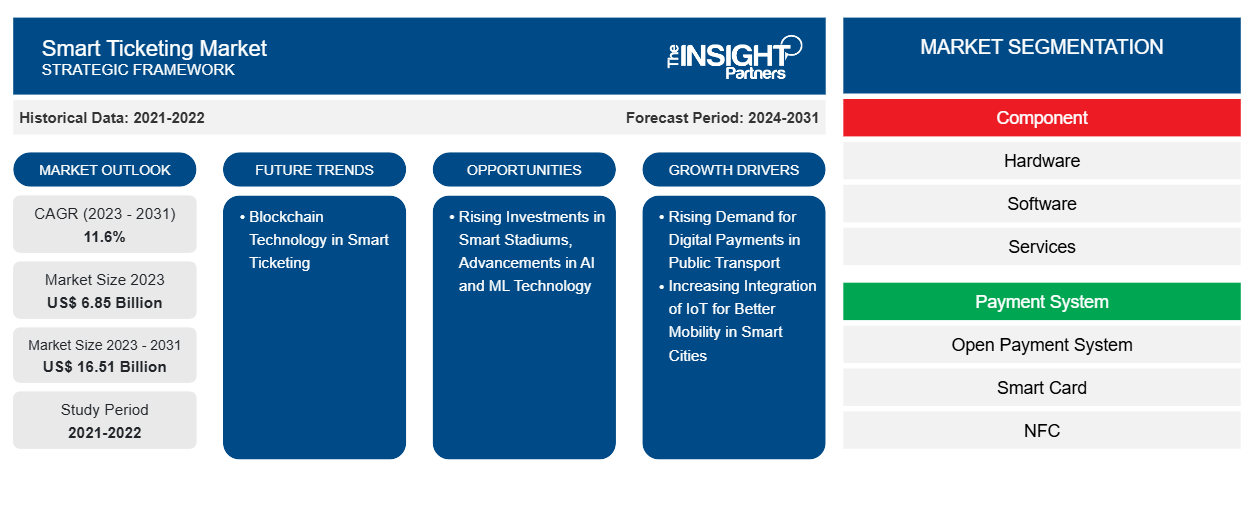

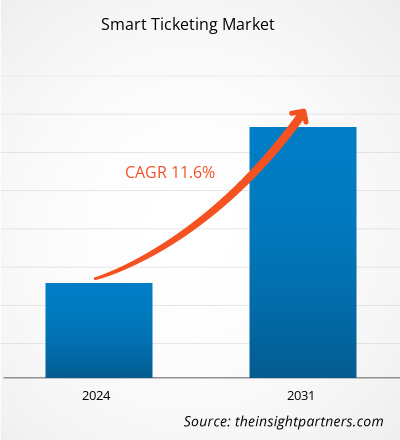

The smart ticketing market size is projected to reach US$ 16.51 billion by 2031 from US$ 6.85 billion in 2023. The market is expected to register a CAGR of 11.6% during 2023–2031. Blockchain technology in smart ticketing is likely to bring in new trends in the market.

Smart Ticketing Market Analysis

The smart ticketing market has witnessed significant growth in recent years. Factors such as rapid digitization across industries have led to a growing dependence on contactless payment. Moreover, the increasing adoption of smart devices for booking tickets across the globe is expected to contribute to the growing smart ticketing market size. Additionally, the integration of advanced technologies such as artificial intelligence, virtual reality maps, smartphones, and wearables in the ticketing system is expected to bring new smart ticketing market trends in the coming years.

Smart Ticketing Market Overview

The process of electronically storing a travel ticket on a microchip—which is typically put on a smartcard—is known as smart ticketing. Using an ITSO smartcard would eliminate the need for traditional payment methods through cash and receiving paper tickets, thereby enabling users of public transportation to board and exit buses, trams, or trains with ease. To authorize the trip, the transport operator scans the contactless smartcard at a barrier using a static ticket machine or a handheld ticket machine. Smart tickets have gained significant traction as a modern replacement for traditional paper-based ticketing, driven by the increasing emphasis on digitizing ticketing processes. This innovative technology saves passengers' time by eliminating the need to queue for ticket purchases. It has also evolved to encompass smartcards and mobile apps, offering a superior alternative to paper tickets. Furthermore, smart ticketing is widely utilized across various modes of transportation and has seen growing applications in sports and entertainment events. A notable example is Rio de Janeiro, which hosted the Olympic Games and expected half a million international visitors. The city's public transport ticketing system featured Gemalto's contactless technology, including the waterproof "Celego Contactless Wristband" and "Celego Contactless Sticker," both embedded with Gemalto's contactless chip and certified by Visa and MasterCard. These solutions, activated with a simple wave of the wristband near the contactless readers, represented a significant infrastructure enhancement introduced at a global level.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Smart Ticketing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Smart Ticketing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Smart Ticketing Market Drivers and Opportunities

