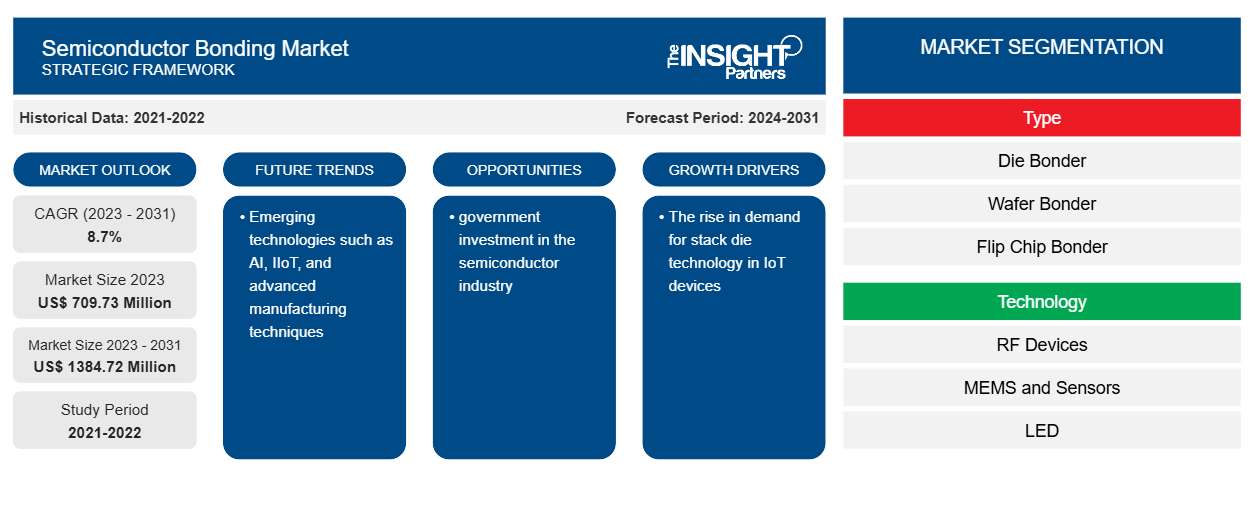

The semiconductor bonding market size is projected to reach US$ 1384.72 million by 2031 from US$ 709.73 million in 2023. The market is expected to register a CAGR of 8.7% during 2023–2031. The rise in demand for stack die technology in IoT devices and government investment in the semiconductor industry are likely to remain key trends in the market.

Semiconductor Bonding Market Analysis

The need for semiconductor bonding in consumer electronics goods, aerospace and defence equipment, and medical equipment and machinery drive the market growth. The government initiatives to foster the electric vehicle market in the forecast period will generate the demand for semiconductor bonding. The growing demand for smartphones and wearable devices further propels the market growth.

Semiconductor Bonding Market Overview

Semiconductor bonding is used to produce a large number of equipment and integrated circuits. The mounting demand for the semiconductor industry is one of the major factors driving the semiconductor bonding market. The demand for semiconductors from a wide range of industries, such as manufacturing, automotive, healthcare, and others, fosters market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Semiconductor Bonding Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Semiconductor Bonding Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Semiconductor Bonding Market Drivers and Opportunities

Government investment in the semiconductor industry

The semiconductor industry is growing at a rapid pace due to the demand for semiconductors from manufacturers of electric vehicles, consumer electronics, machinery, and others. Government authorities across the globe are focused on fueling domestic manufacturing industries to drive economic growth and reduce their dependency on imports. For this, they are investing in semiconductor manufacturing. For example, President Biden signed the bipartisan CHIPS and Science Act into law on August 9, 2022. The Department of Commerce is overseeing US$ 50 billion to revitalize the US semiconductor industry and strengthen the country’s economic and national security.

The advent of hybrid bonding

One of the advanced technologies in semiconductor bonding is hybrid bonding. This technology is widely gaining traction to test and prepare hybrid bonding methods for high-volume production efficiently. It is being used for the semiconductor research and development departments. The adoption of hybrid bonding results in saving space in systems across industries such as automotive, consumer electronics, and others. Thus, due to the demand for this advanced technology, the market players are launching innovative solutions. For example, in May 2024, SÜSS MicroTec SE introduced the XBC300 Gen2 D2W/W2W, a groundbreaking hybrid bonding platform designed for both 200 mm and 300 mm substrates, providing versatile wafer-to-wafer (W2W) and die-to-wafer (D2W) bonding capabilities.

