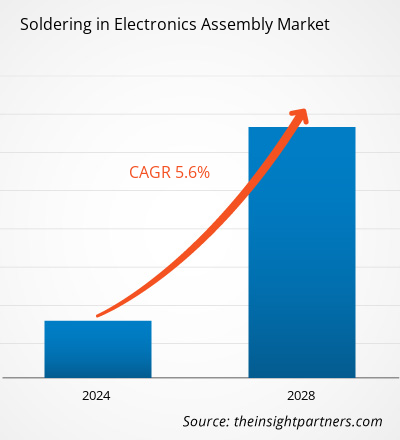

[Research Report] The soldering in electronics assembly market is expected to grow from US$ 2,001.96 million in 2023 to US$ 2,624.71 million by 2028; it is estimated to register a CAGR of 5.6% from 2023 to 2028.

The miniaturization of electronic components plays an important role in the electronic industry. It helps save space so that additional parts or technology can be integrated, or the overall size of consumer electronics, medical devices, automobiles, and more can be reduced. For instance, the reduced size of batteries helps with computer miniaturization. Moreover, miniaturization helps save the cost of the overall material used. For the miniature components, less material is used for the soldering, which helps to save the cost on the material used compared to normal-size components or devices. Such benefits of miniaturization are fueling the demand for this technique in the electronics market. Moreover, the demand for solder pastes with smaller metal particle sizes for miniaturization propels the soldering in electronics assembly market growth. France-based INVENTEC provides Ecorel Free JP32 and Ecorel Free HT 235-16LVD solder paste, which can be used in miniaturization for ultra-fine pitch electronics manufacturing applications. The company is developing more solder paste products due to the growing demand for miniaturization. Thus, an increase in miniaturization in the electronic industry is expected to provide growth opportunities for the soldering in electronics assembly market.

Soldering in Electronics Assembly Market -

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Soldering in Electronics Assembly Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Soldering in Electronics Assembly Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Soldering in Electronics Assembly Market

The COVID-19 pandemic caused disruptions in manufacturing sectors, impacting every process, from supply chain and operations to capital spending, loans, and long-term strategies. The pandemic disrupted exports of parts and interrupted large-scale manufacturing. According to United Nations Conference on Trade and Development (UNCTAD), global foreign direct investment (FDI) collapsed by 42% in 2020 compared to 2019. The prices of tin and lead surged during the pandemic, leading to a decline in demand for soldering products. On the other hand, the demand for medical devices such as pacemakers, defibrillators, neurostimulators, ultrasound machines, and infusion pumps increased due to the pandemic. In addition, the work-from-home culture and online schooling are a few factors that boosted the demand for laptops and mobiles during the pandemic. For instance, Lenovo registered significant financials in the second quarter of 2020 due to the adoption of the work-from-home model; it increased by 7% on a year-on-year basis. Therefore, the COVID impact has negatively caused disruptions in the business of soldering in electronics assembly market.

Market Insights – Soldering in Electronics Assembly Market

Over the years, China and India have significantly increased their investment to develop their manufacturing sector. These countries have also started initiatives such as Made in China 2025 and Make in India to promote local manufacturing. Additionally, the presence of cheap labor is propelling the rapid development of the manufacturing sector in India and China, making these countries hubs for producing consumer electronics and electronic components such as PCBs, sensors, hard disks, and motherboards. Additionally, the rise in investment by global companies across industries such as medical device manufacturing, electronics, and automotive to set up their production plant across the region is further expected to contribute to the APAC soldering in electronics assembly market growth in the coming years.

Product Insights

Based on product, the soldering in electronics assembly market size is segmented into wire, paste, flux, bar, and others. The wire segment accounted for the largest market share in 2022. Solder wires are available in a range of thicknesses, types, and soldering methods. Manual soldering wire, laser soldering, and automated iron soldering are among the commonly used soldering methods. Based on composition, leaded and lead-free solder wires are available in the market. Lead-free solder wires are used in most applications to comply with RoHS Directive. The lead-free solder wire has strong wetting properties as it contains 3% silver. The silver-free soldering wire saves the operational cost of electronic assembly.

