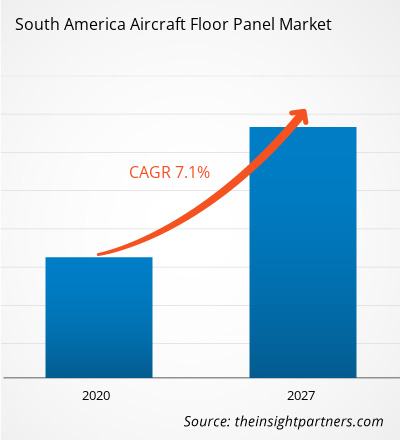

The SAM aircraft floor panel market is expected to grow from US$ 78.63 million in 2019 to US$ 120.69 million by 2027; it is estimated to grow at a CAGR of 7.1 % from 2020 to 2027.

The Brazil is the major economy in SAM. Mounting demand for air freighter fleet is expected to upswing the SAM aircraft floor panel market. The SAM air freight business is surging at an exponential rate, thereby driving the orders and shipment of freighter aircraft models across SAM region. The wide body freighters dominated the air freight industry over the years, thus boosting the procurement volumes of aircraft floor panels for SAM region. The flooring of any freighter aircraft is manufactured with ultimate precaution and accuracy, as the floor panels need to carry heavier loads than passenger aircraft cargo compartments. Moreover, the strength and rigidity of these floor panels is of utmost importance. The increasing demand for stronger floor panels, coupled with the rise in freighter aircraft production volumes, the SAM aircraft floor panel market players offering their products to freighter aircraft manufacturers are experiencing healthy demand, which is driving their business. Several cargo carriers are procuring narrow body freighters and are also converting the existing narrow body passenger aircraft to freighter aircraft. The Boeing B737 series aircraft fleet is also anticipated to experience strong demand for passenger-to-freighter conversion, which would allow several SAM aircraft floor panel market players and aftermarket players to witness higher demand for their products and services. These developments would propel the SAM aircraft floor panel market in the coming years. The mounting demand for freighter aircraft, also leading to the surge in passenger-to-freighter conversion, would escalate the need for suitable floor panels in the coming years, which will drive the SAM aircraft floor panel marketFurther, in case of COVID-19, Brazil has the highest number of cases, followed by Peru, Chile, Colombia, and Ecuador, among others. SAM's government has taken an array of actions to protect their citizens and contain COVID-19's spread. Brazil is the largest spender in the aerospace industry and is the only modern aircraft manufacturing country in the region. Owing to this, the demand for components and parts is at an all-time high in the country. In addition, the majority of the components are imported from the US, China, and European countries. The slowdown in commercial and military aircraft production in the country has impaired the supply chain in Brazil. This has weakened the demand for several components, including aircraft floor panels. Thus, the outbreak of COVID-19 has had a harsh impact on the SAM aircraft floor panels market, especially in Brazil.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the SAM aircraft floor panel market. The SAM aircraft floor panel market is expected to grow at a good CAGR during the forecast period.

SAM Aircraft Floor Panel Market Segmentation

SAM Aircraft Floor Panel Market – By Aircraft Type

- Wide Body Aircrafts

- Narrow Body Aircrafts

- General Aviation

SAM Aircraft Floor Panel Market – By Material Type

- Aluminum Honeycomb

- Nomex Honeycomb

SAM Aircraft Floor Panel Market – By Sales Channel

- OEM

- Aftermarket

SAM Aircraft Floor Panel Market – By End User

- Commercial

- Military

SAM Aircraft Floor Panel Market, by Country

- Brazil

- Rest of SAM

SAM Aircraft Floor Panel Market - Companies Mentioned

- Aim Altitude UK Ltd.

- Collins Aerospace, a Raytheon Technologies Corporation company

- Euro Composite S.A.

- Safran S.A

- Singapore Technologies Engineering Ltd

- The Gill Corporation

South America Aircraft Floor Panel Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 78.63 Million |

| Market Size by 2027 | US$ 120.69 Million |

| Global CAGR (2020 - 2027) | 7.1 % |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Aircraft Type

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Aircraft Type, Material Type, Sales Channel, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Brazil, Argentina

Trends and growth analysis reports related to Aerospace and Defense : READ MORE..

Some of the leading companies are:

- Aim Altitude UK Ltd.

- Collins Aerospace, a Raytheon Technologies Corporation company

- Euro Composite S.A.

- Safran S.A

- Singapore Technologies Engineering Ltd

- The Gill Corporation

Get Free Sample For

Get Free Sample For