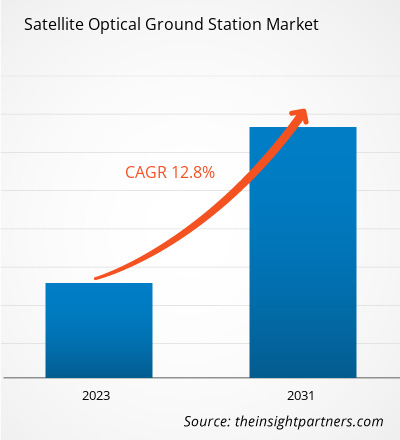

The satellite optical ground station market size is projected to reach US$ 162,540.60 million by 2031 from US$ 62,013.92 million in 2023. The rise in the construction of new airports across the globe is contributing to the increased demand for communication network solutions. The rising number of satellite launches globally is spurring the demand for optical ground stations to track and monitor the movement of satellites and simultaneously receive and transmit data. Also, advanced OGSs are garnering demand for their help in monitoring these satellites. In addition, the demand for OGSs is propelling to avoid the threat of space debris collision with functional space assets. OGSs also help in ensuring safe and sustainable space activities complying with domestic and international guidelines, standards, and other norms.

Satellite Optical Ground Station Market Analysis

The number of satellite launches is increasing globally because of the rising need for satellites in various applications such as earth observation, communication and navigation, and scientific research. According to several space agencies, on average, ~466 SmallSats were launched per year during 2012–2021, and it is expected to increase to 1,846 SmallSats launches per year during 2022–2031. For the launch of these 4,663 SmallSats during 2012–2021, the governments of various countries and companies invested ~US$ 23.1 billion, and it is expected that they will be further investing US$ 84 billion during 2022–2031. In addition, the number of space rocket launches, primarily for deploying satellites in space, is also rising rapidly. In 2021, there were 136 successful rocket launches, whereas in 2022, the number rose to 180. In September 2022, it was seen that 16 orbital launches took place, of which 8 took place in China, 6 in the Americas, and Europe and Russia conducted one each. Furthermore, Falcon 9 launched 191 Starlink broadband satellites, and SpaceX launched 1,465 Starlink satellites in 2022. Again, in January 2023, China launched 14 satellites atop a Long March-2D carrier rocket from the Taiyuan Satellite Launch Center in northern China's Shanxi Province. The 14 satellites included Qilu-2 and Qilu-3, Luojia-3 01, and Jilin-1 Gaofen 03D34. In February 2023, the Indian Space Research Organisation (ISRO) announced the successful deployment of three satellites into their intended orbits via SSLV-D2 vehicle.

Satellite Optical Ground Station Market Overview

An optical ground station (OGS) is a vital part of the infrastructure that links space to the ground. The system helps in providing real-time communications for various applications at much higher data rates (up to several Gbps) than RF. The increasing need for higher-resolution data for missions that require scientists to get a detailed look at the Earth and solar system results in the high demand for OGS systems. The system also helps in providing large volumes of data to fulfill mission requirements and locate the ground assets relating to mission orbit parameters. Thus, the demand for OGSs is increasing globally for more accuracy and high-speed data transfer.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Satellite Optical Ground Station Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Satellite Optical Ground Station Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Satellite Optical Ground Station Market Drivers and Opportunities

Rising Amount of Space Debris

All non-functional artificial materials orbiting the Earth at different altitudes can be termed space debris. Debris includes rocket body parts, fragmentation debris, refuse created during crewed missions, exhaust products from rockets, and defunct satellites. Most of such debris orbit the Earth at an average speed above 26,000 km per hour in Low Earth Orbits (LEO), posing a severe threat of collision for functional space assets. Such threats increase with each rocket launch for LEO and deep space. Growing collision threats of space objects are a persistent problem for the safe and sustainable use of outer space. These threats restrict unhindered access to space and prompt relevant parties to take necessary steps to mitigate risk. In November 2021, the Russian military conducted an anti-satellite test (ASAT) and blew up its defunct Cosmos 1408 satellite (which was launched in 1982) with a Nudol missile. Immediately after the blast, American and Russian astronauts aboard the International Space Station had to take preventive measures to avoid being struck by debris from the satellite, as the International Space Station was supposedly reasonably close to the satellite. In June 2022, International Space Station again had to undertake a collision avoidance maneuver (CAM) to avoid the orbital debris from the destroyed satellite. An uncrewed Progress 81 cargo ship was used by Russia's space agency Roscosmos to move the space station from the path of the debris. In 2021, ISRO carried out 19 CAMs, compared to 12 and 8 CAMs in 2020 and 2019, respectively.

