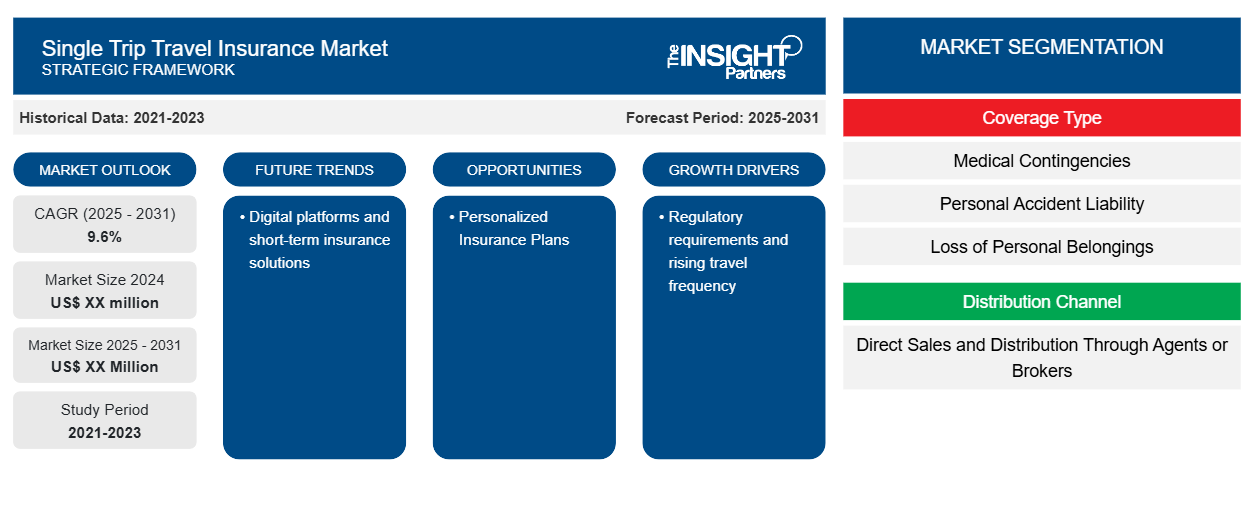

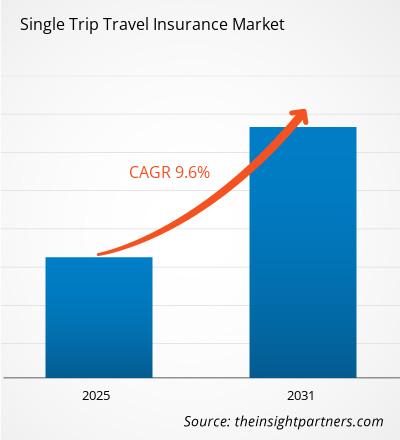

The Single Trip Travel Insurance Market is expected to register a CAGR of 9.6% during 2023–2031. Digital platforms and short-term insurance solutions are likely to remain key trends in the market.

Single Trip Travel Insurance Market Analysis

Overseas journeys are typically prone to bank-breaking occurrences such as aircraft cancellation, missed or misplaced baggage, emergency hospitalizations, etc.; thus, insuring the trip with a single trip travel insurance is most vital even in a once-in-a-lifetime visit to a distant nation. Single trip travel insurance has a lower rate as compared to multi-trip coverage. These can also be customized based on destination-specific needs.

Single Trip Travel Insurance Market Overview

As the name suggests, a single-trip insurance plan is a form of travel insurance policy that only covers one trip. The plan's coverage begins and concludes with the trip itself. Once the user arrives at their return destination, the plan's coverage ends.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Single Trip Travel Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Single Trip Travel Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Single Trip Travel Insurance Market Drivers and Opportunities

Rising Frequency of Travellers to Favor Market

Tourism has expanded dramatically in recent decades. Aviation has expanded domestic and international travel opportunities. Prior to the COVID-19 pandemic, the number of overseas visits has more than doubled since 2000. Tourism may benefit both tourists and the inhabitants of the nations they visit. International tourism is expected to regain about 90% of pre-pandemic levels by the end of the year. According to the most recent data from the World Tourism Organization (UNWTO), an expected 975 million tourists travelled abroad between January and September 2023, a 38% increase over the same months in 2022. This rise in tourism and the number of travellers is driving the demand for single trip travel insurance in the market globally.

Personalized Insurance Plans

The travel insurance industry is about to undergo a shift as a result of advances in artificial intelligence. Personalized insurance coverage is becoming increasingly important as travel becomes more diverse and frequent. Artificial intelligence is optimizing processes and improving customer experience in areas such as insurance claim processing and underwriting. Personalization benefits with exceptional elegance in travel insurance. The generic approach is diminishing as travellers seek coverage that is tailored to their unique risks and interests. AI's data analysis and prediction capabilities enable insurers to offer highly tailored plans.

Single Trip Travel Insurance Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Single Trip Travel Insurance Market analysis are coverage type and distribution channel.

