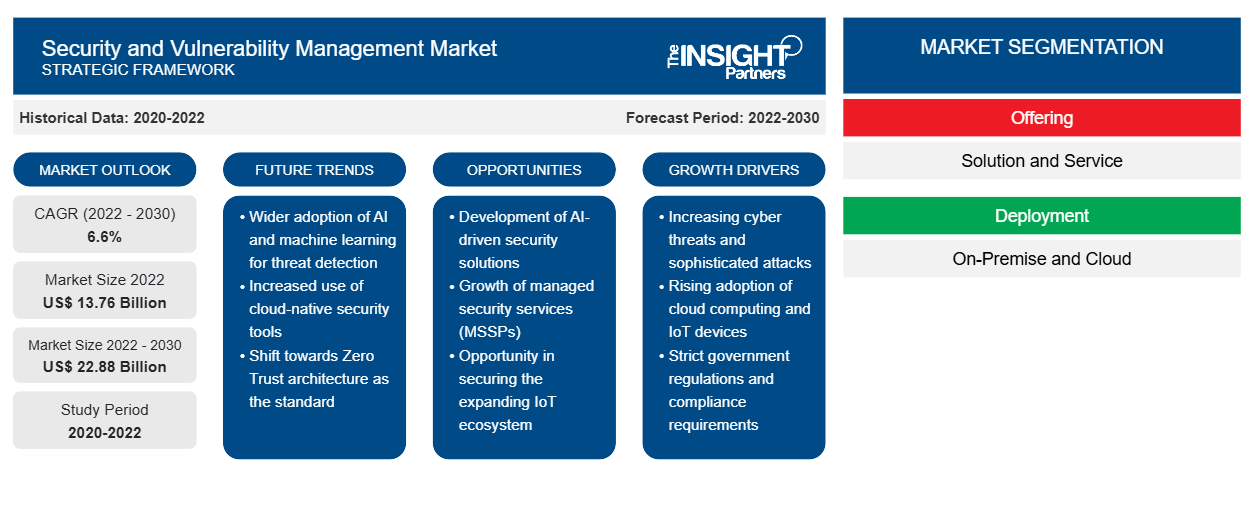

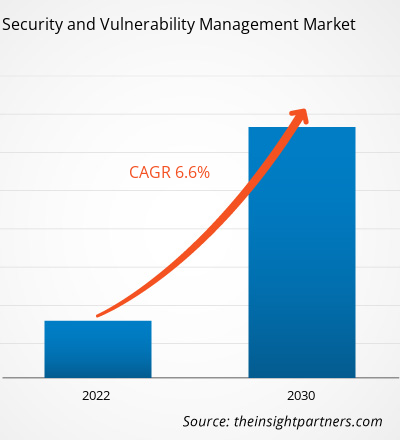

[Research Report] The security and vulnerability management market size is projected to grow from US$ 13.76 billion in 2022 to US$ 22.88 billion by 2030; the market is estimated to record a CAGR of 6.6% from 2022 to 2030.

Analyst Perspective:

The report includes growth prospects owing to the current security and vulnerability management market trends and their foreseeable impact during the forecast period. The growing number of cyberattacks and data breach incidents across the world are among the factors bolstering the market. Growing investments in AI-enabled solutions and the expansion of the BFSI and healthcare sectors are further expected to boost the market during the forecast period. Stringent government regulations related to cybersecurity and data confidentiality also benefit the market. Moreover, the integration of modern technologies such as AI, ML, data analytics tools, and cloud storage is likely to create growth opportunities for the security and vulnerability management market growth in the coming years.

Market Overview:

Security is an organization's most valuable asset, which requires the contribution of both technology and training. Vulnerabilities are caused by faults in systems, which could lead to unauthorized access to private information. Security and vulnerability management is the process of identifying, classifying, mitigating, and fixing vulnerabilities in networking hardware or software. Crucial data obtained from vulnerability assessment is used by security teams to fix vulnerabilities in their networks, thereby facilitating risk assessment and threat mitigation activities. An upsurge in cybercrimes and increasing investments in cybersecurity processes are likely to drive the security and vulnerability management market growth in the near future.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Security and Vulnerability Management Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Security and Vulnerability Management Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Security and Vulnerability Management Market Driver:

Increasing Number of Cyberattacks and Data Breaches Fuel Security and Vulnerability Management Market

According to a report by the AAG published on February 2024, 43% of UK businesses are facing cyber-attacks in 2022, recording an increase of ~32% from 2020. This propels the demand for security and vulnerability management solutions and services among consumers for protecting sensitive data and critical systems against cyberattacks. Moreover, these solutions are also used to identify and address vulnerabilities that help users mitigate risks related to security breaches and protect sensitive data and systems.