Rising Demand for Digital Payments in Public Transport

Modern cities offer a variety of transportation options, such as buses, trains, and metros. Each public transportation system has its own ticketing system. Managing multiple smart cards or applications for different modes of transportation might be overwhelming for commuters. A centralized method is necessary to combine all transportation networks. In this direction, the public transport infrastructure across the world is being upgraded. The upgrades also aim at improving the commuter experience via a seamless payment interface. For instance, in May 2023, Conduent Transportation, a global provider of smart mobility technology solutions and a business unit of Conduent Incorporated (Nasdaq: CNDT), announced that its subsidiary, a partnership between Conduent and Convergint, has been chosen by the State of Victoria (Australia) to provide the next generation of the state's public transport ticketing system, known as myki. The firms aim to implement an advanced, contactless payment account-based transit ticketing system that will upgrade the state's current smartcard solution and provide riders with a better user experience. In December 2022, Hitachi Rail's 360Pass travel platform went live in Trentino (Italy) allowing customers to travel on all modes of public transportation in the city without purchasing a traditional ticket. The app is accessible for free from any app store. Citizens and tourists can easily purchase multimodal tickets using their smartphones after downloading the application. As cities evolve into smart, connected, and digital-first environments, digital payments for public transportation services will remain at the forefront of the agenda, thereby driving the smart ticketing market growth.

Rising Investments in Smart Stadiums

In recent years, the global need for contactless experience systems has accelerated the use of smart ticketing in stadium and event sales processes. Smart ticketing provides an easy way for stadium and event organizers to run their operations more efficiently, avoiding overhead costs and procedural bottlenecks. This is crucial since traditional paper-based ticketing needs more labor and resources, rendering it an unsustainable method of organizing sporting events. The implementation of a smart ticketing system can dramatically enhance ticket sales by allowing fans to check the availability of their favorite seats and order tickets that match their preferences. The significant data acquired from these bookings allows organizers to determine which areas fans are most interested in, resulting in the development of targeted ticketing strategies that appeal to specific audience segments. With smart ticketing taking care of ticket validation, the stadium staff may be reallocated to improve fan experiences, assist with crowd management, provide information and guidance, or support key areas that require human intervention. Smart ticketing makes the best use of workers by streamlining ticketing operations, boosting both operational efficiency and the entire stadium experience for attendees. For instance, RFID tickets were utilized by millions of supporters during the FIFA Confederations Cup in 2013, the FIFA World Cup in 2014, the FIFA Confederations Cup in 2017, the FIFA World Cup in 2018, the FIFA Arab Cup in 2021, and the FIFA World Cup 2022 in Qatar. FIFA had appointed HID as its official ticket producer. Thus, increasing investments in smart stadiums to make the user payment experience seamless is expected to create lucrative opportunities for the smart ticketing market expansion.

Smart Ticketing Market Report Segmentation Analysis

Key segments that contributed to the derivation of the smart ticketing market analysis are component, payment system, and end user.

- Based on component, the market is segmented into hardware, software, and services. The hardware segment held the largest market share in 2023.

- By payment system, the market is divided into open payment system, smart card, and NFC. The smart card segment held the largest market share in 2023.

- In terms of end user, the market is categorized into transportation, sport and entertainment, parking, and others. The sport and entertainment segment dominated the market in 2023.

