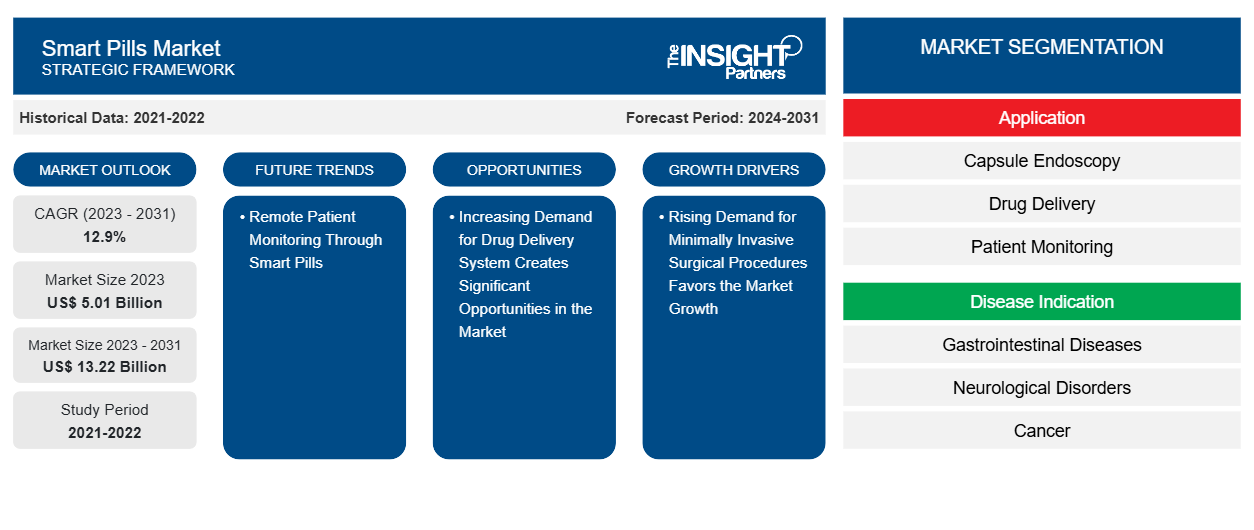

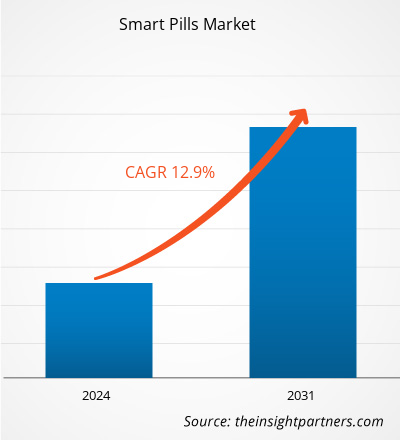

The smart pills market size is projected to reach US$ 13.22 billion by 2031 from US$ 5.01 billion in 2023. The market is expected to register a CAGR of 12.90% during 2023–2031. Remote patient monitoring through smart pills will likely remain a key trend in the market.

Smart Pills Market Analysis

The market for smart pills will grow even more with increased R&D expenditures. Businesses are developing products, and technological advancements like bioelectronics, microprocessor availability, micro-cameras, and miniaturization are expected to expand the market. The market for smart pills is anticipated to overgrow in the Asia-Pacific region due to the rise in chronic illnesses. Businesses in the worldwide market for smart pills have been using both organic and inorganic strategies, which has helped the market expand. These strategies have aided in both the market's expansion and the players' commercial growth, including product launches, partnerships, and acquisitions. For example, Otsuka America Pharmaceutical, Inc. declared in August 2020 that it had acquired Proteus Digital Health, Inc.'s (Proteus) assets, including the intellectual property and assets related to its wearable and edible sensor technology.