- Based on coverage type, the single-trip travel insurance market is divided into medical contingencies, personal accident liability, loss of personal belongings, loss of passport, trip interruptions, cancellations, and others. The personal accident liability segment held a larger market share in 2023.

- By distribution channel, the market is segmented into direct sales and distribution through agents or brokers.

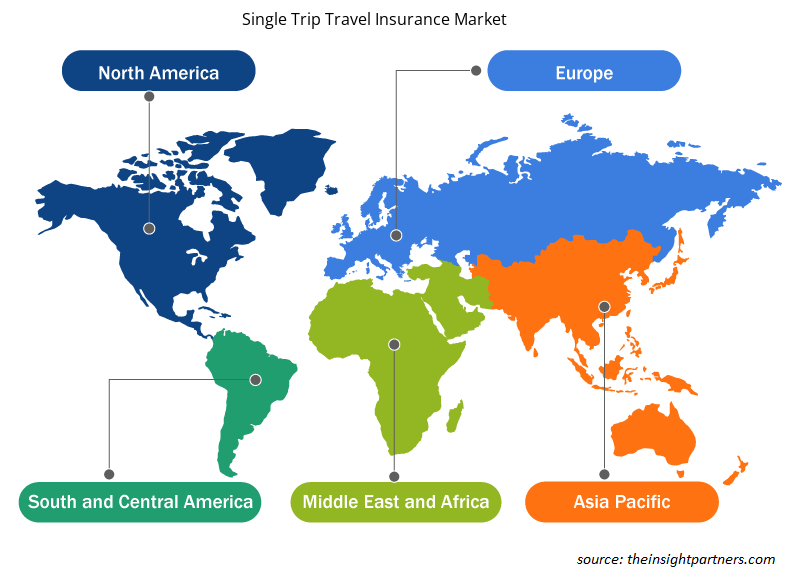

Single Trip Travel Insurance Market Share Analysis by Geography

The geographic scope of the single trip travel insurance market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America held a significant share of the market. The region has a well-developed insurance market and better insurance literacy. The region has a large share of the urban population with high income and financial soundness to invest in insuring travel.

Single Trip Travel Insurance Market Regional Insights

The regional trends and factors influencing the Single Trip Travel Insurance Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Single Trip Travel Insurance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Single Trip Travel Insurance Market

Single Trip Travel Insurance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 9.6% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Coverage Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

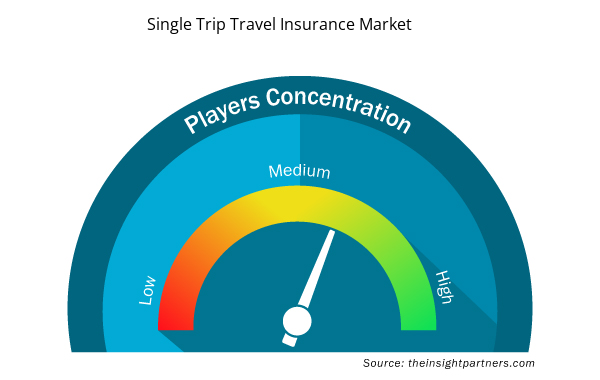

Single Trip Travel Insurance Market Players Density: Understanding Its Impact on Business Dynamics

The Single Trip Travel Insurance Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Single Trip Travel Insurance Market are:

- Tata AIG

- Seven Corners Inc

- Nationwide Mutual Insurance Company

- Generali Global Assistance

- Oriental Travel Insurance

- Bupa Global

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Single Trip Travel Insurance Market top key players overview

Single Trip Travel Insurance Market News and Recent Developments

The single trip travel insurance market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the single trip travel insurance market are listed below:

- Travelex Insurance Services announced the addition of Cancel for Any Reason coverage as an upgrade to the Travel Select plan, giving travellers the assurance to book travel as they return to vacationing in 2021. (Source: Travelex, Press Release, 2021)

Single Trip Travel Insurance Market Report Coverage and Deliverables

The “Single Trip Travel Insurance Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Single trip travel insurance market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Single trip travel insurance market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Single trip travel insurance market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the single trip travel insurance market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Some of the customization options available based on the request are additional 3–5 company profiles and country-specific analysis of 3–5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request.

Tata AIG, Seven Corners Inc, Nationwide Mutual Insurance Company, Generali Global Assistance, Oriental Travel Insurance, Bupa Global, Care Health, Reliance Travel Insurance, Travel Insured International, Bajaj Allianz, Digit General Insurance, GeoBlue, IMG Global, Tin Leg, The Oriental Insurance Company, Royal Sundaram, Travelex, Trawick International, Worlds Nomad, Faye are among the leading payers operating in the single trip travel insurance market.

Digital platforms and short-term insurance solutions are likely to remain key trends in the market.

The single trip travel insurance market is expected to register a CAGR of 9.6% during 2023–2031.

Regulatory requirements and rising travel frequency are expected to drive the Single Trip Travel Insurance market.

Get Free Sample For

Get Free Sample For