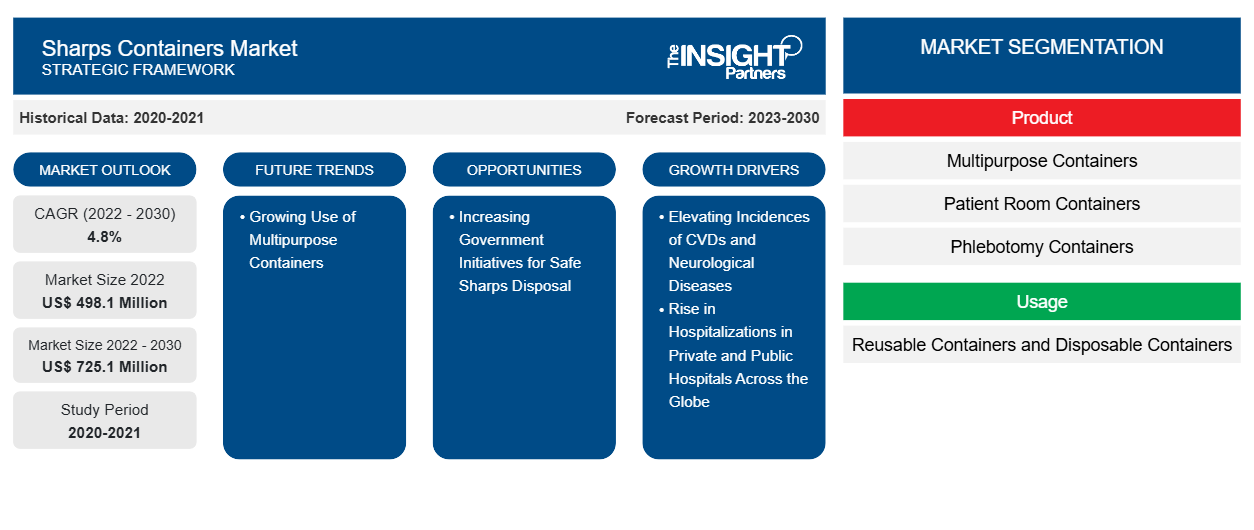

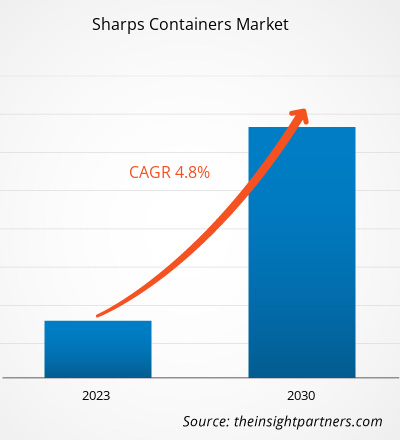

[Research Report] The sharps containers market was valued at US$ 498.1 million in 2022 and is expected to reach US$ 725.1 million by 2030; it is anticipated to record a CAGR of 4.8% from 2022 to 2030.

Market Insights and Analyst View:

"Sharps" refers to objects with sharp points or edges that can puncture or cut the skin, such as needles, syringes, broken glass, lancets, auto-injectors, IV sets, and connecting needles. Sharps containers are specially designed to dispose of used needles and other sharp medical waste. They are designed to protect hospital workers, including sharps users and other downstream workers, from sharps injuries resulting from contact with needles and other sharp devices. Sharps disposal containers are made of rigid, puncture-resistant plastic or metal with leak-resistant sides and bottom and a tight-fitting, puncture-resistant lid with an opening for storing sharps. The increase in the generation of medical waste and the rise in hospitalizations in private and public hospitals across the globe are expected to propel the sharps containers market growth during the forecast period.

Growth Drivers and Challenges:

Healthcare facilities are primarily responsible for collecting, separating, and disposing of the medical, infectious, and hazardous waste they generate. Increasing prevalence of infectious diseases, rising number of hospital visits and admissions, and growing demand for diagnostic and clinical testing contribute to the generation of large amounts of single-use waste. According to the World Health Organization, 16 million injections are used worldwide each year, but there need to be proper disposal options. In the US, with its advanced healthcare facilities, exposure to bloodborne pathogens from needles and other sharp objects is a serious problem, resulting in 385,000 incidents yearly. 85% of all medical waste generated is general non-hazardous waste, and the remaining 15% is hazardous waste containing harmful microorganisms. Therefore, medical waste disposal is the need of the hour, which is increasing the demand for sharps containers worldwide.

