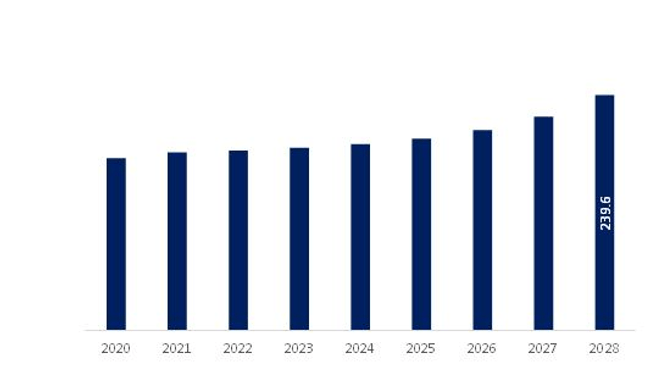

The South & Central America gas engine market is expected to reach US$ 239.6 million by 2028 from US$ 181.1 million in 2021. The market is estimated to grow at a CAGR of 4.1% from 2021–2028.

Governments of various countries are imposing certain regulations to control the emissions of diesel and petrol engines, thus compelling engine manufacturers to opt for alternative fuel solutions such as natural gases. Gas engines release less emissions to generate a sufficient amount of with power high efficiency. The emission monitoring and regulatory bodies from various countries are imposing stringent regulations on the use of diesel engines and generators. To meet these regulatory standards, various industries are deploying gas engine and generators for power generation. Moreover, in December 2020, Rolls-Royce launched MTU Series 500, a new series of gas engines, with a power range of 250–550 kilowatt. The engines are specially designed to meet the emission goals by using hydrogen as a power source, which is offering low fuel costs and low fuel consumption for industrial and utility sectors. Similarly, in June 2020, Kawasaki Heavy Industries, Ltd., a heavy equipment manufacturer, launched a new model KG-18-T gas engine. The company introduced a two-stage turbocharging system with 51% electrical efficiency for power generation. Thus, the rise in such development’s activities owing to stringent regulations related to gas engines is propelling the South & Central America market’s growth.

Brazil has the highest number of COVID-19 cases, followed by Peru, Chile, Colombia, Ecuador, and Argentina, among others. SAM governments have taken an array of actions to protect its citizens and contain COVID-19’s spread and therefore imposed lockdowns to restrict social distancing. The lockdown has resulted in the closure of organizations temporarily in the region to control the spread of the virus. It is anticipated that SAM will require lesser electricity. Containment measures in several countries of South America will reduce economic activity in the manufacturing and service sectors for at least the next quarter and is expected to rebound once the pandemic is contained.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the gas engine market. The South & Central America gas engine market is expected to grow at a good CAGR during the forecast period.

South & Central America Gas Engine Market Revenue and Forecast to 2028 (US$ Million)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

South & Central America Gas Engine Market Segmentation

By Fuel Type

- Natural Gas

- Special Gas

By Power Output

- 100-300 kW

- 300 - 500 kW

- 0.5-1 MW

- 1-2 MW

- 2-5 MW

- 5-10 MW

- 10-20 MW

By End-User

- Remote

- Mining

- Drilling

- Others

- Mid-Stream Oil & Gas

- Heavy Industries

- Chemicals

- Paper

- Metals

- Food and Beverages

- Others

- Light Manufacturing

- Utilities

- Grid

- IPP

- Others

- Biogas

- Datacenters

- MUSH

- Commercial

By Country

- South & Central America

- Brazil

- Argentina

- Rest of South & Central America

Companies Mentioned

- Caterpillar Inc.

- Cummins Inc.

- Kawasaki Heavy Industries, Ltd.

- Liebherr; MAN SE

- Mitsubishi Heavy Industries, Ltd.

- Wärtsilä Corporation

- MTU (Rolls-Royce Power Systems AG)

- 2G ENERGY AG

- MAN SE

South and Central America Gas Engine Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 181.1 Million |

| Market Size by 2028 | US$ 239.6 Million |

| Global CAGR (2021 - 2028) | 4.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Fuel Type

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Smart Mining Market

- Quantitative Structure-Activity Relationship (QSAR) Market

- GMP Cytokines Market

- Grant Management Software Market

- Medical and Research Grade Collagen Market

- Hydrolyzed Collagen Market

- Mice Model Market

- Artificial Intelligence in Defense Market

- Aesthetic Medical Devices Market

- Identity Verification Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Energy and Power : READ MORE..

- Caterpillar Inc.

- Cummins Inc.

- Kawasaki Heavy Industries, Ltd.

- Liebherr; MAN SE

- Mitsubishi Heavy Industries, Ltd.

- Wärtsilä Corporation

- MTU (Rolls-Royce Power Systems AG)

- 2G ENERGY AG

- MAN SE

Get Free Sample For

Get Free Sample For