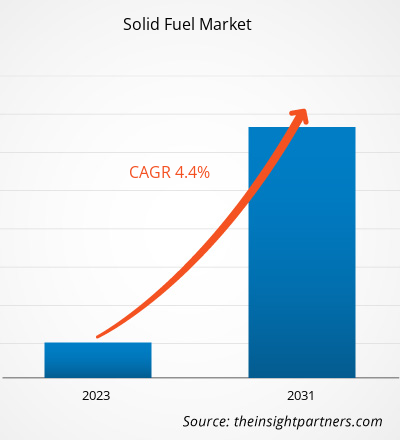

The solid fuel market size is projected to reach US$ 485.54 billion by 2031 from US$ 344.94 billion in 2023. The market is expected to register a CAGR of 4.4% during 2023–2031. Increasing demand for pet coke with rapid industrialization is expected to remain a key trend in the market.

Solid Fuel Market Analysis

The use of coal across different industries across the world is anticipated to boost the growth of the market during the forecast period. In addition, a rise in the development or establishment of oil and gas refineries is further anticipated to fuel the solid fuel market growth during the analyzed timeframe. However, government regulations towards reducing carbon emissions and the availability of coal substitutes are the key restraining factors hampering the solid fuel market growth in the coming years. Moreover, the development and expansion of refineries and the rise in demand for solid fuel are anticipated to drive market growth from 2023 to 2031.

Solid Fuel Market Overview

Growing demand for solid fuel for electricity generation and from the transportation fuel industry drives the solid fuel market growth. Electricity is used in a wide range of domestic, commercial, and industrial purposes. Over the years, the use of electricity has increased. According to the data by the U.S. Energy Information Administration published in 2023, the total electricity consumption in the US was 4.07 trillion kWh in 2022, which was 14 times greater than electricity use in 1950. Thus, the rising use of electricity is fueling the solid fuel market growth.

Steel is increasingly used across industries, as it is the most important material for the manufacturing of components used in cars, utensils, construction products, refrigerators, washing machines, and other appliances. In addition, pet coke is used as feedstock to produce steel. During steel production, a metcake is produced. Thus, the growing steel industry propels the demand for getcoke and produces metcoke that can be used in iron and steel industry processes, which drives the solid fuel market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Solid Fuel Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Solid Fuel Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Solid Fuel Market Drivers and Opportunities

Establishment of Refineries Driving Use of Coal to Favor Market

Petroleum refineries in the world are utilized in producing a variety of end products, including petrol, carbon anodes, aviation fuel, and heating oil. The increasing establishment of petroleum refineries in the world resulted in raising the demand for coal as an energy resource. Four out of the ten biggest oil refining companies across the world are in Asia, whereas three are in North America, and other oil refining companies are in Europe. The US, China, Russia, and India have the largest oil refinery capacities in the world. Asia Pacific is a shelter that has the largest number of operational petroleum refineries. There were around 310 operational petroleum refineries in the region as of 2021. Owing to rising demand from economic powerhouses such as India and China, ~ 90 refining facilities are in a planning phase or work-in-progress (construction) phase.

Development and Expansion of Refineries

In June 2022, the IEA oil market report predicted that net global refining capacity would expand by an extra 1.6 million b/d in 2023. The expansion or new refining capacity growth consists of various high-capacity refinery projects underway, especially in the Middle East and China. The region above and the country has the potential to add over 4.0 million b/d of new capacity in the next two years.

- In China, it is projected that overall capacity would have a snowball effect owing to commence of a minimum of two new refinery projects and one major refinery expansion.

- Substantial refinery capacity was extended in the Middle East in 2021. In Saudi Arabia, the Jizan refinery with 400,000 b/d capacity came online by the end of 2021 and commenced exporting petroleum products at the beginning of 2022.

- New refining construction with more than 2 million b/d capacity is estimated to come online to assist markets in the Indian Ocean basin. Along with this, another major project is scheduled in the Atlantic basin. After completion of the mentioned project, a 650,000 b/d Dangote Industries refinery in Lagos (Nigeria) will be the largest in the country. The development of a refinery would meet domestic and neighboring African countries’ demand for petroleum.

Therefore, the expansion of refineries would increase the use of solid fuels, which is expected to offer lucrative opportunities for the solid fuels market during the forecast period.

Solid Fuel Market Report Segmentation Analysis

The key segment that contributed to the derivation of the solid fuel market analysis is fuel type.

- Based on the fuel type, the solid fuel market is divided into petcoke/flexicoke, anthracite, metallurgical coke, and coal. The coal segment held a larger market share in 2023.

