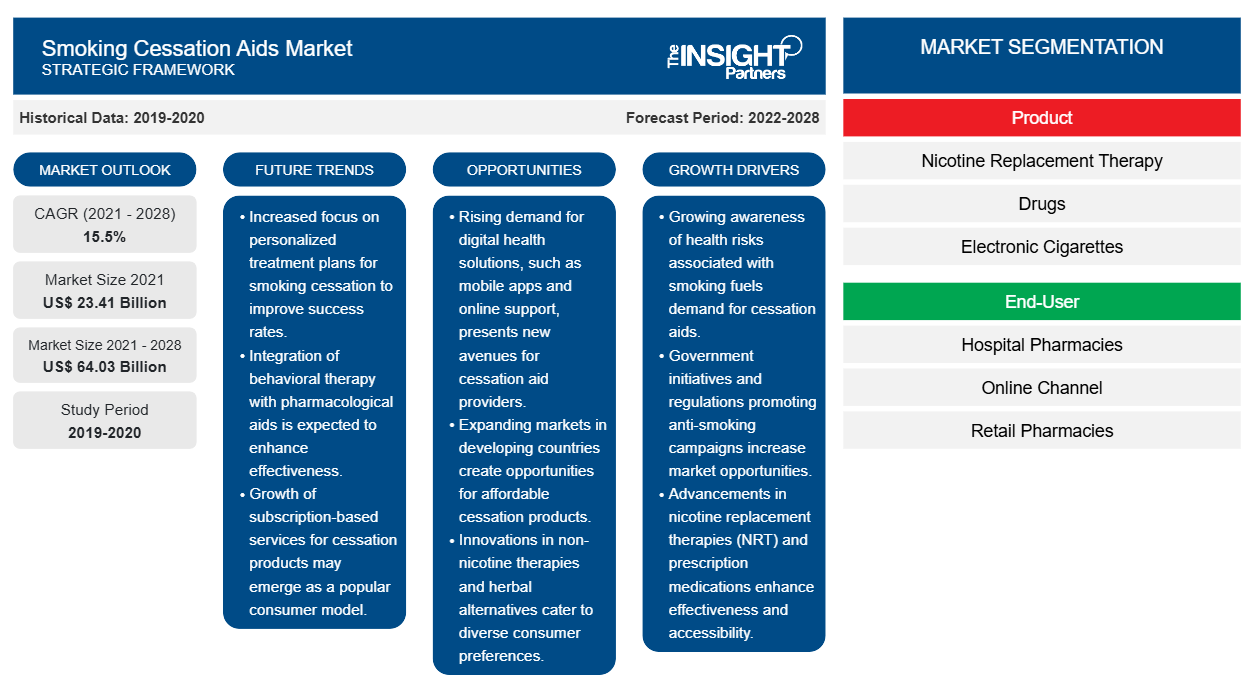

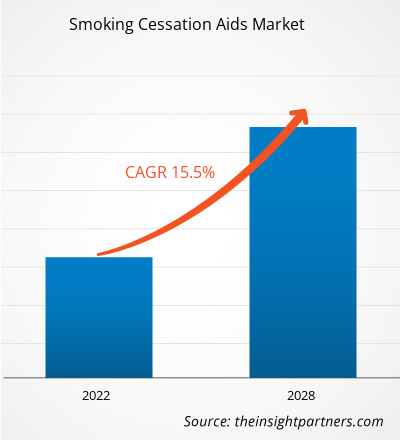

The Smoking Cessation Aids market is expected to reach US$ 64,032.30 million by 2028 from US$ 23,413.08 million in 2021. The market is estimated to grow with a CAGR of 15.5% from 2021 to 2028.

Key factors that are driving the growth of this smoking cessation aids market are rising addiction toward tobacco smoking, increasing number of campaigns to reduce smoking and tobacco dependence. However, steeping costs for development of nicotine replacement therapies are likely to restrain the market growth in the future years to some extent.

