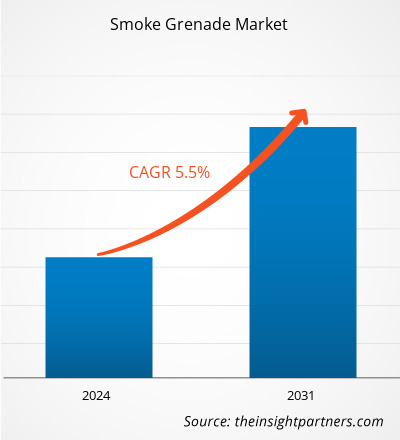

The smoke grenade market size is projected to reach US$ 456.46 million by 2031 from US$ 297.24 million in 2023. The market is expected to register a CAGR of 5.5% during 2023–2031. Upgrading military vehicles with enhanced smoke grenade launching systems is likely to bring a new key trend in the market in the coming years.

Smoke Grenade Market Analysis

The smoke grenade market is growing steadily and is primarily driven by the military and defense sector, as well as law enforcement and emergency services. Smoke grenades are widely used in tactical operations, training exercises, and crowd control. As tensions rise between geopolitical events in different regions of the world, the increase in defense and security spending by governments is creating demand for smoke grenades. Additionally, as the advancements in technology lead to better safety and performance of the products, effective and safe versions of smoke grenades are available for usage in different aspects of applications such as movie productions and outdoor events.

Meanwhile, in the commercial market, smoke grenades are being increasingly used, primarily for leisure and fun activities. There is an increasing popularity of paintball games and airsoft activities, where smoke grenades are used to create an immersive environment. Additionally, smoke grenades are utilized in the rapidly growing fields of special effects filming and photography, generating significant demand among enthusiasts and creative individuals. In addition, due to increased concerns among consumers with regard to issues like safety and impact on the environment, there is an emerging trend of green products, which is propelling companies toward innovation through environmentally friendly smoke formulations, which are either biodegradable or nontoxic.

Smoke Grenade Market Overview

Smoke grenades are mainly used by military and law enforcement forces for different types of operations, including signaling, combat screening and obscuring, crowd control operations, and military training purposes. Major applications of smoke grenades in the military include providing ground-to-air signals, search and rescue operations, helicopter/aircraft landing operations, making the drop location visible, generating a visual distraction during a combat operation, and military training and simulation. There is an increase in demand for smoke grenades and other pyrotechnic products owing to the rising regional conflicts among the countries. The rise in regional conflicts raises the need for training and drill exercises for the armed forces, which, in turn, fuels the smoke grenade market growth. Collaborations between companies and defense forces for live simulation training to supply an adequate volume of smoke grenades are expected to provide growth opportunities for the smoke grenade market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Smoke Grenade Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Smoke Grenade Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Smoke Grenade Market Drivers and Opportunities

Growing Demand from Ground-to-Air Signaling Applications

The rise in demand for signaling applications, specifically for ground-to-air signaling, is one of the major factors driving the growth of the smoke grenade market across different regions. This is further fueled by the need for smoke signaling in search and rescue operations. The longer operational capability of smoke grenades provides suitable capability to the search and rescue teams to provide operational support for their respective operations at remote or urban locations.

Helicopters, vertical take-off and landing (VTOL) aircraft, and parachuting applications require signaling for which smoke grenades are used. The rising number of aircraft and VTOL aircraft operations, propelled by the increasing fleets of helicopters and VTOL aircraft, is generating the need for more volumes of smoke signals, further propelling the growth of the smoke grenade market across different regions. Another major factor supporting the demand for ground-to-air signaling applications is the rising number of helipads and vertiports that are used for take-off/landing operations of helicopters and VTOL aircraft. For instance, in 2023, the Union Civil Aviation Ministry of India announced the construction of ~200–220 new airports, helipads, and water aerodromes in the country in the coming years. Such projects will increase the number of helipads in the country, further driving the demand for signaling cartridges such as illumination rounds and smoke grenades. Similarly, several other countries, such as Indonesia, Japan, South Korea, Malaysia, Canada, Italy, and the UK, have been currently focusing on constructing and upgrading helipads and vertiports across their respective regions, which is further driving the demand for smoke grenades, specifically for ground-to-air applications. For instance, in January 2023, Siemens and Skyway collaborated to develop vertiport infrastructure, especially for emerging VTOL aircraft operations.

