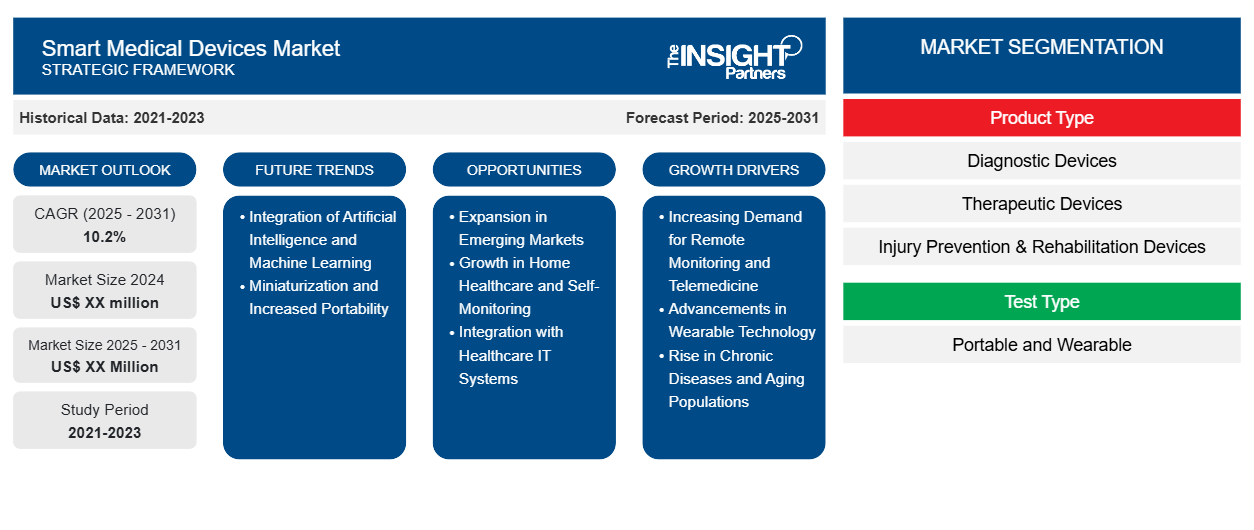

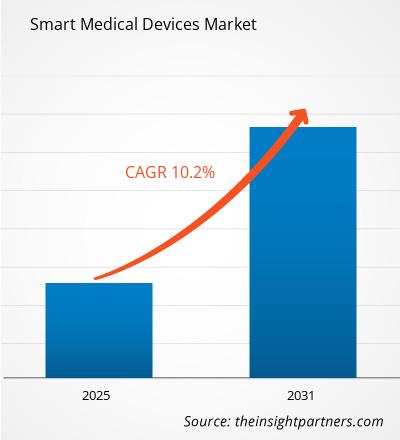

The Smart Medical Devices Market is expected to register a CAGR of 10.2% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Product Type (Diagnostic Devices, Therapeutic Devices, Injury Prevention & Rehabilitation Devices, and Others), Test Type (Portable and Wearable), End User (Hospitals & Clinics, Homecare Settings, and Others). The Report Offers the Value in USD for the above analysis and segments.

Purpose of the Report

The report Smart Medical Devices Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Smart Medical Devices Market Segmentation

Product Type

- Diagnostic Devices

- Therapeutic Devices

- Injury Prevention & Rehabilitation Devices

- Others

Test Type

- Portable and Wearable

End User

- Hospitals & Clinics

- Homecare Settings

- Others

Geography

- North America

- Europe

- Asia-Pacific

- South and Central America

- Middle East and Africa

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Smart Medical Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Smart Medical Devices Market Growth Drivers

- Increasing Demand for Remote Monitoring and Telemedicine: The market for smart medical devices is expanding due to the increasing demand for remote patient monitoring and telemedicine services. As healthcare systems continue to evolve more towards the home care model, the need for real time diagnostic equipment becomes inevitable. Such devices allow patients with chronic illnesses to easily check back into the healthcare system, improving convenience, bettering the services that patients receive and the market as well.

