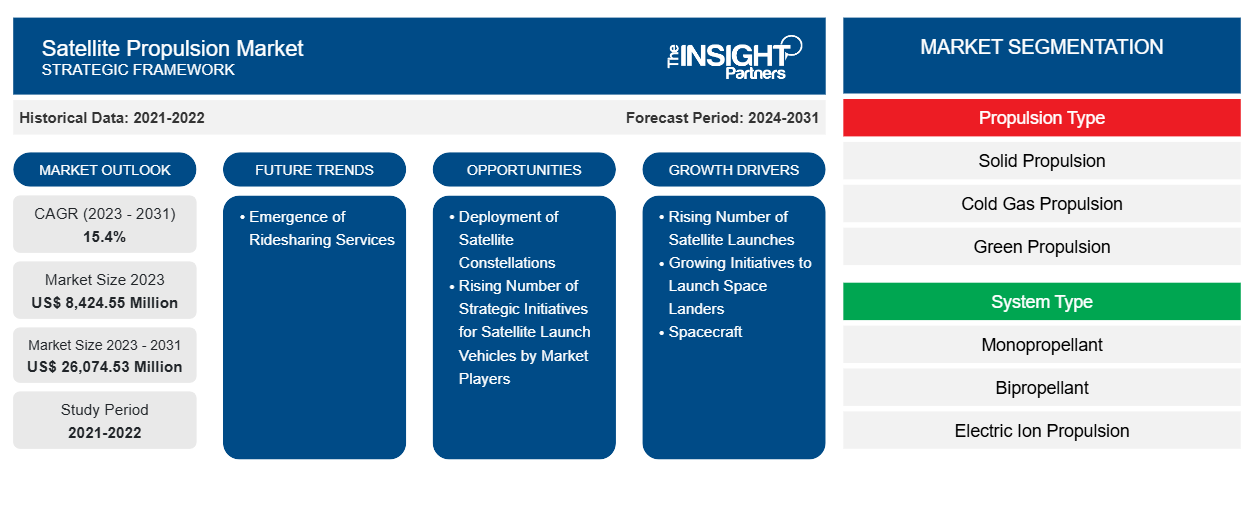

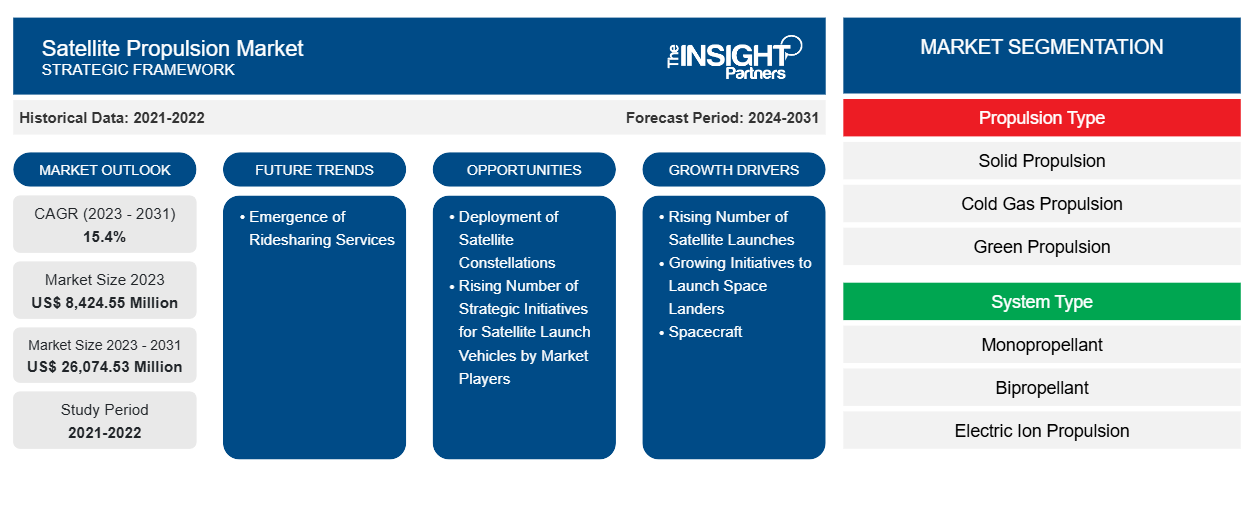

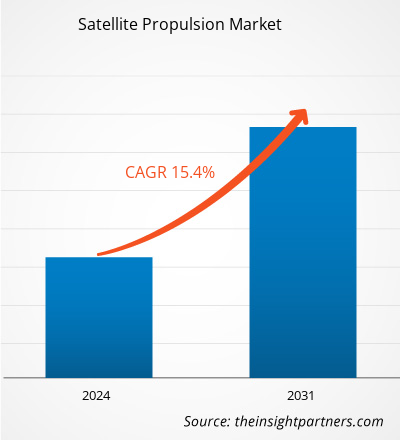

The satellite propulsion market is projected to reach US$ 26,074.53 million by 2031 from US$ 8,424.55 million in 2023; the market is expected to register a CAGR of 15.4% during 2023–2031.

Analyst Perspective:

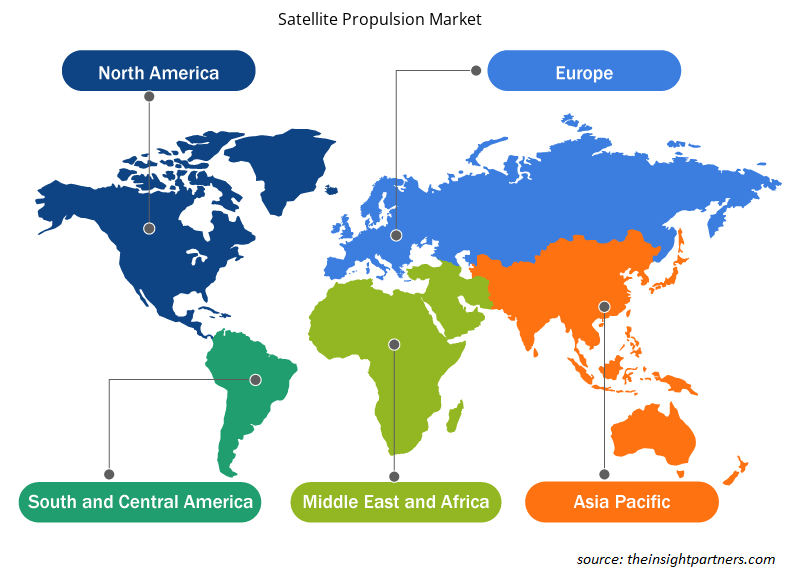

The satellite propulsion market is segmented into North America, Europe, Asia Pacific, and the Rest of the World (the Middle East & Africa and South America). North America and Europe are major regions. The high presence of satellite propulsion system providers, including Northrop Grumman Corporation, Moog Inc., and AQST Canada Inc, in North America acts as a major driver for the market growth in the region.

The rising government spending on space technology across Europe and increasing instances of satellite launches boost the satellite propulsion market growth in Europe. Europe's market benefits from collaborative initiatives facilitated by organizations such as the European Space Agency (ESA). The partnerships foster research and development, encouraging the exchange of knowledge and expertise among member states, which also contributes to the growing satellite propulsion market size.

The Asia Pacific satellite propulsion market is growing owing to product innovation and strategic collaborations. With a strong focus on satellite launches, countries in Asia Pacific such as China, India, Australia, and Japan have emerged as key players in advancing satellite propulsion technologies.

Market Overview:

The growing space sector, owing to the rising number of satellites launches and the increasing number of strategic initiatives by market players, positively impacts the global satellite propulsion market. In addition, the growing focus on deploying satellite constellations, increasing investments in the space sector, and the rising adoption of rideshare services boost the demand for propulsion systems for satellites.

Satellite manufacturing companies are focusing on procuring advanced satellite components to remain competitive in the market. In January 2024, Bellatrix Aerospace launched Rudra and Arka propulsion systems onboard ISRO's PSLV C-58 launch vehicle. In 2023, Neumann Space announced that its propulsion system, Neumann Drive, accomplished its first space mission from Vandenberg Space Force Base in California through the SpaceX Falcon 9 rocket (Transporter-8). The growing instance of satellite launches and rising strategic initiatives by companies bolster the growth of the satellite propulsion market globally.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Satellite Propulsion Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Satellite Propulsion Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Rising Number of Satellite Launches Propels Satellite Propulsion Market Growth