Report Segmentation and Scope:

The security and vulnerability management market analysis has been carried out by considering the following segments: offering, deployment, and industry. Based on offering, the market is segmented into solution and services. In terms of deployment, the security and vulnerability management market is categorized into on-premise and cloud. On the basis of industry, the market is divided into BFSI, IT & telecom, retail and e-commerce, healthcare, government and utilities, and others. By region, the market is segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM).

Segmental Analysis:

Based on industry, the security and vulnerability management market is segmented into BFSI, IT & telecom, retail and e-commerce, healthcare, government and utilities, and others. The BFSI segment is anticipated to hold a significant security and vulnerability management market share during the forecast period. The projected growth of this segment is ascribed to the growing digitalization and the rising number of cyberattacks in the BFSI sector, along with its intense impact on national economies. According to Computer Emergency Response Team (CERT-In) data, the financial sector in India faced over 1.3 million cyber-attacks between January and October 2023, with an average of 4,400 attacks per day. Cybersecurity is becoming increasingly crucial for financial institutions due to the growing digitalization in the financial sector, facilitating the expansion of the security and vulnerability management market. Digitalization makes it easy for cyber-attackers to target websites and transaction systems.

Regional Analysis:

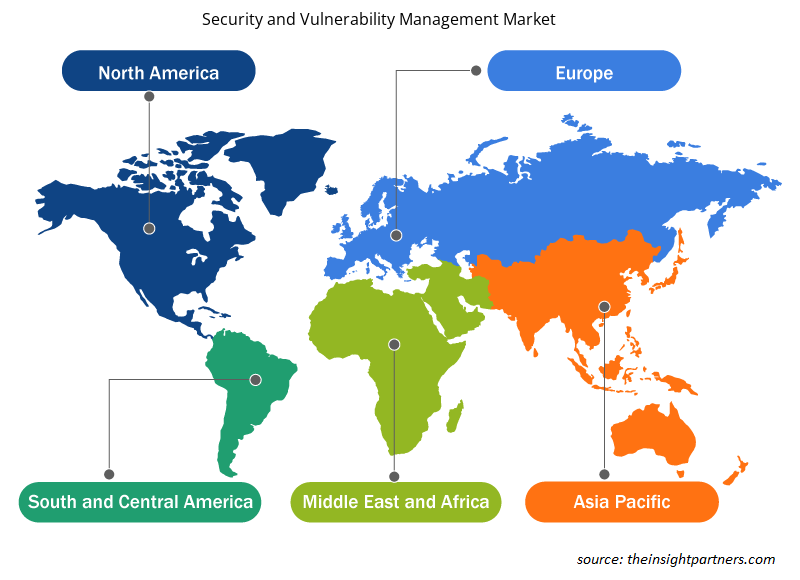

The geographic scope of the security and vulnerability management market report entails North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. In terms of revenue, North America held the largest security and vulnerability management market share in 2022. Growing investments in AI technology, rising awareness related to cyber threats, significant investments in cybersecurity, and stringent rules and regulations for the financial industry are driving the market in this region. The region is highly focused on adopting comprehensive security solutions for protecting data from cyber threats. In October 2023, the House Foreign Affairs Committee and Senate Homeland Security & Governmental Affairs faced a cyberattack from Vietnamese hackers trying to install spyware on the phones of journalists. Such cyberattack incidents trigger the demand for vulnerability management solutions among consumers to protect their sensitive data. Vulnerability management allows users to strengthen their systems, protect data, and comply with security standards.

Key Player Analysis:

Microsoft Corp; International Business Machines Corp;, Hewlett Packard Enterprise Development LP; Qualys Inc; Tenable Holdings Inc; Rapid7; CrowdStrike Holdings Inc; Fortra, LLC; Skybox Security, Inc; and Cisco Systems Inc are among the key companies profiled in the security and vulnerability management market report.

