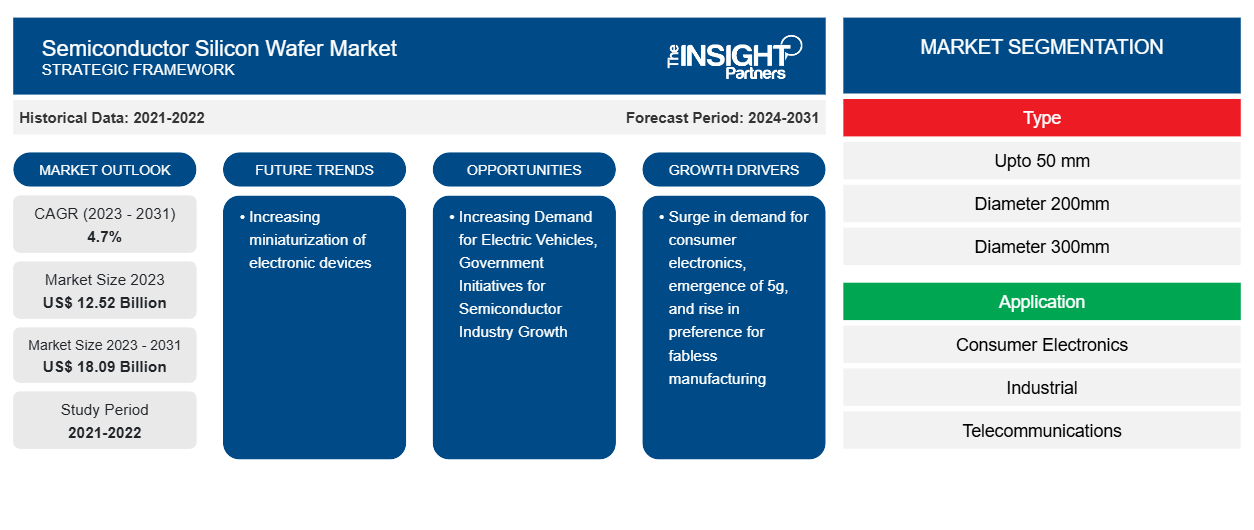

The semiconductor silicon wafer market size is expected to reach US$ 18.09 billion by 2031 from US$ 12.52 billion in 2023. The market is estimated to record a CAGR of 4.7% from 2023 to 2031. Increasing miniaturization of electronic devices is likely to remain a key market trend.

Semiconductor Silicon Wafer Market Analysis

Miniaturization has been a major driving force in the advancement of modern technology, allowing for the construction of smaller, lighter, and more powerful electronic gadgets. With advancements in miniaturization and multi-layer PCB designs, modern bare PCBs meet the demands of high-density applications, encouraging innovation in industries ranging from consumer electronics to automotive systems and telecommunications. This rising inclination toward miniaturization is increasing the demand for ultra-thin and miniaturized PCBs, as these PCBs are suitable for all markets where miniaturization and high reliability play an important role. In addition, miniaturized PCBs can help save space, improve performance, reduce cost, and innovate product design. It also aids in the production of flexible and stretchable electronics that can be used for various purposes; for example, in the healthcare industry, miniaturized PCBs are used in heart rate monitors, sleep trackers, and glucose sensors, which are discreet and comfortable for prolonged wear.

Semiconductor Silicon Wafer Market Overview

A silicon wafer is a material required for the production of semiconductors, which are used in a wide range of electrical products. This ultra-flat disk is highly polished to a mirror-like surface and is free of any microscopic surface flaws. It is also extremely clean, with virtually no microparticles or other contaminants. Almost all of the electronic equipment employs semiconductor devices. This includes information gadgets such as smartphones, PCs, tablets, and wearable computers; home appliances such as televisions and air conditioners; and modes of transportation ranging from cars to trains.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Semiconductor Silicon Wafer Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Semiconductor Silicon Wafer Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Semiconductor Silicon Wafer Market Drivers and Opportunities