Semiconductor Bonding Market Report Segmentation Analysis

Key segments that contributed to the derivation of the semiconductor bonding market analysis are the type and technology.

- Based on the type, the semiconductor bonding market is divided into die bonder, wafer bonder, and flip chip bonder. The wafer bonder segment held the largest share of the market in 2023.

- By end user, the market is segmented into RF devices, MEMS and sensors, LED, CMOS image sensors, and 3D NAND. The RF devices segment held a significant share of the market in 2023.

Semiconductor Bonding Market Share Analysis by Geography

The geographic scope of the semiconductor bonding market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Asia Pacific region held the largest share of the market in 2023. China, India, Japan, and Taiwan are the countries holding a significant share of the market. The government authorities are investing in the manufacturing of semiconductors, which generates the need for semiconductor bonding. For example, in November 2022 in India, a comprehensive program for the development of semiconductors and display manufacturing ecosystem in India was approved by the Government of India with an outlay of more than US$ 10 billion. The program aimed to provide attractive incentive support to companies/consortia that are engaged in silicon semiconductor fabs, display fabs, compound semiconductors/silicon photonics/sensors (including MEMS) fabs / discrete semiconductor fabs, semiconductor packaging (ATMP / OSAT) and semiconductor design.

Semiconductor Bonding Market Regional Insights

The regional trends and factors influencing the Semiconductor Bonding Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Semiconductor Bonding Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Semiconductor Bonding Market

Semiconductor Bonding Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 709.73 Million |

| Market Size by 2031 | US$ 1384.72 Million |

| Global CAGR (2023 - 2031) | 8.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Semiconductor Bonding Market Players Density: Understanding Its Impact on Business Dynamics

The Semiconductor Bonding Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Semiconductor Bonding Market are:

- Palomar Technologies

- Panasonic Corporation

- Toray Industries Inc

- Kulicke & Soffa Industries, Inc

- DIAS Automation (HK) Ltd

- ASMPT Ltd (formerly ASM Pacific Technology Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Semiconductor Bonding Market top key players overview

Semiconductor Bonding Market News and Recent Developments

The semiconductor bonding market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the semiconductor bonding market are listed below:

- TANAKA Kikinzoku Kogyo K.K., which develops industrial precious metals products as one of the core companies of TANAKA Precious Metals, announced that it established a gold particle bonding technology for high-density mounting of semiconductors using AuRoFUSE low-temperature fired paste for gold-to-gold bonding. AuRoFUSE is a composition of submicron-sized gold particles and a solvent that creates a bonding material with low electrical resistance and high thermal conductivity to achieve metal bonding at low temperatures. Using AuRoFUSE preforms (dried paste forms), this technology can reach 4 μm fine-pitch mounting with 20 μm bumps. (Source: TANAKA HOLDINGS Co., Ltd., Press Release, March 2024)

- BE Semiconductor Industries N.V. (the “Company" or "Besi"), a leading manufacturer of assembly equipment for the semiconductor industry, announced the receipt of an order for 26 hybrid bonding systems from a leading semiconductor logic manufacturer. (Source: Besi, Press Release, May 2024)

Semiconductor Bonding Market Report Coverage and Deliverables

The “Semiconductor Bonding Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Semiconductor bonding market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Semiconductor bonding market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Semiconductor bonding market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the semiconductor bonding market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, UAE, UK, US

Frequently Asked Questions

The estimated value of the semiconductor bonding market will be US$ 1384.72 million by 2031.

Palomar Technologies; Panasonic Corporation; Toray Industries Inc; Kulicke & Soffa Industries, Inc; DIAS Automation (HK) Ltd; ASMPT Ltd (formerly ASM Pacific Technology Ltd.); EV Group; Yamaha Motor Corporation (Yamaha Robotics Holdings); WestBond, Inc.; and Applied Materials, Inc. are some of the key players operating in the semiconductor bonding market.

The rise in demand for stack die technology in IoT devices, and government investment in the semiconductor industry are the key driving factors impacting the semiconductor bonding market.

Emerging technologies such as AI, IIoT, and advanced manufacturing techniques are key trends in the semiconductor bonding market.

The global semiconductor bonding market is estimated to register a CAGR of 8.7% during the forecast period 2023–2031.

Get Free Sample For

Get Free Sample For