Market Insights

Rising addiction of tobacco smoking

Nicotine is a highly addictive substance found in tobacco plant. The smoking of tobacco is proven to be dangerous in all forms as it can lead to chronic health conditions, preventable diseases, deaths, and disabilities. According to the World Health Organization (WHO), smoking-related disorders result in about 435,000 deaths per year in the US, which equals to around 1 in 5 of the total deaths in the country. According to the Centers of Disease Control and Prevention (CDC), in 2018, nearly 40 million adults in the US smoked cigarettes. Moreover, about 4.7 million middle and high-school students used at least one tobacco product and around 1,600 young population below the age of 18 in the US smoked their first cigarettes. Every year, nearly half a million patients die due to illness caused by smoking. The US government spends ~US$ 225 billion for medical care to treat patients suffering from smoking-associated conditions in the US. Therefore, prevalence of tobacco smoking is high across various countries in the world.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

The scenario is similar in various European and Asian countries. Greece, Bulgaria, France, and Croatia comprise the high tobacco consuming populations in Europe. According to the Institute of Health Metrics and Evaluation, smoking is a very common addiction in Europe as over 20% adults over the age of 15 smoke every day. Furthermore, according to the World Population Review, the highest smoking rates are found in Southeast Asia and Balkan in Europe. The WPR also suggests that in various South and Southeast Asian countries, the smoking rates tend to be high among men. For instance, in Indonesia, the smoking rate among males was 76.20% in 2018. Thus, the rising number of smoking populations across the world drives the growth of the global smoking cessation aids market.

Product-Based Insights

Based on product, the smoking cessation aids market is segmented into nicotine replacement therapy, drugs, electronic cigarettes, and others. E-cigarettes are considered as a healthy alternative to tobacco cigarettes and is estimated to be the fastest growing segment over the forecast period. E-cigarettes are an effective alternative for reducing health conditions associated with tobacco, while nicotine replacement therapies work best for smoking cessation. E-cigarettes are a potential threat to tobacco-based cigarettes. In addition, Consumption of e-cigarettes are less harmful compared to the regular cigarettes, no smoke and no risk of passive smoking, allowed to use even in no-smoking places, varying nicotine levels, and availability in various flavors are some of the major driving factors for the e-cigarettes market. in addition, the increasing popularity of e-cigarettes backed by its electronic feature is the major factor contributing towards its increasing demand.

End User-Based Insights

Based on end-user, the smoking cessation aids market is segmented into hospital pharmacies, online channel, retail pharmacies, and other end users. The retail pharmacies segment is likely to hold the largest share of the market in 2021, however the online channel segment is anticipated to register the highest CAGR of the market during the forecast period.

The key players such as Pfizer Inc.; GlaxoSmithKline plc.; Dr. Reddy's Laboratories; Johnson and Johnson Services, Inc.; Cipla Inc.; Perrigo Company plc; Bausch Health Companies Inc.; Glenmark; NJOY; and Juul Labs adopt several organic and inorganic strategies to enhance their revenue and market standings. For instance, in July 2020, Dr Reddy’s Laboratories launched of over-the-counter Nicotine Polacrilex lozenges in the American market in the strengths of 2 mg and 4 mg. Moreover, in November 2020, Perrigo Company plc completed its the fourth year of its “Quitting is Better” campaign in partnership with the American Cancer Society (ACS).

Smoking Cessation Aids Market Regional Insights

Smoking Cessation Aids Market Regional Insights

The regional trends and factors influencing the Smoking Cessation Aids Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Smoking Cessation Aids Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Smoking Cessation Aids Market

Smoking Cessation Aids Market Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 23.41 Billion |

| Market Size by 2028 | US$ 64.03 Billion |

| Global CAGR (2021 - 2028) | 15.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

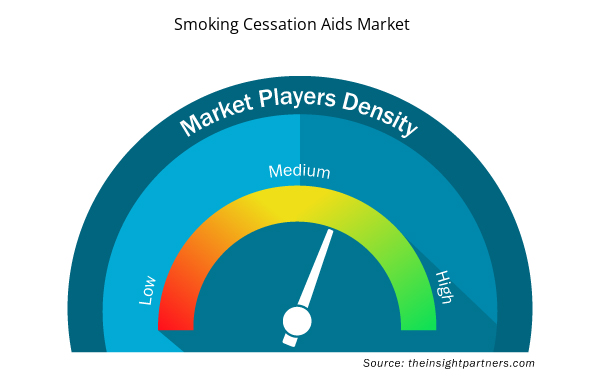

Market Players Density: Understanding Its Impact on Business Dynamics

The Smoking Cessation Aids Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Smoking Cessation Aids Market are:

- Pfizer Inc.