Collaborations of Companies with Armed Forces for Live Training Simulation

The military forces worldwide conduct drilling operations to keep their forces trained all the times. The military training exercises combine various types of military operations and involve a lot of pyrotechnic munitions, including smoke grenades, to create a live simulation environment. The pyrotechnic munition companies collaborate with military forces to supply an adequate volume of smoke grenades for the military's live simulation training exercises. This has led to an increase in the adoption of live pyrotechnic munitions, such as illumination signal rounds, markers, and smoke grenades, across different regions. Military exercises organized during the nighttime involve many pyrotechnic illuminations and signaling rounds, which is another major factor supporting the adoption of pyrotechnic munition for live training simulation, including the colored smoke grenades. For instance, in April 2021, the US Army conducted a live training in Pulaski Country (Arkansas) wherein two Boeing Chinook Helicopters carried out the military cadets for a 4-day exercise. Under this operation, colored smoke canisters, illumination fire rounds, and other types of pyrotechnic munitions were used. Similarly, in March 2021, the Joint Multinational Readiness Center Dragon Team of the US military conducted a fire marker training session at Hohenfels Training Area, wherein the fire marker training involved replicating threats, such as roadside bomb blasts and indirect fire, and using smoke to simulate close-air support. The increase in the use of pyrotechnics for military training is catalyzing the smoke grenade market.

Smoke Grenade Market Report Segmentation Analysis

Key segments that contributed to the derivation of the smoke grenade market analysis are type, offering, and application.

- Based on type, the smoke grenade market is classified into hand operated and launcher operated. The hand operated segment held a larger share of the market in 2023.

- Based on application, the market is categorized into signaling, screening and obscuring, riot control, and others. The signaling segment dominated the market in 2023.

- The end user segment of the smoke grenade market is categorized into military and law enforcement and commercial. The military and law enforcement segment held a larger share of the market in 2023.

Smoke Grenade Market Share Analysis

The geographic scope of the smoke grenade market report offers a detailed global, regional, and country analysis. North America, Europe, and Asia Pacific are major regions witnessing significant growth in the smoke grenade market. North America dominated the smoke grenade market in 2023 with a share of 36.0%; it is likely to continue to dominate the smoke grenade market during the forecast period. Asia Pacific is the second-largest contributor to the smoke grenade market, followed by Europe. The rise in military expenditure globally is one of the key factors boosting the smoke grenade market growth from 2023 to 2031. For instance, as per the report from SIPRI, global military expenditure grew for the ninth consecutive year from 2014, with spending of US$ 2,443 billion in 2023. The key countries contributing to the North America smoke grenade market growth include the US, Canada, and Mexico. This can be attributed to the rise in demand for smoke grenades in law enforcement, military, and other commercial applications in the region. In addition, the rise in military expenditure by the countries in North America is anticipated to fuel the demand for smoke grenades in the coming years. As per the Stockholm International Peace Research Institute report, the military expenditure in North America was valued at US$ 955 billion in 2023, an increase from US$ 912.4 billion in 2022. The rise in military expenditure in the region is anticipated to boost the demand for smoke grenades during the forecast period.

In Europe, smoke grenades find increasing use in signaling, screening, obscuring, riot control, and marking of landing zones. This can be attributed to the rise in demand for smoke grenades in law enforcement, military, and commercial applications in the region. The Europe smoke grenade market is segmented into Germany, France, the UK, Italy, Russia, and the Rest of Europe. The military expenditure in the region has increased from US$ 355.7 billion in 2022 to US$ 465.8 billion in 2023. Russia accounted for the largest military expenditure share, with a share of 23.4% in 2023, followed by the UK, Germany, and France, as per the report from SIPRI. The rise in military equipment and infrastructure spending is expected to boost the smoke grenade market growth from 2023 to 2031.

