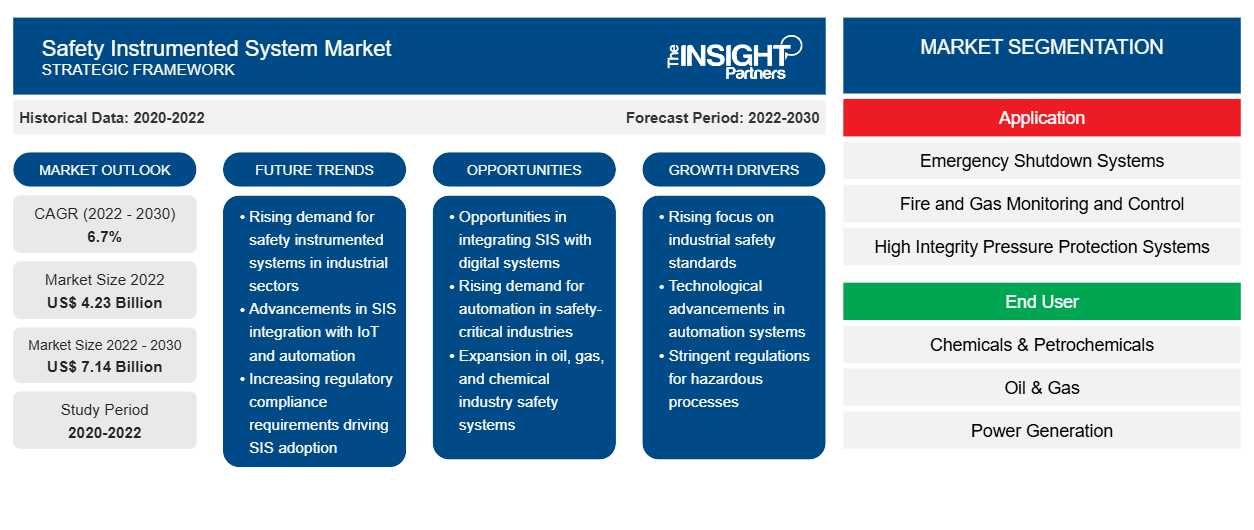

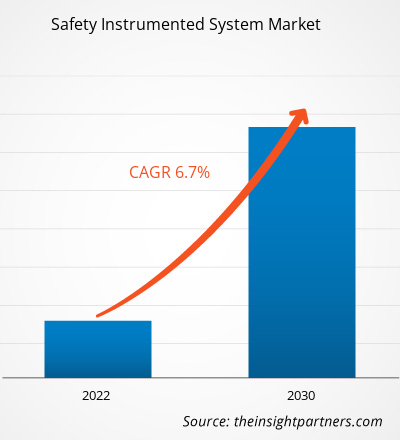

[Research Report] The safety instrumented system market is expected to grow from US$ 4.23 billion in 2022 to US$ 7.14 billion by 2030; it is estimated to record a CAGR of 6.7% from 2022 to 2030.

Analyst Perspective:

The construction of new oil & gas refineries and the growing mining activities worldwide are the major factors fueling the growth of the safety instrumented system market. Also, the growing adoption of safety regulations and standards is boosting the growth of the safety instrumented system market. Moreover, the growing industrial automation in the chemicals & petrochemicals industry to increase the efficiency and safety of employees is further creating opportunities for the growth of the safety instrumented system market. The growing awareness of safety across different industries further accelerates the safety instrumented system market expansion.

Market Overview:

A safety instrumented system (SIS) is used in many process plants as it helps to take automated action to keep a plant in a safe state when abnormal conditions arise. In case of any disturbance that can result in an unfortunate incident, the SIS will automatically bring the process to a safe state and help prevent loss of life, asset damage, and environmental damage. Several catastrophic events can occur at different operational sites in oil & gas, chemical, and other industries that deal with heavy machinery and chemicals. These can range from fires to leaks that could lead to explosions, and the need for high-end safety systems such as SIS is rising worldwide.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Safety Instrumented System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Safety Instrumented System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Rising Expansion of Oil & Gas Industry Drive Safety Instrumented System Market Growth