There is a rising number of satellites launched into orbit for applications such as communication, earth observation, and navigation. According to the United Nations Office for Outer Space Affairs (UNOOSA), 2,474 satellites were launched in 2022, compared to 1,810 in 2021 across the world. In January 2024, Iran launched three satellites utilizing its carrier rocket fabricated by the Ministry of Defense and Armed Forces Logistics. In February 2024, the Indian National Space Promotion and Authorization Centre announced to accelerate space activity with 30 satellite launches by 2025. In February 2024, SpaceX launched a US$ 948 million NASA satellite primarily designed to understand climate change. In March 2024, SpaceX launched a Falcon 9 rocket on the Starlink flight from Vandenberg Space Force Base. It accomplished 91 launches with its Falcon 9 rocket and another 5 with the Falcon Heavy in 2023, exceeding its previous annual record of 61 orbital launches in 2022. In 2023, China initiated the launch of three low Earth orbit broadband test satellites. UK Space Command's operational concept demonstrator satellites under Project Minerva and part of the ISTARI program is anticipated to be launched by 2026. In 2023, France's Arianespace launched 12 satellites into space. In 2023, the SpIRIT (Space Industry Responsive Intelligent Thermal) nanosatellite was launched, which was operated by the University of Melbourne. The satellite has been built in collaboration with the Italian Space Agency and several Australian space industry companies. Therefore, increasing number of satellites launches drives the growth of the global satellite propulsion market.

Increased funding and investments in satellite launching programs reflect a growing emphasis on space exploration, satellite deployment, and space-based services. The public sector propels the demand for heavy- and super-heavy-lift space launch services, whereas the private sector leads the demand for small- and medium-lift satellites. The small- and medium-lift satellites are faster-growing sector owing to rising demand for launching low Earth orbit constellations or small satellites for telecommunications. Other reasons driving private investments in space launch technologies include orbital mining, manufacturing, and tourism. The heightened demand for space launches has been largely led by SpaceX's Falcon 9 medium-lift rocket. The rocket is already NASA's launch vehicle for orbital missions, and SpaceX has been assigned to design the space vehicle for NASA's Artemis 3 mission to the moon. Additionally, NASA is anticipated to collaborate with the private sector to support commercial innovation and procure commercial space services from the private sector.

The rising investments in launching programs indicate a broader commitment to space technology. Owing to growing investments, propulsion system manufacturers focus on developing advanced satellite systems. In 2023, HyPrSpace, Leonardo, Thales, and CT Engineering received funding for a project worth US$38 million that aims to demonstrate a new kind of rocket engine to be launched into space. Thus, the growing investments in the satellite industry leading to the upsurging number of satellites launches boost the growth of the global satellite propulsion market.

Segmental Analysis:

Based on propulsion type, the global satellite propulsion market is segmented into solid propulsion, cold gas propulsion, green propulsion, electric propulsion, and ambipolar propulsion. Electric propulsion is gaining popularity. In March 2024, the Indian Space Research Organization (ISRO) announced its plans to demonstrate the use of electric propulsion systems on its satellites. The system consists of a thruster of 300 millinewtons (mN). It is projected to be launched in the second quarter of 2024. Growing adoption of electric propulsion systems drives the satellite propulsion market growth for the electric propulsion segment.

Satellite Propulsion Market Regional Insights

The regional trends and factors influencing the Satellite Propulsion Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Satellite Propulsion Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Satellite Propulsion Market

Satellite Propulsion Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 8,424.55 Million |

| Market Size by 2031 | US$ 26,074.53 Million |

| Global CAGR (2023 - 2031) | 15.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Propulsion Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Satellite Propulsion Market Players Density: Understanding Its Impact on Business Dynamics

The Satellite Propulsion Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Satellite Propulsion Market are:

- Moog Inc.

- ArianeGroup

- Northrop Grumman Corporation

- Thales SA

- Airbus SE

- IHI Corp.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Satellite Propulsion Market top key players overview

Regional Analysis:

The scope of the satellite propulsion market report encompasses North America (the US, Canada, and Mexico), Europe (Spain, the UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America). In terms of revenue, North America dominated the satellite propulsion market share in 2023. APAC is the second-largest contributor to the global market, followed by Europe. The US, Canada, and Mexico are among the major economies in North America. Rising satellite launches, as well as product developments, bolster the market growth in the region. The US is leading the satellite propulsion market share owing to the wide presence of satellite propulsion system manufacturers and growing focus of the governments on advancing the space sector. Northrop Grumman Corporation, Moog Inc., and AQST Canada Inc. are among the players offering satellite propulsion solutions in North America. Further, product innovation and major developments such as collaboration and mergers are anticipated to propel the satellite propulsion market growth in North America during the forecast period. The Government of Canada is also focusing on initiatives toward establishing new regulations and support policies for the space sector. In 2023, the Government of Canada announced a multi-year plan to support the privately built rocket launch initiatives in the country.

