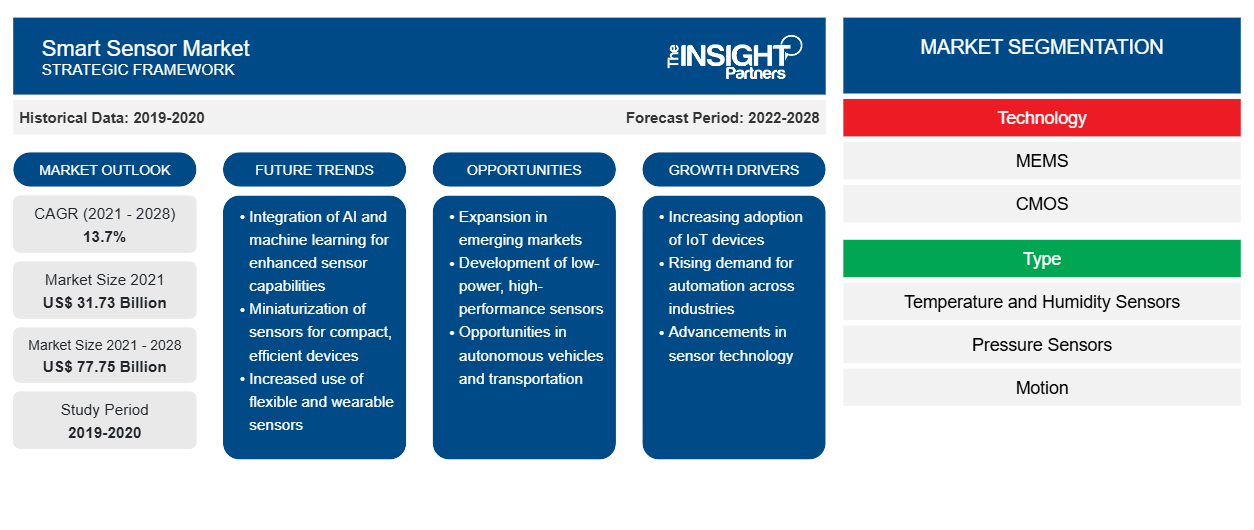

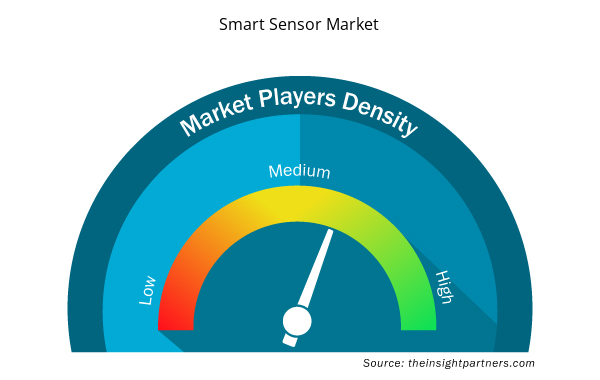

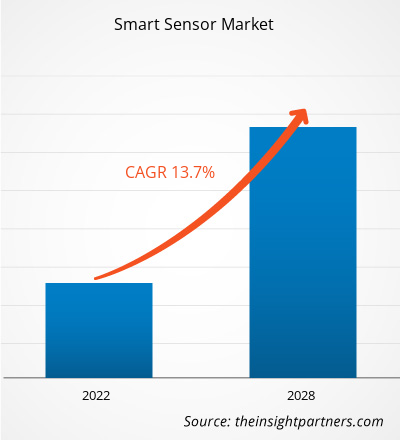

The smart sensor market is expected to grow from US$ 31,731.1 million in 2021 to US$ 77,747.6 million by 2028. It is estimated to grow at a CAGR of 13.7% between 2021 to 2028.

Smart sensor is faster and more accurate than traditional sensors. These sensors are smaller and consume less power than conventional sensors. The use of smart sensors technology in IoT-based devices and consumers electronics and its application in the aerospace & defense, automotive, biomedical & healthcare, industrial automation, building automation, consumer electronics, education, robotics, agriculture, and transportation industries have attracted much interest in the past few years. The increase in usage of smart sensors across the applications is a key factor boosting the smart sensor market size.