Security and Vulnerability Management Market Regional Insights

Security and Vulnerability Management Market Regional Insights

The regional trends and factors influencing the Security and Vulnerability Management Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Security and Vulnerability Management Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Security and Vulnerability Management Market

Security and Vulnerability Management Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 13.76 Billion |

| Market Size by 2030 | US$ 22.88 Billion |

| Global CAGR (2022 - 2030) | 6.6% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

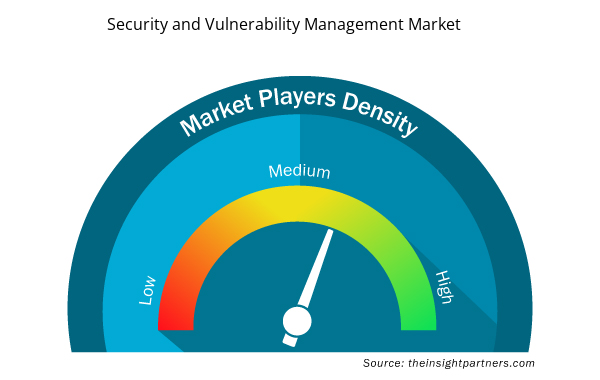

Security and Vulnerability Management Market Players Density: Understanding Its Impact on Business Dynamics

The Security and Vulnerability Management Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Security and Vulnerability Management Market are:

- Microsoft Corp

- International Business Machines Corp

- Hewlett Packard Enterprise Development LP

- Qualys Inc

- Tenable Holdings Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Security and Vulnerability Management Market top key players overview

Recent Developments:

The security and vulnerability management market forecast can help stakeholders in this marketplace plan their growth strategies. The market players highly adopt inorganic and organic strategies; a few of the recent key developments are listed below:

- In October 2023, BackBox Software Inc launched a Network Vulnerability Manager service for enhancing network automation. This new service assists users in network automation and offers a comprehensive solution to manage vulnerabilities within network infrastructures.

- In October 2023, Hackuity launched the version 2.0 of its intelligent risk-based vulnerability management platform. Version 2.0 is a next-generation platform featuring major enhancements to support businesses in handling risks. The new version combines vulnerability severity, threat intelligence, and unique business context, providing businesses with a measurable True Risk Score (TRS).

- In April 2023, Google LLC launched the Hacking Policy Council initiative to strengthen the vulnerability management process. The Hacking Policy Council is collaborating with Intel, Bugcrowd, Intigriti, HackerOne, and Luta Security to enhance vulnerability management practices.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Electronic Toll Collection System Market

- Fertilizer Additives Market

- Space Situational Awareness (SSA) Market

- EMC Testing Market

- Constipation Treatment Market

- Transdermal Drug Delivery System Market

- Semiconductor Metrology and Inspection Market

- Drain Cleaning Equipment Market

- Electronic Health Record Market

- Visualization and 3D Rendering Software Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Offering, Deployment, and Industry Vertical

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Solution segment is expected to hold a major market share of security and vulnerability management market in 2022

The security and vulnerability management market is expected to register an incremental growth value of US$ 9.12 billion during the forecast period

The global market size of security and vulnerability management market by 2030 will be around US$ 22.88 billion

Stringent regulatory standards and data privacy compliances are anticipated to play a significant role in the security and vulnerability management market in the coming years.

Asia Pacific is expected to register highest CAGR in the security and vulnerability management market during the forecast period (2022-2030)

The US is expected to hold a major market share of security and vulnerability management market in 2022

Microsoft Corp; International Business Machines Corp; Hewlett Packard Enterprise Development LP; Qualys Inc; Tenable Holdings Inc; Rapid7; CrowdStrike Holdings Inc; Fortra, LLC; Skybox Security, Inc; and Cisco Systems Inc are the key market players expected to hold a major market share of security and vulnerability management market in 2022

Growing investments in AI-enabled solutions and increasing number of cyberattacks and data breaches are the major factors that propel the security and vulnerability management market.

US, China, and Japan are expected to register high growth rate during the forecast period

The estimated global market size for the security and vulnerability management market in 2022 is expected to be around US$ 13.76 billion

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies - Security and Vulnerability Management Market

- Microsoft Corp

- International Business Machines Corp

- Hewlett Packard Enterprise Development LP

- Qualys Inc

- Tenable Holdings Inc

- Rapid7

- CrowdStrike Holdings Inc

- Fortra, LLC

- Skybox Security, Inc

- Cisco Systems Inc

Get Free Sample For

Get Free Sample For