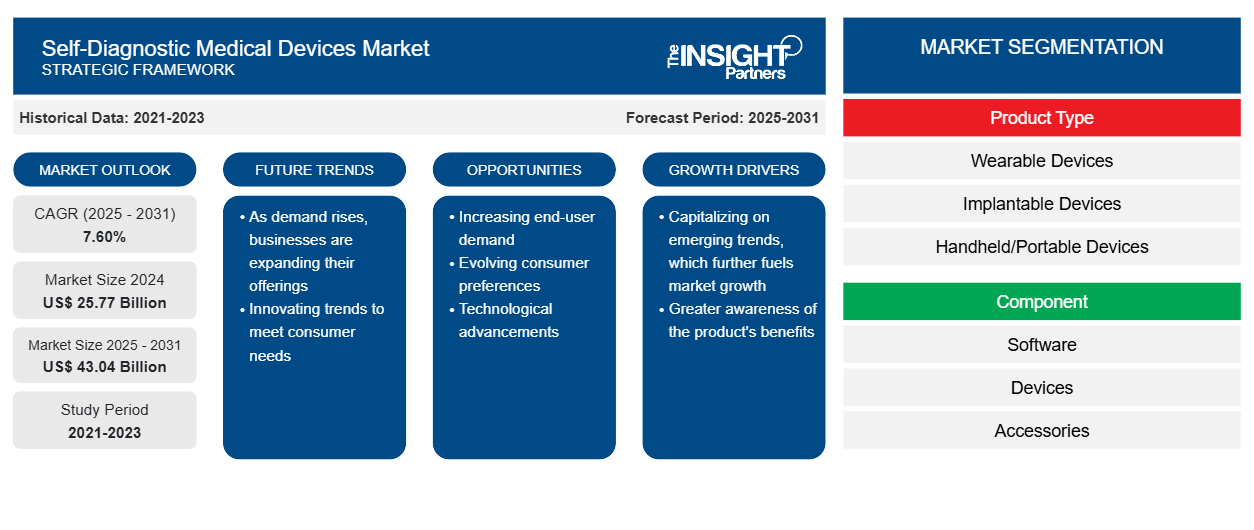

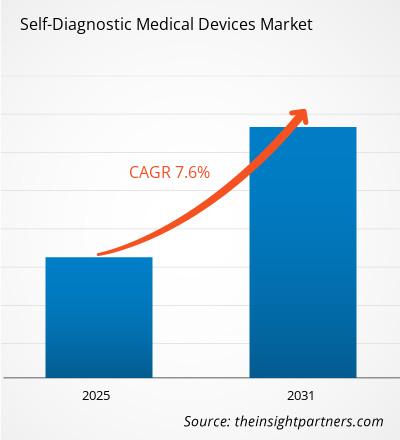

[Research Report] The global self-diagnostic medical devices market size was US$ 22.26 billion in 2022, and the market size is projected to reach US$ 39.88 billion by 2031. It is expected to register a CAGR of 7.6% in 2022-2031.

Market Insights and Analyst View:

Self-diagnostic medical devices are used to measure and monitor vital parameters such as blood sugar level, heart rate, hypertension, and other conditions. The major factors accentuating the growth of SDMD market include rising prevalence of chronic and lifestyle diseases, technological advancements, increasing preference for remote patient monitoring, increasing healthcare awareness and rising population. These devices are portable, cost-effective, and enable the patient to stay at home/workplace or any preferred destination across globe, allowing them to manage their health independently. The addition of features such as real-time remote communication in SDMD enables the healthcare personnel to interpret the results for further diagnosis and treatment.

Growth Drivers and Restraints:

The medical device industry is one of the most R&D-intensive industries globally due to the increasing adoption of software and hardware to develop technologically advanced products. The value of devices is becoming increasingly important; medical device companies are more than ever interested in ensuring R&D achieves their intended goal. Products with advanced technologies offer more effective benefits in diagnosis and treatment. As the prevalence of diseases increases worldwide, the demand for more products with advancements also accelerates. Thus, researchers have been conducting research activities resulting in product innovations over the years. For instance, in April 2023, Abbott received clearance from the U.S. Food and Drug Administration (FDA) for a reader for its FreeStyle Libre 3 integrated continuous glucose monitoring (iCGM) system, which features the world's thinnest, smallest, and most discreet glucose sensor. The FreeStyle Libre 3 reader is a small handheld device that displays glucose readings in real-time directly from a small sensor worn on the back of a patient's upper arm, allowing them to manage diabetes quickly and easily by viewing their glucose readings on an easy-to-see screen.