Smoke Grenade Market Regional Insights

The regional trends and factors influencing the Smoke Grenade Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Smoke Grenade Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Smoke Grenade Market

Smoke Grenade Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 297.24 Million |

| Market Size by 2031 | US$ 456.46 Million |

| Global CAGR (2023 - 2031) | 5.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

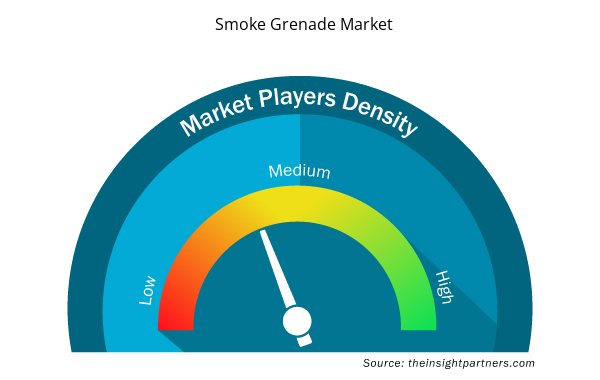

Smoke Grenade Market Players Density: Understanding Its Impact on Business Dynamics

The Smoke Grenade Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Smoke Grenade Market are:

- Arsenal

- Rheinmetall AG

- HFI Pyrotechnics

- Chemring Group Plc

- CONDOR TECNOLOGIAS NÃO LETAIS

- Nammo AS

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Smoke Grenade Market top key players overview

Smoke Grenade Market News and Recent Developments

The smoke grenade market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the smoke grenade market are listed below:

- Rheinmetall has developed a new version of its tried-and-tested, highly effective Maske smoke/obscurant grenade. Like other smoke/obscurant grenades of the Maske family, the Maske 81 mm is based on a bimodular, bi-spectral ammunition concept. It consists of a fast-acting decoy module that generates intense blooming thanks to proven decoy technologies. It is paired with a long-lasting concealment module whose visible and infrared smoke/obscurant interrupts the enemy's line of sight in both the visual and infrared spectrum. (Source: Rheinmetall, Press Release, January 2022)

- World-leading survival solutions manufacturer Wescom Group has expanded its presence in the defense market by acquiring Nottingham-based chemical detection technology company KeTech Defence Ltd. KeTech Defence Ltd is a leading supplier of rapid detection solutions in the defense sector. KDL expands Wescom Group's portfolio and complements its business model of defense survival solutions, which include pyrotechnic signaling, screening, training and simulation, obstacle breaching solutions, and now chemical detection. (Source: Wescom Group, Press Release, January 2024)

Smoke Grenade Market Report Coverage and Deliverables

The "Smoke Grenade Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Smoke grenade market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Smoke grenade market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's and SWOT analysis

- Smoke grenade market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the smoke grenade market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The smoke grenade market was valued at US$ 297.24 million in 2023; it is expected to register a CAGR of 5.5% during 2023–2031.

The rise in demand for signaling applications, specifically for ground-to-air signaling, is one of the major factors driving the growth of the smoke grenade market across different regions. This is further fueled by the need for smoke signaling in search and rescue operations. The longer operational capability of smoke grenades provides suitable capability to the search and rescue teams to provide operational support for their respective operations at remote or urban locations.

Upgrade of military vehicles with enhanced smoke grenade launching systems is expected to drive the growth of the smoke grenade market in the coming years.

The key players operating in the smoke grenade market include Arsenal, Rheinmetall AG, HFI Pyrotechnics, Chemring Group Plc, CONDOR TECNOLOGIAS NÃO LETAIS, Nammo AS, NonLethal Technologies Inc, Centanex Ltd, 3rd Light Limited, and Wescom Group.

North America is anticipated to grow at the fastest CAGR over the forecast period.

The hand operated segment led the smoke grenade market with a significant share in 2023.

The smoke grenade market is expected to reach US$ 456.46 billion by 2031.

Trends and growth analysis reports related to Aerospace and Defense : READ MORE..

The List of Companies - Smoke Grenade Market

- Arsenal

- Rheinmetall AG

- HFI Pyrotechnics

- Chemring Group Plc

- CONDOR TECNOLOGIAS NÃO LETAIS

- Nammo AS

- NonLethal Technologies Inc

- Centanex Ltd

- 3rd Light Limited

- Wescom Group

Get Free Sample For

Get Free Sample For