- GlaxoSmithKline plc.

- Dr. Reddy's Laboratories

- Johnson and Johnson Services, Inc.

- Cipla Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Smoking Cessation Aids Market top key players overview

Smoking Cessation Aids Market – by Product

- Nicotine Replacement Therapy

- Drugs

- Electronic Cigarettes

- Others

Smoking Cessation Aids Market – by End User

- Hospital Pharmacies

- Online Channel

- Retail Pharmacies

- Others

Smoking Cessation Aids Market – by Geography

North America

- US

- Canada

- Mexico

Europe

- France

- Germany

- Italy

- UK

- Spain

- Rest of Europe

Asia Pacific (APAC)

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

Middle East and Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East &Africa

South and Central America (SCAM)

- Brazil

- Argentina

- Rest of South and Central America

Company Profiles

- Pfizer Inc.

- GlaxoSmithKline plc.

- Dr. Reddy's Laboratories

- Johnson and Johnson Services, Inc.

- Cipla Inc.

- Perrigo Company plc

- Bausch Health Companies Inc.

- Glenmark

- NJOY

- Juul Labs

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product and End-User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The Smoking Cessation Aids Market majorly consists of the players such as Pfizer Inc., GlaxoSmithKline plc., Dr. Reddy's Laboratories, Johnson and Johnson Services, Inc., Cipla Inc., Perrigo Company plc, Bausch Health Companies Inc., Glenmark, NJOY, Juul Labs among others amongst others.

The US is the largest market for Smoking Cessation Aids at a global level. The market's growth is attributed to the Increasing implementation of various tobacco control programs, high expenditure in healthcare and wellness by the countries in the region and launch of new and innovative products by market players for smoking cessation are some of the factors likely to drive the Smoking Cessation Aids market in the region. According to CDC, in 2017, 14 of every 100 US adults aged 18 years or older (14.0%) currently smoke cigarettes. This hints at a high usage of de-addiction products. Also, this depicts the growing awareness of the people and their readiness to quit smoking. There are also non-government and government establishments working to educate and help people quit smoking that is engaged dedicatedly, to bring the number of smokers down.

Asia Pacific is expected to be the fastest-growing region and is likely to expand at a high growth rate due to increasing awareness about the smoking cessation and nicotine de-addiction products, and a huge population base in the region. For instance, an international collaboration of researchers, led by those from Vanderbilt University in the United States, studied the trends in tobacco use in China, Japan, South Korea, Singapore, Taiwan, and India in Tobacco Smoking and Mortality in Asia, a pooled meta-analysis published by JAMA Network in March 2019. By 2030, it is anticipated that 8.3 million fatalities would be due to smoking. China, India, and Indonesia account for half of the world's male smokers, and Asia is the world's largest tobacco user and production.

The global Smoking Cessation Aids market based on product is segmented into nicotine replacement therapy, drugs, electronic cigarettes, and others. In 2021, the electronic cigarettes segment held the largest share of the market, by product. The electronic cigarettes segment of Smoking Cessation Aids Market is also expected to witness fastest CAGR during 2021 to 2028.The increasing number of campaigns to reduce smoking and tobacco dependence are likely to increase the demand for the above-mentioned products. Therefore, it is expected that market is likely to propel during the forecast period.

The factors that are driving and restraining factors that will affect Smoking Cessation Aids Market in the coming years. Factors such as rising addiction toward tobacco smoking, increasing number of campaigns to reduce smoking and tobacco dependence. However, steeping costs for development of nicotine replacement therapies are likely to restrain the market growth in the future years to some extent.

Smoking cessation lowers the risk of cancer and other serious health problems. Some products contain nicotine as an active ingredient and others do not. Counseling, behavior therapy, medicines, and nicotine-containing products, such as nicotine patches, gum, lozenges, inhalers, and nasal sprays, may be used to help a person quit smoking.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Smoking Cessation Aids Market

- Pfizer Inc.

- GlaxoSmithKline plc.

- Dr. Reddy's Laboratories

- Johnson and Johnson Services, Inc.

- Cipla Inc.

- Perrigo Company plc

- Bausch Health Companies Inc.

- Glenmark

- NJOY

- Juul Labs

Get Free Sample For

Get Free Sample For