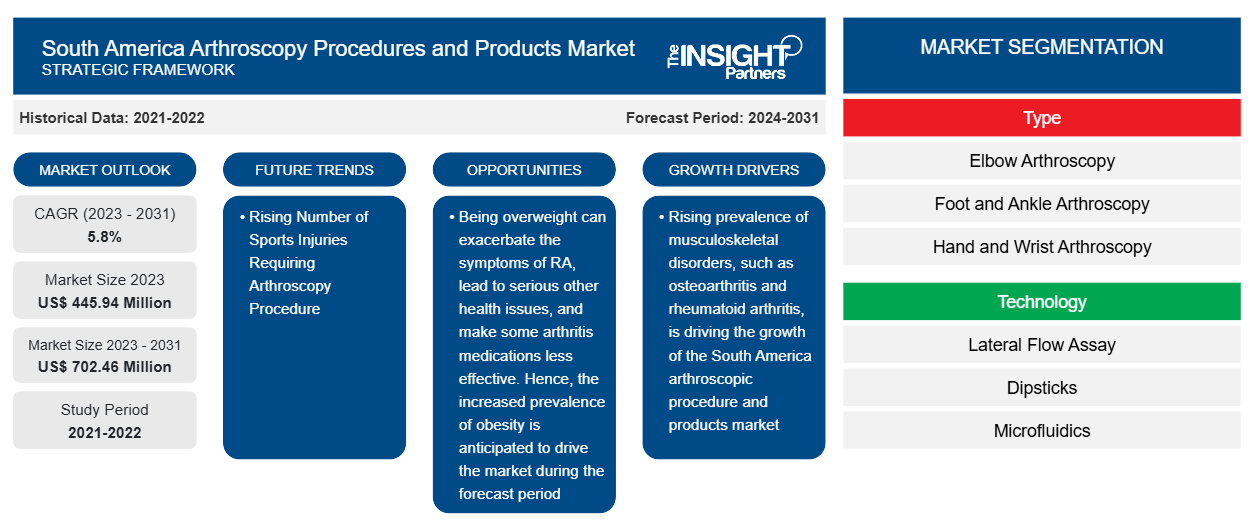

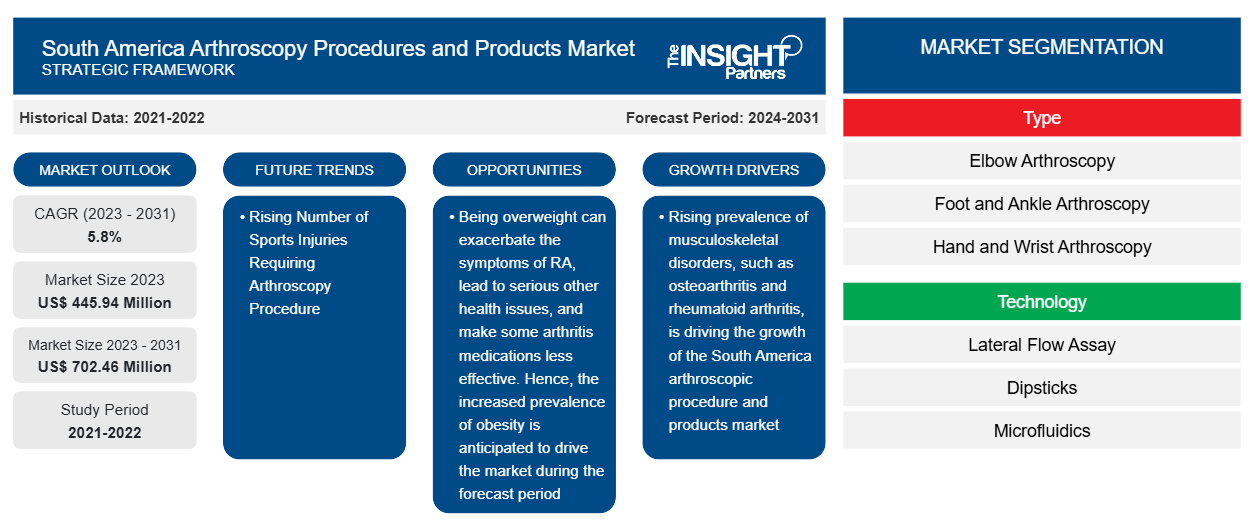

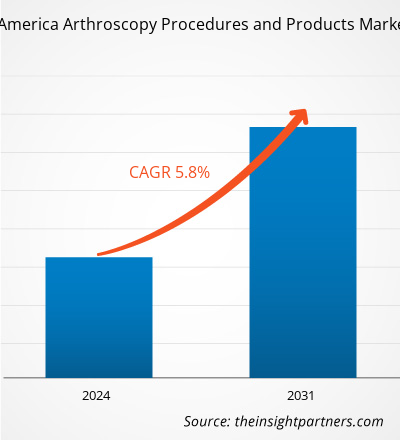

The South America arthroscopy procedures and products market size is projected to reach US$ 702.46 million by 2031 from US$ 445.94 million in 2023. The market is expected to register a CAGR of 5.8% during 2023–2031. Integration of smart probes and sensors are likely to remain a key trend in the market.