Increasing Number of Strategic Alliances

The growing demand for satellite optical ground stations encourages companies to develop advanced solutions for the expansion of the space industry. For this expansion, the governments of different countries and stakeholders across industry verticals are continuously investing in R&D. They prefer various strategic alliances, such as partnerships, collaborations, and contracts, a few of which are mentioned below:

• In March 2023, CONTEC announced that it had chosen Cailabs to supply an optical ground station which will be installed in 2024. This new optical ground station will incorporate the TILBA-ATMO component for reliable, high-speed communications. Also, the ground station will be CCSDS, SDA, and QKD-capable.

• In February 2023, The Rwanda Space Agency (RSA) announced partnering with ATLAS Space Operations Inc. to build satellite ground infrastructure in Rwanda. Under this agreement, RSA is building a teleport capable of hosting multiple ground stations to service satellites in different orbits.

• In September 2022, Safran Data Systems announced that it had signed a contract with CONTEC to deliver an optical ground station that is to be installed in Western Australia. Safran will deliver a turnkey Optical Ground Station (OGS), which will consist of a mount offering optimal coverage; a 50-cm telescope; a complete pointing, acquisition, and tracking system; and a rotating dome.

• In September 2022, SSC announced that the European Space Agency (ESA) had awarded them a US$ 1.09 million (EUR 1.1 million) contract to support the development of the optical communication project Network of Optical Stations for Data Transfer to Earth from Space (NODES). Under this contract, SSC placed an order with Cailabs to deliver a ground station in Western Australia, scheduled to begin trials in early 2024.

Thus, through contracts and partnerships, various companies are working on providing advanced optical ground stations, which are anticipated to offer potential growth opportunities for the satellite optical ground station market during the forecast period.

Satellite Optical Ground Station Market Report Segmentation Analysis

Key segments that contributed to the derivation of the satellite optical ground station market analysis are operation, application, end user, and equipment.

- By operation, the satellite optical ground station market is bifurcated into laser satcom and optical operations. Solutions comprise software such as Smartsky network, Iridium network, SITA connect, and AirportHub. The optical operations segment held the largest market share in 2023.

- By application, the satellite optical ground station market is segmented into laser operations, debris identification, earth observation, and space situational awareness. The earth observation segment held a larger market share in 2023.

- Based on the end user, the satellite optical ground station market is bifurcated into government military, and commercial enterprises. The government and military segment held a larger market share in 2023.

- By equipment, the satellite optical ground station market is segmented into consumer equipment and network equipment. The network equipment segment held a larger market share in 2023.

Satellite Optical Ground Station Market Share Analysis by Geography

The North American satellite optical ground station market is segmented into the US and Canada. Advanced satellite optical ground station technologies are being widely adopted in the US and Canada to improve defense capabilities. In August 2020, the US Space Center announced that the United Launch Alliance (ULA) was awarded to launch its critical national security space missions for the US Space Force. The missions are planned to be deployed from Cape Canaveral Air Force Station in Florida in FY2027. These types of satellite launches help in the adoption of ground station technologies.

Moreover, the launch of new satellite ground stations across the region and the expansion of existing ground stations are other major factors driving the growth of satellite optical ground stations across the North American region. For instance:

• In 2022, BlueHalo won a contract worth US$ 1.4 billion from the US Space Force for the upgrade of 12 military ground stations across the country wherein BlueHalo will replace the old parabolic satellite dishes with electronic phased array antennas across the military ground stations.

• In February 2023, Satellite operator KSAT announced that it is expanding its network with the installation of new ground station antennas across Antarctica and expanding its capacity in the US through multiple antennas in Hawaii, Alaska, and the Southeast US.

