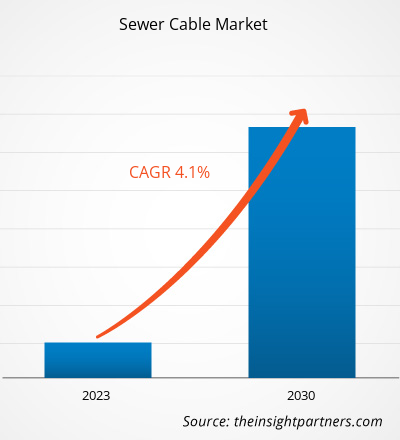

[Research Report] The sewer cable market size is projected to reach US$ 115.99 million by 2030 from US$ 84.32 million in 2022; the market is expected to register a CAGR of 4.1% during 2022–2030.

Analyst Perspective:

The sewer cable market analysis is based on historic trends, current trends, and future outlook, along with manufacturers’ perspectives and end users’ point-of-view. With several well-established and emerging players, the sewer cable market has been experiencing a steady growth rate. However, long lifespans of cables (among other sewer or drain system components) limit the sewer cable market growth to some extent.

North America accounted for the largest sewer cable market share in 2022, followed by Europe and APAC, respectively. The market growth in the region is propelled by rising urbanization and the increasing number of building and construction projects. Moreover, sewer cables are in high demand in the region since sewer cleaning service providers and individuals are well-versed with the technology. The low entry barrier and CAPEX requirements for sewer cable production have resulted in a large number of sewer cable manufacturers in North America. Moreover, the increasing population compels governments and local authorities in the region to undertake the expansion of sewer infrastructure networks, which, in turn, creates a demand for drain-cleaning equipment and its components, such as cables.

Market Overview:

The rising demand for sewer cleaning machines in developed and developing countries to eliminate manual cleaning operations contributes to the expansion of the sewer cable market size. The sewer cleaning industry focuses on developing new solutions to reduce human efforts with the deployment of advanced machinery. Various governments are taking initiatives to encourage the adoption of advanced machinery in sewer cleaning operations. In June 2023, Kochi corporation authorities introduced robotic excavators and suction-cum-jetting machines for cleaning the canals and drains of the city. With the rising adoption of sewer-cleaning machinery, the demand for components such as cables, pipes, and cutters is also likely to surge.

Sewage cable manufacturers are under considerable pressure due to the burgeoning demands from sewer machine manufacturers to deliver cables in huge volumes to be able to meet the demand for cleaning equipment. Thus, drain cable manufacturing businesses have scaled up their operations in recent years. Moreover, manufacturers of sewer cables are concentrating on establishing approved distribution sites, in addition to inventing and selling newer sewer cable models. As a result of this strategy, they can provide services to a larger number of clients. An increase in the use of sewer cleaning machines by sewage cleaning service providers to enhance their offerings bolsters the growth of the sewer cable market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Sewer Cable Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Sewer Cable Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Surging Awareness and Investments in Sewage Infrastructure Propel Sewer Cable Market

A poorly implemented and maintained sewage infrastructure could have a negative impact on the wellness and quality of health of individuals, especially in densely populated metropolitan cities. Further, the lack of efficient waste management and collection practices could result in the spread of various infections and diseases, and the generation of harmful components affecting individuals and compromising public safety. Thus, various government and nongovernment organizations focus on educating the masses about the significance of efficient management of waste as well as the maintenance of sewerage infrastructure across commercial and residential units. For this, governments of various economies are investing heavily in the development of new sewage infrastructure and the upgrading of the old ones. In January 2024, the Guam Waterworks Authority (GWA) signed an agreement with the US to improve the quality of the sewer system of Guam; the improvement work is projected to cost approximately US$ 400 million, involving efforts that would be made to address the violations of the Clean Water Act and other unauthorized overflows of untreated sewage. The Government of Guam is also a party to the agreement. Thus, such investments in the maintenance of aging drain systems by various municipal authorities and government policies supporting sewer system upgrading projects fuel the sewer cable market growth.

