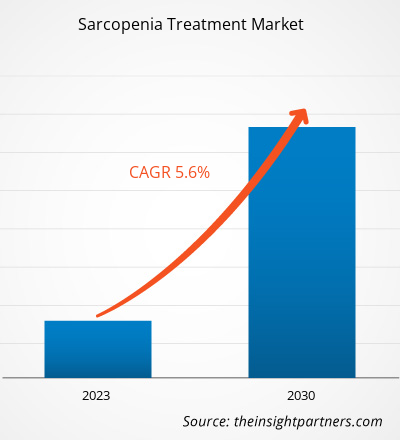

[Research Report] The sarcopenia treatment market size is projected to grow from US$ 3,397.62 million in 2022 to US$ 5,264.76 million by 2030; the market is estimated to record a CAGR of 5.6% during 2022–2030.

Market Insights and Analyst View:

An upsurge in the geriatric population and a rise in malnutrition and vitamin deficiency among adults are the key factors driving the market growth. However, the unavailability of direct interventions hampers the sarcopenia treatment market progress. Malnutrition is one of the major risk factors for sarcopenia. According to the World Health Organization (WHO), approximately 2.3 billion adults worldwide were undernourished as of 2021, representing nearly 30% of the global population. Among the reported risk factors, protein-energy deficiency is a frequent cause of sarcopenia. Further, vitamin D deficiency or insufficiency is positively associated with an increased risk of multiple illnesses, such as cancer, obesity, cardiovascular disease, and sarcopenia. According to the National Institutes of Health (NIH), nearly 50% of the world's population suffers from vitamin D insufficiency, and ~1 billion people are vitamin D deficient. In the US, over 35% of adult individuals have vitamin D deficiency.

Growth Drivers:

The geriatric population is prone to sarcopenia, orthopedic disorders, metabolic disorders, and neurological disorders, among others. Sarcopenia is a geriatric condition caused by a progressive loss of the mass and strength of skeletal muscles. It is associated with a higher risk of unfavorable health outcomes, e.g., falls, disabilities, institutionalization, poor quality of life, and mortality. The elderly populace is rising rapidly in developed countries. According to the World Health Organization (WHO), the aging population across the world is likely to rise from ~1 billion in 2019 to ~2.1 billion by 2050. According to the National Library of Medicine, China's elderly population is expanding at one of the quickest rates in the world. By 2040, 28% of China's population is expected to be over 60 years of age. As per national figures of Japan, 29.1% of the 125 million people living in the country are aged 65 or older. According to the 2020 Census, the US population aged 65 and above increased about five times faster than the total population during 1920–2020. In 2020, the number of older population reached 55.8 million, or 16.8% of the total population of the US.

Aging results in a reduction in muscle mass as one of the major changes in body composition. A significant decline in food consumption among elderly people is one of the key factors causing the loss of muscle mass. According to the National Library of Medicine, people from the age group of 50–60 lose nearly 1.5% of muscle strength every year, while 1–2% of muscle mass is lost annually after the age of 60. Compared to general populations, elderly patients have a higher prevalence of sarcopenia. According to an article published in June 2023 in Elsevier, the prevalence of sarcopenia ranges from 18% in diabetic patients to 66% in those with incurable esophageal cancer. Hence, the rising elderly population contributes significantly to the sarcopenia treatment market growth.

There is not a single approved drug that can be prescribed for treating sarcopenia directly. This can also be attributed to the fact that initially promising avenues could not be supported by any consolidated findings of well-conducted randomized controlled trials. Thus, the unavailability of treatment options directly targeting sarcopenia hinders the sarcopenia treatment market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Sarcopenia Treatment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Sarcopenia Treatment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The sarcopenia treatment market has been segmented on the basis of treatment type and distribution channel. The market, by treatment type, is segmented into vitamin D and calcium supplements, protein supplements, vitamin B12 supplements, and others. The sarcopenia treatment market, based on distribution channel, is segmented into pharmacies, retail channels, online channels, and others. The market, based on geography, is categorized into North America (US, Canada, and Mexico), Europe (France, Germany, Italy, UK, Spain, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (Saudi Arabia, UAE, South Africa, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, Rest of South & Central America).

Segmental Analysis:

The sarcopenia treatment market, by treatment type, is segmented into vitamin D and calcium supplements, protein supplements, vitamin B12 supplements, and others. The vitamin D and calcium supplements segment held the largest share of the market in 2022. The sarcopenia treatment market for this segment is anticipated to record the highest CAGR of 6.5% during 2022–2030. Being a fat-soluble vitamin, vitamin D is crucial for maintaining calcium homeostasis and healthy bone metabolism. The supplementation of vitamin D has been studied as a useful dietary strategy to reduce the risk of sarcopenia. Older adults with suboptimal vitamin D levels are highly susceptible to sarcopenia, often associated with falls, hospitalization, and other adverse effects.

