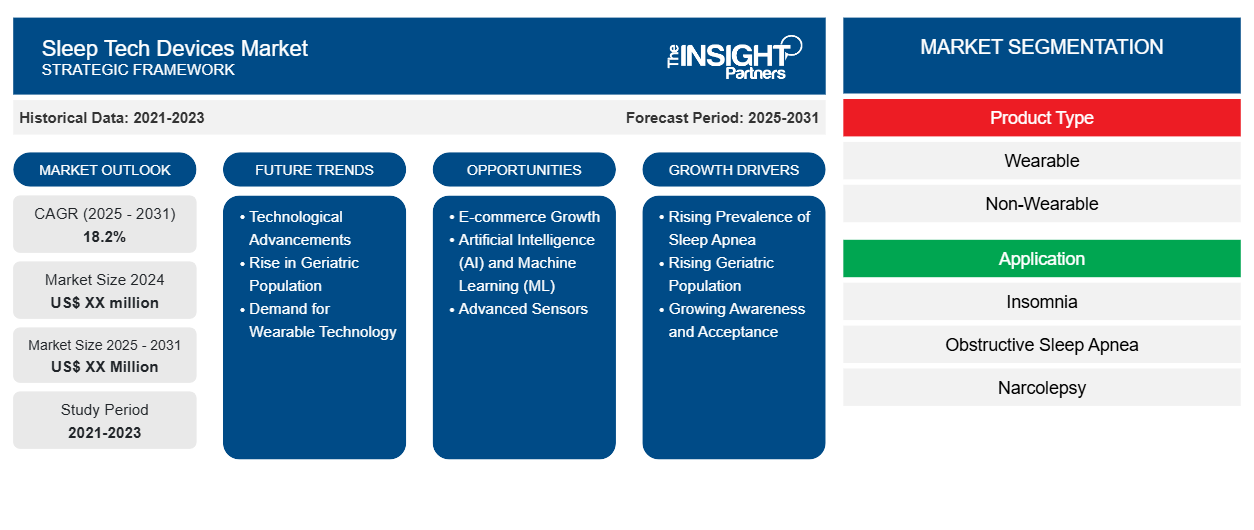

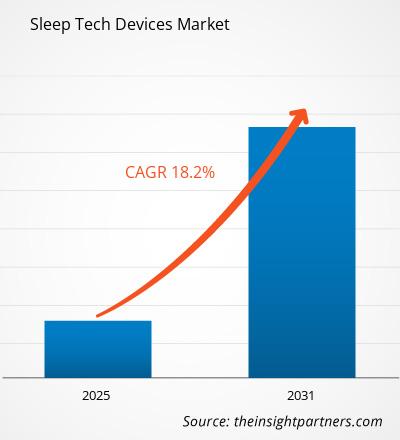

The Sleep Tech Devices Market is expected to register a CAGR of 18.2% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Sleep Tech Devices Market By Product Type [Wearable (Smart Watches & Bands and Others), Non-Wearable (Sleep Monitors, Beds, and Others)], Application (Insomnia, Obstructive Sleep Apnea, Narcolepsy, and Others), Distribution Channel (Sleep Centers & Fitness Centers, Hypermarkets & Supermarkets, E-Commerce, Pharmacy & Retail Stores, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America). The global analysis is further broken-down at regional level and major countries. The Report Offers the Value in USD for the above analysis and segments.

Purpose of the Report

The report Sleep Tech Devices Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Sleep Tech Devices Market Segmentation

Product Type

- Wearable

- Non-Wearable

Application

- Insomnia

- Obstructive Sleep Apnea

- Narcolepsy

- Others

Distribution Channel

- Sleep Centers & Fitness Centers

- Hypermarkets & Supermarkets

- E-Commerce

- Pharmacy & Retail Stores

- Others

Geography

- North America

- Europe

- Asia-Pacific

- South and Central America

- Middle East and Africa

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Sleep Tech Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Sleep Tech Devices Market Growth Drivers

- Rising Prevalence of Sleep Apnea: In the general adult population, the prevalence of OSA, which is indicated by an apnea-hypopnea index (AHI) of five or more occurrences per hour, typically falls between 9% and 38%. Based on more current data from 2008 to 2013, some studies have shown rates as high as 50% for women and 37% for males, indicating that this frequency is noticeably higher in men than in women.

- Rising Geriatric Population: According to the UN.org, the number of people aged 65 years or older worldwide is projected to more than double, rising from 761 million in 2021 to 1.6 billion in 2050. The number of people aged 80 years or older is growing even faster. Such a trend will drive the market of sleep tech devices in the future years.

- Growing Awareness and Acceptance: The demand for sleep technology has increased as a result of growing public awareness of the value of sleep for general health. Customers are more inclined to spend money on products that can enhance their quality of sleep when they learn more about the advantages of these technologies.

Sleep Tech Devices Market Future Trends

- Technological Advancements: These devices are becoming more comfortable and effective thanks to design and material innovations. Newer models have demonstrated encouraging outcomes in terms of lessening snoring and enhancing the quality of sleep. Such a factor has aided the market growth at present and will also continue a similar trend in future years.