Stakeholders in the sewer cable market ecosystem are raw material suppliers, sewer cable manufacturers, sewer cleaning machine manufacturers, and sewer cleaning service providers. The raw material suppliers provide steel, copper, and other metals required to manufacture sewer cables. Sewer cable manufacturers are responsible for designing, assembling, and transforming raw materials into finished cable products. Hongli Pipe Machinery; General Wire Spring Co.; MyTana LLC; SEWER CABLE EQUIPMENT COMPANY.; Coast Manufacturing; DURACABLE; Electric Eel Manufacturing; Ferguson Enterprises, LLC.; RJM Equipment Sales, Inc; Spartan Tool; Trojan Worldwide Inc; Drain Cables Direct (DCD); Gorlitz Sewer & Drain, Inc.; Milwaukee Tool; and RIDGID are among the leading manufacturers of sewer cables. These cables are further integrated into machines for cleaning operations. Sewer machine manufacturers also collaborate with cable providers to procure cables for the assembly of their equipment.

Sewer cleaning service providers purchase sewer machinery from manufacturers. After a certain time of use, the machine needs a cable replacement. Machine manufacturers or third-party distributors provide replacement cables. Sarkinen Restoration, Everest Mechanical, TED & BROS. PLUMBING and Cloud 9 Services LLC are a few sewer cleaning service providers in the sewer cable market ecosystem.

Regional Analysis:

The scope of the sewer cable market report encompasses North America, Europe, Asia Pacific, and Rest of the World. In terms of revenue, North America dominated the sewer cable market in 2022. Europe is the second-largest contributor to the global sewer cable market, followed by APAC. The US, Canada, and Mexico are among the major economies in North America. The willingness of people to adopt modern technologies and spend high amounts on the same has led to intense competition among various companies in the region. The massive increase in population is expected to result in a substantial surge in daily sewage generation, which is likely to exert a significant burden on current infrastructure. Governments of countries in this region are emphasizing on a clean environment, which is a prime determinant of superior states of North America. Municipalities in the US, Canada, and Mexico work hard to keep their sewage and drainage systems clear of clogs. In October 2023, the Canadian government and British Columbia, the municipalities of Burns Lake, and the District of Mackenzie announced more than US$ 10 billion of investment for water and wastewater projects in the region. Such government investments are anticipated to trigger the demand for sewer cables in the region. The sewer cable market share of North America is further expected to grow steadily in the coming years, owing to the presence of numerous well-established and emerging companies.

Sewer Cable Market Regional Insights

The regional trends and factors influencing the Sewer Cable Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Sewer Cable Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Sewer Cable Market

Sewer Cable Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 84.32 Million |

| Market Size by 2030 | US$ 115.99 Million |

| Global CAGR (2022 - 2030) | 4.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

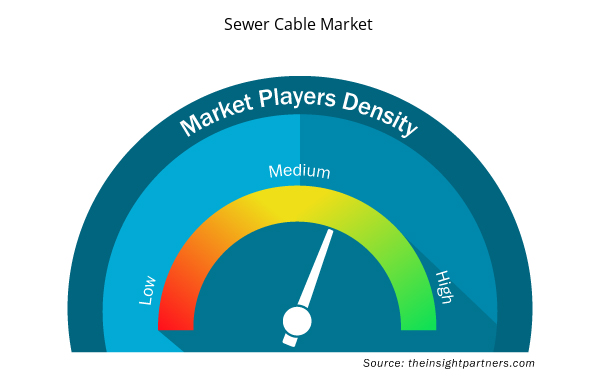

Sewer Cable Market Players Density: Understanding Its Impact on Business Dynamics

The Sewer Cable Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Sewer Cable Market are:

- Hongli Pipe Machinery

- General Wire Spring Co.

- MyTana LLC

- SEWER CABLE EQUIPMENT COMPANY.