Smart Pills Market Overview

Strategic partnerships are essential to the overall expansion of the smart pill market. The participants engage in partnerships, joint ventures, acquisitions, and mergers. In addition, the amount of money invested in the smart pill market is expanding quickly. Several investors are drawn to smart pills due to their growing appeal among people worldwide. Many businesses and investment firms invest significantly in startups, mergers, and acquisitions. These elements may contribute to the market for smart pills expanding more quickly. Other market growth factors include partnerships and collaborations between companies and research institutions, increased R&D investment in smart pills, and licensing agreements. For example, etectRx, Inc. and Pear Therapeutics, Inc. entered into a partnership agreement in January 2021 to develop two product candidates in the CNS space that integrate PDTs (Prescription Digital Therapeutics) and adherence sensors. This collaboration is the first to investigate the use of digital pill solutions with PDTs. Proteus Digital Health, a manufacturer of smart pills, was purchased by Otsuka for USD 15 million in August 2020.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Smart Pills Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Smart Pills Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Smart Pills Market Drivers and Opportunities

Rising Demand for Minimally Invasive Surgical Procedures Favors the Market Growth

The elderly population is particularly susceptible to gastrointestinal conditions. Numerous smart pills are currently being examined for possible use in treating a variety of acute and chronic illnesses. A sizable market for advanced drug delivery products is projected to consist of patients with chronic diseases who take their medications at the target site according to a prescribed dose. The rising need for less invasive surgical procedures has given rise to cutting-edge methods like capsule endoscopy. Because of its many benefits, such as its ease of administration and ability to provide detailed observation of the gastrointestinal tract, capsule endoscopy is predicted to replace traditional endoscopy methods eventually.

Along with new component innovations and hybrid imaging technologies, the capsule endoscopy is essential for the early diagnosis and appropriate treatment of these disorders. According to the University of Texas Health Science Center, using different colorectal cancer screening methods, like capsule endoscopy, increases screening adherence. The university found capsule endoscopy provides more accurate diagnostic results than CT colonography, based on a study involving randomly assigned patients ages 50 to 75. These findings are expected to accelerate the segment's growth throughout the projection period.

Individuals who require home healthcare services to the fullest extent possible encounter difficulties in obtaining and utilizing smart pills. As a result, manufacturers and developers have improved the devices' usability and accessibility, making it easier to interpret data. Most sectors provide compatible software that allows data to be collected over extended periods, providing helpful information about patients' health and recommendations for improving their quality of life. The demand for smart pills is increasing due to their ability to connect to smartphones via Bluetooth and present data in an easy-to-understand and statistical format.

Increasing Demand for Drug Delivery System Creates Significant Opportunities in the Market

There has been an increase in demand for drug delivery systems that offer essential advantages like low side effects or adverse effects, targeted drug delivery, best use of API, and fewer doses required. This has also led to the development of smart pills by integrating cutting-edge medications, technological advancements, and medical equipment into drug delivery systems. The patient base for smart pills is probably going to be composed of people with chronic illnesses who require a specific dosage of medication. The following are just a few of the promotional activities that the companies have provided: product launches, investments, and acquisitions.

Otsuka (Proteus) introduced smart chemo pills in 2019 to enhance the prognosis of cancer patients.

In 2019, Pillo Health and Stanley Black & Decker introduced a robot companion to dispense pills. An integrated voice assistant for communication with caregivers and patients has been designed to assist patients with chronic conditions maintain their medication schedule and overall health.

Technologies for smart pills offer groundbreaking breakthroughs for applications in life science research. Thus, during the forecast period, the market for smart pills is expected to grow faster due to the rising demand for drug delivery systems in emerging economies.

Smart Pills Market Report Segmentation Analysis

Key segments that contributed to the derivation of the smart pills market analysis are application, disease indication, and end user.

- Based on application, the smart pills market is segmented into drug delivery, capsule endoscopy, and patient monitoring. The capsule endoscopy segment held the most significant market share in 2023.

- By disease indication, the market is categorized into inherited disorders, gastrointestinal diseases, neurological disorders, cancer, and other disease indications. The gastrointestinal diseases segment held the largest share of the market in 2023.

- By end user, the market is segmented into hospitals and clinics, home healthcare and research institutes. The hospitals and clinics segment held the significant share of the market in 2023.

