognition System Market

- Human Microbiome Market

- Intraoperative Neuromonitoring Market

- Hydrogen Compressors Market

- Visualization and 3D Rendering Software Market

- Influenza Vaccines Market

- Aerospace Forging Market

- Nurse Call Systems Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Base Oil, Product Type, and End Use Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The automotive segment held the largest share of the market in 2022. Automotive assembly lines encompass several challenges such as potential for injury, handling of high load components, slow production time, and quality inspection. Therefore, automotive industry deploys robots to overcome aforementioned challenges.

In 2022, Asia Pacific held the largest revenue share of the global robotics lubricants market is expected to register the highest CAGR from 2022 to 2028. The robotics lubricants market growth in Japan, China, South Korea, Singapore, Taiwan, and Vietnam is attributed to growing manufacturing sector in the region. Asia Pacific is manufacturing hub for automotive and electronics industries with China, Japan, and South Korea playing major role in installation of robotics for manufacturing process.

Asia Pacific is estimated to register the highest CAGR in the global robotics lubricants market over the forecast period. The growth of the robotics lubricants market in Asia-Pacific is driven by rising demand for robotics lubricants from various end-use industries such as automotive, food and beverage, medical and healthcare, electrical and electronics, metals, and other manufacturing industries.

The major players operating in the global robotics lubricants market are Miller-Stephenson Inc, Shell International BV, Fuchs Petrolub SE, BP Plc, Idemitsu Kosan Co Ltd, Chemie-Technik GmbH, Anand Engineer Pvt Ltd, Kluber Lubrication GmbH & Co KG, and Schaeffler Austria GmbH.

The mineral oil segment held the largest market share. Mineral oil is the most commonly used base oil in lubricant formulations. Paraffinic mineral oils possess several advantages such as high viscosity index and high flash point.

The grease segment held the largest share of the market in 2022. Robotic greases generally consist of mineral or semi-synthetic base oil with viscosity ranging from 40 to 175 centistokes. NLGI (National Lubricating Grease Institute) 0 or NLGI 00 greases are generally preferred for application in robotic joints.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Robotics Lubricants Market

- Miller-Stephenson Inc

- Shell International BV

- Fuchs Petrolub SE

- BP Plc

- Idemitsu Kosan Co Ltd

- Chemie-Technik GmbH

- Anand Engineer Pvt Ltd

- Kluber Lubrication GmbH & Co KG

- Schaeffler Austria GmbH

- ASV Multichemie Pvt Ltd

Get Free Sample For

Get Free Sample For