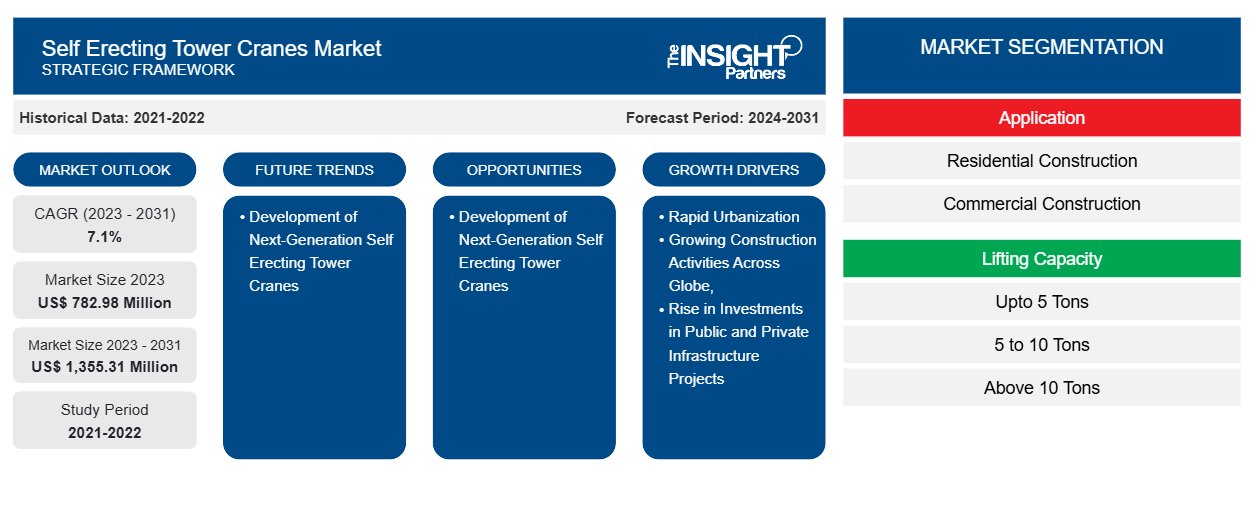

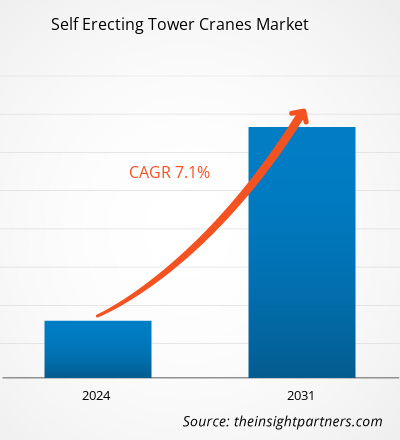

The self erecting tower cranes market is projected to grow from US$ 782.98 million in 2023 and expected to reach US$ 1,355.31 million by 2031. The market is expected to register a CAGR of 7.1% during 2023–2031.

Key players in the self-erecting tower cranes market are developing and adopting advanced technologies to meet the customer's requirements at construction sites. Companies are enabling telematic solutions to offer flexibility for users at remote locations. In January 2024, the Potain tower crane manufacturer launched brand-new advanced technologies based on the Evy 30-23 self-erecting crane model with a capacity of 4 tons. The range of self erecting cranes is designed with the Voice of the Customer development process. Also, the company claims that the new range complies with the European Safety Standard EN 14439 for tower cranes.

Self Erecting Tower Cranes Market Analysis

The construction industry in Asia is growing at a notable growth rate. According to the Asia Development Bank Organization, Asia Pacific countries invest around US$ 1.7 trillion per year in the construction sector. The sector is growing at a rapid pace owing to increasing demand for residential construction projects and rapid infrastructure developments in the public sector. Owing to such developments, the demand for self erecting tower cranes is increasing at a notable rate.

Self Erecting Tower Cranes Market Overview

Self-erecting tower cranes operate remotely without a cabin. The cranes are commonly used on small to mid-sized construction projects due to their self-contained nature and lack of the need for additional cranes. One of the primary factors behind the increasing demand for self erecting tower cranes is the increasing urbanization and rising construction activities. Urbanization results in the conversion of land for residential, commercial, industrial, and transportation use. According to the updated list of urban areas provided by the United States Census Bureau in December 2022, urban population in the US increased by 6.9% between 2010 and 2023. The West region of the US remained the most urban of the country's four census areas, with 88.9% of its inhabitants living in cities, followed by the Northeast region with 84.0% as of 2022. Apart from the US, Spain has also witnessed a notable rise in urbanization.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Self Erecting Tower Cranes Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Self Erecting Tower Cranes Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Self Erecting Tower Cranes Market Drivers and Opportunities

Rise in Investments in Public and Private Infrastructure Projects

In urban and rural areas, there are increased investments by several countries' governments in construction activities. According to the World Bank Organization report, in 2022, US$ 91.7 billion was invested in 263 infrastructure projects in the private sector across all low- and middle-income countries such as India, China, Japan, and Africa. This represents 23% growth in 2022 compared to 2021, at an average growth rate of 4% during 2017–2021. In 2022, there has been a significant rebound in construction activities in developing countries with growing investment commitments post-COVID-19 pandemic.