The US is one of the largest natural gas producers in the world. According to the US Energy Information Administration (EIA), the country produced ~34,517,798 million cubic feet (MMcf) of natural gas and consumed 30,664,951 MMcf of natural gas in 2021. The country also exported 3,560,818 MMcf of liquefied natural gas (LNG). Various new oil and gas construction projects are also in progress worldwide. In Q2 2022, the construction work of the Centre of Excellence for Carbon Capture & Removal project started in Burnaby, British Columbia, Canada. It involved the construction of a CCS plant, which helps in capturing and storing up to 2,000 metric ton of CO2 per day. Similarly, the construction of the Vista Pacifico Liquified Natural Gas Plant project commenced in Q2 2022, with an investment of US$ 2,000 million. Under this project, an LNG export terminal will be constructed on 150 hectares in the Municipality of Ahome, Topolobampo, Sinaloa, Mexico. Thus, such oil and gas construction projects will propel the demand for safety instrumented systems.

Furthermore, According to the Statistics of the Swedish Mining Industry 2021 report, Swedish ore production reached 88.6 million metric ton in 2021, a rise of 22% since 2015. Also, as per the Australian Bureau of Statistics, mining production in Australia increased by 5.7% in the first quarter of 2023. Thus, the growing mining production worldwide is expected to surge the demand for security and monitoring to ensure the safety of employees, equipment, or materials. This increasing need for safety instrumented systems further boosts the growth of the safety instrumented system market.

Report Segmentation and Scope:

The safety instrumented system market is segmented on the basis of application, end user, and geography. Based on application, the safety instrumented system market is divided into emergency shutdown systems, fire and gas monitoring and control, high integrity pressure protection systems, burner management systems, and turbo machinery control. By end user, the safety instrumented system market is categorized into chemicals & petrochemicals, oil & gas, power generation, pharmaceutical, food & beverages, and others. Geographically, the safety instrumented system market is segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM).

Segmental Analysis:

Based on application, the safety instrumented system market is divided into emergency shutdown systems, fire and gas monitoring and control, high integrity pressure protection systems, burner management systems, and turbo machinery control. The emergency shutdown systems segment held the largest safety instrumented system market share in 2022 and is anticipated to register the highest CAGR during 2022–2030. The Emergency Shutdown (ESD) Systems are highly reliable control systems for high-risk industries such as oil & gas and nuclear power with explosion risk. The system helps in protecting personnel, plant, and the environment in case the process goes beyond the control margins.

Regional Analysis:

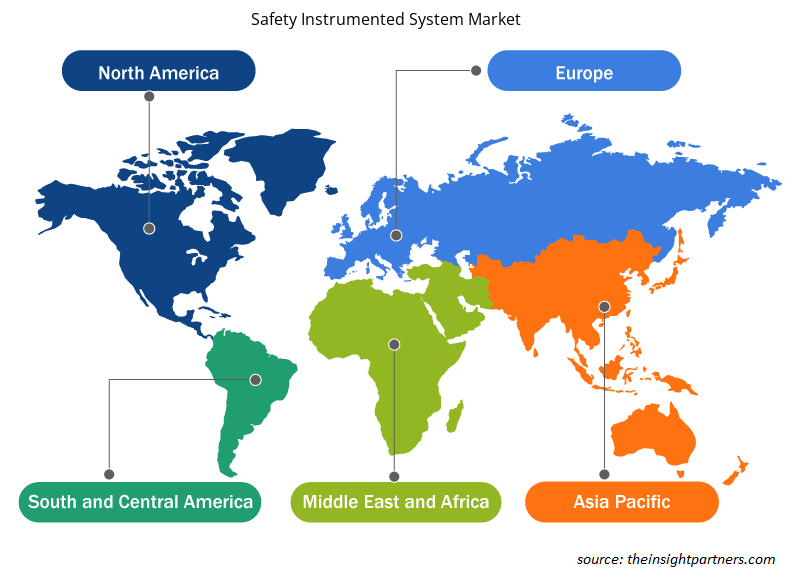

Asia Pacific held the largest safety instrumented system market share in 2022. The region is witnessing tremendous growth in the chemicals & pharmaceuticals industry. The market players in this region are continuously working on expanding their manufacturing facilities. For instance, in December 2022, Balaxi Pharmaceuticals announced that they had initiated the construction of a new drug manufacturing facility in Telangana, India. The company invested approximately US$ 10.29 million (INR 85 crore) in this project. The new production facility will help the company enter the European markets and enhance margins in current markets. Similarly, in September 2021, Hanwha Corp. announced its plan to build a nitric acid production plant by 2024. This plant will provide an annual capacity of 400,000 metric ton in Yeosu Industrial Complex, South Korea. For this, the company will be investing US$ 162 million (190 billion won).