- Advancements in Wearable Technology: The use of such health wearable devices as health trackers, smart watches, and ECG monitors has significantly changed the health care sector. Such devices facilitate constant tracking of vital signs and health parameters such as heart rates, blood pressure and glucose levels enabling the patients to manage their health effectively. The rise in user’s willingness to wear such devices for health purposes is also driving growth in the market in any clinical setting and in consumer markets as well.

- Rise in Chronic Diseases and Aging Populations: The risk factors of chronic diseases management such as diabetes; cardiovascular disease, respiratory disease, and other chronic conditions coupled with the older population is generating the demand of smart medical devices. These devices allow management and monitoring of chronic conditions to decrease the incidence of hospital admissions for such patients and improve their quality of life. The elderly population demographic geography stimulates even more the personalized and effective medicine.

Smart Medical Devices Market Future Trends

- Integration of Artificial Intelligence and Machine Learning: The smart medical devices market is being reshaped by the technology of AI and its cousin ML. AI algorithms allow not only for the improvement of diagnosis and prescribing accuracy, but also for predicting how aggressive a disease is, or what kind of therapy should be offered to certain patients. They enable the devices to collect, store and analyze a patient’s data at the same moment while spacing time for treatment options improvement and making suggestions towards treatment enhancing healthcare delivery and its availability and smartness to a single patient thus increasing the market.The smart medical devices market is being reshaped by the technology of AI and its cousin ML. AI algorithms allow not only for the improvement of diagnosis and prescribing accuracy, but also for predicting how aggressive a disease is, or what kind of therapy should be offered to certain patients. They enable the devices to collect, store and analyze a patient’s data at the same moment while spacing time for treatment options improvement and making suggestions towards treatment enhancing healthcare delivery and its availability and smartness to a single patient thus increasing the market.

- Miniaturization and Increased Portability: The miniaturization of medical devices is one of the significant trends being witnessed in the smart medical devices market today. Such devices which are relatively smaller in size and lighter in weight are helping patients improve adherence to treatment as well as improving on the comfort of the patient. The devices, which can be very small in size such as handheld ECGs or insulin pumps, are making health care services much more accessible to patients, especially those who need constant care or need the service while moving around.

Smart Medical Devices Market Opportunities

- Expansion in Emerging Markets: New geographies, especially in the Asia-Pacific and Latin American regions, provide an enormous potential for smart medical devices. These regions are becoming more urbanized, the healthcare systems are improving, and there is more awareness about health - all factors that increase the need for medical devices. Simple and affordable smart devices that satisfy the existing health care demands, are likely to enhance the adoption rates of smart medical devices in those areas.

- Growth in Home Healthcare and Self-Monitoring: Home healthcare and self-monitoring are rising trends that will significantly benefit the smart medical device market. Wearable heart monitors, glucose monitoring devices, and digital stethoscopes allows patients to take care of themselves at their convenience. With the rise in demand for managing health from a distance, the range of smart devices meant for home use only is on the rise.

- Integration with Healthcare IT Systems: An opportunity arises due to the merging of clinical equipment and health facilities’ information technology systems resourcing such as electronic health records (HER) and their cloud counterparts. These systems support data integration enabling data sharing, monitoring of patients externally and health status updates in real time which enhances diagnosis and treatment of patients. This promotes the purpose of the advanced smart devices in healthcare service delivery and increases their demand in the market.