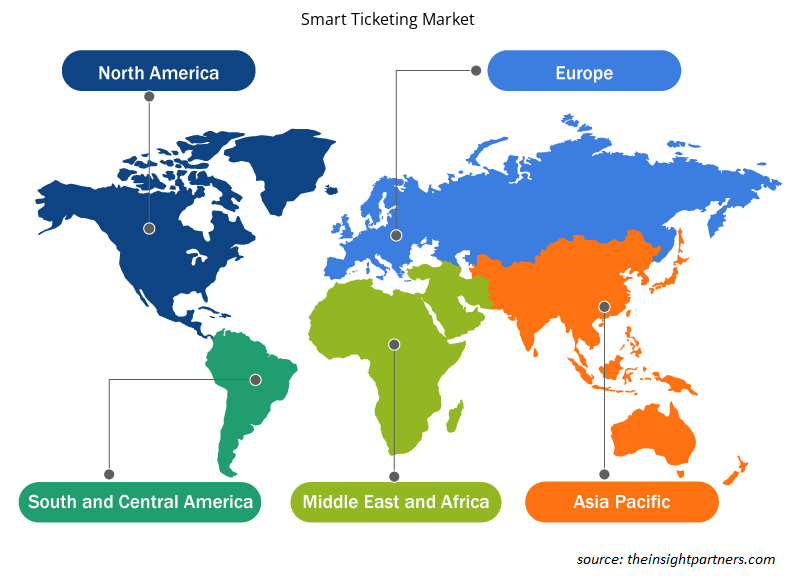

Smart Ticketing Market Share Analysis by Geography

The geographic scope of the smart ticketing market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America held a significant market share in 2023. The North America smart ticketing market is experiencing significant growth owing to the advancements in smart card technology utilized in smart ticketing systems. Contactless solutions facilitated by smartphones and cutting-edge wearable devices are gaining significant traction, as these solutions help optimize time and curb friction at physical ticket counters with flexible payment options. Prominent smart wearable manufacturers, such as Samsung, have introduced payment capabilities in their smartwatches. Additionally, most device manufacturers are integrating payment services, including Samsung Pay, Fitbit Pay, Apple Pay, Garmin Pay, and Google Pay, into their mobile wallet offerings. While smartwatch-enabled payments are still in the developmental phase, they hold significant market potential. These developments are projected to empower consumers to purchase tickets using their wearable devices, reflecting a notable shift in the ticketing landscape. Additionally, initiatives taken by the key smart ticketing market players, such as Cubic Corporation, positively favor the market.

For instance, in May 2023, Infineon's CALYPSO move facilitated the development of interoperable ticketing solutions that adhere to open standards, empowering manufacturers to tailor solutions for the unique needs of transport operators and authorities. This approach eliminates the reliance on magnetic stripes, barcodes, and proprietary tickets, ensuring greater flexibility and compatibility across diverse systems. This development represents a major step forward in modernizing and expanding the contactless ticketing system across the state, with plans for full deployment across the entire passenger rail system, followed by buses and ferries.

Smart Ticketing Market Regional Insights

The regional trends and factors influencing the Smart Ticketing Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Smart Ticketing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Smart Ticketing Market

Smart Ticketing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 6.85 Billion |

| Market Size by 2031 | US$ 16.51 Billion |

| Global CAGR (2023 - 2031) | 11.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

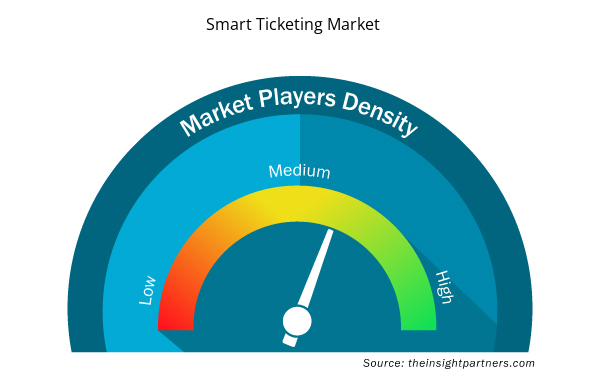

Smart Ticketing Market Players Density: Understanding Its Impact on Business Dynamics

The Smart Ticketing Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Smart Ticketing Market are:

- Infineon Technologies AG

- NXP Semiconductors

- Xerox Corporation

- Cubic Corporation

- IDEMIA

- HID Global Corporation (ASSA ABLOY)

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Smart Ticketing Market top key players overview

Smart Ticketing Market News and Recent Developments

The smart ticketing market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the smart ticketing market are listed below:

- Infineon's CALYPSO move facilitated the development of interoperable ticketing solutions that adhere to open standards, empowering manufacturers to tailor solutions to the unique needs of transport operators and authorities. This approach eliminates the reliance on magnetic stripes, barcodes, and proprietary tickets, ensuring greater flexibility and compatibility across diverse systems. (Source: Infineon, Press Release, May 2023)

- NXP Semiconductors unveiled the latest addition to its MIFARE Ultralight family, heralded as the most secure variant. The MIFARE Ultralight AES leverages standard AES authentication and holds Common Criteria EAL3+ security certification, delivering enhanced privacy and security for limited-use contactless tickets, RFID basic guest cards, and similar applications. (Source: NXP Semiconductors, Press Release, February 2022)

Smart Ticketing Market Report Coverage and Deliverables

The "Smart Ticketing Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Smart ticketing market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Smart ticketing market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Smart ticketing market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the smart ticketing market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Payment System, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Increasing demand for smart ticketing from sport, entertainment, and tourism sectors are driving the smart ticketing market.

The smart ticketing market was estimated to be valued at US$ 6.85 billion in 2023 and is projected to reach US$ 16.51 billion by 2031; it is anticipated to grow at a CAGR of 11.6% over the forecast period.

The hardware segment led the microprocessors market with a significant share in 2023.

The smart ticketing market is expected to reach US$ 16.51 billion by 2031.

Asia Pacific is anticipated to grow at the fastest CAGR over the forecast period.

The usage of blockchain in smart ticketing industry are expected to drive the growth of the smart ticketing market in the coming years.

The key players holding majority shares in the smart ticketing market include Infineon Technologies AG, NXP Semiconductors, Xerox Corporation, Cubic Corporation, and IDEMIA.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Smart Ticketing Market

Infineon Technologies AG

NXP Semiconductors

Xerox Corporation

Cubic Corporation

IDEMIA

HID Global Corporation (ASSA ABLOY)

CPI Card Group Inc.

Confidex Ltd.

Thales Group

Giesecke & Devrient GmbH

Get Free Sample For

Get Free Sample For