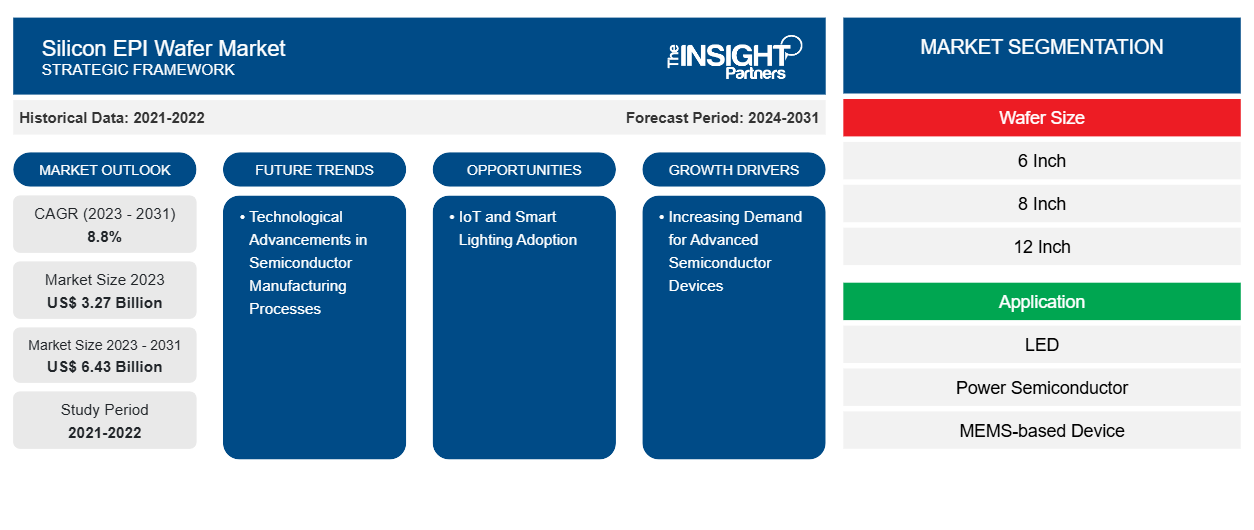

The silicon EPI wafer market size is projected to reach US$ 6.43 billion by 2031 from US$ 3.27 billion in 2023. The market is expected to register a CAGR of 8.8% during 2023–2031. Technological advancements in semiconductor manufacturing processes are likely to remain a key trend in the market.

Silicon EPI Wafer Market Analysis

The market for Silicon EPI wafers is growing at a significant CAGR. Major factors fueling the growth are increasing demand for high-end semiconductor devices in the electronic and communication industry and increased usage of silicon epitaxial wafers in the manufacture of solar cells and applications in renewable energy. In addition, there are growing IoT applications in wafers and an increase across the board in the adoption of smart lighting in countries such as Korea and China that offer tremendous opportunities to the market. In addition, Silicon EPI wafers are developers of technologies such as Artificial Intelligence and Machine Learning that expand their uses, therefore demanding more.

Silicon EPI Wafer Market Overview

Silicon EPI (Epitaxial) wafers are thin slices of silicon subjected to epitaxial growth, where a crystalline layer gets deposited on a substrate of silicon. Such wafers present a base used in the production of semiconductor devices, solar cells, and a number of other electronic components. Additional epitaxial layers are applied to tightly control semiconductor properties so that electronic devices highly efficiently functioning can be created. The EPI silicon wafer has contributed immensely to technologies in sleek devices like IoT devices, smart lighting, and renewable energy applications.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Silicon EPI Wafer Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Silicon EPI Wafer Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Silicon EPI Wafer Market Drivers and Opportunities

Increasing Demand for Advanced Semiconductor Devices

Factors expected to boost the market include rising demand for advanced semiconductor devices from the electronics and communication industry, increasing acceptance of Silicon Epitaxial Wafers in the production of solar cells as a part of renewable energy production, and growing demand for advanced electronic components in industries such as the electronics, automotive, and telecommunications industry. Apart from that, the continuous development in technology and the rise in the adoption rate of smart devices are also fueling rising demand for epitaxial silicon wafers. Moreover, with growing interest in renewable sources of energy, such as solar power, it is forecasted that demand for the epitaxial silicon wafers used in photovoltaic cells will also contribute to the growth in demand. Innovative sectors, such as 5G technology, artificial intelligence, and IoT applications, are also helping the Silicon EPI wafer market grow. Great opportunities hence exist for companies that would want to make a point of difference through technology advancement and process optimization.

