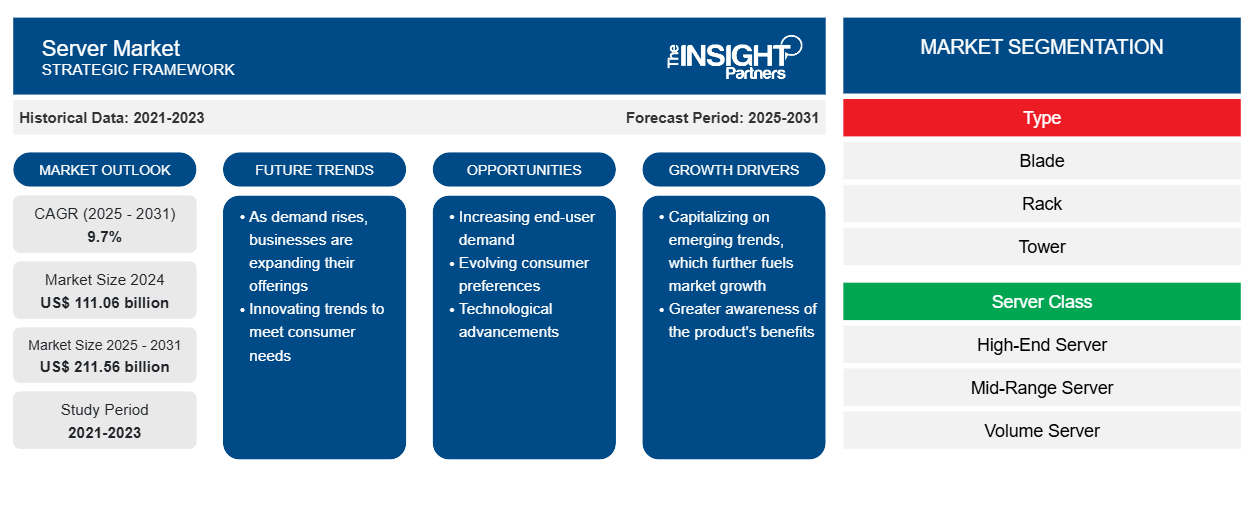

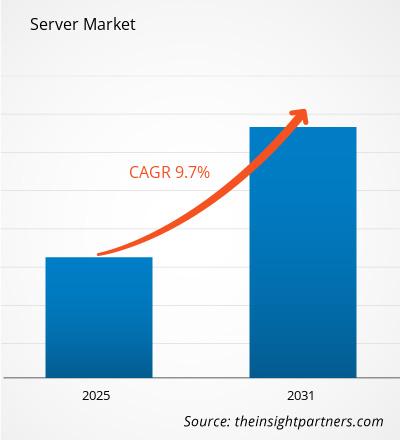

The Server market is projected to grow from US$ 101.24 billion in 2023 to US$ 211.56 billion by 2031; it is expected to expand at a CAGR of 9.7% from 2025 to 2031. Growing demand from hyperscalers and other large, generally IT, cloud buyers is expected to be a key trend in the market.

Server Market Analysis

The server market has witnessed significant growth in recent years, driven by an increasing number of data centers, massive smartphone proliferation, and rising data volumes. Furthermore, advancements in emerging technologies, such as AI, IoT, big data, cloud computing, and 5G, are providing lucrative opportunities for market growth. Rising streaming services, cloud computing, and other data-intensive functions and the shift towards hyper-scale data centers are emerging as significant trends for server market growth. However, high initial and installation costs restrain the server market growth. Furthermore, many enterprises are reducing the number of physical servers in their data centers as virtualization allows fewer servers to run more workloads. The emergence of cloud computing has also altered the number of servers an organization needs to host on-premises.