The sarcopenia treatment market, by distribution channel, is segmented into pharmacies, retail channels, online channels, and others. The pharmacies segment held a substantial market share in 2022. However, the online channels segment is predicted to register the fastest CAGR of 6.4% during 2022–2030. Supplements are available at pharmacies as over-the-counter medicines. Many OTC products composed of various dietary supplements such as vitamin D, vitamin B12, and protein supplements are available on the market, which are prescribed as a part of the sarcopenia treatment regime.

Cashless transaction is a major benefit associated with the progress of online retailers, which helps them expand their reach in non-metro cities. A few of the major online channels that sell supplements for sarcopenia treatment products are apollo pharmacy, HealthKart, and 1mg. The rising number of internet users, ease of access to several brands, fast-paced lifestyle, 24×7 availability of a wide range of products, and high accessibility of shopping platforms are the key factors driving the sales of sarcopenia supplements through the online channel.

Regional Analysis:

Based on geography, the global sarcopenia treatment market is segmented into North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In 2022, North America accounted for the largest share of the global sarcopenia treatment market. Asia Pacific is expected to register the highest CAGR during 2022–2030. The sarcopenia treatment market growth in North America is attributed to the rising popularity of nutraceutical supplements as a treatment option, the surging prevalence of orthopedic disorders, and the increasing cases of vitamin B12 and vitamin D deficiency in the geriatric population.

The sarcopenia treatment market in North America is further split into the US, Canada, and Mexico. Sarcopenia prevalence varies with age and gender; elderly people residing in assisted living facilities or communities in the US are at a higher risk of developing this condition. According to the National Institute of Health, the anticipated hospitalization cost for persons with sarcopenia in the US was US$ 40.4 billion in 2019. On average, people suffering from this condition pay US$ 2,315 more for hospital visits every year than people with normal muscle mass and function; they are almost twice as likely to be hospitalized than people without sarcopenia. Studies suggest that at least 10% reduction in the loss of skeletal muscle strength can prevent sarcopenia and save ~US$ 1 billion in annual US medical care expenses.

Canada is one of the fastest-growing markets for sarcopenia treatments. The market growth in this country is evident with a vast number of orthopedic disorder cases reported every year, mainly due to vitamin and nutrition deficiencies. According to statistics by the Public Health Agency of Canada (PHAC), over 2.3 million people in Canada are reported to have osteoporosis. Sarcopenia is one of the important causes of osteoporosis. Osteoporosis is a major risk factor that causes over 80% of all fractures in people aged 50 and above. Vitamins, calcium, and proteins play an important role in preventing and treating sarcopenia. Ongoing studies on the benefits of supplements on bone health along with advancements in nutraceuticals are expected to generate significant demand for sarcopenia treatments in Canada in the coming years.

Industry Developments and Future Opportunities:

A few major players operating in the sarcopenia treatment market are increasingly focusing on drug development to treat sarcopenia. Novel sarcopenia treatments are currently being developed and tested in clinical trials. A few of these products are mentioned below:

Sarcopenia Drug Under Clinical Development

Company Name | Interventions | Conditions | Clinical Trial Stage |

Abbott Nutrition | Medical Food with AN777 Oral Nutritional Formula | Malnutrition Sarcopenia | PHASE3 |

Nutricia Research | Dietary Supplement: Bolus ONS A Dietary Supplement: Bolus ONS B Dietary Supplement: Bolus ONS C Dietary Supplement: Bolus ONS D | Sarcopenia | PHASE1 |

Novartis Pharmaceuticals | Drug: Bimagrumab | Sarcopenia | PHASE2 |

McMaster University | Behavioral: Step Reduction | Sarcopenia | PHASE1 |

Metabolic Technologies Inc. | Dietary Supplement: Placebo Drug: HMB Plus Vitamin D Behavioral: Non-Exercise Behavioral: Exercise | Sarcopenia | PHASE1 |

Merck Sharp & Dohme LLC | Drug: Comparator MK-077 Drug: Comparator Placebo | Sarcopenia | PHASE2 |

Immunotec Inc. | Dietary Supplement: Immunocal Dietary Supplement: Casein | Aging|Sarcopenia | PHASE2 |

Lijun Yang | Combination Product: 3-Month Intensive Intervention | Sarcopenia | PHASE4 |

Regeneron Pharmaceuticals | Drug: REGN1033 (SAR391786) Drug: Placebo | Sarcopenia | PHASE2 |

Source: Company Websites and The Insight Partners Analysis

Therefore, the extending pipeline of drugs that are in different stages of clinical development presents significant opportunities for the sarcopenia treatment market growth.

