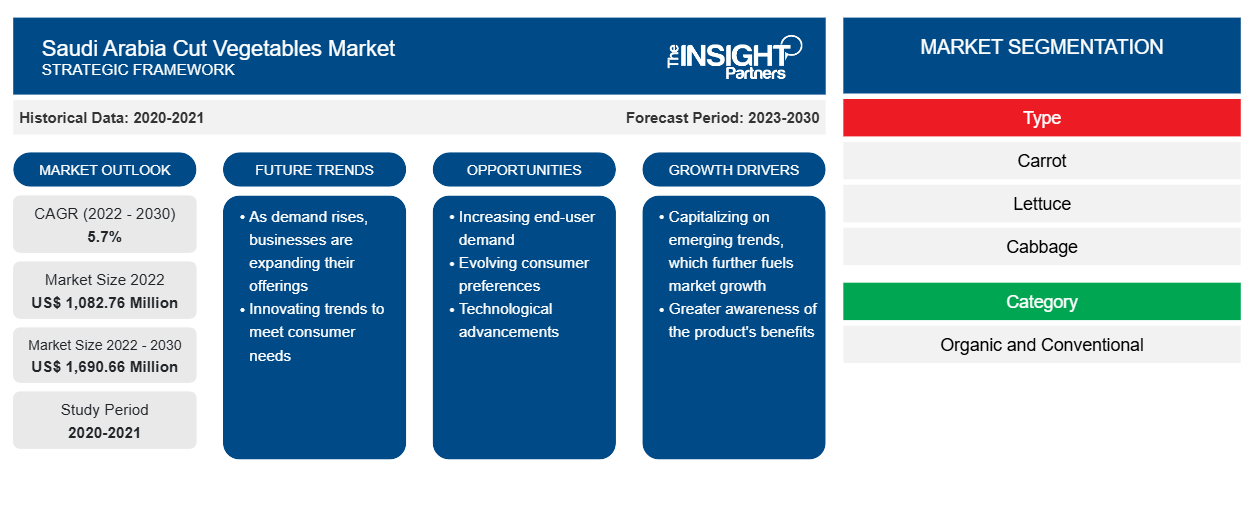

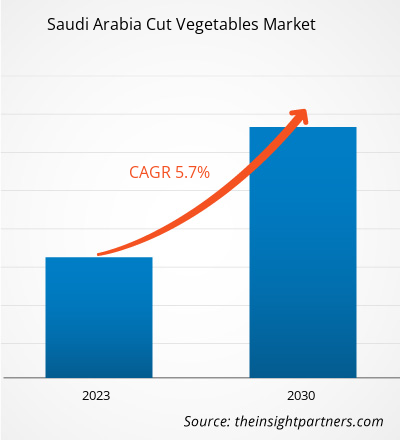

The Saudi Arabia cut vegetables market size is projected to grow from US$ 1,082.76 million in 2022 to US$ 1,690.66 million by 2030. The market is expected to record a CAGR of 5.7% from 2022 to 2030.

Market Insights and Analyst View:

The cut vegetables, also known as pre-cut vegetables, are the vegetables washed, trimmed, and cut into ready-to-use form. Cut vegetables are extensively used by the food service industry due to their growing utilization in salads, coleslaws, picklings, sandwiches, stews, wraps, rolls, and other dishes. The food service industry is significantly growing in Saudi Arabia, which is positively boosting the Saudi Arabia cut vegetables market. Moreover, with rising health awareness, consumers in the country are adopting healthy eating habits, which drives the demand for organic vegetables. These factors play an important role in determining the Saudi Arabia cut vegetables market forecast.

Growth Drivers and Challenges:

The Saudi Arabia cut vegetables market report emphasizes the key factors driving the market. In the past few years, the lifestyle of people in Saudi Arabia has evolved due to hectic work schedules, increasing dependency on convenience food, and a rising demand for time-saving products. The food industry is witnessing a surge in the consumption of high-quality convenience food. Pre-washed, pre-processed, or pre-cut vegetables allow consumers to save time and effort associated with meal preparation and cooking. The development and popularity of these pre-processed food items are ascribed to the increasing number of smaller households and the rising millennial population in the country. Due to hectic work schedules, millennials prefer to be efficient with their time and avoid spending it on tedious tasks. These factors are boosting the demand for pre-cut vegetables among consumers. Cut vegetables in canned or frozen form have extended shelf life and desired freshness. These food products are ready for meal preparation, including salads, stews & soups, curries, and gravies, owing to which they are gaining huge traction among consumers. Thus, all these factors significantly contribute to the growth of Saudi Arabia cut vegetables market.

Online channels such as e-commerce websites and social media platforms allow major companies to reach a broad consumer base. It offers consumers distinct cut vegetable choices in terms of product range, packaging, and brands from different regions. The pandemic further accelerated the growth of e-commerce, leading to a pertinent need for building warehouses across Saudi Arabia. The emergence of e-commerce has transformed how people shop and purchase food products. The growing penetration of the internet and smartphones, quick access to emerging technologies, rising purchasing power, and convenience provided by online retail shopping platforms are among the key factors bolstering e-commerce. Online retail channel bridges the gap between product manufacturers and consumers through direct delivery from their inventories to the global audience through express delivery options. Hence, the emergence of online sales channels is expected to remain a Saudi Arabia cut vegetables market trend in the coming years.