According to the research study titled "Estimation of the National Surgical Needs in India by Enumerating the Surgical Procedures in an Urban Community Under Universal Health Coverage," published in September 2020, ~11% of the global burden of disease requires surgical procedures or anesthetic care or both and estimated 3,646 surgeries would be required annually to meet the surgical needs of the Indian population, compared to the global estimate of 5,000 surgeries per 100,000 people. Therefore, the increasing burden of chronic diseases is leading to a rise in the number of surgical procedures worldwide in which sharp medical instruments such as scalpels, needles, intravenous injections, and other devices are widely used. This is expected to fuel the demand for sharps containers.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Sharps Containers Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Sharps Containers Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

However, the lack of awareness about the proper disposal of sharps is hampering the sharps containers market growth. In clinical settings, it is easier to safely dispose of contaminated materials when there are established standards. However, in non-healthcare settings, there are no standards that mandate the usage of well-designed sharps containers. Most people with diabetes do not follow best practices for sharps disposal, i.e., the disposal of sharp objects in designated, locked waste containers. The lack of proper sharps compartments in the storage bay results in the commingling of the waste after collection. According to the WHO, the most common problem associated with the safe disposal of sharps and other medical waste is the lack of awareness of the health hazards. This is due to insufficient training and low priority given to proper waste management.

Report Segmentation and Scope:

The "Global Sharps Containers Market" is segmented based on product, usage, waste type, waste generator, container size, distribution channel, and geography. Based on product, the sharps containers market is segmented into multipurpose containers, patient room containers, and phlebotomy containers. Based on usage, the sharps containers market is subsegmented into reusable containers and disposable containers. Based on waste type, the sharps containers market is bifurcated into infectious waste and non-infectious waste. Based on waste generator, the sharps containers market is segmented into hospitals, pharmaceutical companies, laboratories, clinics & physician's offices, and others. Based on container size, the sharps containers market is segmented into 1–3 gallons, 4–6 gallons, 7–8 gallons, and others. Based on distribution channel, the sharps containers market is segmented into medical supply companies, pharmacies, online sale, and others. Based on geography, the sharps containers market is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Spain, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America)

Segmental Analysis:

Based on product, the sharps containers market is segmented into multipurpose containers, patient room containers, and phlebotomy containers. The multipurpose containers segment held the largest share of the sharps containers market. The same segment is expected to register the highest CAGR of 5.2% in the market during the forecast period. Multipurpose sharps containers accommodate a variety of sharps sizes with both temporary and permanent closure mechanisms. The product is designed for the accommodation of large sharps items and is available in a variety of lid choices, such as flip, slide, or rotary. Multipurpose containers are not space or function-specific; they can be easily used in different environments and are easy to assemble and inexpensive. In addition, they offer maximum safety for medical professionals and are environmentally friendly. Therefore, the growing volume of medical waste, multiple surgeries, and the features of multipurpose containers over other types are expected to provide growth for the multipurpose containers, thereby boosting the sharps containers market.

Based on usage, the sharps containers market is bifurcated into reusable containers and disposable containers. In 2022, the reusable containers segment held a larger share of the market. However, the disposable containers segment is expected to register a higher CAGR of 5.4% in the market during the forecast period. Disposable containers are also known as single use sharps containers. Disposable sharps containers are convenient for sharps waste collection in patient rooms. In general, sharps disposal containers are regulated by the FDA as Class II devices and are subject to pre-market notification [510(k)] requirements (21 CFR 880.5570; product codes MKK and FMI). FDA-cleared sharps disposal containers are available in a variety of sizes, including smaller travel sizes to use while away from home. The aforementioned factors are expected to fuel the market growth for the disposable containers segment.

Based on waste type, the sharps containers market is segmented into infectious waste and non-infectious waste. In 2022, the infectious waste segment held a larger share of the market and is expected to register a higher CAGR of 5.0% in the market during the forecast period. Waste from sharps is a part of the infectious waste and includes syringes, needles, lancets, broken glass, and any other material that can penetrate the skin. The combination of pathogen contamination and the ability to penetrate skin barriers makes it one of the most hazardous healthcare wastes. According to the World Health Organization (WHO), out of the 16 billion injections a year, the vast majority of sharps and sharps waste is syringes.

