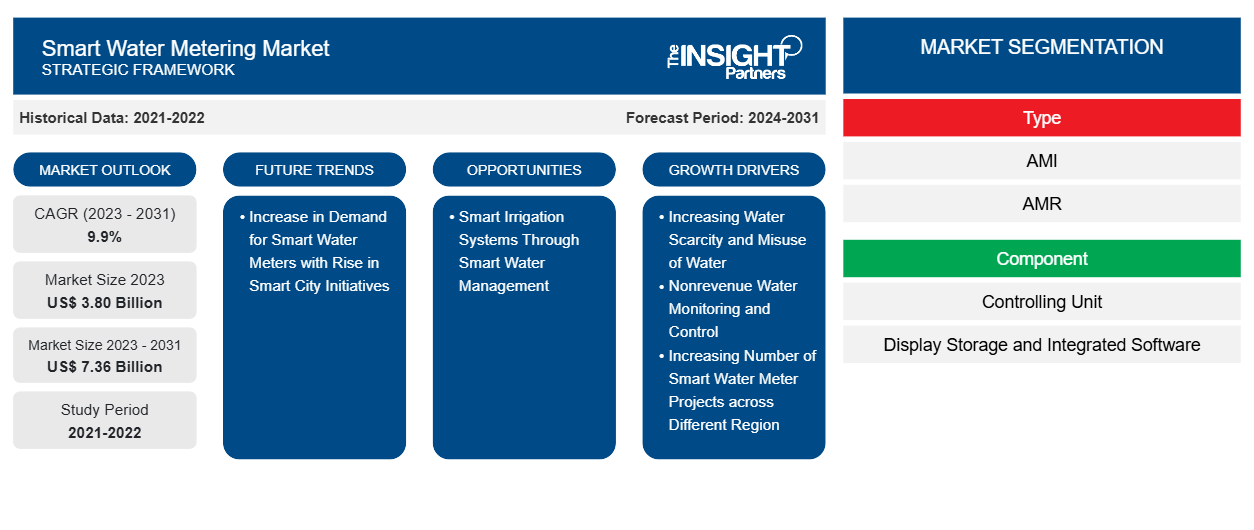

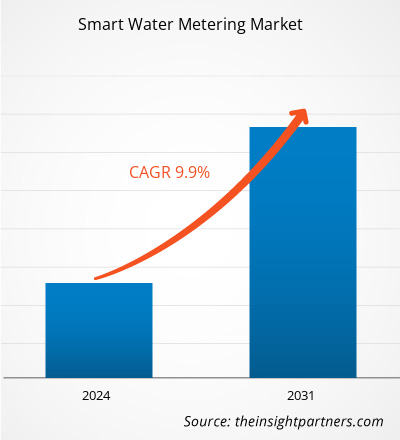

The smart water metering market size is projected to reach US$ 7.36 billion by 2031 from US$ 3.80 billion in 2023. The market is expected to register a CAGR of 9.9% during 2023–2031. Increase in demand for smart water meters with the rise in smart city Initiatives is likely to remain a key trend in the market during the forecast period.

Smart Water Metering Market Analysis

Several government initiatives are helping the smart water metering market to flourish in the current scenario. For instance, several parts of North America have successfully implemented smart water meters with the help of government funding. Also, many city authorities across the region have been launching several projects for new installation or modernization of the existing smart water meter infrastructure. In November 2021, the city of Wilmer in Texas announced the launch of a smart water meter modernization project worth US$ 880,780 to modernize the city's water service infrastructure. The main aim of this project is to allow residential customers to access water usage data in real time and improve operational efficiencies. This also helps in more precise water meter readings along with accurate billings for the water transmission service providers and end users.

Smart Water Metering Market Overview

Water providers and water utilities constantly adopt various technologies to provide an adequate amount of water to every area. It also assists in reducing operational costs, managing assets, and promoting conservation. Among the end users, the residential sector in developed countries and developing economies is adopting technologically advanced water meters to monitor and check the water consumption pattern. The smart water meters also facilitate the residential areas by preventing pipeline leakage, tampering efforts, and reverse flow, which reduces water loss and associated losses. The industrial sector is upgrading their water systems with smart water meters as these meters help understand the quantity of water allotted to them, the quantity of water supplied at the end, and the quantity of water billed at the end of the period. A smart water meter can detect inefficiencies and patterns in water consumption. These meters contain IoT sensors that track each consumer's water usage on a regular basis. The data generated by the sensor’s suite may be further monitored, allowing utilities and customers to better understand their consumption habits and identify areas where they are using excessive water. This decreases instances of excessive water consumption and waste. To reduce nonrevenue water bill generation, industries are increasingly acquiring smart water meters, enabling the market to expand.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Smart Water Metering Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Smart Water Metering Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Smart Water Metering Market Drivers and Opportunities