• In January 2023, SpaceX’s Starlink announced the launch of its fleet of second-generation satellites and expansion of its ground station infrastructure across the US.

• In May 2019, GigaSat, part of Ultra Electronics Communications & Integrated Systems (CIS), in partnership with Inmarsat, delivered 16 satellite multiband earth ground station terminals to Canada’s Department of National Defence (DND).

Such developments are likely to catalyze the growth of satellite ground stations across the region. Further, the growth in the number of satellite launches is another major factor likely to generate new opportunities for market vendors during the forecast period as well.

Satellite Optical Ground Station Market Regional Insights

The regional trends and factors influencing the Satellite Optical Ground Station Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Satellite Optical Ground Station Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Satellite Optical Ground Station Market

Satellite Optical Ground Station Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 62,013.92 Million |

| Market Size by 2031 | US$ 162,540.60 Million |

| Global CAGR (2023 - 2031) | 12.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Operation

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

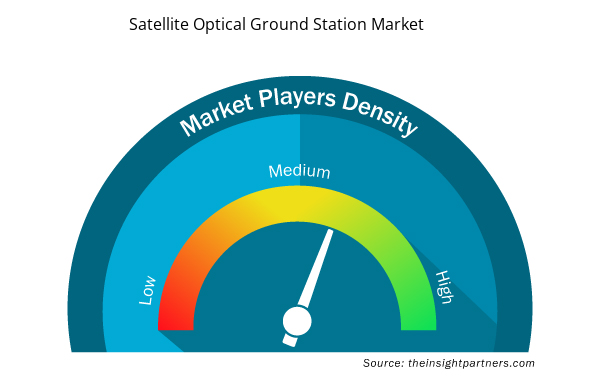

Satellite Optical Ground Station Market Players Density: Understanding Its Impact on Business Dynamics

The Satellite Optical Ground Station Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Satellite Optical Ground Station Market are:

- Thales SA

- Ball Corp

- AAC Clyde Space AB

- Hensoldt AG

- General Atomics Aeronautical Systems Inc

- Tesat-Spacecom GmbH & Co KG

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Satellite Optical Ground Station Market top key players overview

Satellite Optical Ground Station Market News and Recent Developments

The satellite optical ground station market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for innovations, business expansion, and strategies:

- In Apr 2023, HENSOLDT AG, a leading player in the European defense industry, has been promoted to the MDAX, the mid-cap index of the Frankfurt Stock Exchange. The company, which went public in September 2020, has consistently pursued its growth course and has continuously increased its innovative strength. It has increased investments, expanded its product portfolio, and made strategic acquisitions worldwide. (Source: HENSOLDT AG, Press Release)

- In April 2023, Ball Aerospace, Loft Federal, and Microsoft teamed up to work on the Space Development Agency's (SDA) experimental testbed program, called NExT, to carry 10 satellites with experimental payloads into orbit. Ball Aerospace is the prime contractor, leading payload and spacecraft integration and testing. Loft Federal will perform spacecraft integration and testing, procure commercial launch services, and operate the constellation in orbit. Meanwhile, Microsoft will provide Azure Government cloud and ground station infrastructure with secure satellite operations post-launch and productivity solutions to drive mission-critical communications. The collaboration aims to establish a supplier-agnostic rapid delivery pipeline to enable mission success for SDA. (Source: Ball Aerospace, Press Release)

Satellite Optical Ground Station Market Report Coverage and Deliverables

The “Satellite Optical Ground Station Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering the following areas:

- Satellite optical ground station market size and forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities

- Satellite optical ground station market trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Satellite optical ground station market analysis covering key market trends, Global and regional framework, major players, regulations, and recent market developments

- Satellite optical ground station market landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments.

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Human Microbiome Market

- Quantitative Structure-Activity Relationship (QSAR) Market

- Artificial Turf Market

- Predictive Maintenance Market

- Asset Integrity Management Market

- Embolization Devices Market

- Online Recruitment Market

- Educational Furniture Market

- Space Situational Awareness (SSA) Market

- Lyophilization Services for Biopharmaceuticals Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Operation, Equipment, Application, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Canada, China, France, Germany, India, Japan, Middle East and Africa, Russia, South America, United Kingdom, United States

Get Free Sample For

Get Free Sample For