- Coast Manufacturing

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Sewer Cable Market top key players overview

Key players operating in the North American sewer cable market include Sewer Cable Equipment Co., Duracable, General Wire Spring Company, Spartan Tool, Gorlitz Sewer & Drain Inc., and Coast Manufacturing. These companies have been manufacturing sewer cables for years, and they also innovate and update their products with the implementation of various organic and inorganic strategies to expand their market reach. Additionally, a few of these manufacturers function as resellers and aftermarket service providers for other sewer-cable-providing brands. For instance, Sewer Cable Equipment Co. serves as a distributor of General Pipe Cleaners, Gorlitz Sewer and Drain, Spartan Tool, Electric Eel, Shubee, Northwest Jetter, and RIDGID.

Sewer cable manufacturers in Europe are concentrated mostly in Germany, the UK, and the Netherlands. They sell their offerings to a wide range of consumers, including residential customers, and municipalities. Wymefa B.V. (Netherlands), REMS GmbH & Co KG (Germany), Cabere GmbH (Germany), Lehmann GmbH & Co. KG (Germany), and Ferguson Plc are a few of the leading producers of sewer cables in the region. The elevated demand for sewer machines allows sewer cable manufacturers to develop robust cables and easily market their products. Further, APAC is expected to record the highest CAGR in the sewer cable market during the projection period. Increasing populations and surging demand for utility services in China, India, and Japan, among others, propel the market expansion. In 2022, China led the sewage cable market in this region, followed by Japan and South Korea, respectively.

Key Player Analysis:

Hongli Pipe Machinery; General Wire Spring Co.; MyTana LLC; SEWER CABLE EQUIPMENT COMPANY.; Coast Manufacturing; DURACABLE; Electric Eel Manufacturing; Ferguson Enterprises, LLC.; RJM Equipment Sales, Inc; Spartan Tool; Trojan Worldwide Inc; Drain Cables Direct (DCD); Gorlitz Sewer & Drain, Inc.; Milwaukee Tool; and RIDGID are among the key players profiled in the sewer cable market report. The report includes growth prospects in light of current sewer cable market trends and factors influencing the market growth.

Recent Developments:

A few recent developments by the sewer cable market players, as per their press releases, are listed below:

|

|

|

2021 | Ferguson plc acquired S. W. Anderson, an HVAC distributor based in Farmingdale, New York, US. The financial information of the acquisition was not disclosed. | North America |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Applications of high-speed cabling equipment, which were initially developed in response to customer demands, continue to evolve in the drain cleaning business as a large base of customers uses it to clear a more extensive range of sewage obstructions. High-speed cables were initially designed for the descaling of pipes. Traditional drain cleaning cables spin with 240–300 RPMs, which is not fast enough to remove cast iron pipe walls.

According to the UNCTAD Handbook of Statistics, the world population surpassed 8 billion in 2022. The United Nations (UN) data states that 5 in every 6 people live in developing economies. Further, the world population is projected to reach 8.55 billion by 2030, and it is further expected to surge to 9.71 billion by 2050. The global population is anticipated to increase by 1.6 billion in the next 25 years. Many developing economies, particularly from Africa, Asia, and Oceania, are expected to experience significantly high population growth among all countries. The following chart shows the projected population growth (in billions) in developed and developing economies.

The US, Canada, and Mexico are among the major economies in North America. The willingness of people to adopt modern technologies and spend high amounts on the same has led to intense competition among various companies in the region. The massive increase in population is expected to result in a substantial increase in daily sewage generation, which is likely to exert a significant burden on current infrastructure.

Trends and growth analysis reports related to Manufacturing and Construction : READ MORE..

The List of Companies - Sewer Cable Market

- Hongli Pipe Machinery

- General Wire Spring Co.

- MyTana LLC

- SEWER CABLE EQUIPMENT COMPANY.

- Coast Manufacturing

- DURACABLE

- Electric Eel Manufacturing

- Ferguson Enterprises, LLC.

- RJM Equipment Sales, Inc

- Spartan Tool

- Trojan Worldwide Inc

- Drain Cables Direct (DCD)

- Gorlitz Sewer & Drain, Inc.

- Milwaukee Tool

- RIDGID

- Hangzhou Hongli Pipe Machinery Co Ltd

Get Free Sample For

Get Free Sample For