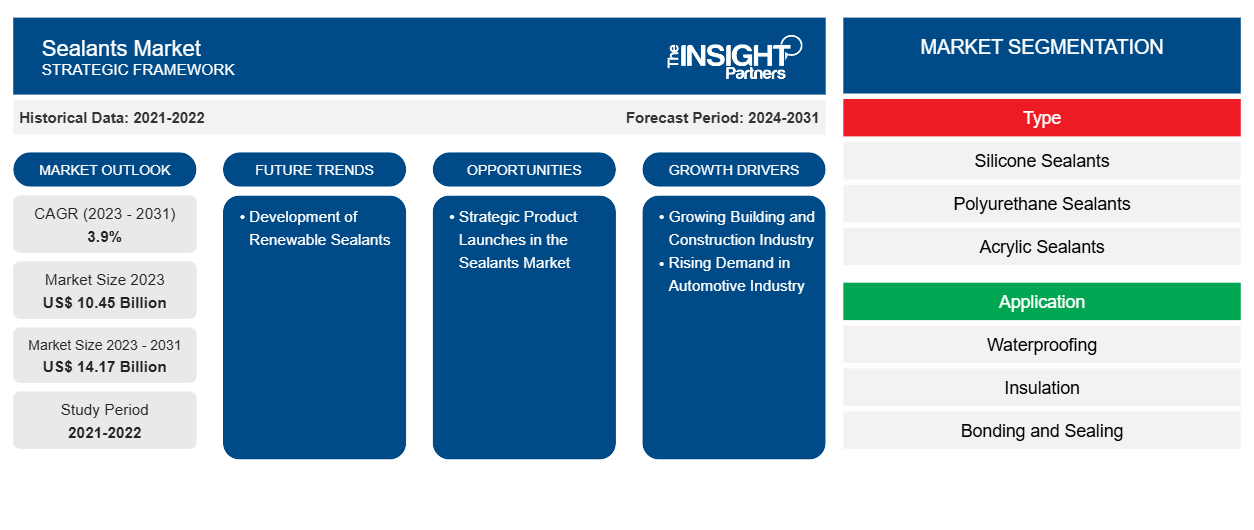

The sealants market is projected to grow from US$ 10.45 billion in 2023 to US$ 14.17 billion by 2031; the market is expected to register a CAGR of 3.9% from 2023 to 2031. The development of renewable sealants is likely to remain a key trend in the market.

Sealants Market Analysis

The building & construction industry across the world is growing significantly owing to rising urbanization; an increasing number of government-supported infrastructure development projects; and surging private and government investments in the development of commercial spaces, offices, and highways. In the building & construction industry, sealants are used to add flexibility to building structures, allowing materials to absorb stress and movement caused by uncertain climatic conditions. They also offer energy efficiency to the buildings and provide a barrier against air, dust, and sound. Structural sealants are used for various applications such as roofing, glass bonding, fire barriers, crack repair, and deck coatings. Also, silicone sealants are used in the expansion, construction, connection, and movement of joints to ensure the stability of structural materials. Thus, the growth of the building & construction industry contributes to the growing sealants market.

Sealants Market Overview

The global sealants market is experiencing substantial growth driven by increasing demand from end-use industries such as building & construction, automotive, energy & power, aerospace, marine, and others. Sealants are used to fill cracks; offer a barrier to air, water, and moisture; and seal joints. Technological advancements have led to the development of high-performance and efficient sealant formulations offering distinct properties. Furthermore, sustainability trends are influencing the sealants market, with manufacturers increasingly focusing on eco-friendly and low-volatile organic compound formulations. Regulatory authorities across the globe are imposing stringent environmental standards and regulations to encourage the production and utilization of green alternatives.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Sealants Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Sealants Market Drivers and Opportunities

Growing Demand in the Automotive Industry Favors Market Growth

The automotive industry is experiencing robust growth owing to technological advancements and an upsurge in preference for SUVs, crossovers, and other light trucks. As per the European Automobile Manufacturers’ Association (ACEA) report published in January 2023, car production in North America has increased by 10.3%, reaching 10.4 million units in 2022 compared to 2021. Companies operating in the automotive sector invest heavily in automobile manufacturing to increase production and sales. According to the International Energy Agency's annual Global Electric Vehicle Outlook, over 10 million electric cars were sold worldwide in 2022, and the sale is projected to grow by 35% in 2023 to reach 14 million.

Sealants are used in different automobile components and induction systems and aid in sealing moisture, dust, and contaminants. In exterior automotive applications, sealants are used for structural bonding, lamp assembly, and glass bonding. Sealants are utilized in the sealing of vehicle body joints and seams, stationary vehicle glass such as windshields, and quarter glass. The sealant applications across the automotive industry include aluminum vehicle doors, hydrogen cars, vehicle sensors, vehicle lighting systems, and powertrains. Thus, the rising demand from the automotive industry drives the sealant market growth.

