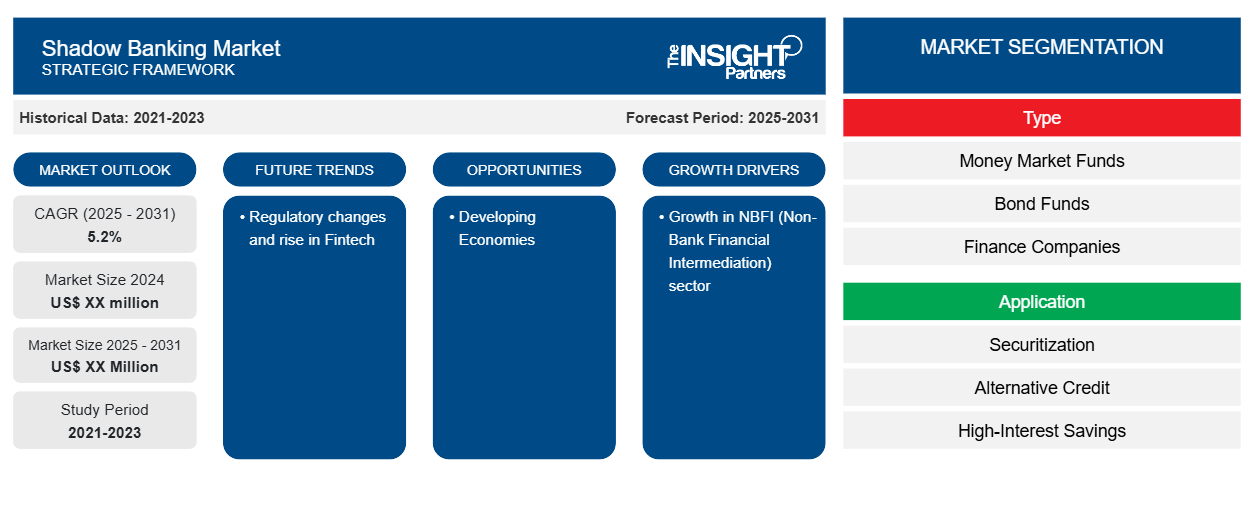

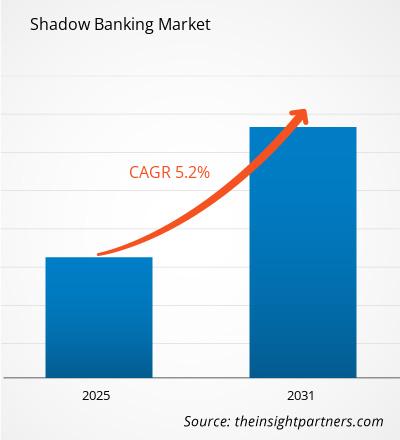

The shadow banking market is expected to register a CAGR of 5.2% in 2023–2031. Regulatory changes and the rise in fintech are likely to remain key shadow banking market trends.

Shadow Banking Market Analysis

Banks are the key functional institutions in the economy. shadow banking systems can be understood as intermediary institutions that function like a banks but are not regulated as a bank is. This type of system consists of various components that fall outside the regulatory realm of traditional banking. These components are brokers, lenders, and other credit intermediaries.

Shadow Banking Market Overview

In the past decade or so, the shadow banking secotor has grown manifolds. Advanced economies have the largest shadow banking networks, with narrower measures indicating stagnation and broader measures (including investment funds) showing expansion since the global financial crisis. In developing market nations, shadow banking has grown faster than traditional banks. Shadow banking can complement traditional banking by increasing lending access, improving market liquidity, transforming maturity, and sharing risk.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Shadow Banking Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Shadow Banking Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Shadow Banking Market Drivers and Opportunities

Growth in NBFI (Non-Bank Financial Intermediation) Sector to Favor Market

According to the 2021 FSB (Financial Stability Board) data, the NBFI industry had significant growth owing to increased investment fund values and inflows during the economic recovery period. The NBFI sector increased by 8.9%, exceeding the five-year average of 6.6%. Its percentage of total global financial assets remained unchanged at 49.2%. This drives the demand in the shadow banking market.

Developing Economies – An Opportunity in Shadow Banking

Shadow banking systems offer finance alternatives to underrepresented market niches in developing economies. Shadow banking in developing nations like China and India bridges the financing gap in the official financial system by offering alternative financing options to market segments underserved by established banks. This promotes economic growth.

Shadow Banking Market Report Segmentation Analysis

Key segments that contributed to the derivation of the shadow banking market analysis are type and application.

- Based on the type, the shadow banking market is divided into money market funds, bond funds, finance companies, special purpose entities, and others. The money market funds segment held the largest share of the market in 2023.

- By application, the market is segmented into securitization, alternative credit, high-interest savings, and innovative financial products.

