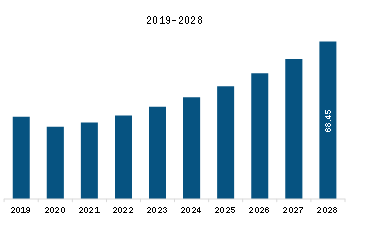

The e-scrap recycling market in SAM is expected to grow from US$ 33.25 million in 2021 to US$ 68.45 million by 2028; it is estimated to grow at a CAGR of 10.9% from 2021 to 2028.

An expected life cycle of any electronic product is the duration entailing its introduction, maturity in demand, and disposal or recycling phases. These products reach the recycling stage due to the end of their functional life, upgrades in associated technologies, and changes in consumer demands. With technological innovations, new products with updated features and additional service back-up replace the products enabled with older technologies, which results in the generation of massive e-waste volumes. Mobile devices, televisions, and computer devices are among the fast-growing electronic segments that undergo frequent upgrades. There is a continuous increase in the sales of these electronics with a surge in purchasing power with the rise in disposable income of people. The life expectancy of these gadgets has been lowered to ~3–4 years; as a result, the volume of e-waste produced is rapidly increasing, compelling e-waste recycling industry players to establish a more accessible e-waste collection and processing network. The continued sale of electronic items, particularly in emerging markets, will present a lucrative environment for e-waste management in the coming years. For instance, in the smartphone industry, the manufacturers are continuously upgrading their models year-on-year, which is leading the customers to scrap their existing models, resulting in increase in e-scrap volume. This parameter is positively impacting the growth of the e-scrap recycling market. In addition, the household appliance manufacturers are also introducing newer models to attract customers. The new product launches are leading to scrap the existing household appliances, which is benefitting the e-scrap recycling market players. This is again catalyzing e-scrap recycling market. Further, as the technological advancements are taking place rapidly across the globe, the manufacturers of consumer electronics or household appliances with limited lifecycle. This helps the manufacturers to enable the customers to upgrade their technologies over a time period, resulting in increase in volume of electronic scrapyard, which is ultimately driving the e-scrap recycling market.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the SAM e-scrap recycling market in the coming years. The market is expected to grow at a good CAGR during the forecast period.

SAM E-Scrap Recycling Market Revenue and Forecast to 2028 (US$ Million)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

SAM E-Scrap Recycling Market Segmentation

The SAM e-scrap recycling market is segmented based on product type, processed material and country. Based on product type, the market is segmented into IT & telecom equipment, small household appliances, large white goods, consumer electronics, and others. The large white goods segment dominated the market in 2020 and consumer electronics segment is expected to be the fastest growing during the forecast period. Based on processed material, the market is segmented into metal, glass, plastic, and others. The metal segment dominated the market in 2020 and is expected to be the fastest growing during the forecast period. Based on country, the SAM e-scrap recycling market is segmented into the Brazil, Argentina, and the rest of SAM. DOWA HOLDINGS CO., LTD; Electronic Recyclers International, Inc; JX Nippon Mining & Metals Corporation; Sims Metal Management Ltd; Stena Metall Ab; Tetronics; and Umicore are among the leading companies in the market.

South America E-Scrap Recycling Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 33.25 Million |

| Market Size by 2028 | US$ 68.45 Million |

| Global CAGR (2021 - 2028) | 10.9% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

- DOWA HOLDINGS CO., LTD

- Enviro-Hub Holdings Ltd

- JX Nippon Mining & Metals Corporation

- Sims Metal Management Ltd

- Stena Metall Ab

- Tetronics

- Umicore

Get Free Sample For

Get Free Sample For