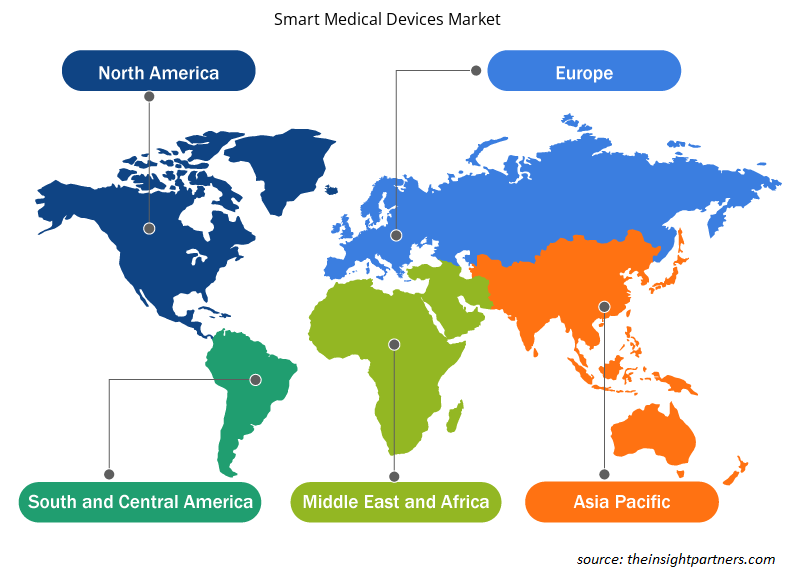

Smart Medical Devices Market Regional Insights

The regional trends and factors influencing the Smart Medical Devices Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Smart Medical Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Smart Medical Devices Market

Smart Medical Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 10.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

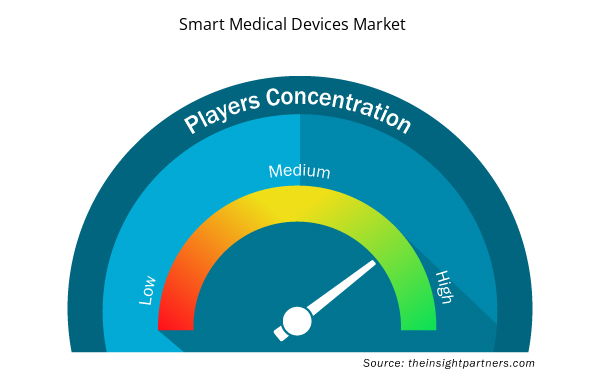

Smart Medical Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Smart Medical Devices Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Smart Medical Devices Market are:

- Abbott Laboratories

- Apple, Inc.

- Dexcom, Inc.

- Fitbit, Inc.

- F. Hoffman-La-Roche Ltd.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Smart Medical Devices Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Smart Medical Devices Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Smart Medical Devices Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Truck Refrigeration Market

- Small Satellite Market

- Predictive Maintenance Market

- Collagen Peptides Market

- Artificial Intelligence in Defense Market

- Advanced Planning and Scheduling Software Market

- Equipment Rental Software Market

- Real-Time Location Systems Market

- Europe Tortilla Market

- Dropshipping Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The diagnostic devices segment accounts for highest revenue in product type segment in 2023

The Smart Medical Devices Market is estimated to witness a CAGR of 10.2% from 2023 to 2031

Asia Pacific region dominated the smart medical devices market in 2023

North America region dominated the smart medical devices market in 2023

The major factors driving the smart medical devices market are:

1.Increasing Demand for Remote Monitoring and Telemedicine

2.Advancements in Wearable Technology

3. Rise in Chronic Diseases and Aging Populations

Abbott Laboratories, Apple, Inc., Dexcom, Inc., Fitbit, Inc., F. Hoffman-La-Roche Ltd., Johnson & Johnson, Medtronic, Zephyr, and Sonova are some of the major market players operating in the market

Trends and growth analysis reports related to Life Sciences : READ MORE..

- Abbott Laboratories

- Apple, Inc.

- Dexcom, Inc.

- Fitbit, Inc.

- F. Hoffman-La-Roche Ltd.

- Johnson & Johnson

- Medtronic

- NeuroMetrix, Inc.

- Zephyr

- Sonova

Get Free Sample For

Get Free Sample For