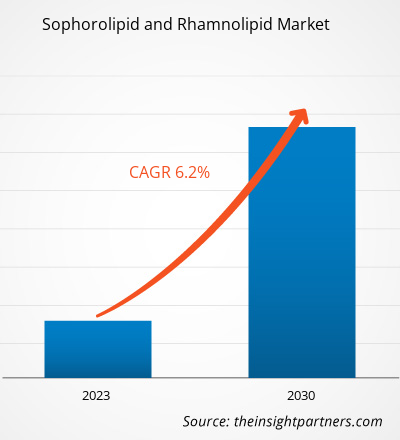

[Research Report] The sophorolipid and rhamnolipid market size is expected to grow from US$ 334.88 million in 2022 to US$ 541.63 million by 2030; it is estimated to register a CAGR of 6.2% from 2022 to 2030.

Market Insights and Analyst View:

Sophorolipids and rhamnolipids are extracted from natural sources. Raw materials required for the manufacturing of sophorolipid are vegetable oil; sugar; and nonpathogenic yeasts such as Candida batistae, C. apicola, Starmerella bombicola, Rhodotorula bogoriensis, Wickerhamiella domercqiae, and Rhodotorula babjevae. Sophorolipids and rhamnolipids are used in different applications such as household detergents, personal care, industrial and institutional cleaners, food processing, oilfield chemicals, leather processing, agriculture, and pharmaceuticals. Due to the low toxicity and high biodegradable properties of sophorolipids, they are highly used as biosurfactants to reduce surface and interfacial tension, increasing the dissolution rate of hydrocarbons and facilitating solubilization and absorption of compounds. Rhamnolipids have gained attention in different sectors due to their non-toxicity, high biodegradability, low surface tension, and minimum inhibitory concentration values.

Growth Drivers and Challenges:

Sophorolipids offer several advantages over chemical surfactants, such as high biodegradability, diversity of biological properties, and renewable characteristics being synthesized as a mixture of different molecules. Sophorolipids have various properties, including antimicrobial and antioxidant activity, that allow their application in different industries, such as detergents and personal care. They are also highly efficient in reducing the surface and interfacial tensions. Further, rhamnolipids are highly used in applications across many industries, such as bioremediation, cosmetics, agriculture, food processing, and pharmaceuticals, owing to their efficient surface and biological capabilities. Rhamnolipids effectively lower surface tension, exhibit low toxicity, have a strong wetting ability, and promote the biodegradation of poorly soluble substrates. Therefore, advantages associated with the usage of sophorolipids and rhamnolipids drive the sophorolipid and rhamnolipid market growth. However, the high cost of rhamnolipids and sophorolipids limits their use in different application sectors, restraining the global sophorolipid and rhamnolipid market growth. The cost of producing rhamnolipids is high due to the poorer yields as compared to commercial synthetic surfactants. High feedstock costs, expensive purification, and downstream processing are key factors increasing the production cost. The main disadvantage of sophorolipid is its high price. However, the chemical industry is analyzing ways to improve production efficiency and lower costs. Many studies have been focusing on finding a new cost-effective bioprocess setting.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Sophorolipid and Rhamnolipid Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Sophorolipid and Rhamnolipid Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The "Global Sophorolipid and Rhamnolipid Market" is segmented on the basis of type, application, and geography. Based on type, the sophorolipid and rhamnolipid market is segmented into sophorolipid and rhamnolipid. In terms of application, the sophorolipid and rhamnolipid market is segmented into household detergents, personal care, industrial and institutional cleaners, food processing, oilfield chemicals, leather processing, agriculture, pharmaceuticals, and others. Geographically, the sophorolipid and rhamnolipid market is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

Based on type, the sophorolipid and rhamnolipid market is segmented into sophorolipid and rhamnolipid. The sophorolipid segment held a significant sophorolipid and rhamnolipid market share in 2022, and the market for the segment is expected to grow significantly from 2022 to 2030. Sophorolipid molecules possess excellent surface-active properties, making them valuable in various applications such as personal care products, detergents, food additives, pharmaceuticals, and environmental remediation. In cosmetics, sophorolipids have gained traction as natural and biodegradable emulsifiers and foaming agents. Their ability to stabilize formulations while being gentle on the skin aligns with the increasing consumer preference for eco-friendly and skin-friendly products.

Regional Analysis:

The sophorolipid and rhamnolipid market is segmented into five key regions—North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. Europe dominated the global sophorolipid and rhamnolipid market, and the regional market accounted for approximately US$ 120 million in 2022. North America is also a major contributor, holding a significant portion of the global sophorolipid and rhamnolipid market share. The North America market is expected to reach over US$ 140 million in 2030. Asia Pacific is expected to register a considerable CAGR of over 7% from 2022 to 2030. The Asia Pacific sophorolipids and rhamnolipids market, by country, is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. The market is driven by factors such as the growing demand from the detergents & cleaning products industry and rising awareness regarding the advantages associated with the use of sophorolipids and rhamnolipids. These biocompatible and environmentally friendly biosurfactants have gained significant traction due to their versatile application in industries such as personal care, pharmaceuticals, agriculture, and oil recovery. The rising awareness regarding sustainable and green technologies is expected to propel the demand for sophorolipids and rhamnolipids due to their effectiveness in reducing environmental impact. Further, the increasing focus on reducing reliance on traditional petrochemical-based surfactants has prompted companies in Asia Pacific to invest in the research, development, and production of these biobased alternatives.