South America Arthroscopy Procedures and Products Market Analysis

The growing prevalence of musculoskeletal disorders and rising number of sports injuries requiring arthroscopy procedures are the key factors driving the market. Furthermore, increased prevalence of obesity is accelerating the growth of the South America arthroscopic procedure and products market.

South America Arthroscopy Procedures and Products Market Overview

Musculoskeletal disorders such as osteoarthritis and rheumatoid arthritis are becoming increasingly common in South America due to sedentary lifestyles, rising obesity rates, and aging population. The statistics released by the National Library of Medicine in 2022 revealed the overall prevalence of symptomatic knee osteoarthritis, as determined by a physician, in adult patients varied from 1.55% in Peru to 7.44% in Ecuador. As a result, there is a greater need for advanced arthroscopic procedures and products that can provide effective treatment options with minimal invasiveness and faster recovery times. Additionally, the increasing adoption of arthroscopic procedures in South America can be attributed to the advancements in technology and healthcare infrastructure, which have made these procedures more accessible. According to the Rheumatology Advisor 2019 report, in Brazil, the annual knee arthroplasty increased by 56% in 2020, i.e., 1,065,000 replacements; it will increase by 110% in 2025, i.e., 1,272,000 replacements.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

South America Arthroscopy Procedures and Products Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

South America Arthroscopy Procedures and Products Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

South America Arthroscopy Procedures and Products Market Drivers and Opportunities

Rising Number of Sports Injuries Requiring Arthroscopy Procedure Favors Market Growth

Football, basketball, and tennis are highly popular sports in South America. With increasing participation in these sports, injuries among athletes are on the rise. According to data released by SciELO in August 2023, women participation in sports stood at 16.9% and men at 31.7% in Brazil. Moreover, the growing emphasis on physical fitness and an active lifestyle has increased sports participation among people of all age groups in South America. This has further contributed to the rise in sports-related injuries and, subsequently, the demand for arthroscopic procedures

Arthroscopy is a preferred method for diagnosing and treating sports injuries, as it allows for a minimally invasive approach, faster recovery times, and reduced post-operative pain compared to open surgery. Anterior cruciate ligament tears are among the most common sports injuries requiring arthroscopic surgery. As patients are now more informed about the advantages of minimally invasive procedures, arthroscopic procedures and products are gaining traction for treating sports injuries.

Increasing Prevalence of Obesity to Create Significant Opportunities

Obesity has a considerable effect on the musculoskeletal system, resulting in the degeneration of bones, cartilage, and ligaments. According to the study published by Nature Research Publications, in 2022, in Brazil, epidemiological studies have also shown an increase in the prevalence of obesity in adults from 12.5% in 2002 to 25.9% in 2019. This massive prevalence of obesity is majorly due to unhealthy habits such as consumption of junk food, sedentary lifestyle, genetic conditions, and deprivation of mental health. Overweight conditions among players and athletes can lead to the increasing prevalence of sports injuries. For instance, according to a study published in the British Journal of Sports Medicine in 2015, athletes with a BMI index of more than 30 kg/m2 are highly susceptible to sports injuries.

Obesity is associated with osteoarthritis, a chronic, chronic joint condition caused by increased force across the joint and other pro-inflammatory factors such as inflammation throughout the body. According to the Obesity Action Coalition, obese people are 60% more likely to develop arthritis than normal-weight people. BMI values enhance joint pain symptoms and severity.

South America Arthroscopy Procedures and Products Market Report Segmentation Analysis

Key segments that contributed to the derivation of the South America arthroscopy procedures and products market analysis are clinical indication, type, product, and end user.

- Based on type, the South America arthroscopy procedures and products market is segmented into elbow arthroscopy, foot and ankle arthroscopy, hand and wrist arthroscopy, hip arthroscopy, knee arthroscopy, shoulder arthroscopy, and others. The knee arthroscopy segment held the largest market share in 2023.

- By clinical indication, the market is categorized into anterior cruciate ligament tears, arthritis, carpal tunnel syndrome, meniscal, chondromalacia, inflammation, labral tears, loose bone or cartilage, rotator cuff tears, shoulder bursitis and shoulder dislocations, and others. The anterior cruciate ligament tears segment held the largest share of the South America arthroscopy procedures and products market in 2023.