Server Market Industry Overview

A server is a computer or system that uses a network to supply resources, information, services, or programs to other computers. Mainframes and minicomputers were among the earliest types of servers. As the name suggests, minicomputers were substantially smaller than mainframe computers. However, as technology developed, they eventually grew to be much larger than desktop computers. The definition of a server has changed along with technology. These days, a server may be nothing more than software running on one or more physical computing devices. Such servers are often referred to as virtual servers.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Server Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Server Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Server Market Driver and Opportunities

Increasing Number Of Data Centers to Favor Market Growth

With the exponential increase in internet consumption, the development of high-end software and application systems and the growth in interconnected devices in public and private networks steers an ever-increasing volume of data. The need to store and process this large volume of data has encouraged companies to adopt advanced storage and processing solutions, thus driving the data center. With the rising adoption, the data center has increasingly become a crucial aspect of the modern economy, from the servers that operate in SMEs to the organization data centers that support large business corporations and the plantations that run cloud computing services that the technology giants including Amazon, Facebook, Google, and others host. In the wake of a globally snowballing digital economy and a data center industry that is continually challenged to stay ahead of customers’ IT roadmaps, different end-users have emerged to distinguish themselves with varying data center requirements. Furthermore, the augmentation of social media and rising digitization, remote work adoption, OTT services, IoT and data analytics demand, and digital technologies utilization propel the need for data centers worldwide. The US (2,701), Canada (328), China (443), Germany (487), and the UK (456) are among the topmost countries with the most significant data center number.

Emergence of Artificial Intelligence (AI)

In today's rapidly changing technology landscape, Artificial Intelligence (AI) has emerged as a revolutionary force, changing the business landscape in a variety of businesses and domains. Artificial intelligence can have a huge impact on servers. AI applications frequently require significant processing power and storage space, which drives the demand for servers. Artificial intelligence systems frequently deal with large datasets, such as image or text corpora, that must be stored and accessed effectively. This causes higher storage demands on servers, necessitating larger and quicker storage solutions. This, in turn, is expected to supplement the growth of server market growth during the forecast period.

Server

Market Report Segmentation Analysis

The key segments that contributed to the derivation of the Server market analysis are coverage type, server class, and vertical.

- Based on type, the market is segmented into the blade, rack, tower, and multimode. The rack segment in the server market is expected to dominate with the highest share in 2022. A rack server is a multipurpose server that is kept inside a rack.

- Rack servers are typically made to support a range of applications and meet different needs for computer infrastructure. Rack servers typically have standard dimensions to be installed within a conventional rack enclosure. Several servers can be stacked and screwed into a rack's metal container. An administrator can physically access and adjust server resources using the keyboard, mouse, and monitor often included in these enclosures and connected to each server.

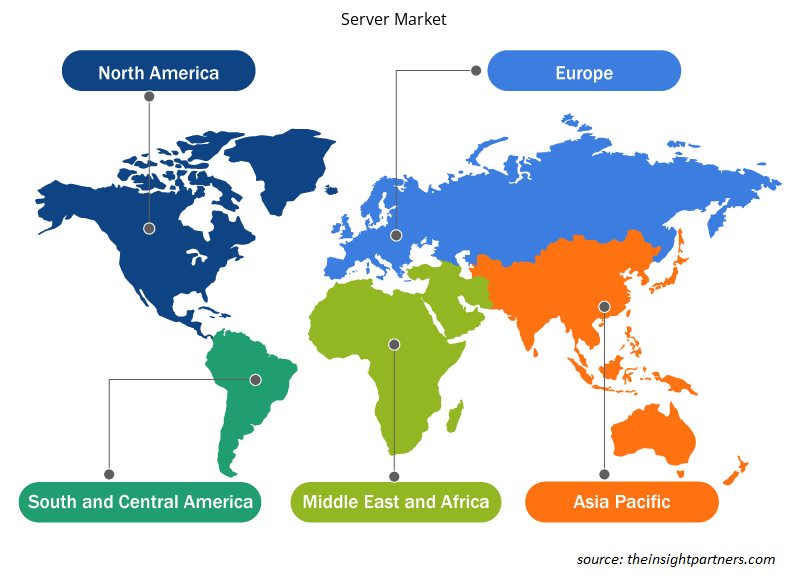

Server Market Share Analysis By Geography

Based on region, the market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America.

