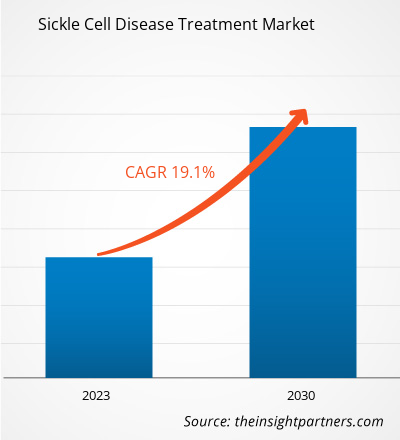

[Research Report] The Sickle Cell Disease Treatment market was valued at US$ 1,160.16 million in 2022 and is projected to reach US$ 4,691.87 million by 2030; it is estimated to record a CAGR of 19.1% from 2022 to 2030.

Market Insights and Analyst View:

Sickle cell anemia is a group of diseases that affect hemoglobin, the molecule that transports oxygen throughout the body's tissues and organs. When this disease occurs, the red blood cells take a crescent or crescent shape, and the patient becomes anemic. Sickle cell disease (SCD) is a genetic disorder that can be treated with medications to manage symptoms and palliative care. Blood transfusions, bone marrow transplants, and medications are among the most common treatment options available. Although bone marrow transplantation is the only potentially curative treatment, it is only recommended for a limited proportion of patients. There are only two FDA-approved medications on the market: hydroxyurea and Endari.

The increasing initiatives by various governments and private organizations to treat this disease are expected to drive the sickle cell disease treatment market in the coming years. For example, according to data released by the WHO in August 2022, a few African health ministers have launched a campaign to raise awareness and strengthen prevention and care to reduce the incidence of sickle cell anemia, one of the most common diseases in the region, which, however, is not given sufficient attention. The source also stated that more than 66% of the 120 million people affected by sickle cell disease worldwide live in Africa. Therefore, the high prevalence of sickle cell anemia and increasing awareness campaigns for the treatment of this disease are a few of the key market drivers.

Increasing research and development in the field of sickle cell anemia could also boost the market. For example, in May 2022, multiple daily doses of GBT601, Global Blood Therapeutics (GBT) experimental oral therapy for sickle cell disease (SCD), were well tolerated and demonstrated promising pharmacologic and efficacy signals in six patients in a Phase I clinical trial. Therefore, factors such as the increasing prevalence of sickle cell anemia, rising awareness campaigns, and surging research and development activities are expected to boost the market growth. However, high treatment costs are hampering the market growth.

Growth Drivers and Challenges:

The treatment plan for sickle cell disease (SCD) can be divided into two categories: maintaining health and treating complications. Sickle cell anemia has genotypic and phenotypic variants that are based on unique mutations in hemoglobin genes. There is a high prevalence of the disease as well as a rise in its severity across the globe. According to the WHO, approximately 5% of the world's population has genes inhibiting hemoglobin diseases such as sickle cell anemia and thalassemia. According to a study on sickle cell disease published in the National Library of Medicine, more than 300,000 babies are born with severe hemoglobin disorders each year; also, 400,000 newborns are expected to have sickle cell disease by 2050. In addition, according to a published report in 2023 by the American Society of Hematology, the estimated number of people suffering from SCD in the US is approximately 70,000–100,000. Thus, the rising prevalence of malaria and sickle cell disease in different regions across the globe boosts the sickle cell disease treatment market growth. Further, governments of various countries across the globe with a high prevalence of sickle cell disease are deploying various strategies to eradicate the disease by improving access to healthcare services, including treatment options, to the people.

The pharmacotherapy of SCD treatment consists of hydroxyurea and a few branded medications. Hydroxyurea is considered a first-line treatment for illness and is recommended by many medical experts. However, there is a shortage of accessibility to treatment options in developing countries across the globe. According to the American Society of Hematology, ~300,000 babies are born with SCD each year in sub-Saharan Africa. Despite the addition of hydroxyurea to the Model List of Essential Medicines for Children by the WHO, it remains unavailable in many developing regions. In addition, the drug is considered highly expensive in Africa. Blood transfusions to treat SCD also depend on the availability of donors; there is a risk of inadequate screening leading to an increase in blood transfusion-transmitted infections even though donors are accessible. Further, there are limited public and private healthcare workers in African countries who are responsible for improving health facilities and care for patients suffering from SCD. Thus, the lack of SCD treatment options is hindering the growth of the sickle cell disease treatment market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Sickle Cell Disease Treatment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Sickle Cell Disease Treatment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The sickle cell disease treatment market is categorized on the basis of treatment, route of administration, and distribution channel. By treatment, the market is divided into generic drugs and originators. The sickle cell disease treatment market, by route of administration, is bifurcated into oral and parenteral. In terms of distribution channel, the sickle cell disease treatment market is segmented into direct tender, hospital pharmacies, retail pharmacies, online pharmacies, and others. The sickle cell disease treatment market, based on geography, is categorized into North America (US, Canada, and Mexico), Europe (France, Germany, Italy, UK, Spain, Benelux, Austria, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, Malaysia, Indonesia, and Rest of Asia Pacific), Middle East & Africa (Saudi Arabia, UAE, South Africa, Kenya, Tanzania, Rwanda, Nigeria, Ghana, Uganda, Angola, Cameroon, Senegal, Zambia, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America)

