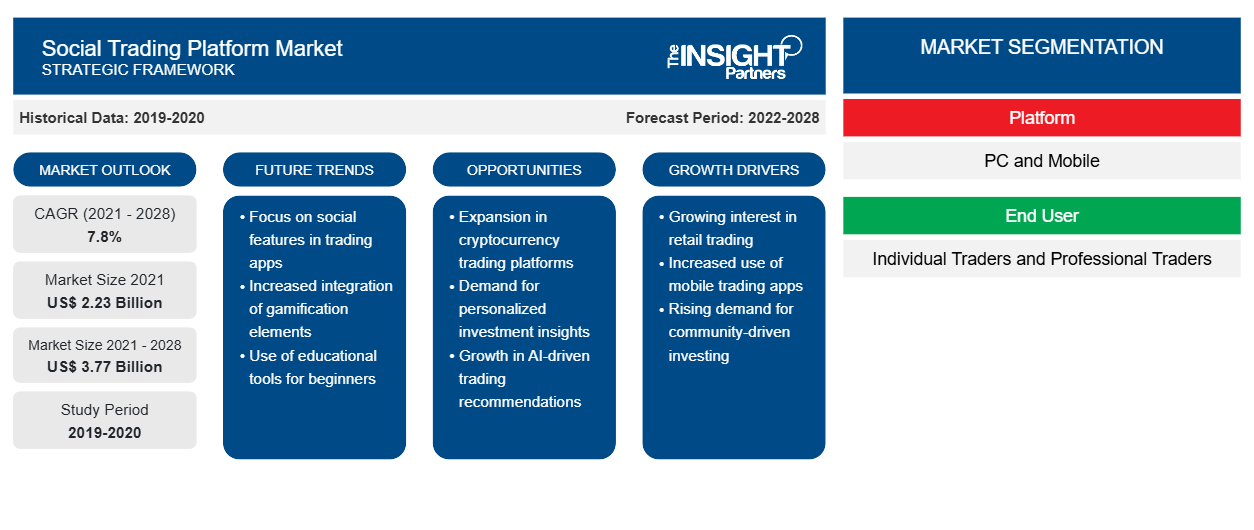

The social trading platform market is expected to grow from US$ 2,229.56 million in 2021 to US$ 3,774.17 million by 2028; it is estimated to rise at a CAGR of 7.8% between 2021 and 2028.

Customized trading platform software effectively increases the organizations' revenue and provides better customer satisfaction. The traders widely adopt a customized trading platform for their easy use. The customized trading platform provides customers with detailed and easy-to-read charts, actual-time statistics, and customized reporting systems. For instance, in May 2021, ParagonEX (financial technology leader) launched a fully customizable trading platform, allowing its broker clients to decide on every detail of the platforms' look and feel. The customization features every element of the trading platform, which allows for endless customization per broker or end-user. The new platform allows each broker to have a unique appearance, displaying elements of their choice, thus creating a distinct brand identity and catering to the profile and mix of their end-users.

The software also provides an advanced and detailed chart analysis according to customers' needs. With this chart analysis, the reading and understanding of a given data are crucial in the trading industry. Advanced chart analysis gives users some flexible and custom features that allow the preparation of charts according to users’ needs. Apart from the above benefits, a customized trading platform also offers several options for reading and understanding industry trends, predicting price fluctuations, creating customized and personalized charts, and managing multiple accounts from a single social trading platform. Thus, due to all these benefits, contributing to the social trading platform market growth globally.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Social Trading Platform Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Social Trading Platform Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Global Social Trading Platform Market

Social trading platforms were prevalent during the digital transformation of financial institutes and banking solutions & services. According to the article published by Business Wire, the spending on digital transformation was US$ 1.18 trillion in 2019, an increase of 17.9% over 2018, and the need for digital transformation supported the growth of the social trading platform market.

Further, in 2021 and 2022, the relaxation of lockdown measures and gain in the employment rates positively impacted the social trading platform market growth. The increase in the trend of investment in cryptocurrency positively impacted market growth. According to the Free Press Journal, Bitcoin boomed and astonished the whole world, from approximately US$ 7,000 in March 2020 to more than US$ 54,000 till June 2021.

Social Trading Platform Market Insights

Rising Benefits of Integration of Chatbots with Trading Platforms

The online trading industry is rising significantly with the evolution of advanced technologies. Due to the COVID-19 pandemic, the online trading pattern strengthened in 2020. According to the article published by Chatbots Life, it has also been observed that over 2.14 billion people worldwide bought goods and services online in 2021, which resulted in the rapid evolvement of the online trading industry globally. Due to the rapid evolvement of the online trading industry, a challenge for traders to keep up with the pace of change to stay current and process all the tasks is also increasing side-by-side. Thus, integrating AI-based chatbots is essential for trading organizations to enhance the customer experience and productivity.

Chatbots perform the role of personal brokers by helping traders with tasks and operations. They perform more profound research, get insights about buyers, their needs, pains, and expectations, and provide 24/7 support and respond to queries. They help users to remain up to date with the latest market trends that can improve the company's progress. Further, integrating financial bots into the system allows users to automate the trading process to run in the background 24/7 without any breaks. The solution help users stay on top of the market trends and make the right trades at the right time.

Moreover, the integration of chatbots into users' online trading platforms helps process and analyze the enormous scope of data and make mathematical calculations effectively. Additionally, trading chatbots are an excellent learning tool, especially for new traders. Therefore, having multiple benefits of chatbots in online trading helps organizations stay competitive and improve the chances of long-term success. Hence, the demand for chatbots is increasing on social trading platforms.

