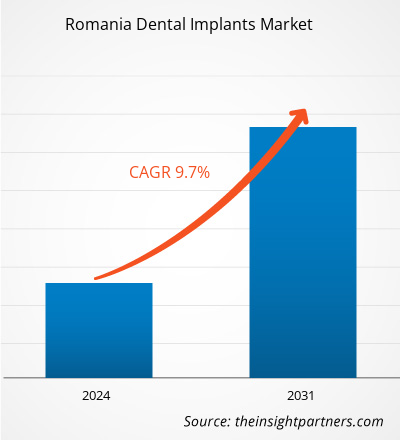

The Romania dental implants market size is projected to reach US$ 25.36 million by 2031 from US$ 12.21 million in 2023. The market is expected to register a CAGR of 9.7% during 2023–2031. The increasing adoption of mini-dental implants is likely to remain a key trend in the market.

Romania Dental Implants Market Analysis

Dental implants are dental surgical devices that are placed between the jaws to support dental prosthesis. These implants are surgically positioned below the gums into the jawbone. Plate-form dental implants and root-form dental implants are among the commonly used dental implants. These implants are made of zirconium and titanium. Bridges and dentures are used to support the implanted artificial teeth and avoid shifting of teeth in the mouth while speaking and eating.

Romania Dental Implants Market Overview

Growing medical tourism in Romania is contributing to the market growth in the country. In December 2022, the Society of Esthetic Dentistry in Romania and The Romanian National Association of Travel Agencies launched tourism packages; each package is available for purchase on the website of Romania's Most Beautiful Dental Clinic in the World. The package combines a dental treatment with an inspired getaway. Tourists can visit a waterfall and get their teeth rinsed with the 'Professional Cleaning and Sparkling Waterfalls package, the 'Dental Crowns and Royal Castles package, or the 'Root Canal Treatments and Delta Canal Trips offers.

Additionally, private and government organizations adopt organic and inorganic growth strategies for market development. For instance, in October 2023, Koite Health Oy (a Finnish health technology company) signed a distribution agreement with Swed Green Group SRL (a Romanian–Swedish company). This company also owns Swed Clinic SRL, which operates dental clinics. The cooperation agreement will make the Lumoral oral self-care technology available in the Romanian market through Swed Clinic dental clinics and family doctors.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Romania Dental Implants Market Drivers and Opportunities

Increasing Incidences of Dental Diseases across Romania Favors Market

According to a study ‘Trends in Access to Oral Health Care among Adults from the N-E Region of Romania,’ published in PubMed Central in December 2022, the prevalence of dental caries in the Northeastern region of Romania was 97.5% in the adult population and 96.3% in young adults. Women were found to be more affected than men. The mounting prevalence of dental caries increases the demand for dental implants.

Consolidation of Dental Practices and Expanding Dental Service Organization Activities to Create Market Opportunities

A report by McCleskey in March 2024 highlighted that the dental industry is ~35% consolidated, signaling that it is halfway through the ongoing consolidation wave. Consolidation is projected to reach 60–70% within the next 5–7 years, indicating a significant shift in the industry's investment dynamics. With more practices becoming part of private-equity-backed dental service organization (DSOs), the flow of investor capital is expected to slow down, fundamentally altering the ownership landscape of dental practices. The dental industry consolidation presents an opportunity for the growth of the dental implants market.

Romania Dental Implants Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Romania dental implants market analysis are product, material, and end user.

- The product segment of the dental implants market is subsegmented into dental bridges, dental crowns, dentures, abutments, and others. The dental bridges segment held the largest market share in 2023.

- Based on material, the market is segmented into titanium implants, zirconium implants, and others. The titanium implants segment held the largest share of the market in 2023.

- By end users, the market is categorized into hospitals & clinics, dental laboratories, and others. The hospitals and clinics segment dominated the market in 2023.