However, the cut vegetables are exposed to oxygen, light, and heat during the production process, which affects vitamin retention. Vitamins B and C are water-soluble and evaporate quickly from pre-cut vegetables, compared to whole vegetables. Further, the respiration rate of vegetables increases after cutting, leading to fast spoilage of the produce. It also leads to the degradation of vegetable quality and undesirable changes in flavor and texture. Supply chain issues, including transportation and packaging, can also contribute to contamination risks. These factors can hamper the Saudi Arabia cut vegetables market growth.

Cut vegetables are susceptible to the proliferation of microbes, such as Listeria monocytogenes and Salmonella, due to moisture content and other suitable environmental conditions. Cut vegetables with high moisture content form a suitable medium for bacterial growth when exposed to air. In 2022, Fresh Del Monte announced a recall of fresh-cut fruits and vegetables from the market due to potential Salmonella contamination. In August 2023, Saudi Food and Drug Authority issued a warning regarding Sanabel frozen okra products imported from Egypt after the detection of insect infestations. The risk of contamination in the cut vegetables is prevalent due to cross-contamination and lack of preservation technologies, which restraints the market expansion.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Saudi Arabia Cut Vegetables Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Saudi Arabia Cut Vegetables Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The Saudi Arabia cut vegetables market analysis is carried out by considering the following segments: type, category, and end user. Based on type, the market is divided into carrot, lettuce, cabbage, capsicum, beans, peas, and others. The market, by category, is bifurcated into organic and conventional. Based on end users, the market is segmented into food processing, food service, and food retail.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Segmental Analysis:

Based on type, the Saudi Arabia cut vegetables market is segmented into carrot, lettuce, cabbage, capsicum, beans, peas, and others. The peas segment holds a significant Saudi Arabia cut vegetables market share. Utilization of frozen peas in food manufacturing or meal preparation ensures standardization and a continuous supply of products. In quick-service restaurants, fine dining establishments, and households, peas are widely used in salads, pasta, casseroles, soups and stews, kebabs, and rice-based dishes. The demand for frozen peas is influenced by factors such as seasonal availability, convenience, and demand for time-saving food ingredients.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Country Analysis:

Saudi Arabia is witnessing a shift in consumers' food preferences due to busy lifestyles, an increase in the number of working women, and the adoption of healthy & convenient food products. Thus, the Saudi Arabia cut vegetables market share is anticipated to grow significantly in the coming years. Moreover, the market is growing as convenience and on-the-go foods have gained popularity after the onset of the COVID-19 pandemic. Consumers opt for frozen cut vegetables for their convenience of preparation and consumption. The food service industry, including restaurants, café, and catering services, requires the convenience of meal preparation and time-saving ingredient options. These establishments often face high demand and time constraints, making cut vegetables a practical solution for efficient meal preparation. The expanding food service industry is expected to favor Saudi Arabia cut vegetables market growth. For instance, Delfino Mayfair announced the opening of an Italian restaurant in Saudi Arabia in October 2023. The restaurant opening is aimed to serve the growing appetite for international cuisine in the country. In addition, in 2023, Arby's opened its first restaurant in Riyadh, Saudi Arabia.

Industry Developments and Future Opportunities:

Initiatives taken by key players operating in the Saudi Arabia cut vegetables market are listed below:

- In May 2023, Sadia Veg&Tal formed a strategic partnership with plantplus foods. B.R.F.'s plant-based product brand launched a positioning focused on the flavor of vegetables and, together with PlantPlus Foods, relaunched two meat-like products, creating the most complete portfolio on the market.

- In June 2022, B.R.F. established a new factory in Dammam, Saudi Arabia. The unit was acquired in January 2021 and received ~US$ 18 million in investments, increasing its monthly production capacity to 1,200 metric tons of food.

Competitive Landscape and Key Companies:

Almunajem Foods Co, Uhrenholt AS, Afdan Co, Grimmway Enterprises Inc, Ovochi, The Egyptian Saudi Food Industries Co, Del Monte Foods (UAE) FZE, Sunbulah Food & Fine Pastries Manufacturing Co Ltd, BRF SA, and Mondial Foods BV. are among the prominent players profiled in the Saudi Arabia cut vegetables market report. These market players adopt strategic development initiatives to expand their businesses, further driving the Saudi Arabia cut vegetables market.

Saudi Arabia Cut Vegetables Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,082.76 Million |

| Market Size by 2030 | US$ 1,690.66 Million |

| Global CAGR (2022 - 2030) | 5.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Saudi Arabia

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Quantitative Structure-Activity Relationship (QSAR) Market

- 3D Mapping and Modelling Market

- Hydrogen Compressors Market

- Genetic Testing Services Market

- Microcatheters Market

- Diaper Packaging Machine Market

- Portable Power Station Market

- Industrial Valves Market

- Rugged Phones Market

- Airline Ancillary Services Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Category, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The List of Companies - Saudi Arabia Cut Vegetables Market

- Almunajem Foods Co

- Uhrenholt AS

- Afdan Co

- Grimmway Enterprises Inc

- Ovochi

- The Egyptian Saudi Food Industries Co

- Del Monte Foods (U.A.E.) FZE

- Sunbulah Food & Fine Pastries Manufacturing Co Ltd

- BRF SA

- Mondial Foods BV

Get Free Sample For

Get Free Sample For