Rise in Preference for Fabless Manufacturing

Building semiconductor manufacturing plants is capital-intensive, requires long-term planning, and carries considerable risks due to the industry's demand cycles. As a result, in recent years, the industry has split between those who focus on front end design and firms that specialize in the backend supply chain of semiconductor fabrication, assembly, sorting, and testing. Fabless enterprises create and sell semiconductor chips while outsourcing manufacturing operations to specialist foundries. This concept allows businesses to focus on innovation and design without incurring the enormous capital costs associated with developing and maintaining fabrication facilities. The fabless approach offers numerous benefits, including lower capital expenditure, faster time-to-market, enhanced flexibility, and increased focus. Furthermore, foundries such as TSMC, GlobalFoundries, and UMC have become critical to the semiconductor ecosystem. These companies spend extensively on innovative manufacturing processes, allowing them to develop cutting-edge chips for a wide range of fabless customers.

The emergence of new semiconductor applications that use AI, IoT, and automotive technologies results in increased demand for specialized chips; these chips can be developed more efficiently using the fabless model. As a result, the fabless approach taken by semiconductor startups enables a more concentrated, agile, and cost-effective means of entering and surviving in the semiconductor sector. This model benefits entrepreneurs as well as shapes the industry's structure by encouraging innovation, collaboration, and a varied ecosystem of players. Thus, the rise in preference for fabless manufacturing of semiconductors fuels the growth of the semiconductor silicon wafer market

Increasing Demand for Electric Vehicles

Electric vehicles use high-capacity lithium-ion batteries to store and transfer energy to the electric drivetrain. The battery management system (BMS) monitors and controls the performance as well as the health of the battery pack. Silicon wafers play an important role in the production of BMS-related integrated circuits. Advanced BMS ICs manufactured on silicon wafers can precisely measure battery parameters such as voltage, current, temperature, and state of charge. This critical data enables the BMS to optimize battery utilization, extend battery life, and ensure safe operation, thereby improving the electric vehicle's overall efficiency and reliability. Overall, the use of silicon wafers in EV components such as inverter systems, power converters, onboard chargers, and motor drives continues to grow. Thus, the increasing demand for EVs is expected to create an opportunity for the growth of the semiconductor silicon wafer market during the forecasted period.

Semiconductor Silicon Wafer Market Report Segmentation Analysis

Key segments that contributed to the derivation of the semiconductor silicon wafer market analysis are type, application, and node type.

- By type, the market is segmented into upto 150 mm, diameter 200 mm, diameter 300 mm, and diameter 450 mm. The diameter 300 mm segment held the largest share of the semiconductor silicon wafer market in 2023.

- By application, the market is categorized into consumer electronics, industrial, telecommunications, automotive, and others. The consumer electronics segment held the largest share of the semiconductor silicon wafer market in 2023.

- By node type, the market is segmented into 180 nm, 130 nm, 90 nm, 65 nm, 45 nm, 22 nm, 14 nm, 7 nm, 5 nm and below, and others. The 7 nm segment dominated the semiconductor silicon wafer market in 2023.

Semiconductor Silicon Wafer Market Share Analysis by Geography

The semiconductor silicon wafer market is segmented into five major regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. Asia Pacific dominated the market in 2023, followed by North America and Europe.

The growing adoption and manufacturing of electric vehicles, advanced driver-assistance systems (ADAS), and telecommunication are creating the need for the development of various electronic components, which drives the semiconductor silicon wafer market. Moreover, Europe is prominent in automotive manufacturing and is experiencing a rise in demand for advanced semiconductors for the electrification and automation of vehicles. The growing demand for semiconductors is fulfilled by the construction of various semiconductor manufacturing facilities across Europe. For example, in August 2023, Robert Bosch, Taiwan Semiconductor Manufacturing Company (TSMC), Infineon Technologies, and NXP have formed a joint venture to invest in a new semiconductor plant in Dresden, Germany. Further, the European Semiconductor Manufacturing Company (ESMC) project began construction in the second half of 2023, with manufacturing expected to commence by the end of 2027. It will have a monthly production capability of 40,000 300 mm (12 inches) wafers using TSMC's 28/22 nanometer planar CMOS and 16/12 nanometer finFET process technologies.