Segmental Analysis:

Based on treatment, the sickle cell disease treatment market is divided into originators and generic drugs. In 2022, the originators segment held a larger share of the market. Also, the segment is expected to record a higher CAGR during the forecast period. Based on route of administration, the sickle cell disease treatment market is bifurcated into oral and parenteral. In 2022, the oral segment held a larger share of the market. Also, the segment is expected to record a higher CAGR during the forecast period. Oral drug delivery is the most ideal and suitable route of drug administration as it offers high patient compliance, noninvasiveness, least sterility constraints, cost-effectiveness, flexibility in the design of dosage form, and ease in the manufacturing process. Benefits such as ease of administration and long-term cost efficiency are the major factors fueling the adoption of oral drugs. Low manufacturing cost of capsules, tablets, and other orally administered drugs propel the sickle cell disease treatment market growth.

By distribution channel, the sickle cell disease treatment market is categorized into direct tender, hospital pharmacies, retail pharmacies, online pharmacies, and others. In 2022, the direct tender segment held the largest share of the market. However, the online pharmacies segment is expected to record the highest CAGR during the forecast period. A tender is an offer to do specific duties or provide items for a fixed amount. In the first step of this tender procedure, contractors will be asked to submit sealed bids for construction or to offer particularly planned services or products within a specific time limit. The e-tendering procedure in India is designed to ensure that work for the government or a specific client is completed in a timely manner. A few places, for example, may have specific procurement regulations that dictate the way decisions are made and which tenders are accepted. Online pharmacies are one of the most developing pharmacies in this era. In this mode of prescribing, prescriptions are generated online. The benefits of online pharmacies include better pricing than retail stores, and this offers low transactions, easy availability, and better consumer compliance. Online pharmacies provide medicine at the doorstep and provide medical alerts and discounts on licensed pharmacy products. Development in online services, use of the Internet, and awareness regarding self-medication for OTC products are substantial factors contributing to the growth of online pharmacy sales. Education about primary treatment and medication will stimulate market development.

Regional Analysis:

Based on geography, the sickle cell disease treatment market is categorized into five key regions—North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. The market in North America has been analyzed with a prime focus on three major countries—the US, Canada, and Mexico. The Middle East & Africa held the largest share of the sickle cell disease treatment market in 2022. Rising disposable income, growing demand for targeted nutrition, rising awareness regarding sickle cell disease treatment and supplements are a few of the prominent factors propelling the market growth.

The sickle cell disease treatment market in Nigeria held the largest market share in 2022 and is likely to be the fastest-growing market during the forecast period. In Nigeria, it has been reported that children with SCD do not attend school and perform poorly academically due to the physical effects of SCD. According to a study titled "The Burden of Sickle Cell Disease," published in the National Library of Medicine, sickle cell anemia affects more than 20,000 out of 1,000,000 people in the Nigerian population. According to a study titled "Impact of Sickle Cell Disease on Affected Individuals in Nigeria," published in the National Library of Medicine, Nigeria is considered the country with the highest sickle cell anemia rate in sub-Saharan Africa, affecting 2–3% of the population. According to the WHO and the Nigerian Ministry of Health, 25% of the country's total population are carriers of mutated genes that cause the genetic disorder. According to the article "Sickle Cell Advocates in Nigeria Urge Authorities to Take Firm Stand on Interventions," published in VOA, an estimated 100,000 children are diagnosed with the disease each year, with up to 80% of children in Nigeria dying before the age of 5.

Sickle Cell Disease Treatment Market Future Trend:

Extending Pipeline of New Drugs and Vaccines

The R&D of new medicines is considered the best strategy; as a result, the SCD drug/vaccine pipeline is becoming increasingly robust. Public-private partnerships are accelerating research activities related to the treatment of sickle cell disease.

A few SCD drugs/vaccines that are under clinical development are mentioned in the table below:

Sickle Cell Disease Drugs/Vaccine/Compounds Under Clinical Development

Drug | Developer | Clinical Trial Stage |

Inclacumab | Pfizer | Phase III |

Voxelotor | Pfizer | Phase III |

GBT021601 | Pfizer | Phase II |

PF-07209326 | Pfizer | Phase II |

RG6107 | Roche | Phase II |

GSK4172239D | GSK | Phase I |

BEAM–101 | Beam Therapeutics | Phase I/II |

HGB-206 | Bluebird Bio, Inc. | Phase I/II |

HGB-210 | Bluebird Bio, Inc. | Phase III |

ALXN1820 | Alexion | Phase II |

NCT05714969 | Takeda Pharmaceutical Company Limited | Phase 2b |

NCT03997760 | Takeda Pharmaceutical Company Limited | Phase I |

Source: Company Website, The Insight Partners Analysis

Therefore, the growing number of SCD drugs/vaccines that are under clinical development is expected to boost the market growth in the future.

