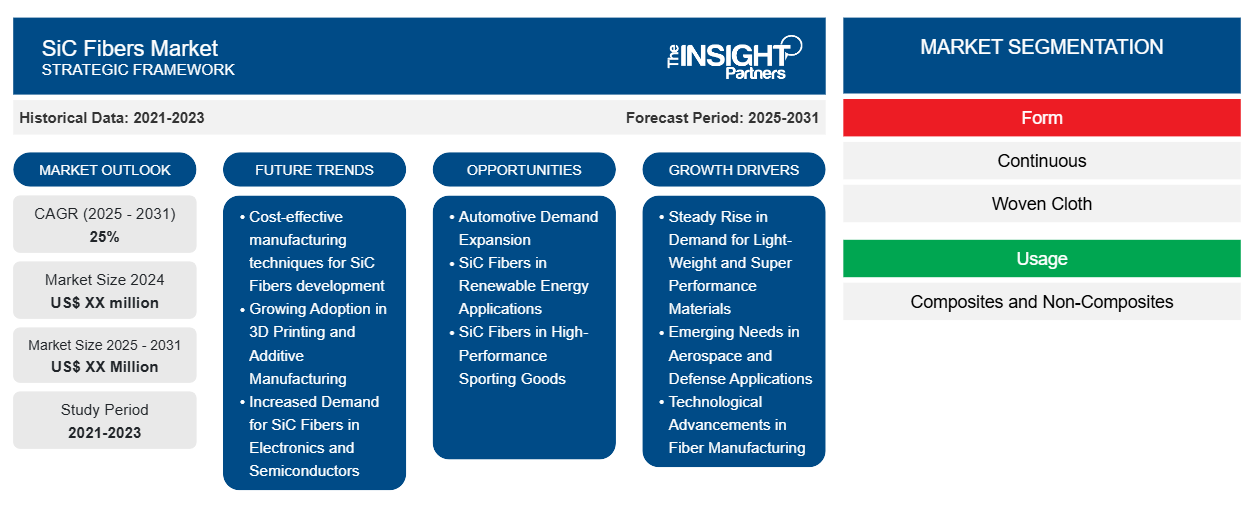

The SiC Fibers Market is expected to register a CAGR of 25% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

SiC Fibers Market covers analysis By Form (Continuous, Woven Cloth, and Others), Usage (Composites and Non-Composites), and End-Use Industry (Aerospace and Defense, Energy and Power, Industrial, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America). SiC fibers are primarily composed of silicon carbide molecules, generally ranging from 5 ?m to 50 ?m in diameter. High temperature capability, lower thermal expansion, lower density, higher oxidative durability, lower permeability, low weight, greater strength, and better thermal conductivity are the key properties of SiC fibers that contribute to their popularity in the aerospace and defense, energy and power, and industrial sectors.

Purpose of the Report

The report SiC Fibers Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

SiC Fibers Market Segmentation

Form

- Continuous

- Woven Cloth

Usage

- Composites and Non-Composites

End-Use Industry

- Aerospace and Defense

- Energy and Power

- Industrial

Geography

- North America

- Europe

- Asia-Pacific

- South and Central America

- Middle East and Africa

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

SiC Fibers Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

SiC Fibers Market Growth Drivers

- Steady Rise in Demand for Light-Weight and Super Performance Materials: Silicon carbide fibers (SiC) are distinct in their mechanical properties, namely, tensile strength, thermal stability, and low density. Therefore, they are suitable for aerospace, automotive, and defense applications. Increasing demand for lightweight and high-performance materials in the above sectors, especially for high-temperature applications, has led to SiC fibers fast emerging as one of the important material components in advanced composites.

- Emerging Needs in Aerospace and Defense Applications: These SiC fibers would effectively meet components specifications of low weight but high strength for applications including parts for engines and turbine blades in the aerospace and defense sectors. The present focus on improved fuel efficiencies with concurrent weight loss in the application of the airplane continues to increase its dependency on industries requiring SiC fibers for high-temperature, high-stress applications and thereby the market.

- Technological Advancements in Fiber Manufacturing: Within that range of changes includes the development of more effective and less expensive means for producing SiC fiber. Thus, the material becomes more readily available. That means that with the new technology and lower production costs, SiC fiber may soon prove commercially viable for many of its potential applications, which will lead to enhanced growth for the market and new opportunities throughout a variety of areas.

SiC Fibers Market Future Trends

- Cost-effective manufacturing techniques for SiC Fibers development: The demand for SiC fibers is anticipated to grow, driving improvements in the production process toward high- quality products at low costs. This will involve optimizations based on cost savings for such techniques as chemical vapor infiltration (CVI) and laser chemical vapor deposition (LCVD), thereby lowering the price of SiC fiber products for extensive commercial applications ranging from automotive to energy and into aerospace.

- Growing Adoption in 3D Printing and Additive Manufacturing: SiC fibers will soon be increasingly used in the 3D printing industry: especially for high-performance parts. The more developed technology adds in the case of additive manufacturing, the more required will be SiC fibers in constructing complex, lightweight, and highly durable structures, so that this used more in aerospace, automotive operations, and defense applications, because in their case tolerance and material strengths are most demanding.