Sarcopenia Treatment Market Regional Insights

Sarcopenia Treatment Market Regional Insights

The regional trends and factors influencing the Sarcopenia Treatment Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Sarcopenia Treatment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Sarcopenia Treatment Market

Sarcopenia Treatment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 3.4 Billion |

| Market Size by 2030 | US$ 5.26 Billion |

| Global CAGR (2022 - 2030) | 5.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Treatment Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Sarcopenia Treatment Market Players Density: Understanding Its Impact on Business Dynamics

The Sarcopenia Treatment Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Sarcopenia Treatment Market are:

- Abbott Laboratories

- Bayer AG

- Metagenics LLC

- Nestle Health Science SA

- Novartis AG

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Sarcopenia Treatment Market top key players overview

Competitive Landscape and Key Companies:

Abbott Laboratories, Bayer AG, Metagenics LLC, Nestle Health Science SA, Novartis AG, Pfizer Inc., Sanofi SA, Amway Corp, GSK Plc, and Makers Nutrition LLC are among the prominent companies in the sarcopenia treatment market. These companies focus on introducing new technologies, upgrading existing products, and expanding geographic reach to meet the growing consumer demand worldwide.

- In October 2023, Metagenics LLC completed the acquisition of 100% shares of Amipro Advanced Development Products. For many years, Ampiro has been the exclusive distributor of Metagenics LLC’s products in South Africa. The acquisition has strengthened the company’s distribution network in the country, further allowing it to have direct distribution operations in all major EMEA countries.

- In September 2023, Biophytis received Food and Drug Administration (FDA) authorization to launch its SARA-31 study in the US. It is the first-ever phase 3 study in the sarcopenia treatment specialty.

- In September 2022, Abbott India Ltd, a subsidiary of Abbott Laboratories, launched Ensure with HMB, a new formulation. The Ensure with HMB was launched to provide dietary support to elderly population in Indian. The product is formulated with the special and exclusive ingredient β-hydroxy-β-methyl butyrate (HMB), which helps counteract muscle loss, and restore strength and energy.

- In March 2022, MusclePharm Corporation, a global provider of leading sports nutrition and lifestyle brands of nutritional supplements, expanded its portfolio with the addition of the ready-to-drink protein category as it launched its new whey protein drink.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Quantitative Structure-Activity Relationship (QSAR) Market

- Europe Industrial Chillers Market

- Adaptive Traffic Control System Market

- Investor ESG Software Market

- Lyophilization Services for Biopharmaceuticals Market

- Digital Pathology Market

- Skin Graft Market

- Airline Ancillary Services Market

- Real-Time Location Systems Market

- Hair Extensions Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Treatment Type, Distribution Channel, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The progressive loss of muscular mass, strength, and function is known as sarcopenia. The illness, which is most common in the elderly, is said to be brought on by ageing. Sarcopenia can significantly lower the quality of life by making it harder to carry out daily activities. It may result in the need for long-term care.

Sarcopenia has an impact on the musculoskeletal system and is a significant contributor to fractures, falls, and an increase in frailty. Hospital stays and surgical procedures brought on by these illnesses raise the possibility of complications, including death. Hormone supplements can be used to build muscle and treat sarcopenia. However, there aren't any FDA-approved drugs available right now to treat sarcopenia.

The factors that are driving growth of the market are upsurge in geriatric population and rise in malnutrition and vitamin deficiency among adults.

The sarcopenia treatment market majorly consists of the players such as Abbott Laboratories, Bayer AG, Metagenics LLC, Nestle Health Science SA, Novartis AG, Pfizer Inc., Sanofi SA, Amway Corp, GSK Plc, and Makers Nutrition LLC among others.

US holds the largest market share in sarcopenia treatment market. Sarcopenia prevalence varies with age and gender; elderly people residing in assisted living facilities or communities in the US are at a higher risk of developing this condition. According to the National Institute of Health, in 2019, the anticipated hospitalization cost for persons with sarcopenia in the US was US$ 40.4 billion. People with sarcopenia pay US$ 2,315 more for hospital visits than people with normal muscle mass and function every year on average; they are almost twice as likely to be hospitalized than people without sarcopenia.

Asia Pacific is expected to be the fastest growing region in the sarcopenia treatment market. Asia is the world’s most populated continent with a rapidly aging population, and sarcopenia-related issues are becoming more prevalent in several Asian countries. Asians lead extremely different lifestyles and follow different dietary habits than people from the Western world. In Asia, sarcopenia in older individuals is more common in males (prevalence 9.6–22.1%) than females (prevalence 7.7–21.8%). Asian Working Group for Sarcopenia (AWGS) aims to promote sarcopenia research.

The sarcopenia treatment market, based on distribution channel, is segmented into pharmacies, retail channels, online channels, and others. The pharmacies segment held a substantial market share in 2022. However, the online channels segment is predicted to register the fastest CAGR during 2022–2030.

The sarcopenia treatment market, based on treatment type, is segmented into vitamin D and calcium supplements, protein supplements, vitamin B12 supplements, and others. The vitamin D and calcium supplements segment held the largest share of the market in 2022.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Sarcopenia Treatment Market

- Abbott Laboratories

- Bayer AG

- Metagenics LLC

- Nestle Health Science SA

- Novartis AG

- Pfizer Inc

- Sanofi SA

- Amway Corp

- GSK Plc

- Makers Nutrition LLC

Get Free Sample For

Get Free Sample For