Smart Pills Market Share Analysis by Geography

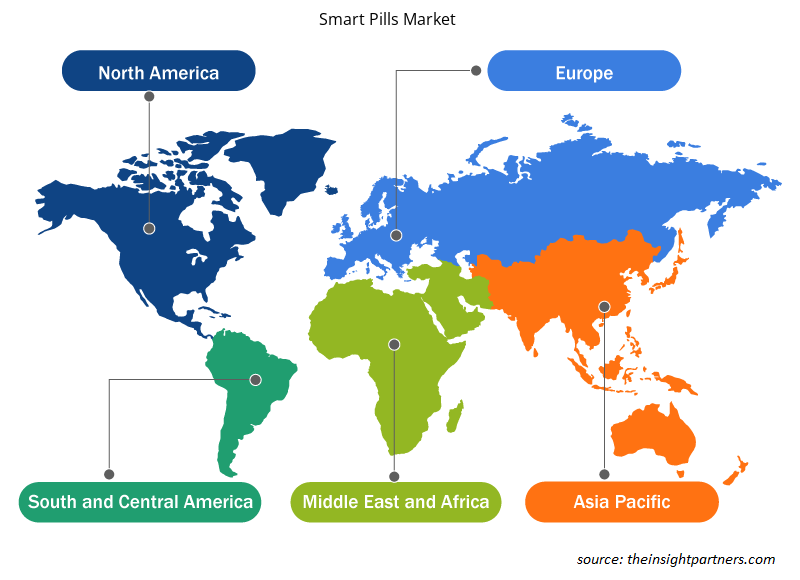

The geographic scope of the smart pills market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The North America smart pills market is segmented into the US, Canada, and Mexico. The increase in the demand for minimally invasive devices in the US, and the rise in gastrointestinal disorders in the U.S., characterize the growth of North America. In addition, rapid technological advancements in drug delivery will likely boost the North American smart pills market during the forecast period. The growth of this market is mainly driven by the growing prevalence of gastrointestinal diseases, favorable reimbursement scenarios, FDA approvals for smart pills, developments by the market players, and the presence of significant market players in the US will accelerate the growth of this market in this country. Furthermore, the growing prevalence of neurological diseases is likely to demand smart pills for the real-time diagnosis and treatment of the disease. As per the Alzheimer’s Association, in 2020, an estimated 5.8 million Americans aged 65 or more are living with Alzheimer’s dementia, and the number is expected to reach 13.8 million by 2050. Thus, the growing prevalence of neurological diseases will likely favor the market's growth during the forecast period.

Smart Pills Market Regional Insights

The regional trends and factors influencing the Smart Pills Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Smart Pills Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Smart Pills Market

Smart Pills Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 5.01 Billion |

| Market Size by 2031 | US$ 13.22 Billion |

| Global CAGR (2023 - 2031) | 12.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Smart Pills Market Players Density: Understanding Its Impact on Business Dynamics

The Smart Pills Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Smart Pills Market are:

- CapsoVision, Inc.

- Given Imaging, Inc.

- Check-Cap

- PENTAX Medical

- Olympus

- BodyCap

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Smart Pills Market top key players overview

Smart Pills Market News and Recent Developments

The smart pills market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the smart pills market are listed below:

- Check-Cap Ltd. announced that the Company had received approval from the U.S. Food and Drug Administration (FDA) for its amended Investigational Device Exemption (IDE) application, enabling the initiation of the U.S. pivotal study. (Source: Check-Cap Ltd, Press Release, February 2022)

- Dignio AS, Norway’s leading provider of digital remote care to Home Care services and Care Homes, announced today that it has integrated AceAge Inc. Karie – smart pill dispenser, into its Dignio Connected Care solution. (Source: Dignio AS, Press Release, February 2022)

Smart Pills Market Report Coverage and Deliverables

The “Smart Pills Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Smart pills market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Smart pills market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Smart pills market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the smart pills market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Application, Disease Indication, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

CapsoVision, Inc., Check-Cap, Olympus, BodyCap, Otsuka America Pharmaceutical, Inc., PENTAX Medical, IntroMedic, Jinshan Science & Technology (Group) Co., Ltd., Given Imaging, Inc., RF Co., Ltd.

Remote patient monitoring through smart pills will likely remain a key trend in the market.

Key factors driving the market are rising demand for minimally invasive surgical procedures and an upsurge in strategic collaborations & partnerships on smart pills

North America dominated the smart pills market in 2023

The market is expected to register a CAGR of 12.90% during 2023–2031.

Get Free Sample For

Get Free Sample For