- Increased Demand for SiC Fibers in Electronics and Semiconductors: The silicon carbide revolution in electronics, especially in semiconductors, is opening up new frontiers for SiC fibers. Such fibers have excellent thermal conduction and high-voltage-resistant properties and are thus most suitable for applications in advanced electronics, power systems, and grids. Further, the introduction of next-generation electronic devices will act as a growth driver in this space.

SiC Fibers Market Opportunities

- Automotive Demand Expansion: As the automotive industry is fast moving towards the electric vehicle (EV) and lightweighting future, SiC has great potential. Potential use of SiC fibers in the electric motor components, batteries, and thermal management systems can be very attractive and helpful to enhance the performance and efficiency of the electric vehicle. The SiC fibers are being explored by the manufacturers concerning the high performance and energy efficiency of the vehicles which are sought after by the growing market.

- SiC Fibers in Renewable Energy Applications: The formation of more efficient and long-lasting components for turbines and power systems will be taking effect by SiC fibers in line with the growing renewable energy technologies such as solar and wind. With their high thermal conductivity, wear resistance, and excellent strength in extreme situations, SiC fibers are ideal for improving performance in renewable energy applications.

- SiC Fibers in High-Performance Sporting Goods: The introduction of these fibers to the production of equipment used in high-performance sports, such as sporting bicycles, helmets, and protective gear, is one of the emerging applications. Their lightweight, strength, and impact resistance could enable the equipment safety and performance in sports. This would also propel more diversification of SiC fibers in non-traditional segments.

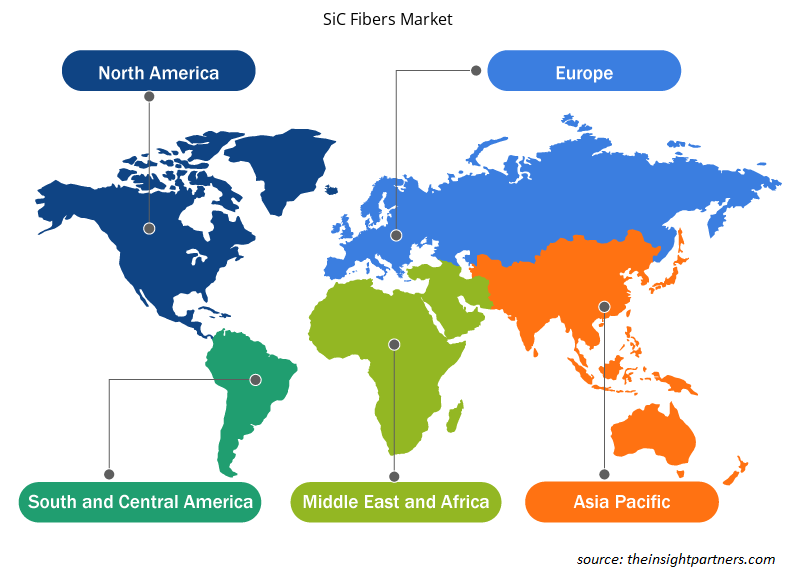

SiC Fibers Market Regional Insights

The regional trends and factors influencing the SiC Fibers Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses SiC Fibers Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for SiC Fibers Market

SiC Fibers Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 25% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Form

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

SiC Fibers Market Players Density: Understanding Its Impact on Business Dynamics

The SiC Fibers Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the SiC Fibers Market are:

- SiC Fibers Market

- American Elements

- BJS Ceramics GmbH

- COI Ceramics, Inc.

- General Electric Company

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the SiC Fibers Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the SiC Fibers Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the SiC Fibers Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Ceramic Injection Molding Market

- Environmental Consulting Service Market

- Constipation Treatment Market

- Sports Technology Market

- Point of Care Diagnostics Market

- Fertilizer Additives Market

- Dealer Management System Market

- Semiconductor Metrology and Inspection Market

- Neurovascular Devices Market

- Photo Editing Software Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Form, Usage, and End-Use Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Development of advanced composite materials is an emerging trend in the market.

The North America market is expected to account for the highest CAGR during the forecast period, owing to the growing aerospace industry in the region.

The continuos form segment accounted for the largest market share in 2023

Growing demand for aerospace and defense is a key driver in the market.

American Elements, BJS Ceramics GmbH, COI Ceramics, Inc, General Electric Company, Haydale Technologies Inc., Matech, NGS Advanced Fibers Co., Ltd., Specialty Materials, Inc., Suzhou Saifei Group Co., Ltd, and Ube Industries, Ltd are some of the key players in the market.

The SiC Fibers Market is estimated to witness a CAGR of 25% from 2023 to 2031

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - SiC Fibers Market

- American Elements

- BJS Ceramics GmbH

- COI Ceramics, Inc.

- General Electric Company

- Haydale Technologies Inc.

- Free Form Fibers

- NGS Advanced Fibers Co., Ltd.

- Specialty Materials, Inc.

- Suzhou Saifei Group Co., Ltd

- Ube Industries, Ltd.

Get Free Sample For

Get Free Sample For