Sickle Cell Disease Treatment Market Regional Insights

Sickle Cell Disease Treatment Market Regional Insights

The regional trends and factors influencing the Sickle Cell Disease Treatment Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Sickle Cell Disease Treatment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Sickle Cell Disease Treatment Market

Sickle Cell Disease Treatment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1.16 Billion |

| Market Size by 2030 | US$ 4.69 Billion |

| Global CAGR (2022 - 2030) | 19.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Treatment

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

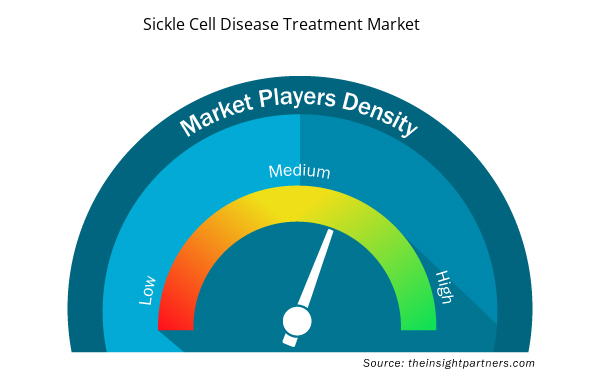

Sickle Cell Disease Treatment Market Players Density: Understanding Its Impact on Business Dynamics

The Sickle Cell Disease Treatment Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Sickle Cell Disease Treatment Market are:

- Novartis AG

- Pfizer Inc

- Emmaus Life Sciences Inc

- Teva Pharmaceutical Industries Ltd.

- Bristol-Myers Squibb Company

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Sickle Cell Disease Treatment Market top key players overview

Competitive Landscape and Key Companies:

A few of the prominent players operating in the global sickle cell disease treatment market are Novartis AG, Pfizer Inc, Emmaus Life Sciences Inc, Teva Pharmaceutical Industries Ltd., Bristol-Myers Squibb Company, Siklos, Mylan NV, Taj Pharmaceuticals Limited, and Apotex. These companies focus on the development of new technologies, advancements in existing products, and expansion of geographic footprint to meet the growing consumer demand worldwide and expand their product range in specialty portfolios. Companies operating in the global sickle cell disease treatment market are implementing various inorganic and organic strategies. A few of them are mentioned below:

- In April 2023, the US FDA offered Editas Medicine, Inc. an Orphan Drug Designation for its EDIT-301, which is used for the treatment of sickle cell anemia.

- In October 2022, Pfizer Inc. completed the acquisition of Global Blood Therapeutics, Inc., which is involved in the development and commercialization of drugs to treat SCD.

- In February 2022, Global Blood Therapeutics Inc. received marketing approval for Oxbryta for the treatment of hemolytic anemia caused by SCD in adult and pediatric patients (12 years and above) as monotherapy or in combination with hydroxycarbamide.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Print Management Software Market

- Advanced Planning and Scheduling Software Market

- Constipation Treatment Market

- Integrated Platform Management System Market

- Hair Wig Market

- Pharmacovigilance and Drug Safety Software Market

- MEMS Foundry Market

- Fill Finish Manufacturing Market

- Fishing Equipment Market

- Virtual Pipeline Systems Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Treatment, Route of Administration, and Distribution Channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The originators segment dominated the sickle cell disease treatment market and accounted for the largest market share in 2022.

The direct tender segment dominated the sickle cell disease treatment market and accounted for the largest market share in 2022.

Based on route of administration, the oral segment took the forefront leaders in the worldwide sickle cell disease market by accounting largest share in 2022 and is expected to continue to do so till the forecast period.

Answer: - Novartis AG, Pfizer Inc, Emmaus Life Sciences Inc, Teva Pharmaceutical Industries Ltd., Bristol-Myers Squibb Company, Siklos, Mylan NV, Taj Pharmaceuticals Limited, and Apotex among others are among the leading companies operating in the sickle cell disease treatment market.

Increasing prevalence of sickle cell disease and government and private sector's initiative to raise awareness about sickle cell disease are the most significant factors responsible for the overall market growth.

Sickle cell disease treatment market is segmented by countries comprising of North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America

Sickle cell disease (SCD) is the most common inherited blood disorder that affects the red blood cells. Treatments for SCD can relieve pain and help prevent complications related with the disease. SCD is identified with a simple blood test. In addition, SCD can be detected while the baby is in the womb. Diagnostic tests such as amniocentesis and chorionic villus sampling are done before the baby is born, which helps to check the chromosomal or genetic abnormalities in the baby. A bone marrow transplant can cure SCD. The transplant needs a donor who’s healthy, genetic match, such as a sibling. However, only about 18% of people with SCD have a compatible donor. In addition, there are complications and risks involved with a transplant.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Sickle Cell Disease Treatment Market

- Novartis AG

- Pfizer Inc

- Emmaus Life Sciences Inc

- Teva Pharmaceutical Industries Ltd.

- Bristol-Myers Squibb Company

- Siklos

- Mylan NV

- Taj Pharmaceuticals Limited

- Apotex

Get Free Sample For

Get Free Sample For