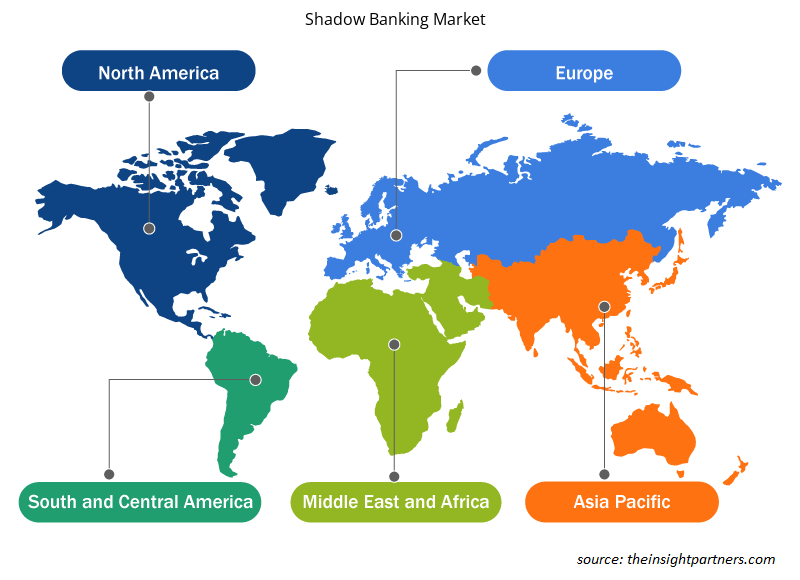

Shadow Banking Market Share Analysis by Geography

The geographic scope of the shadow banking market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

North America has dominated the shadow banking market. According to the 2023 Federal Reserve Data, the amount that US banks have lent to so-called shadow banks has crossed the $1 trillion mark. Thus, the shadow banking market is undergoing substantial development in North America.

Shadow Banking Market Regional Insights

Shadow Banking Market Regional Insights

The regional trends and factors influencing the Shadow Banking Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Shadow Banking Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Shadow Banking Market

Shadow Banking Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 5.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

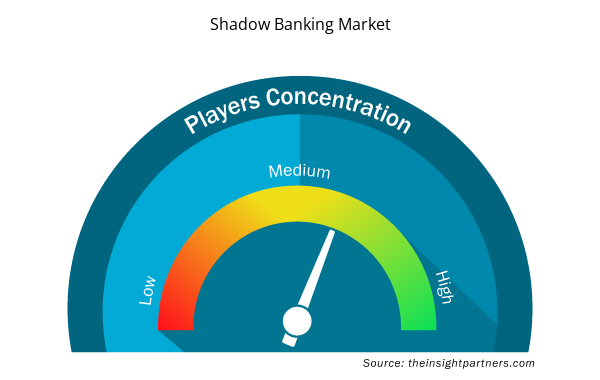

Shadow Banking Market Players Density: Understanding Its Impact on Business Dynamics

The Shadow Banking Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Shadow Banking Market are:

- UBS Group AG

- Standard Chartered PLC

- JPMorgan Chase and Co.

- Bangkok Bank Public Company Limited

- Financial Stability Board

- Goldman Sachs Group, Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Shadow Banking Market top key players overview

Shadow Banking Market News and Recent Developments

The shadow banking market is evaluated by gathering qualitative and quantitative data post post-primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for shadow banking and strategies:

- JPMorgan Chase and Co. has accelerated the pace of securitizing billions of dollars of its loan portfolio in anticipation of proposed new US capital requirements for large banks. The bank has US$ 1.3 trillion in loans at the end of June 2023. Securitization helped the company to take the loan off its balance sheet. (Source: JPMorgan Chase and Co., Press Release, 2023)

Shadow Banking Market Report Coverage and Deliverables

The “Shadow Banking Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Terahertz Technology Market

- Health Economics and Outcome Research (HEOR) Services Market

- Saudi Arabia Drywall Panels Market

- Bio-Based Ethylene Market

- Industrial Inkjet Printers Market

- Personality Assessment Solution Market

- Lymphedema Treatment Market

- Space Situational Awareness (SSA) Market

- Cut Flowers Market

- Point of Care Diagnostics Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The global shadow banking market is expected to grow at a CAGR of 5.2% during the forecast period 2023 - 2031.

Growth in the NBFI (Non-Bank Financial Intermediation) sector is the major factors that propel the global shadow banking market growth.

Regulatory changes and the rise in Fintech are anticipated to bring new shadow banking market trends in the coming years.

In terms of revenue, the money market funds segment held the major market share in 2023.

The key players holding the majority of shares in the global shadow banking market are UBS Group AG, Standard Chartered PLC, JPMorgan Chase and Co., and Bangkok Bank Public Company Limited.

Get Free Sample For

Get Free Sample For