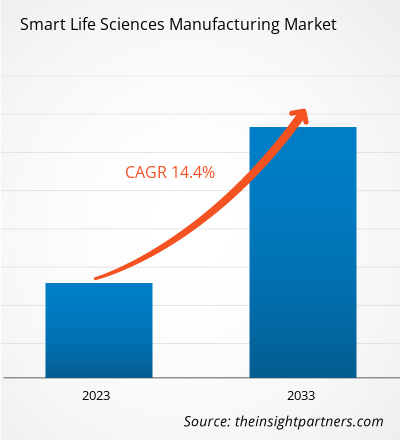

The smart life sciences manufacturing market is projected to reach US$ 78,974.61 million by 2033 from US$ 18,649.50 million in 2022; it is expected to record a CAGR of 14.4% during 2023–2033.

The life sciences manufacturing process has changed significantly over the past ten years. Life science manufacturing is a complex process. A smart factory concept that interconnects machinery and system on the production site can simplify the manufacturing process. The system is also connected to the client, partner, and production site. After COVID-19 pandemic, many pharma and medical device manufacturers started to adopt pharma 4.0 esp. due to rising regulations and inspection concerns. Smart life sciences manufacturing, often known as Pharma 4.0, aims to provide practical guidance, embed regulatory best practices, and accelerate Pharma 4.0 transformations. The main goal is to allow organizations participating in the pharmaceutical product lifecycle to control the full potential of digitalization and provide faster therapeutic innovations & improved production processes for the benefit of end-users. These changes will bring huge opportunities to life science manufacturers in the coming years. Modern data analytics tools have allowed biotechnology researchers to create predictive analytics models and understand the most effective ways to achieve their goals and objectives. Big data, AI, virtual reality, data visualization, and data security are among the common technologies used in biotech laboratories. Such factors are expected to boost the smart life sciences manufacturing market size strongly in the coming years.

Smart Life Sciences Manufacturing Market -

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Smart Life Sciences Manufacturing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Smart Life Sciences Manufacturing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights – Smart Life Sciences Manufacturing Market

The pharmaceutical segment is a key contributor to the global industrial sector. Moreover, the demand and sales of medicine are increasing every day. Thus, pharmaceutical manufacturing businesses invest huge amounts of economic resources in R&D for bringing innovations to markets. Technology upgrades are the key to tackling future manufacturing problems. With this, the Pharma 4.0 market is gaining huge attention worldwide. In June 2022, GSK, a British Big Pharma, inaugurated its new aseptic smart manufacturing plant in Barnard Castle, England. This fully automated plant leverages digitalization to streamline the manufacturing process. This, in turn, would allow GSK to accelerate the launch of new medicines while cutting down on waste. In December 2020, Bayer AG announced the launch of a Cell and Gene Therapy Platform within its Pharmaceuticals division. This platform will combine multiple backbone functions for providing support across the entire value chain of the research and development of cell and gene therapies. In November 2020, the UK started building a “factory of the future” to renovate small-molecule drug production. Drugmakers, academic institutions, healthcare providers, and regulators are expected to come together at the facility to test and improve new technologies, including continuous, digital, and autonomous manufacturing. Hence, the growing adoption of digital transformation is expected to boost the smart life sciences manufacturing market size.

Component-Based Insights

The smart life sciences manufacturing market, by component, is bifurcated into solutions and services. The solutions segment is expected to hold a larger smart life sciences manufacturing market share during the forecast period, despite recording slower growth rates than the services segment. The pharmaceutical industry is rapidly adopting digital transformation as digitalization brings flexibility and efficiency to processes. With the growing complexity of production systems and processes, establishing interconnectivity and deploying robust smart factory solutions in line with good manufacturing practices (GMP) have become a strategic priority for life sciences companies. Moreover, Industry 4.0 has simplified the process of accessing operations data, along with enabling businesses to meet targeted key performance indicators (KPIs). Smart manufacturing solutions assist in quality management by monitoring the temperature and humidity of inventory, monitoring end-to-end process visibility, enhancing product consistency, and identifying specific issues related to batch manufacturing. The life science industry engages in developing novel, effective, quality, and precise treatments. Pioneers in the industry are exploring new therapeutic areas and approaches by harnessing the latest technological advancements to gain a competitive edge. Such factors drive the smart life sciences manufacturing market growth for the solutions segment.