With rising safety and security concerns, the demand for smart sensors in consumer electronics is increasing, impacting the smart sensor market. Various sensors, such as night vision IR sensors, sound sensors or microphones, and smart toilets, are used in home automation. Companies incorporate various features, such as automatic cleaning, automatic flushing, tank-leak monitoring, water overflow protection, and health monitoring, into their smart sensors. Lights and fans can be controlled with an automatic system that uses infrared or motion sensors.

Further, with the changing lifestyle and new modern standard of living thus, the demand for modular kitchens integrated with home automation is witnessing exponential growth, positively impacting the smart sensor market. Manufacturers are developing synthetic sensor-based devices to monitor vibration, kitchen sounds, light, gas, temperature, heat, and electromagnetic temperature and noise, increasing the the smart sensor market size. For instance, Analog Devices, Inc. offers HMC1126 GaAs pHEMT sensors. It is a low noise amplifier that operates at a range of 400 MHz-52 GHz and is used in several applications, such as microwave radios, very small aperture terminals (VSATs), test equipment, and 5G communication.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Smart Sensor Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Smart Sensor Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Smart sensor technology has led to rapid technological advancements in smartphones and wearable devices. Automobile manufacturers are increasingly demanding smart sensors to improve safety and comfort. The use of wireless technology to monitor and control security devices equipped with smart sensors is becoming more common. Amid COVID-19, the surge in demand for smart sensor-enabled wearable devices, ongoing government support for green building construction, and predictive maintenance are offering lucrative opportunities for the smart sensor market players.

The rise in smartphone penetration has been substantially fuelling the smart sensor market growth. Smart sensors include popular sensors, such as motion, position, ambient light, accelerometer, and gyroscope. Specific Absorption Rate (SAR) sensors enhance connectivity for a wide range of wireless technologies, such as 5G sub-6/4G/Wi-Fi in smartphones, tablets, and laptops. SEMTECH, a leading semiconductor supplier, offers PerSeTM Connect, PerSe Connect Pro, and PerSe Control sensors, which can be used in various applications, such as smartphones, laptops, tablets, and wearables.

Many companies are developing new and advanced smart sensors that combine microcontrollers in a single package. Modern technologies, such as AI (Artificial Intelligence) and IoT, enable this combination within small packaging. For instance, Bosch Sensortec's BHA250 can combine a 32-bit microcontroller with a 14-bit acceleration sensor in a 2.2 x 2.2 x 0.95 mm3 package. Further, the TE Connectivity company has integrated sensors with connectors to pack functionality into a small space. These developments in smart sensor technology are positively impacting the smart sensor market growth. With the growth in the consumer electronic industry, such as in smart beverage vending machines, smart home automation systems, simple computers, digital assistants (such as Alexa), and human wearable devices, the demand for smart sensors has increased in the smart sensor market. Traditional consumer products, such as laptops, smartphones, and televisions, continue to exceed expectations as consumers continue to adopt new and emerging products, including wearables, voice-activated smart speakers, and smart home devices.

According to multiple studies, tens of billions of IoT devices will connect to the Internet in the coming years, which will greatly impact the smart sensors market. COVID-19 is driving urban resilience and digital transformation strategy agendas as city governments adjust to a new reality.

Impact of COVID-19 Pandemic on Smart Sensor Market

Impact of COVID-19 Pandemic on Smart Sensor Market

The emergence of COVID-19 has brought the need to harness and leverage digital infrastructure for remote patient monitoring into sharp focus. Due to the slow development of current viral tests and vaccines, it has been determined that a greater need exists for more robust disease detection and monitoring of individual and population health, which wearable sensors could aid. While the utility of this technology has been used to correlate physiological metrics to daily living and human performance, it is still necessary to apply it to predict the occurrence of COVID-19.

The growing demand for energy-saving devices is driving up market demand for smart sensors in the smart sensors market in North America. Companies are shifting towards energy-efficient energy-saving equipment, as the changing scenario necessitates energy-efficient equipment and products. Further, sensor demand in the smart sensor market has increased across a variety of industries with the lifting of governments' stringent regulations, which are gaining traction in automation industries. In addition, the demand for sensors in the automotive sector is being driven by the desire to reduce the average weight of a car. Lightweight automobiles aid in both fuel efficiency and energy optimization.