- Rise in Geriatric Population: The need for sleep technology devices that are suited to the demands of the elderly population is growing as a result of their increased vulnerability to sleep problems. The elderly are a crucial market for these items since they frequently deal with conditions like sleeplessness and other sleep-related disorders.

- Demand for Wearable Technology: The use of wearable technology for tracking health indicators has spread to the field of sleep technology. Because of their accessibility and ease of use, wearable sleep trackers held a sizable market share in 2023 and are predicted to do so going forward. Multipurpose gadgets that can monitor several health metrics, including sleep patterns, are becoming more and more popular among consumers.

Sleep Tech Devices Market Opportunities

- E-commerce Growth: A variety of sleep technology devices are becoming more easily accessible thanks to the growth of e-commerce platforms. Customers may read reviews, compare items, and make well-informed judgments when they shop online, which boosts sales in this market. Leading companies in the industry are aggressively introducing new goods with cutting-edge features meant to improve user experience and solve particular sleep-related problems. This competitive environment encourages market diversification and ongoing improvement.

- Artificial Intelligence (AI) and Machine Learning (ML): By allowing gadgets to evaluate enormous volumes of sleep data, spot trends, and offer tailored recommendations, AI and ML are transforming the sleep technology industry. By altering bedtime habits or environmental elements like lighting and room temperature, individuals can customize their sleep to suit their specific needs.

- Advanced Sensors: The precision of sleep tracking has increased because to the incorporation of advanced sensors in sleep technology devices. These sensors provide thorough insights into the cycles and quality of sleep by tracking a variety of physiological characteristics, such as heart rate, breathing patterns, and body movements. These sensors are used by wearable technology and smart mattresses to collect data in real time for improved analysis.

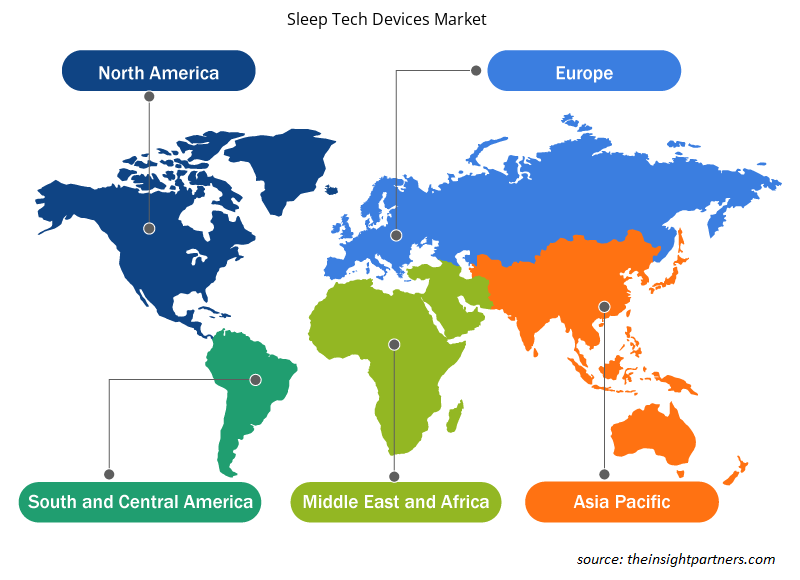

Sleep Tech Devices Market Regional Insights

The regional trends and factors influencing the Sleep Tech Devices Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Sleep Tech Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Sleep Tech Devices Market

Sleep Tech Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 18.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

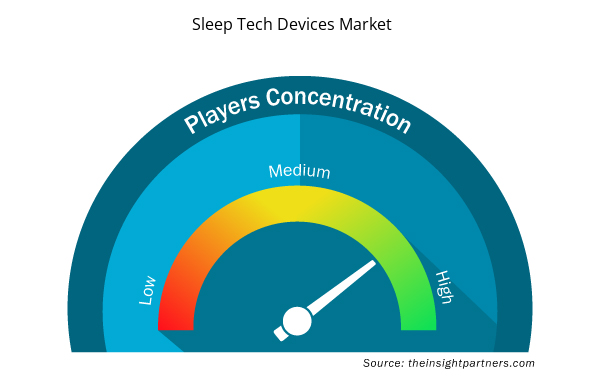

Sleep Tech Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Sleep Tech Devices Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Sleep Tech Devices Market are:

- Apple Inc

- Koninklijke Philips N.V.

- SleepScore Labs

- Withings

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Sleep Tech Devices Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Sleep Tech Devices Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Sleep Tech Devices Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

High Competition and Price Pressure

Asia Pacific region is expected to witness the highest growth during the forecast period

The Sleep Tech Devices Market is estimated to witness a CAGR of 18.2% from 2023 to 2031

Europe region is expected to witness a high growth rate in terms of CAGR after Asia Pacific region during the forecast period

Rising Prevalence of Sleep Apnea

Get Free Sample For

Get Free Sample For