Thus, the increasing number of new production facilities in the region will raise the demand for safety instrumented systems, as it helps prevent any accidents at the plant, propelling the safety instrumented system market growth.

Key Player Analysis:

ABB Ltd, Applied Control Engineering Inc, AVEVA Group plc, Emerson Electric Co, HIMA, Honeywell International, Rockwell Automation Inc, Schneider Electric, Siemens AG, and Yokogawa Electric Corporation are the key safety instrumented system market players profiled in the report.

Safety Instrumented System Market Regional Insights

Safety Instrumented System Market Regional Insights

The regional trends and factors influencing the Safety Instrumented System Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Safety Instrumented System Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Safety Instrumented System Market

Safety Instrumented System Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 4.23 Billion |

| Market Size by 2030 | US$ 7.14 Billion |

| Global CAGR (2022 - 2030) | 6.7% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Safety Instrumented System Market Players Density: Understanding Its Impact on Business Dynamics

The Safety Instrumented System Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Safety Instrumented System Market are:

- ABB Ltd

- Applied Control Engineering Inc

- AVEVA Group plc

- Emerson Electric Co

- HIMA, Honeywell International

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Safety Instrumented System Market top key players overview

Recent Developments:

The safety instrumented system market players highly adopt inorganic and organic strategies. A few recent key market developments are listed below:

- In May 2022, Emerson introduced the TopWorxTM DX PST with HART 7. Units provide valuable valve data and diagnostic information, enabling the digital transformation of process applications. The new DX PST integrates seamlessly with existing valves and control systems, giving operators access to critical valve data, trends, and diagnostics that can be used to predict and schedule maintenance. Capable of Safety Integrity Level 3 (SIL 3), the DX PST is available with an integrated 2oo2 or 2oo3 solenoid valve redundancy when paired with ASCOTM Series Advanced Redundant Control System (ARCS) to further enhance safety and open terminals that allow an additional pressure transmitter along with two pressure switches.

- In March 2022, INTECH was awarded a contract to provide a high-integrity pressure protection system (HIPPS) for protecting infield oil gathering infrastructure at a major oil field in the Middle East. Under this contract, Middle Eastern oilfield companies sought INTECH’s expertise for manufacturing and installing IOPPS packages downstream of the manifolds for protecting trunklines and degassing stations from potential overpressure.

- In November 2020, ABB launched ABB Ability Safety Plus for hoists, a suite of mine hoist safety products that brings the highest level of personnel and equipment safety available to the mining industry. The products include safety plus hoist monitor (SPHM), safety plus hoist protector (SPHP), and safety plus brake system (SPBS), including safety brake hydraulics (SBH).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Application, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The US held the largest safety instrumented system market share in 2022.

The incremental growth expected to be recorded for the safety instrumented system market during the forecast period is US$ 2.90 billion.

Rising expansion in oil & gas industry and growing adoption of safety regulations and standards are the major factors that propel the safety instrumented system market.

The key players holding majority shares in the safety instrumented system market are Rockwell Automation Inc, Honeywell International, Emerson Electric Co, Yokogawa Electric Corporation, and ABB Ltd.

Asia Pacific is anticipated to grow with the highest CAGR over the forecast period.

The Safety instrumented system market is expected to reach US$ 7.14 billion by 2030.

Growing awareness of safety across different industries is anticipated to play a significant role in the safety instrumented system market in the coming years.

The safety instrumented system market was estimated to be US$ 4.23 billion in 2022 and is expected to grow at a CAGR of 6.7 % during the forecast period 2023 - 2030.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Safety Instrumented System Market

- ABB Ltd

- Applied Control Engineering Inc

- AVEVA Group plc

- Emerson Electric Co

- HIMA, Honeywell International

- Rockwell Automation Inc

- Schneider Electric

- Siemens AG

- Yokogawa Electric Corporation

Get Free Sample For

Get Free Sample For