Self-diagnostic devices are vulnerable to malicious cyberattacks. Therefore, the number of data breaches associated with healthcare information and patient data has gradually increased. According to a survey published in the HIPAA Journal 2021, about 50.41 million people were affected by healthcare data breaches, with a 24% rise over the previous year. The study includes 905 instances, reporting a 19% surge from the previous year. According to an article by GE Healthcare, healthcare breaches has increased over 84% in 3 years, i.e., from 386 in 2021 to 711 in 2021. According to the data provided by IBM’s Security annual report, the average data breach cost in 2021 was US$ 3.86 million across all global industries. The healthcare industry recorded the highest industry-average cost of US$ 7.13 million in 2021. Thus, digital healthcare is a lucrative target for cyberattacks and data breaches, with misconfigured cloud storage buckets, weaponized ransomware, and phishing e-mails, which, in turn, restrains the adoption of self-diagnostic medical devices.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Self-Diagnostic Medical Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Self-Diagnostic Medical Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “Global Self-Diagnostic Medical Devices Market” segmentation is done based on product type, components, application, end user, and geography. The self-diagnostic medical devices market is segmented based on product type into wearable, implantable, handheld/portable, stationary, and others. Based on components, the self-diagnostic medical devices market is segmented into software, devices, and accessories. Based on application, the self-diagnostic medical devices market is segmented into blood pressure, temperature, blood glucose, pregnancy/fertility test kits, sleep apnea devices, and others. The self-diagnostic medical devices market is segmented based on end users into home care settings, rehabilitation centers, and others. The self-diagnostic medical devices market based on geography is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

Based on product type, the self-diagnostic medical devices market is segmented into wearable devices, implantable devices, handheld/portable devices, stationary devices, and others. In 2023, the handheld/portable devices segment, by product type, held the largest market share of the self-diagnostic medical devices market. However, the wearable devices segment is expected to grow at the highest CAGR during the forecast period. Increasing cases of diabetes blood pressure and use of pregnancy kits for pregnancy detection fuel the growth of the handheld/portable devices segment. According to World Heart Federation, 1.3 billion people globally are affected by high blood pressure every year. Increase in demand for wearable devices for continuous monitoring of blood pressure, heart rate, and blood glucose is expected to fuel the growth of the wearable devices segment in the forecast period.

The self-diagnostic medical devices market is segmented based on end users into home care settings, rehabilitation centers, and others. In 2023, the home care settings segment held the largest self-diagnostic medical devices market share. The shift of point of care (PoC) from hospital to home provides good chances for better, consistent, and timely interaction between patient and doctor, making cloud and mobility-driven medical devices a foremost trend. Also, the COVID-19 crisis triggered the importance of AI in healthcare, which led to the growing emphasis on home-based care due to limited hospital bed capacity and a scarcity of skilled healthcare professionals. By monitoring the patient’s vitals remotely, healthcare professionals can avoid hospital admission if cases can be handled virtually, thereby reserving hospital beds only for patients requiring critical care. Home monitoring, often known as remote patient monitoring (RPM), has a subset of applications with different requirements and data delivery frequency, including monitoring chronic diseases and tracking patients’ health status.

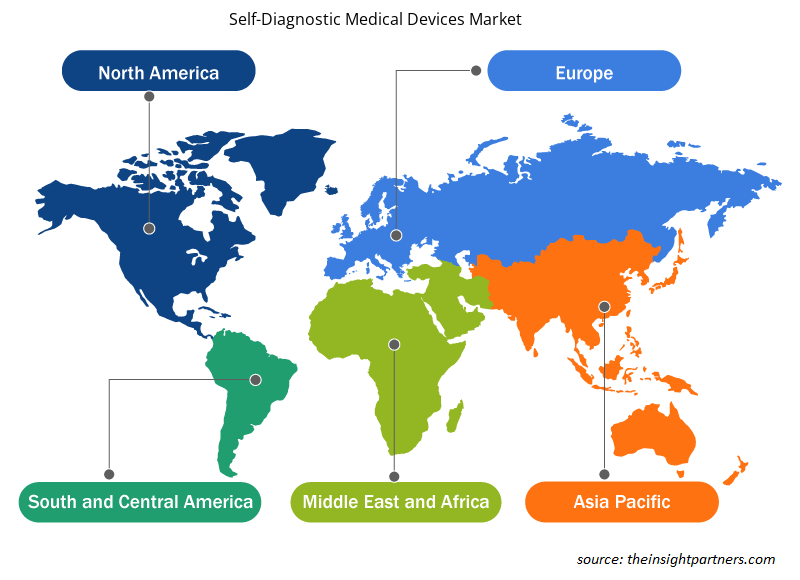

Regional Analysis:

Based on geography, the self-diagnostic medical devices market segments into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. In 2023, the North America self-diagnostic medical devices market held the largest share of the global self-diagnostic medical devices market, and the Asia Pacific self-diagnostic medical devices market is estimated to register the highest CAGR during the forecast period. The US self-diagnostic medical devices market held the largest share in the North American self-diagnostic medical devices market. The growth of this market is primarily driven by increasing expenditure of research and development expenditures. According to the American Diabetes Association report, over 37 million children and adults have diabetes in the US alone. The estimated total costs of diagnosed diabetes in the US account for US$ 16,752 annually, among which US$ 9,601 is attributed to diabetes. Also, the US holds high expenditure on hospital inpatient care (30% of the total medical cost), anti-diabetic agents and diabetes supplies (15%), prescription medications to treat complications of diabetes (30%), and physician office visits (13%). According to the Government of Canada report, about 3 million Canadians or over 8.9% of the population, have been diagnosed with diabetes. The prevalence is increasing at an average rate of 3.3% annually.

