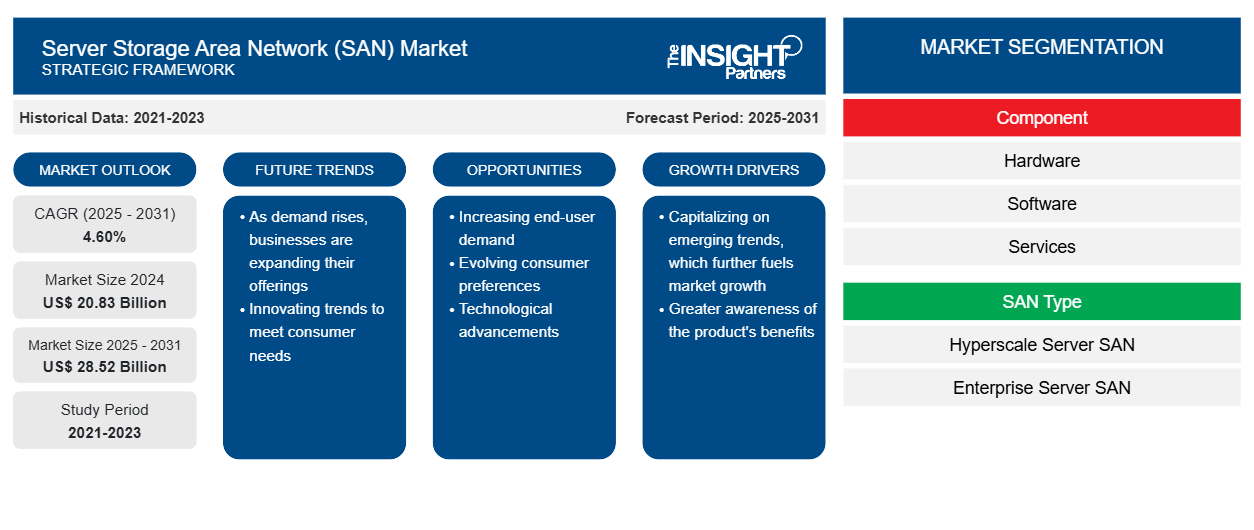

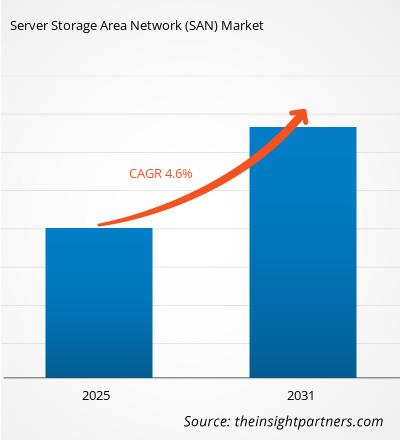

[Research Report] The server storage area network (SAN) market size is expected to grow from US$ 19.03 billion in 2022 to US$ 27.30 billion by 2031; it is estimated to grow at a CAGR of 4.6% from 2022 to 2031.

Analyst Perspective:

The server storage area network (SAN) market has witnessed significant growth in recent years, driven by increasing demand for faster data access, increasing need for improved data security, and rising number of cyber-attacks. Furthermore, Increasing demand for IoT devices and an increasing number of data centers are providing lucrative opportunities for market growth. Adoption Of cloud-based storage services is emerging as a significant trend for server storage area network (SAN) market growth. However, SANs are relatively complex, expensive, and very advanced storage networks. Many recent large-scale outages and performance problems in the cloud are related to failures of SANs. Due to the intricate and lucrative nature of SANs, any failure in SAN architecture would result in a significant and intricate issue for the company, which, in turn, would restrain the server storage area network (SAN) market growth.

Furthermore, the use of server storage area network (SAN), is growing globally with the expansion of medium-sized and small-sized organizations (SMEs). The main drivers of storage area network (SAN) adoption in small businesses are its benefits, which include flexibility, cloud resources, and centralized power. Almost 99% of all businesses worldwide are small-sized enterprises (SMEs). It is projected that these factors will accelerate market expansion.

Market

Overview:

The server storage area network (SAN) is a popular storage networking design that offers a high throughput and low latency for business-critical applications. SANs use a high-speed architecture with uniform security procedures throughout the network to store data in blocks and split them into different tiers. This results in enhanced data security and protection as well as more efficient data storage. SANs use a high-speed architecture with uniform security procedures throughout the network to store data in blocks and split them into different tiers. This results in enhanced data security and protection as well as more efficient data storage

The majority of businesses use storage area networks, which are virtual networks that hold an organization's critical customer data on separate devices and servers. Businesses from a variety of sectors, such as government agencies, education, retail, banking, telecommunications, insurance, and financial services, use server storage area network (SAN). These businesses frequently require high-performance computing in order to run hybrid multi-cloud operations and virtualization applications. To handle their enormous data, they also require the massive data storage capacity of the server storage area network (SAN).