Romania Dental Implants Market Share Analysis by Country

The dental implants market growth in Romania is attributed to increasing medical tourism, including dental treatments across Romania. As of 2020, there were 16,887 registered dentists in Romania with the Romanian Dental Council, amounting to 8 dentists per 10,000 population. This creates a significant deficit in the healthcare system, leading to long wait times for basic treatments in public care facilities. Although 90% of the population is covered by oral health interventions in their benefit packages, the per-person spending for dental procedures is only US$ 19. Romania has been struggling to attract foreign tourists, losing out to neighboring countries. Meanwhile, the UK continues to suffer from a post-pandemic NHS dentist shortage, with people in Britain remaining on waiting lists for treatment. Drawing this insight, the Romanian National Association of Travel Agents and The Society of Esthetic Dentistry in Romania have partnered to offer tourism packages that combine Romania's cultural sites with a trip to the dentist.

Furthermore, the growing cases of lip and oral cavity cancer contribute to the increasing demand for dental implants in the country.

Romania Dental Implants Market Regional Insights

The regional trends and factors influencing the Romania Dental Implants Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Romania Dental Implants Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Romania Dental Implants Market

Romania Dental Implants Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 12.21 Million |

| Market Size by 2031 | US$ 25.36 Million |

| Global CAGR (2023 - 2031) | 9.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Romania

|

| Market leaders and key company profiles |

Romania Dental Implants Market Players Density: Understanding Its Impact on Business Dynamics

The Romania Dental Implants Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Romania Dental Implants Market are:

- Dentsply Sirona Inc

- BioHorizons Inc

- Adin Dental Implant Systems Ltd.

- 3M Co

- MEGA'GEN IMPLANT CO., LTD

- ZimVie Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Romania Dental Implants Market top key players overview

Romania Dental Implants Market News and Recent Developments

The Romania dental implants market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Romania dental implants market are listed below:

- The BEGO Group announced the launch of the Semados Esthetic Line. With the launch of the Semados Esthetic Line, BEGO establishes new benchmarks in dental aesthetics and functionality. (Source: BEGO Group, Company Website, April 2024)

- Straumann acquired GalvoSurge Dental AG, a Swiss medical device manufacturer. The acquired company specializes in implant care and maintenance solutions, offering an innovative concept to support the treatment of peri-implantitis. (Source: Straumann Group, Company Website, May 2024)

Romania Dental Implants Market Report Coverage and Deliverables

The "Romania Dental Implants Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Romania dental implants market size and forecast at country levels for all the key market segments covered under the scope

- Romania dental implants market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Romania dental implants market analysis covering key market trends, country framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Romania dental implants market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Dental implants are dental surgical devices that are placed between the jaws to support dental prosthesis. These implants are surgically positioned below the gums into the jawbone. Plate-form dental implants and root-form dental implants are among the commonly used dental implants. These implants are made of zirconium and titanium. Bridges and dentures are used to support the implanted artificial teeth and avoid shifting of teeth in the mouth while speaking and eating.

The factors driving the growth of the Romania dental implants market include the increasing incidences of dental diseases across Romania and technological advancements in dental implants. However, the high cost of dental implants is hampering the growth of the market.

The Romania dental implants market is expected to be valued at US$ 25.36 million by 2031.

The Romania dental implants market, by product, is segmented into dental bridges, dental crowns, dentures, abutments, and others. The dental bridges segment held the largest Romania dental implants market share in 2023.

The Romania dental implants market was valued at US$ 12.21 million in 2023.

The Romania dental implants market majorly consists of the players, including Dentsply Sirona Inc, BioHorizons Inc, Adin Dental Implant Systems Ltd., 3M Co, MEGA'GEN IMPLANT CO., LTD, ZimVie Inc, Institut Straumann AG, Alpha Dent Implants GmbH.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Romania Dental Implants Market

- Dentsply Sirona Inc

- BioHorizons Inc

- Adin Dental Implant Systems Ltd.

- 3M Co

- MEGA'GEN IMPLANT CO., LTD

- ZimVie Inc

- Institut Straumann AG

- Alpha Dent Implants GmbH

Get Free Sample For

Get Free Sample For