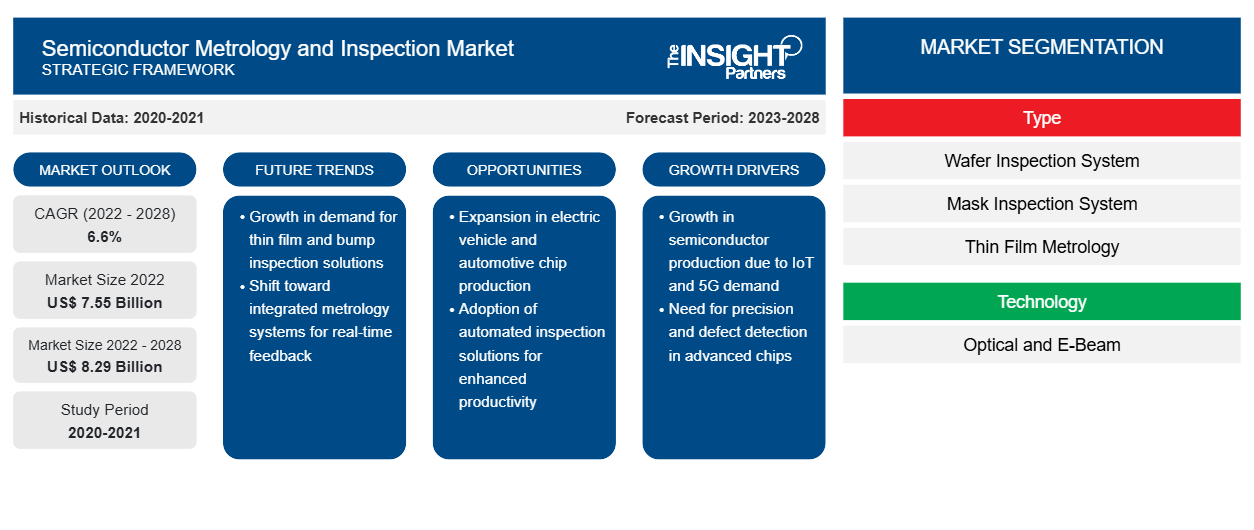

The semiconductor metrology and inspection market is projected to reach US$ 7,553.00 million in 2022 to US$ 8,288.55 million by 2028; it is expected to grow at a CAGR of 6.6% from 2022 to 2028.

The semiconductor industry has been witnessing drastic changes over the years, which has resulted in complex semiconductor manufacturing assembly lines. Growing smart devices application, rising industrial automation, and widespread chips integration in vehicles propel the demand for semiconductors globally. Wafer and mask inspection and other metrology and inspection systems are used in semiconductor inspection in the semiconductor production lines; the systems detect defects and ensure the quality of manufactured semiconductor devices. Owing to the growing demand for semiconductors, semiconductor manufacturers are focused on expanding their manufacturing facilities, leading to growing application of semiconductor metrology and inspection systems. Most players are launching innovative products in the market. For instance, Hitachi High-Tech Corporation introduced the SEM*1 CR7300 high-speed defect inspection in November 2020. The CR7300 is a new review SEM type that will help enhance semiconductor device manufacturing productivity. It is based on electron optics, which allows for the best high-resolution picture acquisition. Simultaneously, new imaging and stage technologies allow for high-speed image acquisition in half the time of traditional methods, reducing total inspection time considerably. In 2022, ASML announced that they have successfully installed a HMI eScan 1100 equipment, the first multiple e-beam (multibeam) wafer inspection system for in-line yield enhancement applications, such as voltage contrast defect inspection and physical defect inspection. The above-mentioned initiatives are expected to create opportunities for semiconductor metrology and inspection market players during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Semiconductor Metrology and Inspection Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Semiconductor Metrology and Inspection Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Semiconductor Metrology and Inspection Market Players

The continuous growth in the number of novel coronavirus-infected patients compelled government authorities to impose stringent lockdowns across the US and other regions in the first three quarters of 2020. The manufacturing sector witnessed severe losses due to temporary factory shutdowns and low production volumes, which hindered the growth of the automotive, electronics & semiconductor, and retail sectors. The effects of the COVID-19 pandemic shrunk the North America semiconductor metrology and inspection market size in the first three quarters of 2020. In addition, there was a massive disruption in the supply chain across the region due to the lockdown measures, which further triggered a huge backlog of orders, and resulted in the loss of revenue for many large and small enterprises operating in the North America semiconductor metrology and inspection market. However, the market experienced a positive impact since Q4 of 2020. Semiconductor shortage, due to disruptions caused by the pandemic, forced manufacturers to optimize their raw material usage, which led to a higher investment in procuring these equipment, thus boosting the semiconductor metrology and inspection market size This enabled the market players to generate revenues and contribute to the semiconductor metrology and inspection market growth. Nonetheless, the revenue generated in 2020 was slightly less than that generated in 2019, but grew by a substantial amount in 2021. Hence, although the pandemic caused certain disruptions, the semiconductor metrology and inspection player’s businesses were positively impacted due to the pandemic.