Platform-based Market Insights

Based on platform, the social trading platform market is bifurcated into PC and mobile. In 2021, the mobile segment led the social trading platform market, accounting for the largest share in the market.

End User-based Market Insights

Based on end user, the social trading platform market can be bifurcated into individual traders and professional traders. In 2021, the individual traders segment accounted for the largest market share.

Social Trading Platform Market Regional Insights

Social Trading Platform Market Regional Insights

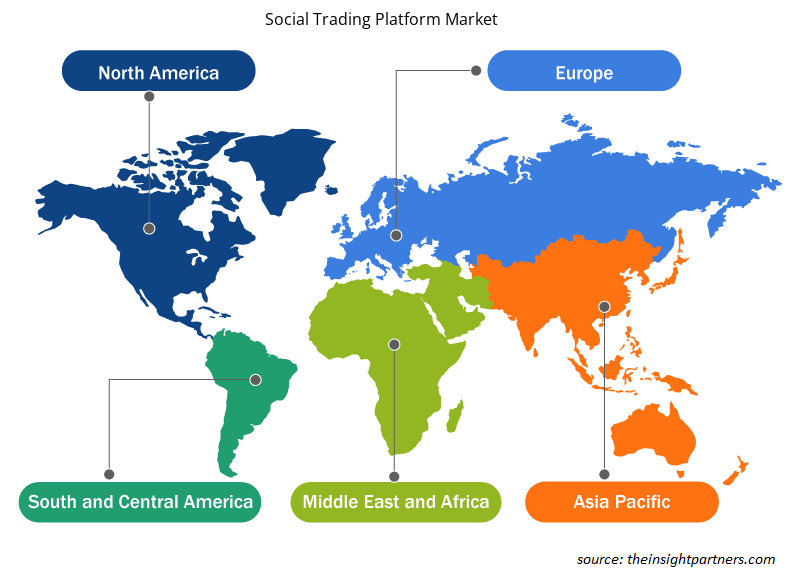

The regional trends and factors influencing the Social Trading Platform Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Social Trading Platform Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Social Trading Platform Market

Social Trading Platform Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 2.23 Billion |

| Market Size by 2028 | US$ 3.77 Billion |

| Global CAGR (2021 - 2028) | 7.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Platform

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Social Trading Platform Market Players Density: Understanding Its Impact on Business Dynamics

The Social Trading Platform Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Social Trading Platform Market are:

- eToro

- A-Trade

- ZuluTrade

- Tornado

- MetaQuotes

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Social Trading Platform Market top key players overview

Asset Class-based Market Insights

Based on asset class, the social trading platform market can be segmented into equity, commodity, derivatives, crypto, and others. In 2021, the crypto segment accounted for the largest share in global social trading platform market.

Players operating in the social trading platform market have been taking up various strategies, such as mergers and acquisitions, to maintain their positions in the social trading platform market. A few developments by key players are listed below:

- In January 2022, eToro expanded its investment offering in the US to include US Stocks and ETFs (exchange-traded funds).

- In December 2021, eToro had announced the launch of its eToro Money program for UK consumers. eToro Money integrates with a user's eToro investing account, allowing them to deposit and withdraw cash instantaneously and manage their crypto and finances in one spot.

Company Profiles

- eToro

- A-Trade

- ZuluTrade

- Tornado

- MetaQuotes

- PrimeXBT

- Pepperstone Markets Limited

- Tickmill

- Octa Markets Incorporated

- Assetgro Fintech Pvt. Ltd (Stockgro)

- Public Holding, Inc.

- Naga Group AG

- Snowball X

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Sterilization Services Market

- Artificial Intelligence in Healthcare Diagnosis Market

- Tortilla Market

- Medical Devices Market

- Pressure Vessel Composite Materials Market

- Virtual Event Software Market

- Diaper Packaging Machine Market

- Airport Runway FOD Detection Systems Market

- Hand Sanitizer Market

- Bathroom Vanities Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Platform, End User, and Asset Class

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Rising need of customized trading platforms and rising benefits of integration of chatbots with trading platforms such as artificial intelligence are driving the growth of the social trading platform market.

The market opportunity lies in developing countries. Developing countries have become a hub of opportunity for various markets, including the social trading platform market. Further, the rising surge in the internet penetration globally is presenting significant potential for the future growth of the social trading platform market players.

Based on platform, the social trading platform market is bifurcated into PC and mobile. In 2021, the mobile segment led the social trading platform market, accounting for the largest share in the market.

The major five companies in social trading platform includes eToro; ZuluTrade; Pepperstone Market Limited; Tickmill Group; and NAGA Group AG.

In 2021, North America led the market with a substantial revenue share, followed by Europe and Asia Pacific (APAC). North America is a prospective market for social trading platform developers.

Based on end user, the social trading platform market can be bifurcated into individual traders and professional traders. In 2021, the individual traders segment accounted for the largest market share.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies - Social Trading Platform Market

- eToro

- A-Trade

- ZuluTrade

- Tornado

- MetaQuotes

- PrimeXBT

- Pepperstone Markets Limited

- Tickmill

- Octa Markets Incorporated

- Assetgro Fintech Pvt. Ltd (Stockgro)

- Public Holding, Inc.

- Naga Group AG

- Snowball X

Get Free Sample For

Get Free Sample For