Growing Number of Smart City Initiatives

Smart city projects focus on the transition to a more efficient and effective utility infrastructure. Smart city development projects use tower cranes, self-erecting cranes, and other advanced construction equipment to optimize material handling. The use of self-erecting cranes helps increase operational efficiency, reduces energy usage and expenditures, and leads to proactive decision-making. According to Smart America, in June 2022, city governments in the US announced their plan to invest ∼US$ 41 trillion in infrastructure upgrades and the implementation of Internet of Things solutions over the next 20 years. Also, the European Union Commission's Horizon Europe objective aims to transform 100 cities into climate-neutral and smart by 2030.

Self Erecting Tower Cranes Market Report Segmentation Analysis

Key segments that contributed to the derivation of the self erecting tower cranes market analysis are application and capacity.

- Based on application, the self erecting tower cranes market is segmented into residential construction, commercial construction, and others. The residential segment held the largest market share in 2023.

- By lifting capacity, the market is segmented into upto 5 tons, 5 to 10 tons, and above 10 tons.

Self Erecting Tower Cranes Market Share Analysis by Geography

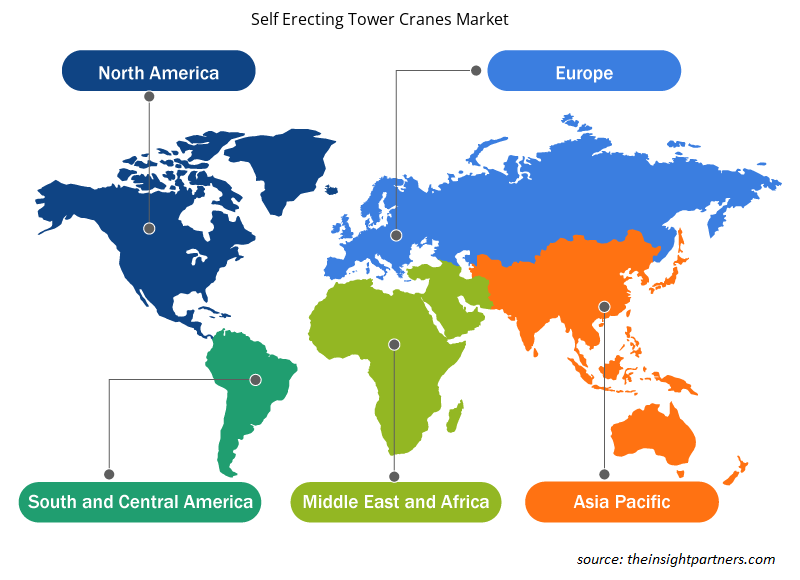

The geographic scope of the self erecting tower cranes market report is mainly divided into five regions: North America, Asia Pacific, Europe, the Middle East & Africa, and South America.

Europe recorded the largest self-erecting crane market share in 2023, owing to an increase in demand for constructing small residential houses and a surge in the construction activities of bridges, roadways, and highways. Germany has the largest construction market, recording a revenue of US$ 175 billion in 2020, as per the data provided by the Germany Trade and Invest (GTAI). In addition, the German government's initiatives toward residential construction boost the demand for self-erecting cranes in the country. In 2024, the German government has set a goal to build 400,000 apartments a year. In addition to residential construction, investments in infrastructure development bolster the self-erecting cranes market growth.

Self Erecting Tower Cranes Market News and Recent Developments

The self erecting tower cranes market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments and strategies in the self erecting tower cranes market:

- Terex Self Erecting Cranes announced the appointment of Kranlyft UK as an authorized distributor for the UK and Ireland. With immediate effect, Kranlyft UK will offer the complete range of Terex Self-Erecting Cranes, including the newest CSE range and the unique FC 6.24—Europe’s only self-erecting top-slewing crane, along with sales, service, and parts support. (Source: Terex Corp., Press Release/Company Website/Newsletter, 2023)