Solid Fuel Market Share Analysis by Geography

The geographic scope of the solid fuel market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Asia Pacific is leading the market. Based on country, the solid fuel market in Asia Pacific is categorized into Australia, China, India, Japan, South Korea, & the Rest of Asia Pacific. Asia Pacific has the presence of many pet coke producers which resulted in driving the market growth during the analyzed timeframe. China is one of the prominent countries in the solid fuel market in the Asia Pacific. The region has strong coal production as it is very essential source for energy production which can increase the demand for coal in the region which in turn is expected to fuel the market growth from 2023 to 2031. There is a increase in steel production in Asia Pacific region. The World Steel Association stated in December 2022 that Asia and Oceania produced 101.4 Mt steel in November 2022, an increase of 2.7% compared to November 2021. In addition, according to the data by Indian Ministry of Steel published in December 2022, domestic steel production rose to 78.09 Mt in the fiscal year 2022 from 73.02 Mt in fiscal year 2021, with an increase of 6.9%. As anthracite is used in steel making process. Rising steel production will propel the demand for anthracite, which, in turn, is expected to bolster the solid fuel market in the coming years.

Solid Fuel Market Regional Insights

The regional trends and factors influencing the Solid Fuel Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Solid Fuel Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Solid Fuel Market

Solid Fuel Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 344.94 Billion |

| Market Size by 2031 | US$ 485.54 Billion |

| Global CAGR (2023 - 2031) | 4.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Fuel Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

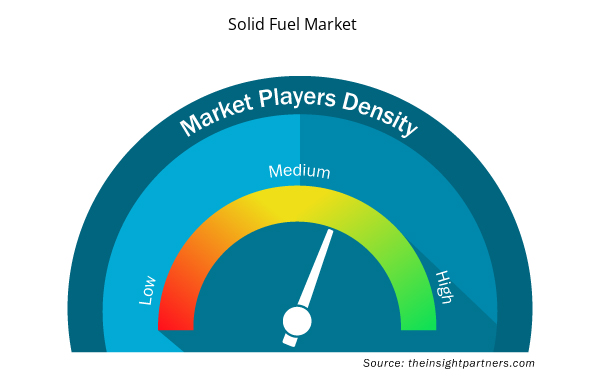

Solid Fuel Market Players Density: Understanding Its Impact on Business Dynamics

The Solid Fuel Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Solid Fuel Market are:

- Indian Oil Corp Ltd

- Elinoil Hellenic Petroleum Company SA

- RESORBENT Sro

- JH CARBON PTY LTD

- Chevron Corporation

- Phillips 66 Company

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Solid Fuel Market top key players overview

Solid Fuel Market News and Recent Developments

The solid fuel market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the solid fuel market are listed below:

- Petróleos de Venezuela, S.A. (PDVSA) signed two contracts with Latif Petrol and Reussi Trading. Through these agreements, PDVSA will export ~ 1.6 million metric tons of pet coke. (Source: PDVSA, Press Release, July 2023)

- SOCAR Star Oil Refinery increased production of pet coke by 23.7% in October 2023. This has expanded the production capacity of the refinery in the pet coke market. (Source: SOCAR Star Oil Refinery, Press Release, December 2023)

Solid Fuel Market Report Coverage and Deliverables

The “Solid Fuel Market Size and Forecast (2021–2031)” report provides a detailed market analysis of the covering below areas:

- Solid fuel market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Solid fuel market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Solid fuel market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the solid fuel market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Bathroom Vanities Market

- Vision Guided Robotics Software Market

- Long Read Sequencing Market

- Public Key Infrastructure Market

- Data Annotation Tools Market

- Medical Collagen Market

- Emergency Department Information System (EDIS) Market

- Cell Line Development Market

- Extracellular Matrix Market

- Influenza Vaccines Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Fuel Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Russia, Saudi Arabia, South Africa, South Korea, UAE, United Kingdom, United States

Frequently Asked Questions

Asia Pacific dominated the solid fuel market in 2023.

Increasing demand for pet coke with rapid industrialization is the future trend in the solid fuel market

Indian Oil Corp Ltd, Elinoil Hellenic Petroleum Company SA, RESORBENT Sro, JH CARBON PTY LTD, Chevron Corporation, Phillips 66 Company, Consol Emnergy, BP Plc, Lukoil, and Valero Energy Corp are some of the leading players in the solid fuel market.

US$ 485.54 billion estimated value of the solid fuel market by 2031.

4.4% is the expected CAGR of the solid fuel market.

Get Free Sample For

Get Free Sample For