The smart life sciences manufacturing market is segmented on the basis of component, technology, and application. Based on component, the market is bifurcated into solutions and services. By technology, the smart life sciences manufacturing market is segmented into Augmented Reality/Virtual Reality (AR/VR) systems, Internet of Things (IoT), artificial intelligence (AI), cybersecurity, big data, and others. IoT segment commanded the largest smart life sciences manufacturing market share in 2022. Based on application, the smart life sciences manufacturing market is segmented into pharma, bio-pharma, and medical device. Based on geography, the smart life sciences manufacturing market is primarily segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM). ABB Ltd, Bosch Rexroth AG, Emerson Electric Co, Fortinet Inc, General Electric Co, Honeywell International Inc, IBM Corporation, Rockwell Automation, Siemens AG, and Sophos Group plc are among the key smart life sciences manufacturing market players.

Smart Life Sciences Manufacturing Market Regional Insights

The regional trends and factors influencing the Smart Life Sciences Manufacturing Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Smart Life Sciences Manufacturing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Smart Life Sciences Manufacturing Market

Smart Life Sciences Manufacturing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 18.65 Billion |

| Market Size by 2033 | US$ 78.97 Billion |

| Global CAGR (2022 - 2033) | 14.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2033 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Smart Life Sciences Manufacturing Market Players Density: Understanding Its Impact on Business Dynamics

The Smart Life Sciences Manufacturing Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Smart Life Sciences Manufacturing Market are:

- ABB Ltd

- Bosch Rexroth AG

- Emerson Electric Co

- Fortinet Inc

- General Electric Co

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Smart Life Sciences Manufacturing Market top key players overview

Smart life sciences manufacturing market players mainly focus on partnerships to create customer value.

- In February 2023, Theragent, a cell therapy CDMO focused on advancing next-generation cancer and rare disease treatments, signed a multi-year exclusive contract with Insight68, an AI-driven software provider that aims to digitalize and streamline the cell therapy manufacturing process. The partnership reinforces Theragent's commitment to 100% digital batch record compliance and elevates the company's reputation as a leading CDMO in the current biopharma manufacturing transformation.

- In December 2022, Hovione announced a strategic collaboration with GEA for Advance Continuous Tableting. Hovione is a company engaged in industrializing and democratizing emerging pharmaceutical technologies. It offers amorphous solid spray-dried dispersions converted into dependable and scalable offerings, made available to all.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Electronic Signature Software Market

- Embolization Devices Market

- Excimer & Femtosecond Ophthalmic Lasers Market

- Hydrocephalus Shunts Market

- Visualization and 3D Rendering Software Market

- Wheat Protein Market

- Ceramic Injection Molding Market

- Real-Time Location Systems Market

- Small Satellite Market

- Playout Solutions Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Technology, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The incremental growth, expected to be recorded for the smart life sciences manufacturing market during the forecast period, is US$ 58,475.08 million.

The solutions segment led the smart life sciences manufacturing market with a significant share in 2022.

The smart life sciences manufacturing market is expected to reach US$ 78.974.61 million by 2033.

India, China, and Germany are expected to register high growth rates during the forecast period.

The US held the largest market share in 2022, followed by China.

Asia Pacific is the fastest growing regional market, followed by Europe.

The key players, holding majority shares, in smart life sciences manufacturing market includes ABB Ltd, Emerson Electric Co, General Electric Co, Honeywell International Inc, and Rockwell Automation.

The connection of data silos is increasing, which is likely to result in better access to insights and data leads. Additionally, there is an increasing usage of blockchain, coupled with roadmaps been created for Pharma 5.0.

Smart life sciences manufacturing market is being driven by the growing adoption of Pharma 4.0. Additionally, rising application of advanced technologies in cancer research is expected to provide growth opportunities for the smart life sciences manufacturing market.

The global smart life sciences manufacturing market was estimated to be US$ 18,649.50 million in 2022 and is expected to grow at a CAGR of 14.4%, during the forecast period 2023 - 2033.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies - Smart Life Sciences Market

- ABB Ltd

- Bosch Rexroth AG

- Emerson Electric Co

- Fortinet Inc

- General Electric Co

- Honeywell International Inc

- IBM Corporation

- Rockwell Automation

- Siemens AG

- Sophos Group plc

Get Free Sample For

Get Free Sample For