Semiconductor Silicon Wafer Market Regional Insights

The regional trends and factors influencing the Semiconductor Silicon Wafer Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Semiconductor Silicon Wafer Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Semiconductor Silicon Wafer Market

Semiconductor Silicon Wafer Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 12.52 Billion |

| Market Size by 2031 | US$ 18.09 Billion |

| Global CAGR (2023 - 2031) | 4.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Semiconductor Silicon Wafer Market Players Density: Understanding Its Impact on Business Dynamics

The Semiconductor Silicon Wafer Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Semiconductor Silicon Wafer Market are:

- Okmetic

- Wafer Works Corp

- SUMCO CORPORATION

- NANOCHEMAZONE

- Alfa Chemistry

- LONGi Green Energy Technology Co Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Semiconductor Silicon Wafer Market top key players overview

Semiconductor Silicon Wafer Market News and Recent Developments

The semiconductor silicon wafer market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the semiconductor silicon wafer market are listed below:

- Wafer Works, a veteran semiconductor silicon wafer foundry in China, made its debut on Shanghai's STAR Market in February 2024; it launched a major expansion project for 12-inch wafer production across facilities in Taiwan.

(Source: Wafer Works, Press Release, July 2024)

- Sumco Corporation agreed to acquire Mitsubishi Polycrystalline Silicon America Corp and Semiconductor Polysilicon Business Of Mitsubishi from Mitsubishi Materials Corporation.

(Source: Oracle, Press Release, October 2022)

Semiconductor Silicon Wafer Market Report Coverage and Deliverables

The "Semiconductor Silicon Wafer Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Semiconductor silicon wafer market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Semiconductor silicon wafer market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Semiconductor silicon wafer market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the semiconductor silicon wafer market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Legal Case Management Software Market

- Skin Graft Market

- Medical Audiometer Devices Market

- Greens Powder Market

- Non-Emergency Medical Transportation Market

- Sleep Apnea Diagnostics Market

- Smart Grid Sensors Market

- Dairy Flavors Market

- Microplate Reader Market

- Single-Use Negative Pressure Wound Therapy Devices Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The key players holding majority shares in the global semiconductor silicon wafer market are Okmetic, Wafer Works Corp, SUMCO CORPORATION, NANOCHEMAZONE, Alfa Chemistry, LONGi Green Energy Technology Co Ltd, Wafer World Inc., WaferPro, PI-KEM Limited, Nano Quarz Wafer GmbH, Sino-American Silicon Products Inc., Nanografi Nano Technology, Fujimi Incorporated, Hangzhou Semiconductor Wafer Co.,Ltd., Ferrotec Holdings Corporation, Silicon Materials, Inc., Shin-Etsu Chemical Co Ltd, SK Siltron Co., Ltd., Siltronic AG, and GlobalWafers Co., Ltd.

The incremental growth expected to be recorded for the global semiconductor silicon wafer market during the forecast period is US$ 5.57 billion.

The global semiconductor silicon wafer market is expected to reach US$ 18.09 billion by 2031.

The surge in demand for consumer electronics, the emergence of 5g, and the rise in preference for fabless manufacturing are the major factors that propel the global semiconductor silicon wafer market.

The global semiconductor silicon wafer market was estimated to be US$ 12.52 billion in 2023 and is expected to grow at a CAGR of 4.7 % during the forecast period 2023 - 2031.

Increasing miniaturization of electronic devices is anticipated to play a significant role in the global semiconductor silicon wafer market in the coming years.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Semiconductor Silicon Wafer Market

- Okmetic

- Wafer Works Corp

- SUMCO CORPORATION

- NANOCHEMAZONE

- Alfa Chemistry

- LONGi Green Energy Technology Co Ltd

- Wafer World Inc.

- WaferPro

- PI-KEM Limited

- Nano Quarz Wafer GmbH

Get Free Sample For

Get Free Sample For