Based on waste generators, the sharps containers market is segmented into hospitals, pharmaceutical companies, laboratories, clinics & physician's offices, and others. In 2022, the hospitals segment held the largest share of the market, and the same segment is expected to register the highest CAGR of 5.5% in the market during the forecast period. Hospitals are important sites for waste generation. Every department in the hospital generates waste, and the overall product is waste of different kinds. These items can be pathogenic and environmentally adverse. These wastes are also called hazardous healthcare wastes. Hospitals are the major consumer of sharp waste containers.

Based on container size, the sharps containers market is segmented into 1–3 gallons, 4–6 gallons, 7–8 gallons, and others. In 2022, the 1–3 gallons segment held the largest share of the market, and the same segment is expected to register the highest CAGR of 5.2% in the market during the forecast period. The sharp container holds a capacity between 1 and 3 gallons. These sharps container sizes are mostly used by the healthcare industry. The product can be wall mounted or used on countertops. Its large horizontal opening allows for easy disposal. Healthcare facilities such as laboratories, physician offices, clinics, hospitals, and surgery centers are the major consumer of these products. Further, the 4-gallon sharps containers are generally used in hospitals and pharmaceutical companies where there is a higher volume of waste. These containers primarily dispose of biohazardous materials, including surgical waste generated in hospitals, research laboratories, and diagnostic laboratories.

Based on distribution channel, the sharps containers market is segmented into medical supply companies, pharmacies, online sales, and others. In 2022, the medical supply companies segment held the largest share of the market. The online sales segment is expected to register the highest CAGR of 5.3% in the market during the forecast period.

Regional Analysis:

Based on geography, the sharps containers market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. The North America sharps containers market has been analyzed based on three major countries: the US, Canada, and Mexico. The US is estimated to hold the largest sharps containers market share during the forecast period. The sharps containers market growth in the US is attributed to the rising cases of diabetes and needlestick injuries and growing government initiatives. the prevalence of chronic illnesses such as Crohn's disease and diabetes, which can be treated with self-injectable medication, is rising across the US. For instance, according to the CDC 2022 National Diabetes Statistics Report estimates, more than 130 million adults are suffering from diabetes or prediabetes in the US. Due to their significance during the administration of medications and tests, syringes are necessary for most diagnostic and therapeutic techniques for the treatment of chronic diseases, which is boosting the demand for sharps containers.

Europe is the second-largest market for sharps containers. Germany is expected to hold the largest share in the Europe sharps containers market during the forecast period. The high-growth countries, such as Germany and the UK, contribute to the growth of the sharps container market in the region. France and Spain are improving the supply chain and raising awareness of waste management, which would be a key driver for market growth in the region. Regulators in Europe are taking initiatives to introduce favorable and strict guidelines for reusable sharp containers that are environmentally friendly and offer cost-effective features. Furthermore, the growing prevalence of diseases such as diabetes and the vaccination campaign against COVID-19 resulted in a large volume of sharps and sharps waste requiring proper disposal, boosting the sharps containers market. However, the lack of compliance and the introduction of single-use sharps containers in economically weaker European countries are expected to hamper the growth of this region.

COVID-19 Impact:

As per the study titled "Scientists develop suitable human cell line for anti-SARS-CoV-2 drug screening" published in the Journal Viruses in June 2022, researchers have described the creation of a suitable human cell line for the high-throughput testing of antiviral medications that target the coronavirus 2 that causes severe acute respiratory syndrome (SARS-CoV-2). Angiotensin-converting enzyme 2 (ACE2) and transmembrane serine protease 2 (TMPRSS2), two essential host proteins required for viral entry, were engineered to express high levels in the human lung carcinoma cell line A549. Resulting in the development of more cell lines to manage COVID-19, which had a significant impact on the sharps containers market during the pandemic. Therefore, the pandemic had a positive impact in the sharps containers market.