Smart Sensor Market Regional Insights

Smart Sensor Market Regional Insights

The regional trends and factors influencing the Smart Sensor Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Smart Sensor Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Smart Sensor Market

Smart Sensor Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 31.73 Billion |

| Market Size by 2028 | US$ 77.75 Billion |

| Global CAGR (2021 - 2028) | 13.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

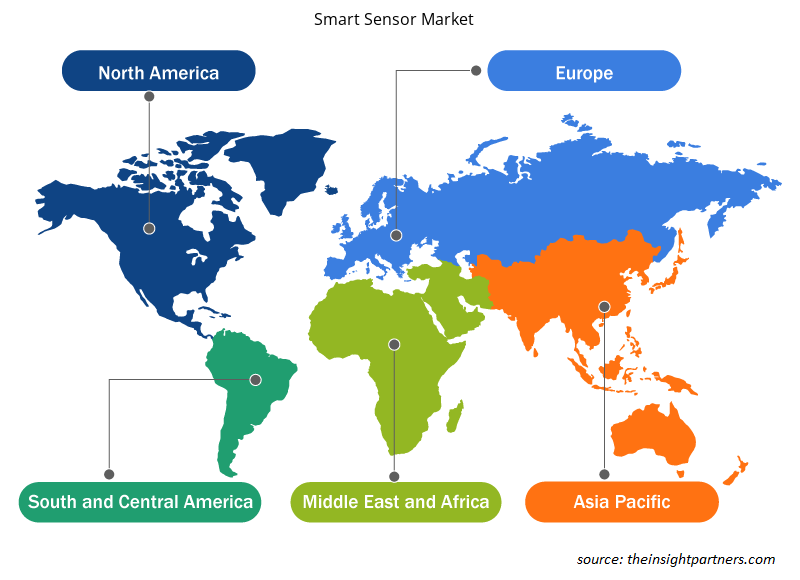

Smart Sensor Market Players Density: Understanding Its Impact on Business Dynamics

The Smart Sensor Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Smart Sensor Market are:

- Analog Devices Inc.

- Infineon Technologies Inc.

- STMicroelectronics

- TE Connectivity

- Microchip Technologies

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Smart Sensor Market top key players overview

Smart Sensor Market Segmentation

Based on technology, the smart sensor market is segmented into MEMS, CMOS, and Others. In 2021, the MEMS segment led the market. Based on type, the smart sensor market is segmented into temperature & humidity sensors, pressure sensors, motion sensors, position sensors, and others. In 2021, the temperature & humidity sensors segment accounted for the largest market share. Based on end-use industry, the smart sensor market is segmented into consumer electronics, automotive, healthcare, manufacturing, retail, and others.

Analog Devices Inc., Infineon Technologies Inc., STMicroelectronics, TE Connectivity, Microchip Technologies, NXP Semiconductor, Siemens AG, ABB Ltd., Robert Bosch GmbH, and Honeywell International are among the key smart sensor market players. In addition to these, several other players were analyzed to understand the overall dynamics of the global smart sensor market.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Rare Neurological Disease Treatment Market

- Virtual Pipeline Systems Market

- Data Center Cooling Market

- Diaper Packaging Machine Market

- Saudi Arabia Drywall Panels Market

- Maritime Analytics Market

- Intraoperative Neuromonitoring Market

- Virtual Event Software Market

- Drain Cleaning Equipment Market

- Medical Collagen Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Technology, Type, and End-use Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The Internet of Things (IoT) has accelerated the evolution of sensors to new heights. With the industry 4.0-powered cyber-physical transformation of manufacturing industries, many production facilities are taking up smart sensors. IoT platforms use a variety of sensors to deliver intelligence and data, allowing devices to function autonomously and the entire ecosystem to become more intelligent. Devices share information and improve their efficiency and functionality by combining a set of sensors and a communication network. The demand for IoT is growing in various industrial verticals, which, in turn, is supporting the growth of the smart sensor market.