Industry Developments and Future Opportunities:

Following are initiatives taken by the key players operating in the sophorolipid and rhamnolipid market:

- In 2023, Holiferm Ltd and Sasol Chemicals, a business unit of Sasol Ltd., announced a collaboration to produce and market rhamnolipids and mannosyl erythritol lipids (MELs). This collaboration expands the partnership announced in March 2022 between the two companies to develop and commercialize another biosurfactant product, sophorolipids.

- In 2022, Evonik announced an investment to build a new plant for the production of bio-based and fully biodegradable rhamnolipids. The investment at the Slovenská Ľupča site in Slovakia is expected to strengthen the company’s partnership with the consumer goods group Unilever, which began in 2019.

- In 2020, Stepan Co acquired Logos Technologies LLC's NatSurFact business, a rhamnolipid-based line of biosurfactants derived from renewable sources.

Sophorolipid and Rhamnolipid Market Regional Insights

Sophorolipid and Rhamnolipid Market Regional Insights

The regional trends and factors influencing the Sophorolipid and Rhamnolipid Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Sophorolipid and Rhamnolipid Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Sophorolipid and Rhamnolipid Market

Sophorolipid and Rhamnolipid Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 334.88 Million |

| Market Size by 2030 | US$ 541.63 Million |

| Global CAGR (2022 - 2030) | 6.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Sophorolipid and Rhamnolipid Market Players Density: Understanding Its Impact on Business Dynamics

The Sophorolipid and Rhamnolipid Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Sophorolipid and Rhamnolipid Market are:

- Dow Inc

- Allied Carbon Solutions Co Ltd

- Saraya Co Ltd

- Evonik Industries AG

- Givaudan SA

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Sophorolipid and Rhamnolipid Market top key players overview

COVID-19 Pandemic Impact:

The COVID-19 pandemic negatively affected almost all industries in various countries. Lockdowns, travel restrictions, and business shutdowns in North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa hampered the growth of several industries, including the chemicals & materials industry. The shutdown of manufacturing units of sophorolipid and rhamnolipid companies disturbed global supply chains, manufacturing activities, and delivery schedules. Various companies reported delays in product deliveries and a slump in product sales in 2020. Negative impact of the pandemic on the growth of industries such as food, personal care, leather processing, and others adversely affected the sophorolipid and rhamnolipid market growth. However, several industries have started operating at full capacity as supply constraints resolve gradually, which propels the demand for sophorolipid and rhamnolipid from various industries, driving the sophorolipid and rhamnolipid market growth.

Competitive Landscape and Key Companies:

Dow Inc., Allied Carbon Solutions Co. Ltd., Saraya Co. Ltd., Evonik Industries AG, Givaudan SA, Godrej Industries Ltd., Holiferm Ltd., Stepan Co, Deguan Biosurfactant Supplier, and Jeneil Bioproducts GmbH are a few players operating in the global sophorolipid and rhamnolipid market. Players operating in the global sophorolipid and rhamnolipid market focus on providing high-quality products to fulfil customer demand. They also focus on adopting strategies such as new product launches, capacity expansion, partnerships, and collaborations to stay competitive in the market.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

A few players operating in the global sophorolipid and rhamnolipid market include Dow Inc, Allied Carbon Solutions Co Ltd, Saraya Co Ltd, Evonik Industries AG, Givaudan SA, Godrej Industries Ltd, Holiferm Ltd, Stepan Co, Deguan Biosurfactant Supplier, and Jeneil Bioproducts GmbH.

In 2022, Europe held the largest share of the global sophorolipid and rhamnolipid market. In Europe, the increasing use of sophorolipid and rhamnolipid in detergents, cleaning products, personal care and cosmetic products, food processing, pharmaceuticals, and many other applications is driving market growth.

The sophorolipid segment held the largest share in the global sophorolipid and rhamnolipid market in 2022. Sophorolipid molecules possess excellent surface-active properties, making them valuable in various applications such as personal care products, detergents, food additives, pharmaceuticals, and environmental remediation.

The household detergents segment held the largest share of the global sophorolipid and rhamnolipid market in 2022. Sophorolipids and rhamnolipids have shown effective results in hard surface cleaning and automated dishwashing aid formulations. Sophorolipid and rhamnolipids-based detergents are biodegradable and environmentally friendly.

The projected growth of the market is attributed to the advantages associated with usage of sophorolipids and rhamnolipids and the growing demand from detergents & cleaning products industry.

Asia Pacific is estimated to register the fastest CAGR in the global sophorolipid and rhamnolipid market over the forecast period. The market is driven by factors such as the growing demand from the detergents & cleaning products industry and rising awareness regarding advantages associated with using sophorolipids and rhamnolipids.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Sophorolipid and Rhamnolipid Market

- Dow Inc

- Allied Carbon Solutions Co Ltd

- Saraya Co Ltd

- Evonik Industries AG

- Givaudan SA

- Godrej Industries Ltd

- Holiferm Ltd

- Stepan Co

- Deguan Biosurfactant Supplier

- Jeneil Bioproducts GmbH.

Get Free Sample For

Get Free Sample For