North America holds one of the most significant global server market shares. The region has the highest number of internet users worldwide, directly contributing to the demand for data centers, leading to the need for servers. Factors such as increased adoption of digital tools and high technological spending by government agencies are expected to drive the North American server market growth. In addition, the US has a large number of server market players who have been increasingly focusing on developing innovative solutions. Some of the key players in the server market are IBM Corporation, Hewlett Packard Enterprise Development LP, and Cisco Systems, Inc., among others. All these factors contribute to the region's growth of the server market.

Server Market Regional Insights

The regional trends and factors influencing the Server Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Server Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Server Market

Server Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 111.06 billion |

| Market Size by 2031 | US$ 211.56 billion |

| Global CAGR (2025 - 2031) | 9.7% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

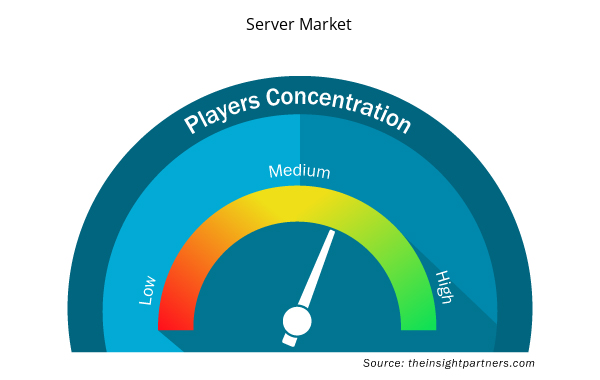

Server Market Players Density: Understanding Its Impact on Business Dynamics

The Server Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Server Market are:

- Cisco Systems Inc.

- Dell Technologies Inc

- FUJITSU

- Hewlett-Packard Corp

- Hitachi Data Systems

- Huawei Technologies Co., Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Server Market top key players overview

Server Market News and Recent Developments

The Server market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Server Market are listed below:

- BrainChip and Unigen partnered to deliver a powerful, energy-efficient edge AI server. The Cupcake Edge AI Server is a small form factor solution that can run complex AI applications at the Edge. (Source: BrainChip, Press Release, December 2023)

Server Market Report Coverage & Deliverables

The Server market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Server Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Server Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Server Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Server Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Server Market

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Server Class, Vertical!

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The global Server market was estimated to grow at a CAGR of 9.7% during 2023 - 2031.

Growing demand from Hyperscalers and other large, generally IT, cloud buyers is the major trend in the market.

IBM Corporation, Hewlett Packard Enterprise Development LP, Dell Inc., Cisco Systems, Inc., Huawei Technologies Co., Ltd, Fujitsu, Oracle Corporation, Intel Corporation, NEC Corporation, ASUSTeK Computer Inc., Lenovo, Quanta Computer lnc., SMART Global Holdings, Inc., Super Micro Computer, Inc., Wistron Corporation, ZT Systems, MiTAC Holdings Corp., Atos SE, SK Infotech, and Inspur are the major market players.

Some of the customization options available based on the request are additional 3–5 company profiles and a country-specific analysis of 3–5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

The increasing number of data centers and the upgradation of the IT infrastructure are the major factors that drive the global Server market.

The report can be delivered in PDF/PPT format; we can also share an Excel dataset based on the request.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies

1. Cisco Systems Inc.

2. Dell Technologies Inc

3. FUJITSU

4. Hewlett-Packard Corp

5. Hitachi Data Systems

6. Huawei Technologies Co., Ltd

7. IBM Corporation

8. Inspur Technologies Co. Ltd

9. Lenovo

10. Oracle Inc

Get Free Sample For

Get Free Sample For