Additionally, 6.1% of Canadian adults live with prediabetes, putting them at risk of developing type 2 diabetes. The alarming growth rate of diabetes in the country is leading to advancements in science and clinical evidence at a rapid pace. The increasing prevalence of chronic diseases such as cardiovascular diseases, diabetes, and blood pressure is fueling the market growth in North America.

India is among the countries in the Asia Pacific region emerging in terms of developments in healthcare. The rising prevalence of diabetes and robustly increasing geriatric population are adding up to the growth of the self-diagnostic medical devices market in the country. As per the International Diabetes Federation 2021, it is estimated that 77.3 million adults live with diabetes in India, which is expected to reach 101.2 million by 2031. WHO has predicted that there about 10 crore Indians will suffer from diabetes in the next 10 years.

Several entrants are entering the market, which is further propelling the market for self-diagnostic medical devices. In November 2021, Abbott unveiled a do-it-yourself version of its continuous glucose-monitoring device in India, a decision prompted by the pandemic. The reader is a one-time cost to the consumer at US$66.61, while the sensor is a recurring cost of US$60.55, possibly every three months. The sensor gives continuous readings for 14 days and analytics cover a three-month period, mapping the sugar levels against diet, exercise, etc. The growing Indian market offers opportunities for international companies to increase their revenues owing to improving healthcare facilities in the country. Thus, the market is likely to experience significant growth in India during the forecast period.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global self-diagnostic medical devices market are listed below:

- In August 2022, GOQii introduced Smart Vital Ultra and GOQii Stream devices targeting young adults and youth, encouraging them to lead a healthy and active lifestyle. It monitors blood oxygen saturation levels (SpO2) and continuous and non-disruptive heart rate, and detects sleep patterns by analyzing these two factors while a user is asleep.

- In February 2022, CardiAI Inc introduced its new 24-hour ambulatory blood pressure monitoring system, BPAro, a compact, portable, self-monitoring blood pressure device that uses bluetooth for wireless data collection. The data collected by BPAro is then uploaded on a secure cloud database. US Food and Drug Administration and Health Canada validate and approve the device.

- In June 2021, Terumo Corporation launched Japan's Dexcom G6 continuous glucose monitoring (CGM) system. A CGM system is a medical device that supports diabetes control. The Dexcom G6 CGM system allows real-time glucose monitoring. Its innovative technology uses a small, wearable sensor and transmitter to measure and automatically send glucose values wirelessly to a smart device 1 or receiver every 5 minutes.

Competitive Landscape and Key Companies:

Some self-diagnostic medical devices market leaders are Medtronic, Roche, Siemens, Johnson & Johnson, Abbott, Omron, Nova Biomedical, Philips Healthcare, Biotronik, and GE Healthcare. These companies focus on product launches and expansions geographically to meet the increasing consumer demand worldwide and increase their product range in specialty portfolios. These companies have a widespread global presence, allowing them to serve many customers and subsequently increase their market share. The report offers a trend analysis of the self-diagnostic medical devices market emphasizing on various parameters such as market dynamics, technological advancements, and competitive landscape analysis of leading market players across the globe.

Report ScopeSelf-Diagnostic Medical Devices Market Regional Insights

The regional trends and factors influencing the Self-Diagnostic Medical Devices Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Self-Diagnostic Medical Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Self-Diagnostic Medical Devices Market

Self-Diagnostic Medical Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 25.77 Billion |

| Market Size by 2031 | US$ 43.04 Billion |

| Global CAGR (2025 - 2031) | 7.60% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

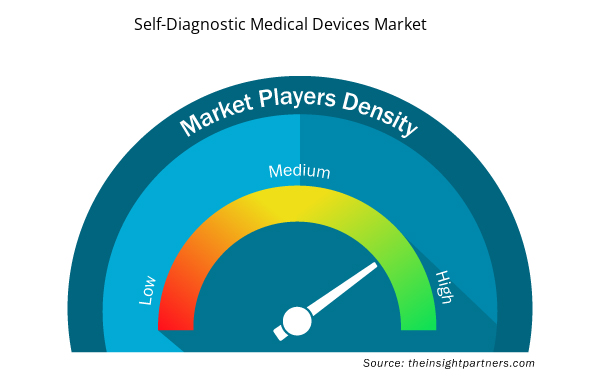

Self-Diagnostic Medical Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Self-Diagnostic Medical Devices Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Self-Diagnostic Medical Devices Market are:

- Medtronic

- Roche

- Siemens

- Johnson & Johnson

- Abbott

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Self-Diagnostic Medical Devices Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Get Free Sample For

Get Free Sample For