The flux-cored solder wire is used in various processes, including automated and robotic soldering. The CW-818 flux cored wire manufactured by Indium Corporation provides fast wetting speed to minimize cycle times in manual and robotic soldering processes; this wire exhibits heat resistance and low spatter properties of the core flux, thereby providing better assemblies for manual and robotics soldering processes.

Soldering in Electronics Assembly Market Regional Insights

The regional trends and factors influencing the Soldering in Electronics Assembly Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Soldering in Electronics Assembly Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Soldering in Electronics Assembly Market

Soldering in Electronics Assembly Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2 Billion |

| Market Size by 2028 | US$ 2.62 Billion |

| Global CAGR (2023 - 2028) | 5.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

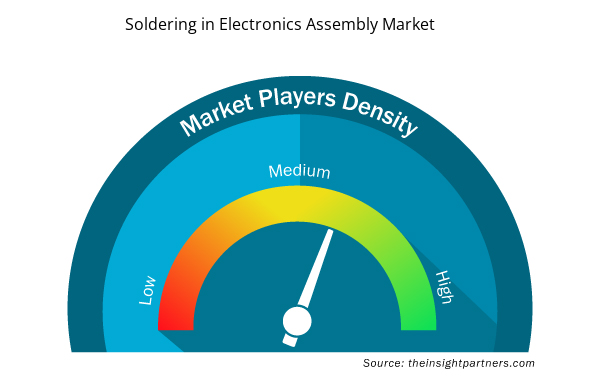

Soldering in Electronics Assembly Market Players Density: Understanding Its Impact on Business Dynamics

The Soldering in Electronics Assembly Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Soldering in Electronics Assembly Market are:

- Lucas-Milhaupt, Inc

- GENMA Europe GmbH

- S-Bond Technology

- Fusion Incorporated

- Indium Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Soldering in Electronics Assembly Market top key players overview

The global soldering in electronics assembly market size is segmented based on product. Based on product, the market is segmented into wire, paste, flux, bar, and others. By region, the soldering in electronics assembly market is segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM).

GENMA Europe GmbH, Indium Corporation, Fusion Incorporated, AIM Metals & Alloys LP, and MacDermid Alpha Electronics Solutions are among the key soldering in electronics assembly market players operating worldwide.

The soldering in electronics assembly market players are mainly focused on the development of advanced and efficient products.

- In 2021, Electronics manufacturing services provider “Foxconn Technology Group” and semiconductor company “MediaTek” announced a collaboration to develop new 5G solutions for smart manufacturing and Industry 4.0 applications. This collaboration could lead to new advancements in the soldering electronics industry.

- In 2020, Soldering equipment manufacturer “Metcal” partnered with electronics distributor “Farnell” to expand its product offerings and reach new customers in Europe.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, Taiwan, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The key players of soldering in electronics assembly market are encompassed with GENMA Europe GmbH, Indium Corporation, Fusion Incorporated, AIM Metals & Alloys LP, and MacDermid Alpha Electronics Solutions.

The global soldering in electronics assembly market was valued at US$ 2,001.96 Mn in 2023

The wire segment led the global soldering in electronics assembly market in 2022.

The key driving factors impacting soldering in electronics assembly market growth includes:

• Growth of Electronic Industry

• New Product Developments

The US, the UK, India, the UAE, Brazil are the countries registering high growth rate during the forecast period.

APAC is the fastest-growing regional market in the global soldering in electronics assembly market between 2023-2028.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Soldering in Electronics Assembly Market

- Lucas-Milhaupt, Inc

- GENMA Europe GmbH

- S-Bond Technology

- Fusion Incorporated

- Indium Corporation

- KOKI Company Ltd

- SUPERIOR FLUX & MFG. CO.

- MacDermid Alpha Electronics Solutions

- Nathan Trotter & Co., Inc.

- AIM Metals & Alloys LP

Get Free Sample For

Get Free Sample For