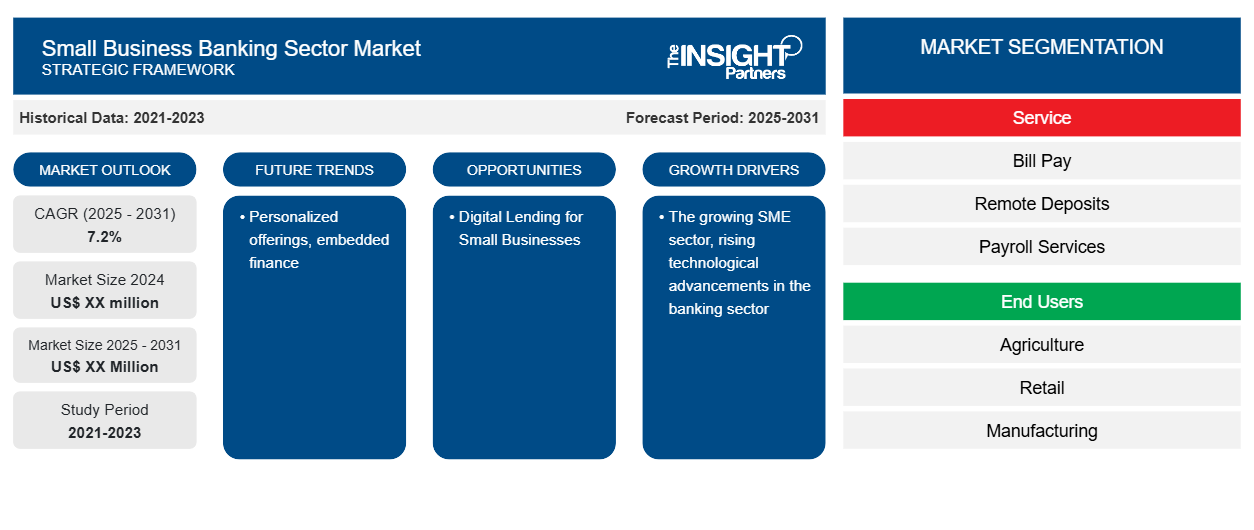

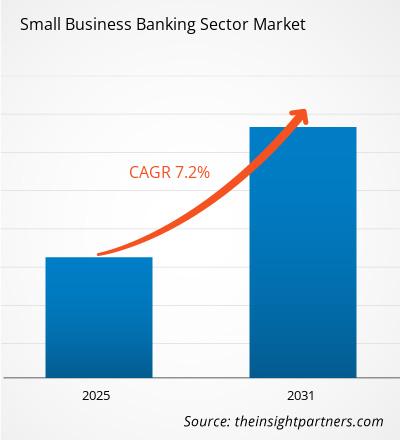

The Small Business Banking Sector market is expected to register a CAGR of 7.2% during 2023–2031. Personalized offerings and embedded finance are likely to remain key trends in the market.

Small Business Banking Sector Market Analysis

Small business banking solutions cater to various needs and demands from small enterprise customers. It assists the institution financially to capitalize on opportunities to increase their income. SMEs play a crucial role in regions economic development, particularly in developing economies. They represent about 90% of businesses and more than 50% of employment worldwide. According to the World Bank, 600 million jobs will be required by 2031 to accommodate the rising global workforce, making SME growth a top priority for many governments around the world. This is driving the market for the small business banking sector.

Small Business Banking Sector Market Overview

Small businesses constitute a significant chunk of a bank’s revenue. In the current market scenario with tech development, there are limited barriers to the entry of startups and small businesses in the world. Banks offering small business finances and services are focusing on overhauling their operations and offering to support small businesses in their growth. This helps them capitalize on the current momentum to acquire new customers. According to Fiserv, on average, 10% of the bank’s accounts are constituted by small businesses. But they generate 35% of its revenue.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Small Business Banking Sector Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Small Business Banking Sector Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Small Business Banking Sector Market Drivers and Opportunities

Strengthening of the MSME Sector Globally to Favor Market

Small and medium-sized firms (SMEs) provide significant contributions to the global economy, including income, output, and employment, according to a report by National Action Plans on Business and Human Rights. The world's estimated 400 million SMEs serve as the backbone of economies. They are the primary source of job creation worldwide, accounting for more than 95% of enterprises and 60-70% of employment. SMEs create a significant percentage of new jobs in OECD nations and even more so in the EU, where they account for nearly 99% of all enterprises, 85% of new jobs, and two-thirds of total private sector employment. This motivated financial institutions across the world to develop and offer substantial lending and banking offers to the small business sector.

