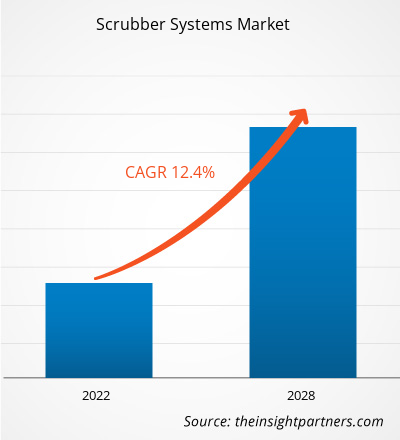

The scrubber system market was valued at US$ 1,316.0 million in 2021 and is projected to reach US$ 2,989.2 million by 2028; it is expected to grow at a CAGR of 12.4% from 2021 to 2028.

Major manufacturing industries such as cement, glass, chemical and petrochemical, food and agriculture, and pharmaceuticals are known for harmful gas emissions. Hence, the stringent environmental regulations imposed on these industries are driving the market. For instance, the cement industry is one of the major polluting industries as it releases nitrogen dioxide (NO2) and sulfur dioxide (SO2) particulate during production. Additionally, rising international trades through sea routes and increasing leisure activities are propelling the growth of the scrubber system market. The rise in global seaborne business can be attributed to its economical transportation cost and continually rising global demand for goods and petroleum products. Furthermore, the increasing participation in leisure activities such as cruise vacations and international voyages is boosting the use of marine ships and subsequently fueling the growth of the scrubber system market.

Impact of COVID-19 Pandemic on Scrubber System Market

The sudden outbreak of COVID-19 has witnessed a significant negative impact of COVID-19 in their demand for the scrubber systems industry in the wake of the global pandemic. In August 2020, Yara Marine Technologies—one of the leading players for marine scrubbers—has diverted its focus from the market due to COVID-19 and low oil prices. The company's innovation manager stated that they had high hopes in 2020 for scrubber systems, but COVID-19 changed it all. However, the market has witnessed a rise in demand from the third quarter as several governments have introduced stringent regulations to maintain clean air. Air scrubber systems play a vital role in removing hazardous particles from exhaust, supporting the market to regain its momentum.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Scrubber Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Scrubber Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights –

Scrubber System Market

Increase in Global Seaborne Trades and Leisure Activities

Rising international trades through sea routes and increasing leisure activities are propelling the growth of the scrubber system market. The rise in global seaborne business can be attributed to its economical transportation cost and continually rising global demand for goods and petroleum products. Furthermore, the rising participation in leisure activities such as cruise vacations and the international voyage is increasing the use of marine ships and subsequently fueling the growth of the scrubber system market. The rise in leisure activities can be attributed to the increasing per capita income of consumers. Hence, the increase in sulfur emission from ships—owing to flourishing global trade—and escalated maritime transportation across the developing and developed economies are boosting the scrubber system installations.

Technology-Based Insights

Based on technology, the scrubber system market is segmented into wet technology and dry technology. The wet technology segment held a larger market share in 2021.

Players operating in the scrubber system market are mainly focused on the development of advanced and efficient products.

- In July 2021, Babcock & Wilcox Environmental announced that it would support Amager Resource Center's application to build an advanced carbon dioxide capture facility at ARC's Amager-Bakke (Copenhill) waste to energy facility in Copenhagen, Denmark, for more than US$ 140 million.

- In September 2021, DuPont Clean Technologies introduced an innovative and advanced steam plume suppression solution for its MECS DynaWave scrubbers in sulfur recovery units (SRU) applications. Sennuba provides reliable corrosion control and plume suppression in the scrubbing system that is at minimal risk of plugging.

Scrubber Systems Market Regional Insights

The regional trends and factors influencing the Scrubber Systems Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Scrubber Systems Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Scrubber Systems Market

Scrubber Systems Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 1.32 Billion |

| Market Size by 2028 | US$ 2.99 Billion |

| Global CAGR (2021 - 2028) | 12.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

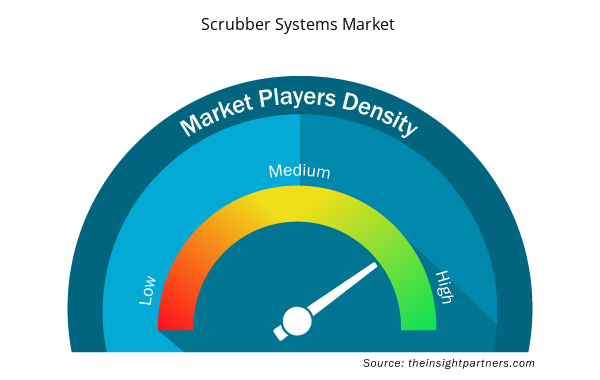

Scrubber Systems Market Players Density: Understanding Its Impact on Business Dynamics

The Scrubber Systems Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Scrubber Systems Market are:

- Babcock & Wilcox Enterprises, Inc

- Alfa Laval

- DuPont de Nemours, Inc.

