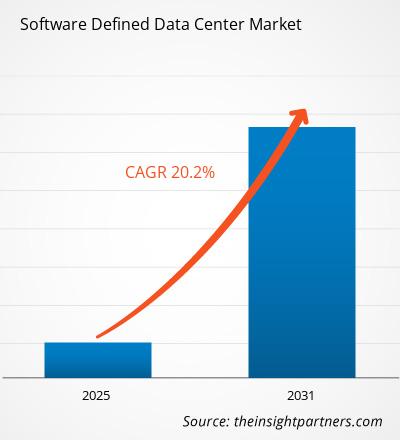

The Software Defined Data Center Market is expected to register a CAGR of 20.2% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Component (Solution, Services); Organization Size (Large Enterprises, SMEs); End Users (Enterprises, Telecom Service Providers, Cloud Service Providers, Managed Service Providers). The global analysis is further broken-down at regional level and major countries. The report offers the value in USD for the above analysis and segments

Purpose of the Report

The report Software Defined Data Center Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Software Defined Data Center Market Segmentation

Component

- Solution

- Services

Organization Size

- Large Enterprises

- SMEs

End Users

- Enterprises

- Telecom Service Providers

- Cloud Service Providers

- Managed Service Providers

Geography

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- South and Central America

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Software Defined Data Center Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Software Defined Data Center Market Growth Drivers

- Intensifying Regulatory Compliance Requirements: The global regulatory landscape for ESG reporting is becoming increasingly complex and stringent. New regulations like the EU's CSRD, SEC's climate disclosure rules, and various national mandates are forcing organizations to adopt sophisticated reporting solutions. ESG reporting software provides automated compliance checks, standardized frameworks, and audit-ready documentation to meet these evolving requirements. The software's ability to track multiple reporting standards simultaneously, while ensuring data accuracy and consistency across different jurisdictions, makes it essential for organizations operating in multiple regulatory environments.

- Growing Investor Pressure for ESG Transparency: Institutional investors and stakeholders are demanding greater transparency and granularity in ESG disclosures. Organizations need robust software solutions to collect, verify, and report ESG metrics that satisfy investor due diligence requirements. The software enables companies to provide detailed sustainability performance data, impact assessments, and progress tracking against ESG goals. This capability is particularly crucial for public companies and those seeking sustainable financing, as investors increasingly integrate ESG performance into their investment decisions.

- Rising Corporate Commitment to Sustainability Goals: Organizations are setting ambitious sustainability targets and need sophisticated tools to track and report their progress. ESG reporting software provides real-time monitoring of environmental impacts, social initiatives, and governance practices. These platforms enable companies to measure carbon emissions, track resource consumption, monitor supply chain sustainability, and assess social impact metrics. The software's analytical capabilities help organizations identify areas for improvement and demonstrate tangible progress toward their sustainability commitments.

Software Defined Data Center Market Future Trends

- Integration of AI and Machine Learning Capabilities: ESG reporting platforms are increasingly incorporating AI and machine learning to enhance data collection, analysis, and reporting capabilities. These technologies enable automated data extraction from various sources, anomaly detection in ESG metrics, and predictive analytics for sustainability performance. AI-powered features help organizations identify trends, forecast impacts, and generate more accurate sustainability reports while reducing manual effort and potential human errors.

- Real-time ESG Data Integration: The market is shifting toward real-time ESG data collection and reporting capabilities. Organizations are demanding platforms that can continuously monitor and update ESG metrics, rather than relying on periodic manual updates. This trend is driven by the need for more timely decision-making and stakeholder communications regarding ESG performance. Real-time monitoring enables immediate identification of issues and faster response to sustainability challenges.

Software Defined Data Center Market Opportunities

- Supply Chain ESG Integration: There's significant opportunity for ESG reporting software to expand into supply chain sustainability monitoring. Organizations need tools to track and report on their suppliers' ESG performance, ensuring compliance with sustainability standards throughout their value chain. Software platforms can facilitate supplier assessments, monitor sustainability certifications, and aggregate ESG data across the supply network, enabling comprehensive reporting on scope 3 emissions and other indirect impacts.

- Small and Medium Enterprise Solutions: The SME segment presents a growing opportunity for simplified, cost-effective ESG reporting solutions. As sustainability reporting requirements extend to smaller organizations, there's increasing demand for streamlined platforms that offer essential reporting capabilities without the complexity of enterprise-scale solutions. Software providers can develop specialized offerings that help SMEs meet basic reporting requirements while maintaining affordability.

Software Defined Data Center Market Regional Insights

The regional trends and factors influencing the Software Defined Data Center Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Software Defined Data Center Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Software Defined Data Center Market

Software Defined Data Center Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 20.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

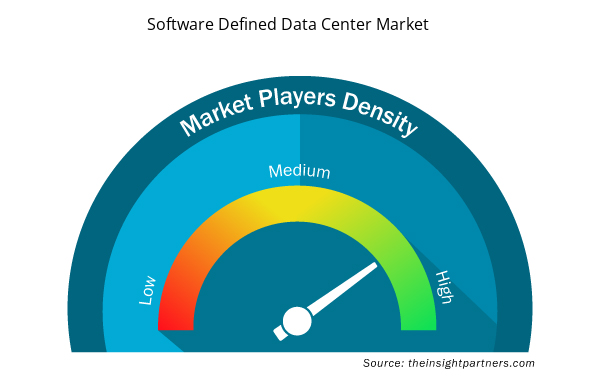

Software Defined Data Center Market Players Density: Understanding Its Impact on Business Dynamics

The Software Defined Data Center Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Software Defined Data Center Market are:

- VMware

- Microsoft

- Cisco

- HPE

- IBM

- Dell Technologies

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Software Defined Data Center Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Software Defined Data Center Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Software Defined Data Center Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Type, Enterprise Size, Industry Vertical, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Some of the customization options available based on the request are an additional 3–5 company profiles and country-specific analysis of 3–5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation# as our team would review the same and check the feasibility

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request

Increased adoption of hybrid and multi-cloud architectures and integration with artificial intelligence and machine learning are anticipated to play a significant role in the global software defined data center market in the coming years

Demand for flexibility and scalability and cost optimization and operational efficiency are the major factors driving the software defined data center market

The global software defined data center market is expected to grow at a CAGR of 20.2% during the forecast period 2024 - 2031.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies

- Cisco Systems, Inc.

- Citrix Systems, Inc.

- Fujitsu Ltd.

- Hitachi, Ltd.

- Hewlett Packard Enterprise

- Huawei Technologies Co. Ltd.

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- VMware, Inc.

Get Free Sample For

Get Free Sample For