Nonrevenue Water Monitoring and Control

Nonrevenue water is the discrepancy between the amount of water produced and the amount of water billed to customers. Water loss from source to destination occurs due to various reasons, including leaks (physical loss) and metering mistakes, manipulation, and theft (apparent losses). The NRW is increasing at an exponential rate, resulting in water scarcity and other concerns. On average, according to the research, water theft or illegal tapping is responsible for 8% of nonrevenue water in North America year on year. According to recent research by the International Water Association (IWA), global water waste is around 346 million cubic meters per day or 126 billion cubic meters per year in water distribution networks on their way to customers. Such losses are also known as NRW, and they amount to around US$39 billion per year as the average water cost in North America. The requirement to troubleshoot nonrevenue water has resulted in the need for the development of several technologies, such as smart water meters, which are generally approved by various governments. Smart water meter records hourly data on leaks or losses, as well as the time and date of occurrence. The system also enables the operator to review obtained data on-site or from any platform. Many smart water meters include alarms to reduce the likelihood of pipeline theft or manipulation. These warning systems help generate income from the end users' location. The increasing demand to monitor, control, and reduce nonrevenue water is driving companies in the industry to innovate and design robust technologies, which is driving the smart water metering market growth.

Smart Irrigation Systems Through Smart Water Management

Smart irrigation or smart agriculture is a flourishing sector in North America and Europe due to the fact that the regions have sufficient agricultural land. However, they lack human labor and time for the conventional form of agriculture. Smart agriculture or smart irrigation systems involve the usage of several sensors, data loggers, and communication systems along with data platforms with which the operator can easily review the procedures. Pertaining to the trends mentioned above in the agriculture industry among North American and European countries and the upsurge in prices of individual sensors, data loggers, and other components, farmers or farming organizations implement smart water meters on the grounds. Smart metering technology can be integrated into irrigation systems to monitor and manage water consumption for landscape and agriculture. Smart irrigation controllers and sensors can help users optimize their water usage and avoid water waste. This can result in significant water conservation in regions where irrigation is a major water consumer. In addition, smart water meters benefit farmers or farming organizations by coupling all the individual components into one unit, which, in turn, reduces the upfront costs of the company. The meters facilitate farmer's or farming organizations' enhanced energy management, water usage, water conservation, and ultimately saving costs. The advantages of smart water meters in irrigation or agriculture are sensing the amount of water needed and spraying the required amount. It reduces time, minimizes human labor, and enhances accuracy, thereby resulting in high-quality crop yield. The technological advancements in water conservation are highly benefiting the agriculture industry in countries such as the US, Canada, Mexico, Germany, France, the UK, Italy, Australia, and others. The high adoption of smart technologies in irrigation is expected to bolster the growth of the smart water metering market in the coming years.

Smart Water Metering Market Report Segmentation Analysis

Key segments that contributed to the derivation of the smart water metering market analysis are type, component, end user, and meter type.

- Based on type, the smart water metering market is bifurcated into AMR and AMI. The automatic meter reader segment held a larger market share in 2023.

- Based on component, the market is bifurcated into controlling units; display, storage, and integrated software; and others. The display, storage, and integrated software segment accounted for the largest market share in 2023.

- By end user, the smart water metering market is bifurcated into residential and industrial. The residential segment held a larger market share in 2023.

- By meter type, the market is segmented into ultrasonic meter, electromagnetic meter, and electromechanical meter. The ultrasonic meter segment held the largest smart water metering market share in 2023.

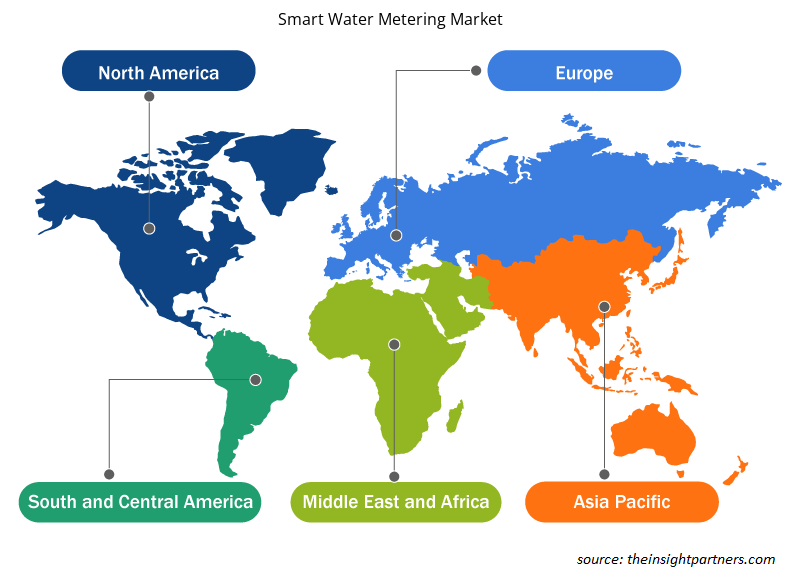

Smart Water Metering Market Share Analysis by Geography

The geographic scope of the smart water metering market report is mainly divided into five regions: North America, Asia Pacific, Europe, the Middle East & Africa, and South & Central America.