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Server Storage Area Network (SAN) Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Server Storage Area Network (SAN) Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Increasing Number of Cyberattacks Across Enterprises to Drive Growth of the Market

Cyber-attacks have been rated the fifth top-rated risk in 2021 and are increasing day by day with technology. Computer malware, data breaches, and denial of service (DoS) are some of the examples of cyber risks. Businesses are under continuous threat of cybercrimes. Cyber-attacks have grown more widespread in recent years. In the pandemic period, cybercriminals took advantage of misaligned networks as businesses were moving towards remote working environments. For instance, According to OneLogin, cybercrime cost the world over US$1 trillion, wherein 37% of organizations were affected by ransomware, and 61% were affected by malware attacks in 2021. Between 2021 and 2021, cyber-attacks in the US have increased by 139%. There were a staggering 145.2 million cases in Q3 2021 alone. Malware attacks increased by 358% in 2021 when compared to 2021. Similarly, according to the Clusit Report, cyber-attacks across the globe have increased by 10% in 2021 when compared to the previous year. Cyber-attacks increased by 125% globally in 2021 and increasing volumes of cyber-attacks continued to threaten businesses and individuals in 2022. For instance, according to AAG, the UK had the highest number of cybercrime victims per million internet users at 4783 in 2022, an increase of 40% over 2021 figures. The average cost of a cyber breach was US$4.35 million in 2022, and it is predicted that this number is expected to rise to US$10.5 trillion by 2031.

Cyber threats are a huge matter of concern in today's digital environment. They have serious consequences for individuals, corporations, and governments. Prevention from cyber-attacks is essential. The rise in the number of cyber-attacks has increased the importance of cybersecurity to safeguard critical infrastructures and to ensure the safety of individuals and organizations. By storing data in centralized shared storage, server storage area network (SAN) enable organizations to apply consistent methodologies and tools for security, data protection, and disaster recovery. Server storage area network (SAN) system not only protects against unauthorized access, data breaches, and cyber-attacks but also provides data encryption. Moreover, SAN storage devices have built-in security features such as secure boot, hardware encryption, and access controls. The server storage area network (SAN) helps businesses to quickly implement essential security measures to enhance data safety and privacy.

Thus, the increasing number of cyberattacks across enterprises drives the growth of the market.

Segmentation and Scope:

The "Server Storage Area Network (SAN) Market" is segmented based on component, SAN type, organization size, vertical, and geography. Based on components, the market is segmented into hardware, software, and services. Based on the SAN type, the market is segmented into hyperscale server SAN and enterprise server SAN. Based on organization size, the server storage area network (SAN) market is segmented into large enterprises and small and medium-sized enterprises. Based on vertical, the market is segmented into BFSI, IT & telecom, government, healthcare, manufacturing, retail & e-commerce, and others. The market, based on geography, is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Segmental Analysis:

Based on organization size, the market is segmented into large enterprises and small and medium-sized enterprises. The large enterprises segment in the server storage area network (SAN) market is expected to dominate with the highest share in 2022. As technology advances, the need for business storage is increasing significantly. Server storage area network (SAN) are continuously being adopted by large enterprises to improve server performance and streamline data management procedures. A server storage area network (SAN) acts as a reliable file server, providing documents and data across organizations and providing a central point for data storage and backup.

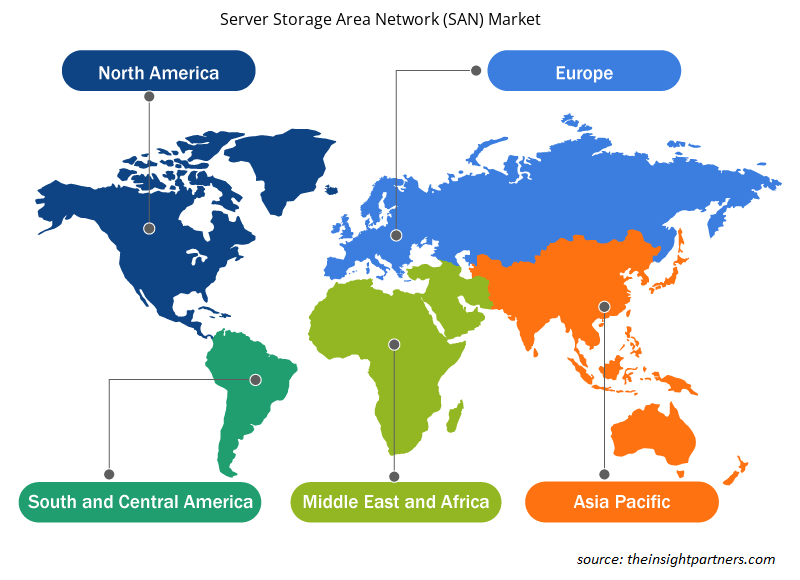

Regional Analysis:

North America holds one of the largest global market shares. High technology adoption trends in various industries in the North American region have fueled the growth of the server storage area network (SAN) market. Factors such as increased adoption of digital tools and high technological spending by government agencies are expected to drive the North American market growth. Moreover, a strong emphasis on research and development in the developed economies of the US and Canada is forcing the North American players to bring technologically advanced solutions into the market. Furthermore, the rise in permeation and adoption of storage area networks (SAN) solutions in North American countries drives the market growth. In addition, the US has a large number of server storage area network (SAN) market players who have been increasingly focusing on developing innovative solutions. Some of the key players in the server storage area network (SAN) market are IBM Corporation, Hewlett Packard Enterprise Development LP, Dell Inc.; and Cisco Systems, Inc., among others. All these factors contribute to the region's growth of the market.

Key Player Analysis:

The server storage area network (SAN) market analysis consists of players such as IBM Corporation; Hewlett Packard Enterprise Development LP; Dell Inc.; Cisco Systems, Inc.; Lenovo Group; MSys Technologies; Arista Networks, Inc.; NEC Corporation; Brocade Communications Systems, Inc.; NetApp are among the key server storage area network (SAN) market players profiled in the report.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the market. A few recent key server storage area network (SAN) market developments are listed below:

- In June 2023, Hewlett Packard Enterprise (HPE) announced the launch of their storage as a service (SaaS) lineup with 32Gb fiber channel connectivity. HPE GreenLake for Block Storage MP powered by HPE Alletra Storage MP hardware features a next-generation platform connected to the storage area network (SAN) using either traditional SCSI-based FC or NVMe over FC connectivity.

- In November 2023, Lenovo announced a distributed storage solution for IBM storage scale (DSS-G) on ThinkSystem V3. Lenovo Distributed Storage Solution for IBM Storage Scale (DSS-G) is a software-defined storage (SDS) solution for dense scalable file and object storage suitable for high-performance and data-intensive environments. DSS-G combines the performance of Lenovo ThinkSystem servers, Lenovo storage enclosures, and industry-leading IBM Storage Scale software to offer a high-performance, scalable building block approach to modern storage needs.

- ThinkSystem SR655 V3 2U servers with an AMD EPYC 9004 Series processor, Lenovo storage enclosures, and industry-leading IBM Storage Scale software to offer a high-performance, scalable building block approach to modern storage needs.

Server Storage Area Network (SAN) Market Regional Insights

The regional trends and factors influencing the Server Storage Area Network (SAN) Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Server Storage Area Network (SAN) Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Server Storage Area Network (SAN) Market

Server Storage Area Network (SAN) Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 20.83 Billion |

| Market Size by 2031 | US$ 28.52 Billion |

| Global CAGR (2025 - 2031) | 4.60% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

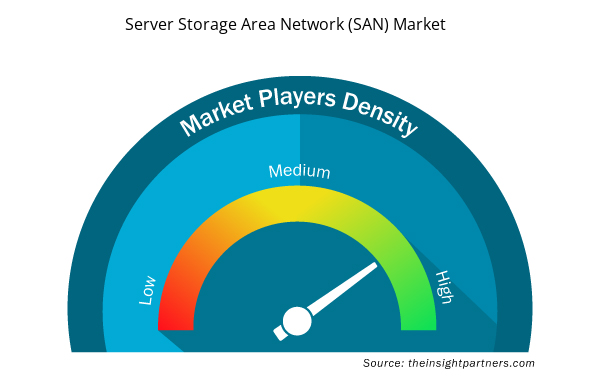

Server Storage Area Network (SAN) Market Players Density: Understanding Its Impact on Business Dynamics

The Server Storage Area Network (SAN) Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Server Storage Area Network (SAN) Market are:

- Advanced Network Solutions, LLC

- Arista Networks, Inc.

- Cisco Systems, Inc.

- Dell Inc.

- Hewlett Packard Enterprise Development LP

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Server Storage Area Network (SAN) Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, SAN Type, Organization Size, Vertical

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies

1. Advanced Network Solutions, LLC

2. Arista Networks, Inc.

3. Cisco Systems, Inc.

4. Dell Inc.

5. Hewlett Packard Enterprise Development LP

6. iCorps Technologies, Inc.

7. Lenovo Group

8. MSys Technologies

9. Thomas-Krenn.AG

10. Zones, LLC

Get Free Sample For

Get Free Sample For