In 2021, the market for temperature & humidity sensors held the largest market share. The demand for dependable, high-performance, low-cost sensors is growing, fueling the development of new technologies such as micro-and nanotechnology. Stick-on or printed sensors can be attached to equipment as labels to measure physical factors such as humidity, temperature, and gas pressure. Because of their inexpensive cost, compact size, and ease of use, the sensors are widely used in various sectors, including automobiles, homes, medical devices, the environment, food processing, and chemical. A temperature sensor's primary application is in a smart thermostat, a smart home device. Because of significant consumer interest, incremental technology breakthroughs, and increased accessibility, the total market for smart homes is expected to expand fast. Analog Devices, Inc., STMicroelectronics, TE Connectivity Corporation, Microchip Technology Inc., NXP Semiconductors, and other firms provide a wide range of temperature and humidity sensors to the global market.

MEMS is expected to dominate the smart sensor market during the forecast period. MEMS uses small miniaturized electromechanical and mechanical systems of actuators, sensors, and microelectronics. This technology is expected to continue to dominate the market for smart sensors in the coming years and to be the fastest-growing technology during the forecast period, owing to the numerous benefits it provides, including fast operations, high reliability, improved accuracy, easy maintenance, and replacement, and low energy and material consumption. This technology enables the sensor to perform intelligently by allowing them to store a significant quantity of data in the blink of an eye. The typical data obtained by the sensor is processed by the microprocessor, which erases or saves the data based on an advanced computation. The primary benefits of MEMS technology are reduced energy and material consumption, higher repeatability, increased accuracy, and increased sensitivity and selectivity. The MEMS segment is expected to have the most significant CAGR during the anticipated period. It is due to the increased use of IoT and wearable devices such as smartwatches. Smartwatches include tiny sensors, which contributes to an increase in the demand for MEMS technology for use in these devices. As a result, rising sales of smartwatches are likely to increase demand for MEMS technology throughout the forecasted period. Furthermore, the growing preference for smart homes would fuel the need for MEMS technology throughout the forecast period.

Many automotive manufacturers are coming up with new intelligent vehicles. They are more inclined toward cutting-edge smart sensors. APAC is expected to be the most important market for smart sensors vendors over the coming years in the automotive, infrastructure, consumer electronics, and pharmaceuticals industries, with China, India, and Japan demonstrating a significantly high demand. As the global manufacturing hub for various industries, including semiconductor and automotive, which produce home appliances, smartphones, computers, and peripheral devices, China's manufacturing sector has seen massive growth over the last few years. As a result, an enormous increase in the production and sale of sensing devices can be seen in this region. Long-range low-power wide-area network (LPWAN) technologies, such as NB-IoT, LoRa, LTE-M, and Sigfox, are fueling IoT vehicle connectivity innovation. LPWANs for IoT sensors allow low-power devices to wirelessly stream data packets over longer distances, as required in the automotive industry.

APAC dominated the smart sensor market in 2020. The APAC's vertical growth in the automotive, infrastructure, consumer electronics, and pharmaceuticals industries has positively impacted the smart sensor market. As the global manufacturing hub for various industries, such as semiconductor—which produces home appliances, smartphones, computers, and peripheral devices—and automotive, China's and India’s manufacturing sectors have seen massive growth. Consequently, an enormous increase in the sale and production of sensing devices can be seen in APAC. The growing population, low cost of smart sensors, the prominent existence of several manufacturing facilities, and rapid technological advancements in emerging markets are further contributing to the growth of the APAC smart sensor market.

Best-in-class sensors are highly secure and designed for indoor occupant analytics and energy savings, providing unprecedented precision in occupant detection, count, and movements and accurate reading of ambient lighting and motion sensing. These smart sensors can work as standalone devices or be integrated into other infrastructure appliances, such as thermostats or lighting fixtures, in keeping with the edge computing approach. As these intelligent building sensors can perform all analytics in-house, images are never stored or transmitted over the network, ensuring that occupants' privacy is fully protected. Biosensors and electronic, chemical, and smart grid sensors are in high demand in smart cities.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Smart Sensor Market

- Analog Devices Inc.

- Infineon Technologies Inc.

- STMicroelectronics

- TE Connectivity

- Microchip Technologies

- NXP Semiconductor

- Siemens AG

- ABB Ltd.

- Robert Bosch GmbH

- Honeywell International Inc.

Get Free Sample For

Get Free Sample For