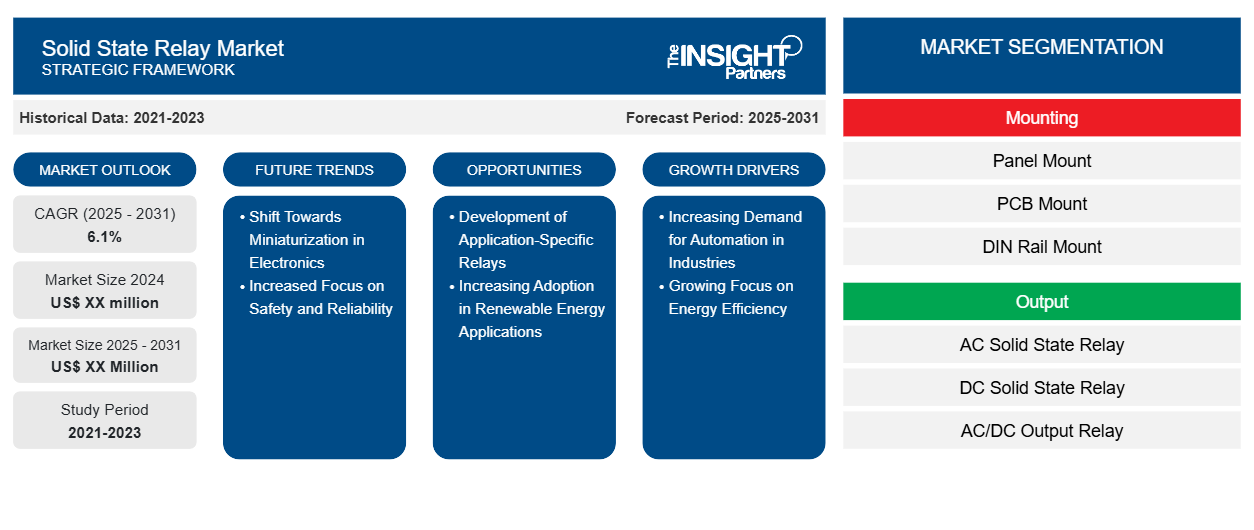

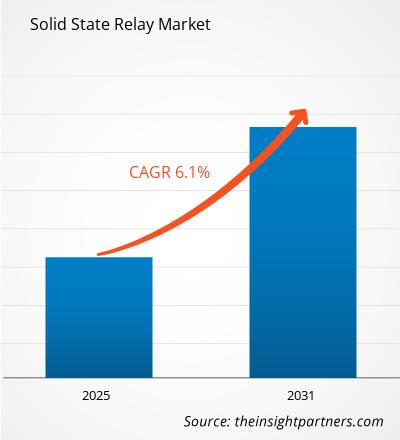

The Solid State Relay Market is expected to register a CAGR of 6.1% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented By Mounting (Panel Mount, PCB Mount, and DIN Rail Mount), Output (AC Solid State Relay, DC Solid State Relay, and AC/DC Output Relay), Application (Energy and Power, Industrial Automation, Automotive, Food and beverage, Others). The global analysis is further broken-down at regional level and major countries. The report offers the value in USD for the above analysis and segments

Purpose of the Report

The report Solid State Relay Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Solid State Relay Market Segmentation

Mounting

- Panel Mount

- PCB Mount

- DIN Rail Mount

Output

- AC Solid State Relay

- DC Solid State Relay

- AC/DC Output Relay

Application

- Energy and Power

- Industrial Automation

- Automotive

- Food and beverage

- Others

Geography

- North America

- Europe

- Asia-Pacific

- South and Central America

- Middle East and Africa

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Solid State Relay Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Solid State Relay Market Growth Drivers

- Increasing Demand for Automation in Industries: The rise of automation across various industries is a significant driver for the solid-state relay (SSR) market. As factories and manufacturing processes become increasingly automated, the need for efficient and reliable switching solutions grows. Solid state relays offer several advantages over traditional electromechanical relays, including faster switching speeds, longer lifespans, and reduced maintenance requirements. These features make SSRs particularly appealing for automated systems, driving their adoption in sectors such as manufacturing, automotive, and process control.

- Growing Focus on Energy Efficiency: With the global push for energy efficiency and sustainability, industries are seeking solutions that minimize energy consumption and reduce waste. Solid state relays are inherently more efficient than their mechanical counterparts, as they produce less heat and have lower power losses during operation. This efficiency not only helps organizations lower their operational costs but also aligns with green initiatives aimed at reducing environmental impact. Consequently, the increasing emphasis on energy-efficient technologies is propelling the demand for solid-state relays.

Solid State Relay Market Future Trends

- Shift Towards Miniaturization in Electronics: Another trend impacting the solid state relay market is the ongoing shift towards miniaturization in electronic devices. As consumer electronics and industrial equipment become smaller and more compact, the need for space-saving components increases. Solid state relays offer a compact design with high performance, making them ideal for applications where space is at a premium. This trend towards smaller devices is driving manufacturers to adopt SSRs to meet the demands of modern design without compromising on functionality or reliability.