North America held a significant market share in 2023. North America comprises the US, Canada, and Mexico. The US is a developed country in terms of the adoption of modern technology, standard of living, infrastructure development, and others. Also, affordability concerns regarding the development of water infrastructures have reached a critical stage. The US Environmental Protection Agency (EPA) manages two State Revolving Fund programs — the Clean Water State Revolving Fund (CWSRF) and the Drinking Water State Revolving Fund (DWSRF). In addition, DWSRF is co-funded by the federal and state governments, with 80% and 20%, respectively.

The water industry's investors have focused on opportunistic upgrades—primarily to support smart meter installation and data collection and visualization rather than full network optimization. Governments of the region continue to take measures to reduce unyielding water usage and undergo modernization and replace older water meters with avant-garde smart water meters, which is becoming a major trend in North America.

Smart Water Metering Market Regional Insights

The regional trends and factors influencing the Smart Water Metering Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Smart Water Metering Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Smart Water Metering Market

Smart Water Metering Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 3.80 Billion |

| Market Size by 2031 | US$ 7.36 Billion |

| Global CAGR (2023 - 2031) | 9.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

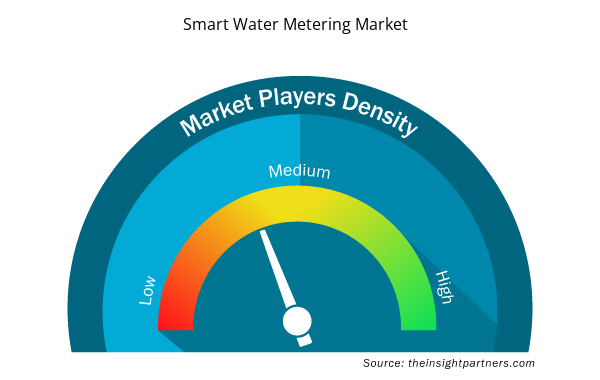

Smart Water Metering Market Players Density: Understanding Its Impact on Business Dynamics

The Smart Water Metering Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Smart Water Metering Market are:

- Arad Ltd

- Badger Meter Inc.

- Bmeters SRL

- Diehl Stiftung & Co KG

- Itron Inc.

- Kamstrup AS

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Smart Water Metering Market top key players overview

Smart Water Metering Market News and Recent Developments

The smart water metering market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the smart water metering market are listed below:

- The water utility across Mexico deployed Xylem's AMI solution in 2011. In addition,, in 2022, the utility deployed additional cloud-hosted Sensus analytics and residential water meters via the FlexNet communication network to collect water pressure data. (Source: Sensus USA Inc, Press Release, July 2022)

- Neptune Technology Group Inc. announced the launch of its MACH 10 ultrasonic water meters for commercial and industrial (C&I) applications in extension to its residential and intermediate MACH 10 meters operational across North America. (Source: Neptune Technology Group Inc., Press Release, June 2022)

Smart Water Metering Market Report Coverage and Deliverables

The "Smart Water Metering Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Smart water metering market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Smart water metering market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Smart water metering market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the smart water metering market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Space Situational Awareness (SSA) Market

- Batter and Breader Premixes Market

- Fertilizer Additives Market

- Vision Guided Robotics Software Market

- Wind Turbine Composites Market

- Nuclear Decommissioning Services Market

- Single Pair Ethernet Market

- Bio-Based Ethylene Market

- Visualization and 3D Rendering Software Market

- Medical Devices Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Component, Application, and Meter Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, UAE, UK, US

Frequently Asked Questions

The smart water metering market was valued at US$ 3.80 billion in 2023 and is projected to reach US$ 7.36 billion by 2031; it is expected to grow at a CAGR of 9.9% during 2023–2031.

Increasing water scarcity, misuse of water and nonrevenue water monitoring and control and increasing number of smart water meter projects across different region are the driving factors impacting the smart water metering market.

Europe is anticipated to grow with the highest CAGR over the forecast period 2024-2031.

The key players, holding majority shares, in smart water metering market includes Badger Meter Inc, Sensus USA Inc., Itron Inc., Mueller Water Products Inc., and Kamstrup AS.

Increase in demand for smart water meters with rise in smart city initiatives is the future trends of the smart water metering market.

The Europe held the largest market share in 2023, followed by North America.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Smart Water Metering Market

- Kamstrup AS

- Mueller Water Products Inc

- Badger Meter Inc

- Itron Inc

- Neptune Technology Group Inc

- Arad Ltd

- Sensus USA Inc

- WAVIoT Integrated Systems LLC

- Bmeters SRL

- Diehl Stiftung & Co KG

Get Free Sample For

Get Free Sample For