Sharps Containers Market Regional Insights

Sharps Containers Market Regional Insights

The regional trends and factors influencing the Sharps Containers Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Sharps Containers Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Sharps Containers Market

Sharps Containers Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 498.1 Million |

| Market Size by 2030 | US$ 725.1 Million |

| Global CAGR (2022 - 2030) | 4.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

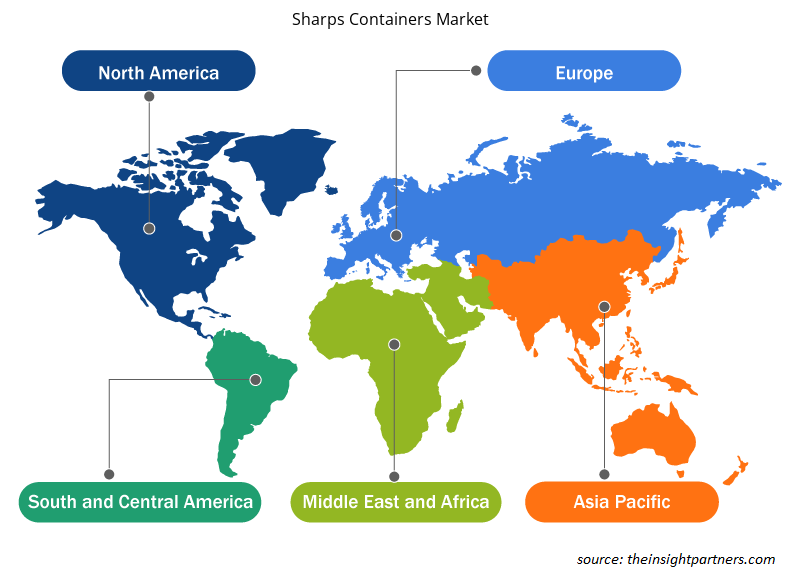

Sharps Containers Market Players Density: Understanding Its Impact on Business Dynamics

The Sharps Containers Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Sharps Containers Market are:

- Sanypick Plastic SA

- Bondtech Corp

- Mauser Group NV

- EnviroTain LLC

- Stericycle Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Sharps Containers Market top key players overview

Competitive Landscape and Key Companies:

Prominent players operating in the global sharps containers market include Sanypick Plastic SA, Bondtech Corp, Mauser Group NV, EnviroTain LLC, Stericycle Inc, Dailymag Magnetic Technology Ltd, GPC Medical Ltd, Bemis Co Inc, Becton Dickinson and Co, and The Harloff Co. These companies focus on new product launches and geographical expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. They have a widespread global presence, which allows them to serve a large set of customers and subsequently increases their sharps containers market share.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Usage, Waste Type, Waste Generators, Container Size, Distribution Channel, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The medical supply companies segment dominated the global sharps containers market and held the largest market share of 46.23% in 2022.

The sharps containers market mssajorly consists of the players such Sanypick Plastic SA, Bondtech Corp, Mauser Group NV, EnviroTain LLC, Stericycle Inc, Dailymag Magnetic Technology Ltd, GPC Medical Ltd, Bemis Co Inc, Becton Dickinson, and Co, and The Harloff Co among others.

The hospitals segment dominated the global sharps containers market and held the largest market share of 41.81% in 2022.

The 1-3 gallons segment dominated the global sharps containers market and held the largest market share of 40.29% in 2022.

The reusable containers segment dominated the global sharps containers market and accounted for the largest market share of 63.90% in 2022.

"Sharps" refers to objects with sharp points or edges that can puncture or cut the skin, such as needles, syringes, broken glass, lancets, auto-injectors, IV sets, and connecting needles. Sharps containers are specially designed to dispose of used needles and other sharp medical waste. They are designed to protect hospital workers, including sharps users and other downstream workers, from sharps injuries resulting from contact with needles and other sharp devices. Sharps disposal containers are made of rigid, puncture-resistant plastic or metal with leak-resistant sides and bottom and a tight-fitting, puncture-resistant lid with an opening for storing sharps.

The CAGR value of the sharps containers market during the forecasted period of 2022-2030 is 4.8%.

The infectious waste segment dominated the global sharps containers market and held the largest market share of 71.65% in 2022.

The multipurpose containers segment held the largest share of the market in the global sharps containers market and held the largest market share of 42.43% in 2022.

Key factors such as the increase in generation of medical waste and rise in hospitalizations in private and public hospitals across the globe are expected to boost the market growth for the sharps containers over the years.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Sharps Containers Market

- Sanypick Plastic SA

- Bondtech Corp

- Mauser Group NV

- EnviroTain LLC

- Stericycle Inc

- Dailymag Magnetic Technology Ltd

- GPC Medical Ltd

- Bemis Co Inc

- Becton Dickinson and Co

- The Harloff Co

Get Free Sample For

Get Free Sample For