- FUJI ELECTRIC CO., LTD.

- GEA Group AG

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Scrubber Systems Market top key players overview

The scrubber system market has been segmented as follows:

Scrubber System Market – by Technology

Scrubber System Market – by Industry Verticals

- Marine

- Oil and Gas

- Petrochemicals and Chemicals

- Food and Agricultural

- Wastewater Treatment

- Healthcare

- Others

Scrubber System Market – by Geography

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- Italy

- UK

- Russia

- Rest of Europe

- Asia Pacific (APAC)

- China

- India

- Japan

- South Korea

- Thailand

- Rest of APAC

- Middle East & Africa

- South Africa

- Rest of MEA

- South America

- Brazil

- Argentina

- Rest of SAM

Scrubber System Market – Company Profiles

- Babcock & Wilcox Enterprises, Inc

- Alfa Laval

- DuPont de Nemours, Inc.

- FUJI ELECTRIC CO., LTD.

- GEA Group AG

- Wärtsilä Corporation

- Hamon

- Yara Marine Technologies

- Verantis Environmental Solutions Group

- CECO Environmental

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Technology and Industry Verticals

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The scrubber system market in Europe is sub-segmented into France, Germany, Russia, Italy, the UK, and the Rest of Europe. Compared with the Nordic and Eastern European countries, western European countries are more developed and technologically advanced. EU is increasingly stringent policies to observe the numerous constituents of air which is anticipated to propel the growth of the scrubber system market. Also, despite the EU proposals, all member states of the IMO again approved scrubbing system technology as an accepted compliance method. According to European exports, Germany is one of the essential countries for deploying marine scrubbers in long voyage vessels.

The rising application of sulfur dioxide (SOx) removal scrubber technology in the marine industry has gained significant traction in recent years. It is expected to propel the growth of the scrubber system market in the coming years. The SOx removal scrubber technology offers three different scrubber technology variants based on the vessel's operating profile, such as open-loop scrubber technology, closed-loop scrubber technology, and hybrid scrubber technology. The open-loop scrubber technology uses seawater to scrub the exhaust gas. It discharges the sulfuric acid content water back into the sea as the natural alkalinity of seawater neutralizes the acid.

Marine segment of the scrubber system market comprises ship industries including passenger and cargo. Marine segment holds the largest revenue of the scrubber system market and anticipated to maintain its dominance in the coming years. The growth of the segment can be attributed to the rising stringent policies for the ship industry. For instance, In January 2020, International Maritime Organization (IMO) has changed the emission rules and limits the sulphur in the fuel oil used on board ships operating outside designated emission control areas to 0.5% m/m (mass by mass) previously the limit was 3.5%. Similarly, within specific designated emission control areas the limits are 0.1% m/m.

The wet technology segment of the scrubber system market is poised to grow with significant during the estimated period. The growth of the segment can be attributed to its large application in a wide range of industries such as oil and gas, petrochemicals, marine, wastewater treatment, electronics and semiconductor, and others. For instance, CECO Environmental Corp. is providing CECO HEE-Duall Scrubber (a wet scrubber system) to leading global semiconductor chip manufacturers for removing harmful gaseous contaminants. The technology facilitates an efficient air pollution control methods for eliminating particles as well as gases from industrial exhaust streams. The Wet scrubber technology are considered the most appropriate device for air pollution control which collects both gas and particulates in a single system.

Major manufacturing industries such as cement, glass, chemical and petrochemical, food and agriculture, and pharmaceuticals are known for harmful gas emissions. Hence, the stringent environmental regulations on these industries are driving the market. For instance, the cement industry is one of the major polluting industries as it releases nitrogen dioxide (NO2) and sulfur dioxide (SO2) particulate during production.

The rapid industrialization in developing economies is creating a lucrative opportunity for scrubber system manufacturers to augment their market share further. The growing industrial activities in developing economies such as China, India, Brazil, and Vietnam result in more establishments of plants and factories of various industries. In this rapid industrialization era, the developing economies are witnessing a surge in new production facilities or capacities of the manufacturing industries such as cement, glass, petrochemicals and chemicals, oil & gas, food & beverages, pharmaceuticals, mining & metallurgy, and pulp & paper. For instance, China's National Bureau of Statistics (NBS) has reported a 1.6% year-on-year rise in cement production to 2.377 billion tons for 2020. Also, the country is witnessing constructions of 3,203 cement factory projects, which started in December 2020, with a total investment of US$ 415.6 billion.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Scrubber System Market

- Babcock & Wilcox Enterprises, Inc

- Alfa Laval

- DuPont de Nemours, Inc.

- FUJI ELECTRIC CO., LTD.

- GEA Group AG

- Wärtsilä Corporation

- Hamon

- Yara Marine Technologies

- Verantis Environmental Solutions Group

- CECO Environmental

Get Free Sample For

Get Free Sample For