The space industry in the US is witnessing rapid development in terms of satellite launches and growing advancements in propulsion systems. The US led the market in terms of satellite launches in 2023. SpaceX independently launched 98 of the 109 satellite launch attempts made by the US in 2023, and 1,937 of the 2,234 US-built satellites were successfully orbited. The growing number of satellite launches, along with rising product developments in the satellite industry, is contributing to the growing satellite propulsion market size in the US. In 2023, Terran Orbital collaborated with Safran to explore US-based production of satellite propulsion systems. As per the agreement, Terran Orbital and Safran Electronics & Defense are anticipated to investigate opportunities and requirements for the manufacturing of electric propulsion systems primarily for satellites based on Safran's PPSX00 plasma thruster. In March 2024, Benchmark Space System's Xantus electric propulsion system was launched into space with the SpaceX Transporter-10 rideshare mission. SpaceX is manufacturing a network of hundreds of spy satellites in collaboration with a US intelligence agency. SpaceX's Starshield business unit is establishing the network under a US$ 1.8 billion contract sealed in 2021.

Key Player Analysis:

Moog Inc.; ArianeGroup; Northrop Grumman Corporation; Thales SA; Airbus SE; IHI Corp.; Bellatrix; Aerospace Private Limited; Busek, Co. Ltd.; Safran S.A.; and Avio S.p.A are among the key players profiled in the satellite propulsion market report. The report includes growth prospects in light of current satellite propulsion market trends and factors influencing the market growth.

Recent Developments:

A few recent developments by the satellite propulsion market players, as per their press releases, are listed below:

|

|

|

February 2023 | Thales Alenia Space, the joint venture between Thales (67%) and Leonardo (33%), signed a contract with the Korea Aerospace Research Institute (KARI) to provide electric propulsion for incorporation on their GEO-KOMPSAT-3 (GK3) satellite. Scheduled for launch in 2027, GK3 is a multi-band communications satellite that will provide broadband satellite communication services in the Korean Peninsula and surrounding maritime areas. In particular, it will support national maritime rescue and protection; monitor water disasters in mountains, rivers, and dams; and help in emergency response to other disaster situations. | APAC |

November 2023 | The École Polytechnique engineering school, the French national scientific research center CNRS, and Safran Electronics & Defense signed a partnership agreement for a joint laboratory dedicated to the research and development of electric satellite thrusters. The new unit is called COMHET (laboratoire Commun pour l’étude des Hall Effect Thrusters) and will focus on improving HET technology. | Europe |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The rise in satellite launches, as well as product development, are a few of the major drivers for the satellite propulsion market in North America. The US is leading the satellite propulsion market owing to the wide presence of satellite propulsion system manufacturers and governments’ growing focus on advancing the space sector. Northrop Grumman Corporation, Moog Inc., and AQST Canada Inc., among others, are offering satellite propulsion solutions in North America.

Increased funding and investments in satellite launching programs reflect a growing emphasis on space exploration, satellite deployment, and space-based services. The public sector propels the demand for heavy- and super-heavy-lift space launch services, whereas the private sector leads the demand for small- and medium-lift satellites. The small- and medium-lift satellites are faster-growing sector owing to rising demand for launching low Earth orbit constellations or small satellites for telecommunications.

The substantial upsurge in satellite constellations has propelled the requirement for a competent satellite constellation management plan. To address this emerging need, companies and agencies operating in the space industry are analyzing the potential strategies for constellation launches, set-ups, alternatives for failed satellites, and end-of-life policies.

Moog Inc.; ArianeGroup; Northrop Grumman Corporation; Thales SA; Airbus SE; IHI Corp.; Bellatrix; Aerospace Private Limited; Busek, Co. Ltd.; Safran S.A.; and Avio S.p.A. are the key market players operating in the global satellite propulsion market.

Trends and growth analysis reports related to Aerospace and Defense : READ MORE..

The List of Companies - Satellite Propulsion Market

- Moog Inc.

- ArianeGroup

- Northrop Grumman Corporation

- Thales SA

- Airbus SE

- IHI Corp.

- Bellatrix

- Aerospace Private Limited

- Busek, Co. Ltd.

- Safran S.A.

- Avio S.p.A

Get Free Sample For

Get Free Sample For