- Increased Focus on Safety and Reliability: The growing emphasis on safety and reliability in industrial applications is shaping the solid state relay market. End-users are seeking components that not only perform well but also provide protection against electrical faults and hazardous conditions. Solid state relays offer enhanced safety features, such as isolation between control and load circuits, which minimizes the risk of electrical shock. This heightened focus on safety is prompting manufacturers to choose SSRs over traditional relays, thus driving market growth.

Solid State Relay Market Opportunities

- Development of Application-Specific Relays: There is a growing opportunity for manufacturers to develop application-specific solid state relays tailored to meet the unique needs of various industries. For example, relays designed for automotive applications may require specific voltage ratings and thermal management features, while those for HVAC systems might need to handle varying load conditions. By focusing on niche markets and creating specialized SSRs, companies can differentiate themselves from competitors and cater to the specific requirements of end-users, thus driving sales and market share.

- Increasing Adoption in Renewable Energy Applications: The increasing shift towards renewable energy sources presents a significant opportunity for the solid state relay market. With the rapid growth of solar and wind energy installations, there is a rising demand for efficient switching and control solutions that can enhance system performance and reliability. Solid state relays are well-suited for use in renewable energy systems due to their durability, low power consumption, and ability to handle high switching frequencies. Companies that position themselves in the renewable energy sector can harness this growing demand for SSRs, contributing to sustainable energy solutions.

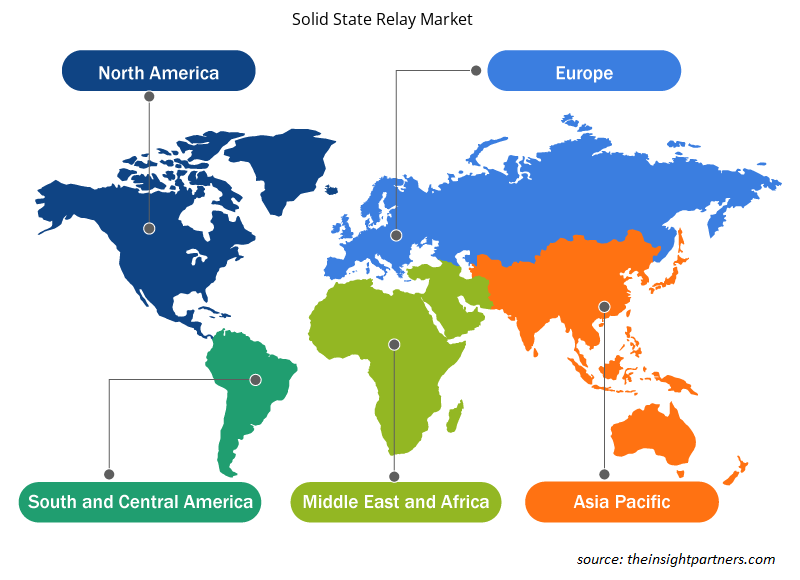

Solid State Relay Market Regional Insights

The regional trends and factors influencing the Solid State Relay Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Solid State Relay Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Solid State Relay Market

Solid State Relay Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 6.1% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Mounting

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

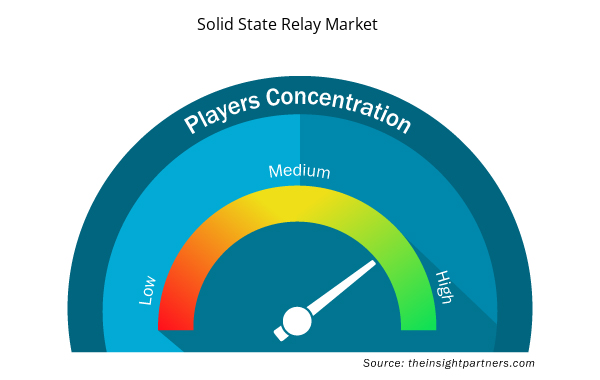

Solid State Relay Market Players Density: Understanding Its Impact on Business Dynamics

The Solid State Relay Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Solid State Relay Market are:

- Anacon Electronic Sales, Inc.

- Broadcom

- Carlo Gavazzi Holding AG

- Crydom Inc.,

- FUJITSU

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Solid State Relay Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Solid State Relay Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Solid State Relay Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Some of the customization options available based on the request are an additional 3-5 company profiles and country-specific analysis of 3-5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation# as our team would review the same and check the feasibility

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request

Integration of IoT and smart control technologies to play a significant role in the global solid state relay market in the coming years

Industrial automation growth and renewable energy transformation are the major factors driving the solid state relay market

The Solid State Relay Market is estimated to witness a CAGR of 6.1% from 2023 to 2031

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies

- Anacon Electronic Sales, Inc.

- Broadcom

- Carlo Gavazzi Holding AG

- Crydom Inc. ,

- FUJITSU

- GENERAL ELECTRIC

- OMEGA Engineering inc.

- OMRON Corporation

- Rockwell Automation, Inc.

- Teledyne Relays

Get Free Sample For

Get Free Sample For