- Leading tower crane brand Potain announced a brand-new self-erecting crane, the Evy 30-23 4 t. This new model marks the debut of the Evy range, the latest generation of Potain self-erecting cranes, designed using the Voice of the Customer product development process and market demands for simplicity and increased height under hook, as well as complying with the updated European Safety Standard EN 14439 for tower cranes. (Source: Potain Group, Press Release/Company Website/Newsletter, 2023)

Self Erecting Tower Cranes Market Regional Insights

The regional trends and factors influencing the Self Erecting Tower Cranes Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Self Erecting Tower Cranes Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Self Erecting Tower Cranes Market

Self Erecting Tower Cranes Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 782.98 Million |

| Market Size by 2031 | US$ 1,355.31 Million |

| Global CAGR (2023 - 2031) | 7.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

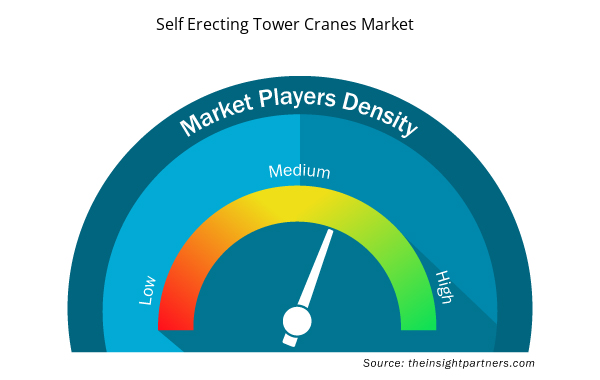

Self Erecting Tower Cranes Market Players Density: Understanding Its Impact on Business Dynamics

The Self Erecting Tower Cranes Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Self Erecting Tower Cranes Market are:

- Liebherr-International AG

- The Manitowoc Co Inc.

- Terex Corp

- FMGru srl

- Grúas Sáez

- S.L

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Self Erecting Tower Cranes Market top key players overview

Self Erecting Tower Cranes Market Report Coverage and Deliverables

The “Self Erecting Tower Cranes Market Size and Forecast (2023–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Electronic Health Record Market

- Saudi Arabia Drywall Panels Market

- Malaria Treatment Market

- Genetic Testing Services Market

- Procedure Trays Market

- Airport Runway FOD Detection Systems Market

- Embolization Devices Market

- Aircraft Wire and Cable Market

- Hot Melt Adhesives Market

- Third Party Logistics Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Urbanization results in the conversion of land for residential, commercial, industrial, and transportation use. According to the updated list of urban areas provided by the United States Census Bureau in December 2022, urban population in the US increased by 6.9% between 2010 and 2023. The West region of the US remained the most urban of the country's four census areas, with 88.9% of its inhabitants living in cities, followed by the Northeast region with 84.0% as of 2022. Apart from the US, Spain has also witnessed a notable rise in urbanization. According to United Nations in 2023, 82.0% of the population lived in cities. With a rapidly increasing urban population, the construction sector is growing at a rapid pace. Small-scale construction activities are upsurging across the world. The self-erecting cranes play a vital role in fulfilling the demands for housing, lighting issues resolution, residential construction activities, and others.

Smart city projects focus on the transition to a more efficient and effective utility infrastructure. Smart city development projects use tower cranes, self-erecting cranes, and other advanced construction equipment to optimize material handling. The use of self-erecting cranes helps increase operational efficiency, reduces energy usage and expenditures, and leads to proactive decision-making. According to Smart America, in June 2022, city governments in the US announced their plan to invest ∼US$ 41 trillion in infrastructure upgrades and the implementation of Internet of Things solutions over the next 20 years. Also, the European Union Commission's Horizon Europe objective aims to transform 100 cities into climate-neutral and smart by 2030.

Key players in the self-erecting cranes market are developing and adopting advanced technologies to meet the customer's requirements at construction sites. Companies are enabling telematic solutions to offer flexibility for users at remote locations. In January 2024, the Potain tower crane manufacturer launched brand-new advanced technologies based on the Evy 30-23 self-erecting crane model with a capacity of 4 tons. The range of self-erecting cranes is designed with the Voice of the Customer development process.

Liebherr International AG, The Manitowoc Co Inc., Terex Corp., FMGRU SRL, Gruaz Saez S.L, Tavol Cranes Group, and ACE. are the key market players operating in the global self erecting tower crane market.

Trends and growth analysis reports related to Manufacturing and Construction : READ MORE..

The List of Companies - Self Erecting Tower Cranes Market

- Liebherr International AG

- The Manitowoc Co Inc.

- Terex Corp.

- FMGru srl

- Gruas Saez S.L

- Gru Dalbe srl

- Tavol Cranes Group Co.,ltd

- Dawson Group Ltd.

- P&J Acromet

- Action Construction Equipment Limited

Get Free Sample For

Get Free Sample For