Digital Lending for Small Businesses

MSME digital lending is gradually increasing as internet lenders offer advantages to small firms. Online digital lending solutions for MSMEs are gaining appeal for a variety of reasons, including an easy loan application process, speedy loan approval and disbursement, and reduced credit history monitoring. Digital lending is becoming a popular funding alternative for MSMEs. The number of online money lending platforms and Neobanks is increasing as they seek to meet credit demand among MSMEs and individuals. Small businesses are drawn to digital financing options for a variety of reasons, including more relaxed approval criteria and shorter processing times.

Small Business Banking Sector Market Report Segmentation Analysis

Key segments that contributed to the derivation of the small business banking sector market analysis are service and end users.

- Based on service, the small business banking sector market is divided into working capital loans, merchant finance, long-term loans, unsecured loans, and others. The working capital loans segment held a larger market share in 2023.

- By end user, the market is segmented into agriculture, retail, manufacturing, construction, transportation, and others.

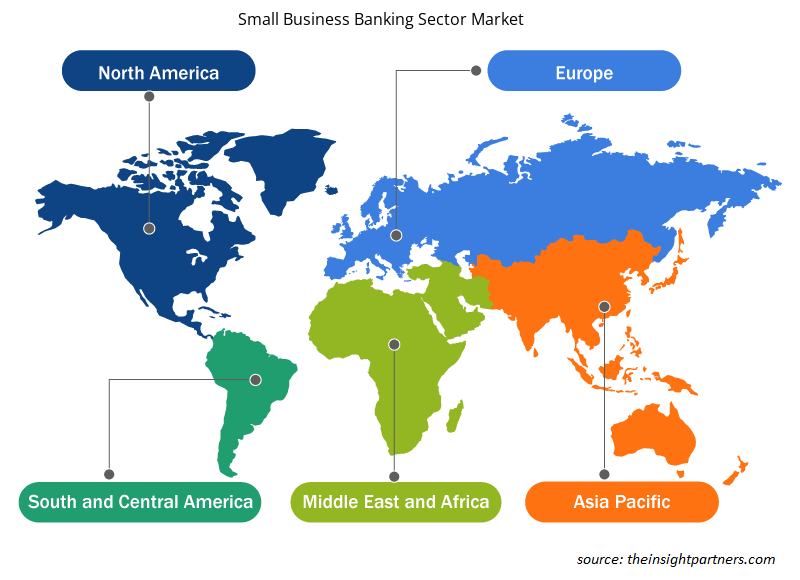

Small Business Banking Sector Market Share Analysis by Geography

The geographic scope of the small business banking sector market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the market. According to the statistics shared by the Small Business Administration, 45 to 50% of US GDP is constituted by the SME sector. Established a strong financial sector for the growth of these SMEs, boosting the growth of the market in the region.

Small Business Banking Sector Market Regional Insights

The regional trends and factors influencing the Small Business Banking Sector Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Small Business Banking Sector Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Small Business Banking Sector Market

Small Business Banking Sector Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 7.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Service

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Small Business Banking Sector Market Players Density: Understanding Its Impact on Business Dynamics

The Small Business Banking Sector Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Small Business Banking Sector Market are:

- Fiserv

- Bank of America

- NBKC

- Chase

- Wise

- Comerica

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Small Business Banking Sector Market top key players overview

Small Business Banking Sector Market News and Recent Developments

The small business banking sector market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the small business banking sector market are listed below:

- Fiserv, Inc., a leading global provider of payments and financial services technology, is partnering with Genesis Bank, one of only two diverse multiracial Minority Depository Institutions (MDIs) in the country, to drive economic empowerment and create a positive impact in local communities. (Source: Fiserv, Newsletter, 2024)

- U.S. bank is doubling its team of Business Access Advisors in order to serve more cities. As a Business Access Advisor at U.S. Bank, Cassandra Kidd’s goal is to help underserved small businesses thrive by providing them access to information, connections, and other resources. (Source: U.S. Bank, Newsletter, 2024)

Small Business Banking Sector Market Report Coverage and Deliverables

The “Small Business Banking Sector Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Small business banking sector market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Small business banking sector market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Small business banking sector market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the small business banking Sector market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Some of the customization options available based on the request are additional 3–5 company profiles and country-specific analysis of 3–5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request.

Fiserv, Bank of America, NBKC, Chase, Wise, Comerica, TD Bank, U.S. Bank, Capital One, First Citizens Bank, IndusInd Bank, Wells Fargo, Truist, Scotiabank, WaFd Bank, WSFS bank, Santander Bank, First Bank, Axos Bank, LendingClub, First Internet Bancorp and among the leading payers operating in the small business banking sector market.

Personalized offerings and embedded finance are likely to remain key trends in the market.

The small business banking sector market is expected to register a CAGR of 7.2% during 2023–2031.

The growing SME sector and rising technological advancements in the banking sector are expected to drive the small business banking sector market.

Get Free Sample For

Get Free Sample For