IoT and Smart Lighting Adoption

Another huge opportunity for the Silicon EPI wafer market is the growing popularity of IoT in wafers and the rising adoption of smart lighting, mainly in Korea and China. This growth can be pointed out to be driven by the increasing integration of IoT technology in a wide range of applications, from smart home devices to industrial automation and connected infrastructure. With heavy investments in smart city projects and developing advanced lighting systems, Korea and China open up vast opportunities for Silicon EPI wafer manufacturers to cater to the increasing demand for high-performance semiconductor materials. The expanding IoT applications in the industrial and consumer sectors increase the demand for silicon epitaxial wafers exponentially.

Silicon EPI Wafer Market Report Segmentation Analysis

Key segments that contributed to the derivation of the silicon EPI wafer market analysis are wafer size, application, end-user, and type.

- Based on wafer size, the market is segmented into 6 Inch, 8 Inch, 12 Inch, and others. The 6 Inch segment held a significant market share in 2023.

- In terms of application, the market is segmented into LED, power semiconductor, and MEMS-based devices. The LED segment held a significant market share in 2023.

- Based on end user, the market is segmented into consumer electronics, automotive, healthcare, aerospace and defense, and others. The consumer electronics segment held a significant market share in 2023.

- In terms of type, the market is segmented into heteroepitaxy and homoepitaxy. The heteroepitaxy segment held a significant market share in 2023.

Silicon EPI Wafer Market Share Analysis by Geography

The geographic scope of the Silicon EPI Wafer Market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The Asia Pacific Silicon EPI wafer market is experiencing significant growth in the forecasted period. This growth is attributed to the increasing integration of solar renewable energy into the mainstream energy sector, driven by technological advancements, falling capital costs, new capacity additions, and escalating energy demand. The manufacturers of various electronics and semiconductor products that use silicon EPI wafers as a core component have experienced delays in lead time, impacting the market. Additionally, Asia Pacific benefits from cost-effective manufacturing, a highly skilled workforce, and strong government support for the semiconductor industry, positioning it as a major consumer of electronic products and driving the demand for advanced semiconductor devices, including LEDs, power semiconductors, and MEMS-based devices.

Silicon EPI Wafer Market Regional Insights

The regional trends and factors influencing the Silicon EPI Wafer Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Silicon EPI Wafer Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Silicon EPI Wafer Market

Silicon EPI Wafer Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 3.27 Billion |

| Market Size by 2031 | US$ 6.43 Billion |

| Global CAGR (2023 - 2031) | 8.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Wafer Size

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Silicon EPI Wafer Market Players Density: Understanding Its Impact on Business Dynamics

The Silicon EPI Wafer Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Silicon EPI Wafer Market are:

- Applied Materials, Inc.

- II-VI Incorporated

- Shin-Etsu Chemical Co., Ltd.

- SUMCO Corporation

- Wafer World Inc.

- Siltronic AG

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Silicon EPI Wafer Market top key players overview

Silicon EPI Wafer Market News and Recent Developments

The silicon EPI wafer market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the silicon EPI wafer market are listed below:

- DENSO CORPORATION has decided to adopt a silicon carbide epitaxial wafer for power semiconductor (SiC epi-wafer) manufactured by Resonac Corporation (Tokyo: 4004) (President: Hidehito Takahashi) with the aim of using it as material for driver element of DENSO’s new inverter. This inverter will be installed in Toyota Motor Corporation’s new model, “LEXUS RZ,” which is the first battery electric vehicle (BEV) of the LEXUS brand. This is also the first case for LEXUS to adopt SiC epi-wafer as material for the inverter’s driver element.

(Source: Resonac Holdings Corporation, Company Website, March 2023)

Silicon EPI Wafer Market Report Coverage and Deliverables

The “Silicon EPI Wafer Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Silicon EPI wafer market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Silicon EPI wafer market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Silicon EPI wafer market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the silicon EPI wafer market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Wafer Size, Application, End User, and Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, Taiwan, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The market is projected to record a CAGR of 8.8% during 2023–2031.

The market is expected to reach a value of US$ 6.43 billion by 2031.

Applied Materials, Inc., II-VI Incorporated, Shin-Etsu Chemical Co., Ltd., SUMCO Corporation, Wafer World Inc., Siltronic AG, Nichia Corporation, GlobalWafers Japan Co., Ltd., EpiGaN nv (Soitec Belgium N.V.), SK Siltron Co., Ltd. are key players in the market.

Technological advancements in semiconductor manufacturing processes a key trends in the market.

The increasing demand for advanced semiconductor devices is driving the market.

Get Free Sample For

Get Free Sample For