Rising Number of Product Launches by Market Players to Create Significant Opportunities

Key manufacturers operating in the sealants market invest significantly in strategic development initiatives such as product innovation, business expansion, and research and development to enhance their market position and attract a wide customer base. In March 2023, Dow expanded its product portfolio with silicone sealant products to offer photovoltaic (PV) module assembly materials, supporting the global movement toward renewable energy. The DOWSIL PV product line contains six silicone-based sealant and adhesive solutions that offer durability and performance for rail bonding, junction box bonding and potting, frame sealing, and building integrated photovoltaics (BIPV) installation materials.

In 2022, Bostik launched a comprehensive range of sealants developed for construction applications. The Bostik Pro Sealants range features high and low modulus formulations, and it offers high performance, made available in post-consumer recycled cartridges, reducing the net effect of plastic on the environment. In 2022, Evonik launched the sustainable liquid polybutadienes with POLYVEST eCO, used as a raw material for the production of adhesives and sealants for application in end-use industries such as automotive, electronics, construction, and others. Thus, rising product innovations are expected to create lucrative opportunities in the sealants market during the forecast period.

Sealants Market Report Segmentation Analysis

Key segments that contributed to the derivation of the sealants market analysis are type, application, and end-use Industry.

- The sealants market, based on type, is segmented into silicone sealants, polyurethane sealants, acrylic sealants, polysulfide sealants, butyl sealants, hybrid sealants, and others. The hybrid sealants segment is further segmented into silane-modified polymer sealants, polyurethane-modified acrylic sealants, and others. The silicone sealants segment accounted for the largest market share in 2023.

- By application, the market is segmented into waterproofing, insulation, bonding and sealing, soundproofing, and others. The waterproofing segment held the largest share of the market in 2023.

- In terms of end-use industry, the market is segmented into building & construction, automotive, electronics, healthcare, aerospace & defense, marine, energy & power, and others. The building & construction segment held a significant market share in 2023.

Sealants Market Share Analysis by Geography

Geographically, the sealants market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. Asia Pacific held the largest market share in 2023 and is expected to register the highest CAGR during the forecast period. Europe held the second-largest sealant market share in 2023. In terms of revenue, China held the largest share of the market in Asia Pacific in 2023. The Chinese government has taken several initiatives to stimulate the annual production capacities of automobile manufacturers to 35 million units by 2025. According to the 2022 report by the International Energy Agency, China recorded electric vehicle sales of 3.3 million in 2021. Further, the country is the world's largest construction market, and it is highly supported by government initiatives. The Government of China invested US$ 1.9 billion in 13 public housing projects in 2019. Under the 14th Five-Year Plan, China aims to increase its urbanization rate to 65% during 2021–2025. Thus, government support for urbanization has the potential to bring developments in the construction and infrastructure sectors, thereby driving the demand for sealants. China is among the largest producers of electronic products in the world. The country is also a major supplier of intermediate electronics parts. The expansion of the electronics industry in the country contributes to the growth of the sealants market.

Sealants Market Regional Insights

The regional trends and factors influencing the Sealants Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Sealants Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Sealants Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 10.45 Billion |

| Market Size by 2031 | US$ 14.17 Billion |

| Global CAGR (2023 - 2031) | 3.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Sealants Market Players Density: Understanding Its Impact on Business Dynamics

The Sealants Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Sealants Market top key players overview

Sealants Market News and Recent Developments

The sealants market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the market are listed below:

- Henkel signed an agreement to acquire the US-based Seal for Life Industries LLC ("Seal for Life") from Arsenal Capital Partners (USA). (Source: Henkel, Press Release, February 2024)

- Dow announced the expansion of its silicone sealant products to offer photovoltaic (PV) module assembly materials, furthering the global movement toward renewable energy. (Source: Dow, Press Release, March 2023)

- BASF announced that it will increase the production capacity for its medium-molecular weight polyisobutenes, marketed under the tradename OPPANOL B, at its site in Ludwigshafen, Germany, by 25%. The medium-molecular weight polyisobutenes comprise applications such as surface protective films, window sealants, binder material for batteries, and food packaging solutions. (Source: BASF, Press Release, August 2023)

Sealants Market Report Coverage and Deliverables

The “Sealants Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Sealants market size and forecast for all the key market segments covered under the scope

- Sealants market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter’s Five Forces and SWOT analysis

- Sealants market analysis covering key market trends, country framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the sealants market

- Detailed company profiles

Frequently Asked Questions

What are the factors driving the sealants market?

Based on type, which segment held the largest share in the global sealants market?

What are the future trends in the sealants market?

Which are the leading players operating in the sealants market?

What is the expected CAGR of the sealants market?

Which region held the largest share of the global sealants market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For