- By product, the market is segmented into arthroscopy accessories, integrated visualization systems, fluid management systems, powered shaver systems/diamond-like carbon-coated blades, bipolar arthroscopic RF systems, arthroscopic implants, and arthroscopic resection systems. The arthroscopic implants segment held the largest share of the market in 2023.

- Based on end user, the South America arthroscopy procedures and products market is divided into hospitals, specialty clinics and centers, and others. The hospitals segment held the largest market share in 2023.

South America Arthroscopy Procedures and Products Market Share Analysis by Geography

The regional scope of the South America arthroscopy procedures and products market report is mainly divided into Brazil, Argentina, Chile, Ecuador, Peru, Colombia, and the Rest of South America.

The orthopedic industry in Brazil has observed significant progress in the last few years. The development of the healthcare sector, the growing number of orthopedic procedures, and increasing foreign direct investment are responsible for the market growth. Many hospitals provide excellent treatment options for various orthopedic problems. The growth of medical tourism, the increasing number of citizens seeking private insurance coverage, and the rising demand for orthopedic implants and other knee prostheses support the market growth. The growing number of hip fractures also fuels the market growth. As per the US Census Bureau, Brazil accounted for ~121,000 hip fractures per year, which is expected to increase to 160,000 by 2050. Osteoporosis is regarded as a significant health problem in Brazil. Therefore, public and private healthcare institutes create awareness regarding diagnosis and treatment for osteoporosis through various awareness programs and campaigns. For instance, "Osteoporosis Prevention Campaign: from the Child to the Senior" was launched by the Ministry of Health in 2011. This initiative aimed to raise the population's awareness of the risks of osteoporosis.

South America Arthroscopy Procedures and Products Market Regional Insights

The regional trends and factors influencing the South America Arthroscopy Procedures and Products Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses South America Arthroscopy Procedures and Products Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for South America Arthroscopy Procedures and Products Market

South America Arthroscopy Procedures and Products Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 445.94 Million |

| Market Size by 2031 | US$ 702.46 Million |

| Global CAGR (2023 - 2031) | 5.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

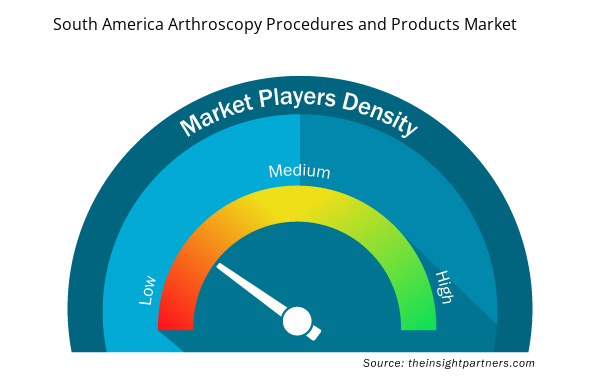

South America Arthroscopy Procedures and Products Market Players Density: Understanding Its Impact on Business Dynamics

The South America Arthroscopy Procedures and Products Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the South America Arthroscopy Procedures and Products Market are:

- Conmed Corp,

- Arthrex Inc,

- DePuy Synthes Inc,

- Karl Storz SE & Co KG,

- Stryker Corp,

- Richard Wolf GmbH,

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the South America Arthroscopy Procedures and Products Market top key players overview

South America Arthroscopy Procedures and Products Market Report Coverage and Deliverables

The “South America Arthroscopy Procedures and Products Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- South America arthroscopy procedures and products market size and forecast at country levels for all the key market segments covered under the scope

- South America arthroscopy procedures and products market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- South America arthroscopy procedures and products market analysis covering key market trends, country framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the South America arthroscopy procedures and products market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The use of smart probes and sensors is likely to continue to remain a key trend in the market.

The growing prevalence of musculoskeletal disorders and the rising number of sports injuries requiring arthroscopy procedures are the major factors accelerating the market growth. However, cost-intensive arthroscopic implants and surgeries are hampering the market progression.

The market is anticipated to register a CAGR of 5.8% during 2023–2031.

Conmed Corp, Arthrex Inc, DePuy Synthes Inc, Karl Storz SE & Co KG, Stryker Corp, Richard Wolf GmbH, Zimmer Biomet Holdings Inc, Biomecanica, South America Implants S.A., and Advin Health Care Pvt Ltd are among the leading players in the South America arthroscopy procedures and products market.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - South America Arthroscopy Procedures and Products Market

- Conmed Corp

- Arthrex Inc

- DePuy Synthes Inc

- Karl Storz SE & Co KG

- Stryker Corp

- Richard Wolf GmbH

- Zimmer Biomet Holdings Inc

- Biomecanica

- South America Implants S.A.

- Advin Health Care Pvt Ltd

Get Free Sample For

Get Free Sample For