Market Insights – Semiconductor Metrology and Inspection Market

Wafer fabrication, manufacturing, and other procedures use advanced packaging (AP) technology. Controlling these operations in the back end necessitates inspection and measurement methods. Shrinking feature sizes are driving demands for high accuracy, precision, sensitivity, and throughput. On the other hand, AP procedures face measurement and inspection issues that are unique to back-end applications, such as bump metrology and nonvisual flaws. Special requirements, combined with the increased diversity and rapid evolution of AP processes, is primarily propelling the demand for semiconductor metrology and inspection equipment globally.

Organization Size-Based Insights

The semiconductor metrology and inspection market, by organization size, is segmented into large enterprises and SMEs (Small and Medium Enterprises). The large enterprises segment is expected to register a higher CAGR during the forecast period. Large enterprises are the major end-users of the market. This comprises foundries, such as TSMC and GlobalFoundry, and integrated device manufacturers, such as Intel Corporation and Samsung Corporation. In November 2021, Samsung Corporation announced to build a semiconductor manufacturing unit in Texas due to the increasing requirement for chips for phones and other devices. The company planned to invest US$ 17 billion in building this unit. A significant part of that amount is expected to be utilized for purchasing semiconductor metrology and inspection equipment. Such strategic developments adopted by large enterprises are expected to drive the semiconductor metrology and inspection market growth for this segment during the forecast period.

The semiconductor metrology and inspection market is segmented on the basis of type, technology, organization size, and geography. Based on type, the market is segmented into wafer inspection system, mask inspection system, thin film metrology, bump inspection, package inspection, lead frame inspection, and probe card inspection. Based on technology, the semiconductor metrology and inspection market is segmented into optical and e-beam. By organization size, the market is bifurcated into large enterprises and SMEs. Based on geography, the semiconductor metrology and inspection market is primarily segmented into North America, Europe, Asia Pacific (APAC), and the rest of the world (ROW). KLA Corporation; ASML Holding N.V.; Applied Materials, Inc.; Onto Innovation, Inc.; and Hitachi High-Technologies Corporation are among the key market players.

Semiconductor Metrology and Inspection Market Regional Insights

The regional trends and factors influencing the Semiconductor Metrology and Inspection Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Semiconductor Metrology and Inspection Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Semiconductor Metrology and Inspection Market

Semiconductor Metrology and Inspection Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 7.55 Billion |

| Market Size by 2028 | US$ 8.29 Billion |

| Global CAGR (2022 - 2028) | 6.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Semiconductor Metrology and Inspection Market Players Density: Understanding Its Impact on Business Dynamics

The Semiconductor Metrology and Inspection Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Semiconductor Metrology and Inspection Market are:

- Applied Materials, Inc.

- ASML Holdings N.V.

- Hitachi High-Technologies Corporation

- JEOL, Ltd.

- KLA Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Semiconductor Metrology and Inspection Market top key players overview

In the semiconductor metrology and inspection market, the companies are mainly focused on the development of advanced and efficient products.

- In 2022, Lasertec Corporation announced the release of the MATRICS X9ULTRA series, a mask inspection system designed to inspect the photomasks used in extreme ultraviolet (EUV) lithography while their pellicles are not attached.

- In 2020, KLA Corporation announced two new products—the PWG5 wafer geometry system and the Surfscan SP7XP wafer defect inspection system. The new systems are designed to address exceedingly difficult issues in the manufacture of leading-edge memory and logic integrated circuits.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Technology, and Organization Size

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Canada, China, France, Germany, India, Italy, Japan, MEA, Mexico, Russian Federation, SAM, South Korea, Taiwan, United Kingdom, United States

Frequently Asked Questions

By 2028, the global market size of semiconductor metrology and inspection market will be USD 11,102.53 Million.

The US, Germany, China, and South Korea are registering a high growth rate during the forecast period.

China holds the major market share of semiconductor metrology and inspection market in 2022.

KLA Corporation, ASML Holding N.V., Applied Materials, Inc., Onto Innovation, Inc. and Hitachi High-Technologies Corporation are the five key market players operating in the global semiconductor metrology and inspection market.

Optical segment held the largest share in semiconductor metrology and inspection market. Optical semiconductor inspection equipment is one of the most used equipment in semiconductor production line.

The increasing use of AI in metrology and inspection systems is one of the major trends anticipated to propel the market growth during the forecast period.

Rising use of metrology and inspection for advanced packaging processes and surging number of semiconductor applications are major driving factors contributing towards the growth of semiconductor metrology and inspection market.

The global semiconductor metrology and inspection market is expected to be valued at US$ 7,553.00 million in 2022.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Semiconductor Metrology and Inspection Market

- Applied Materials, Inc.

- ASML Holdings N.V.

- Hitachi High-Technologies Corporation

- JEOL, Ltd.

- KLA Corporation

- Lasertec Corporation

- NOVA Measuring Instruments

- Nikon Metrology N.V.

- Onto Innovation

- Thermofisher Scientific, Inc.

Get Free Sample For

Get Free Sample For